Please use attached spread sheet, use attached data to fill in spreadsheet financial analysis report.

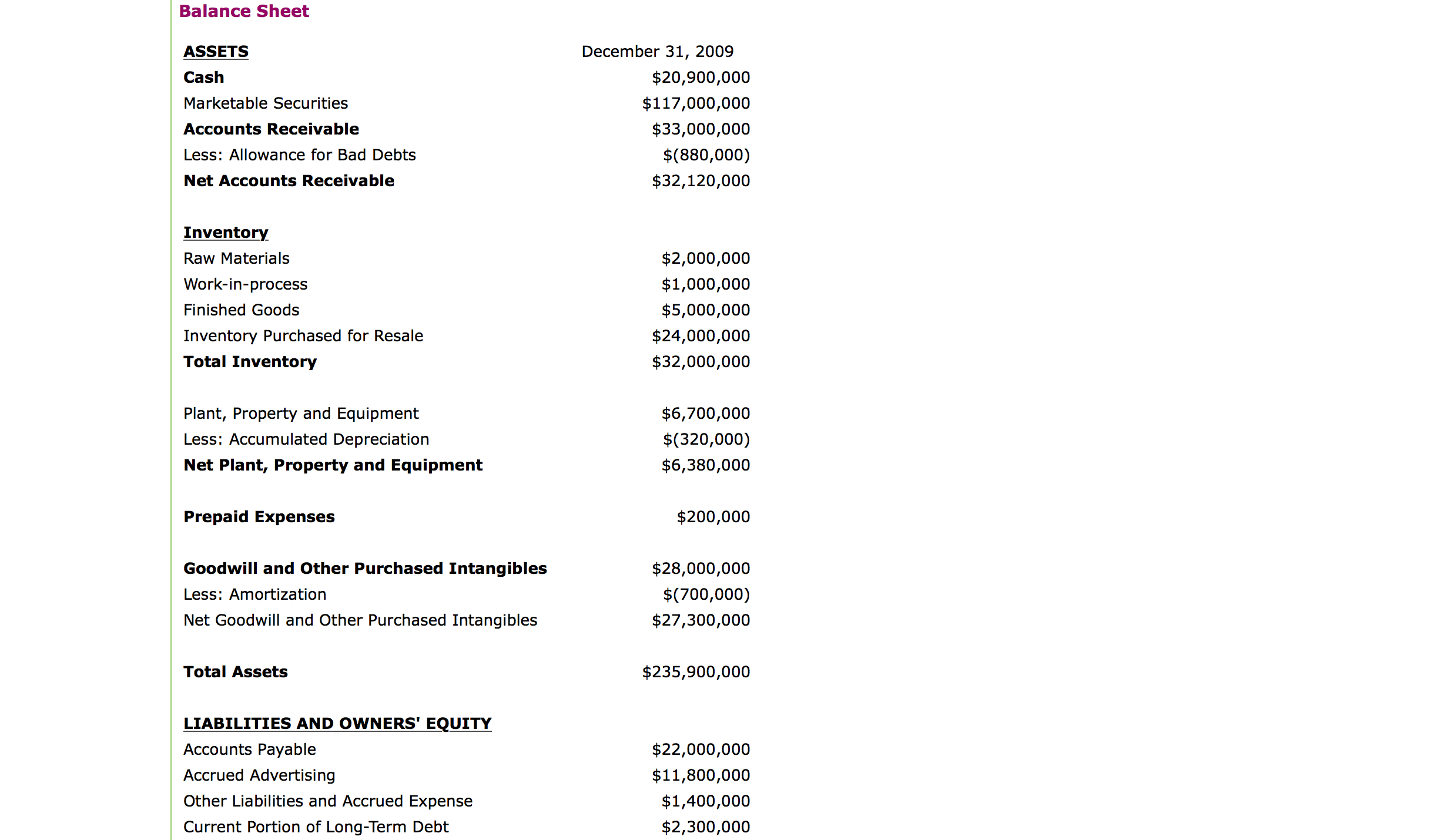

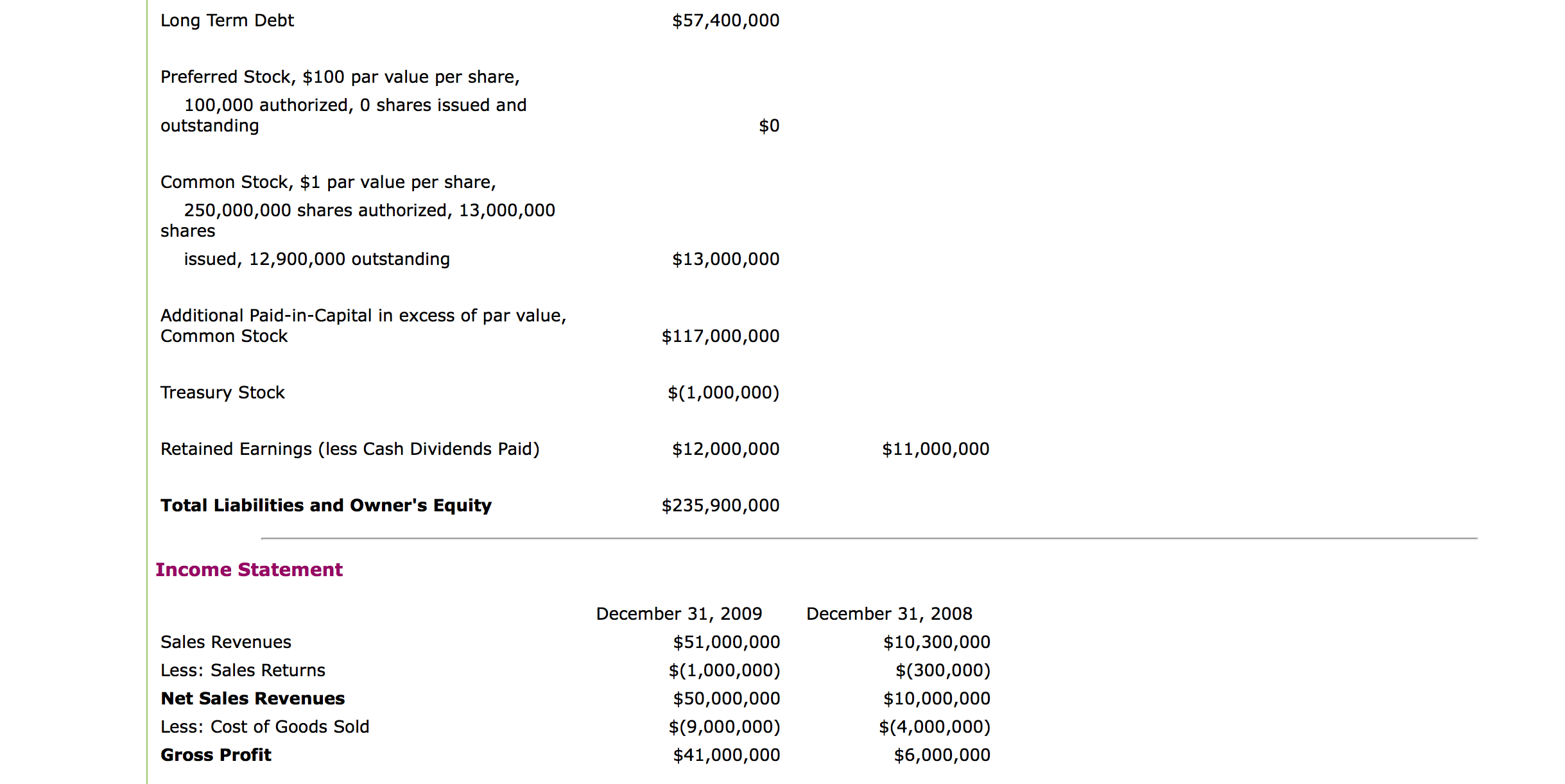

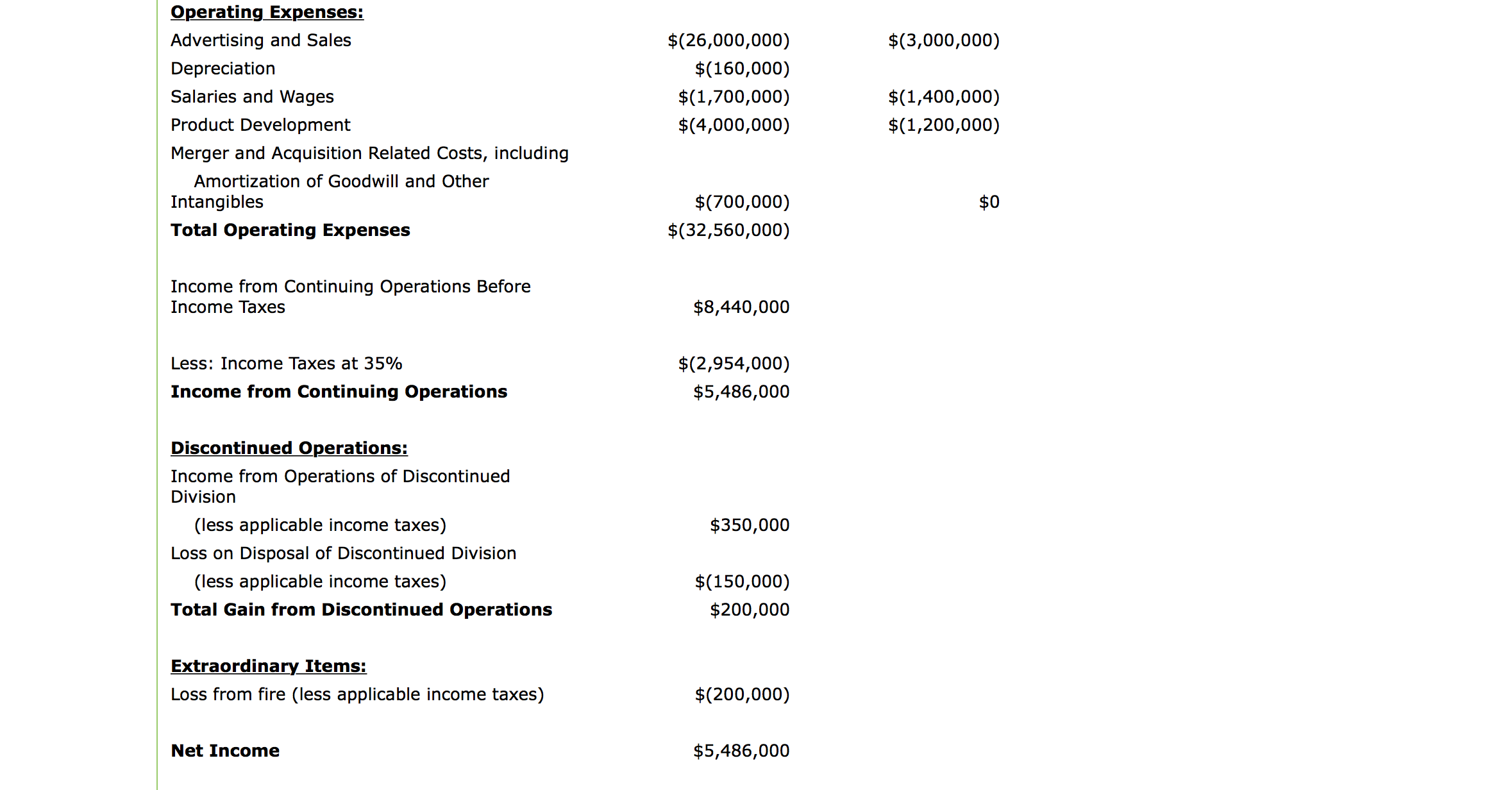

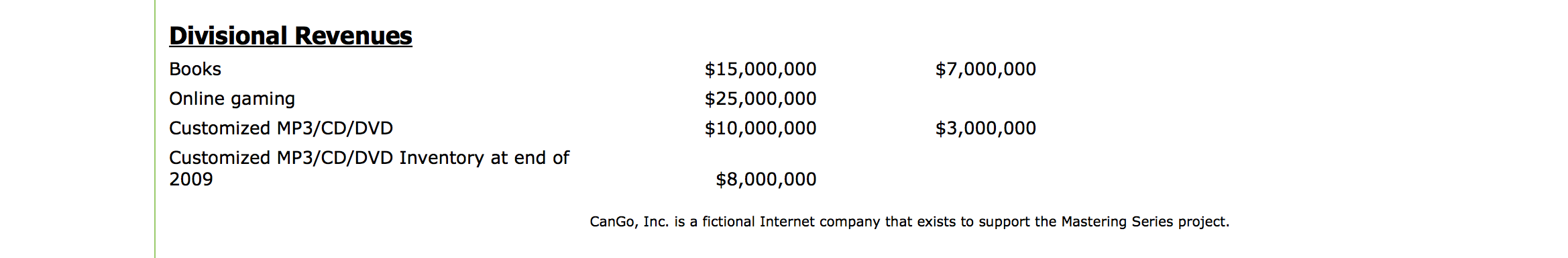

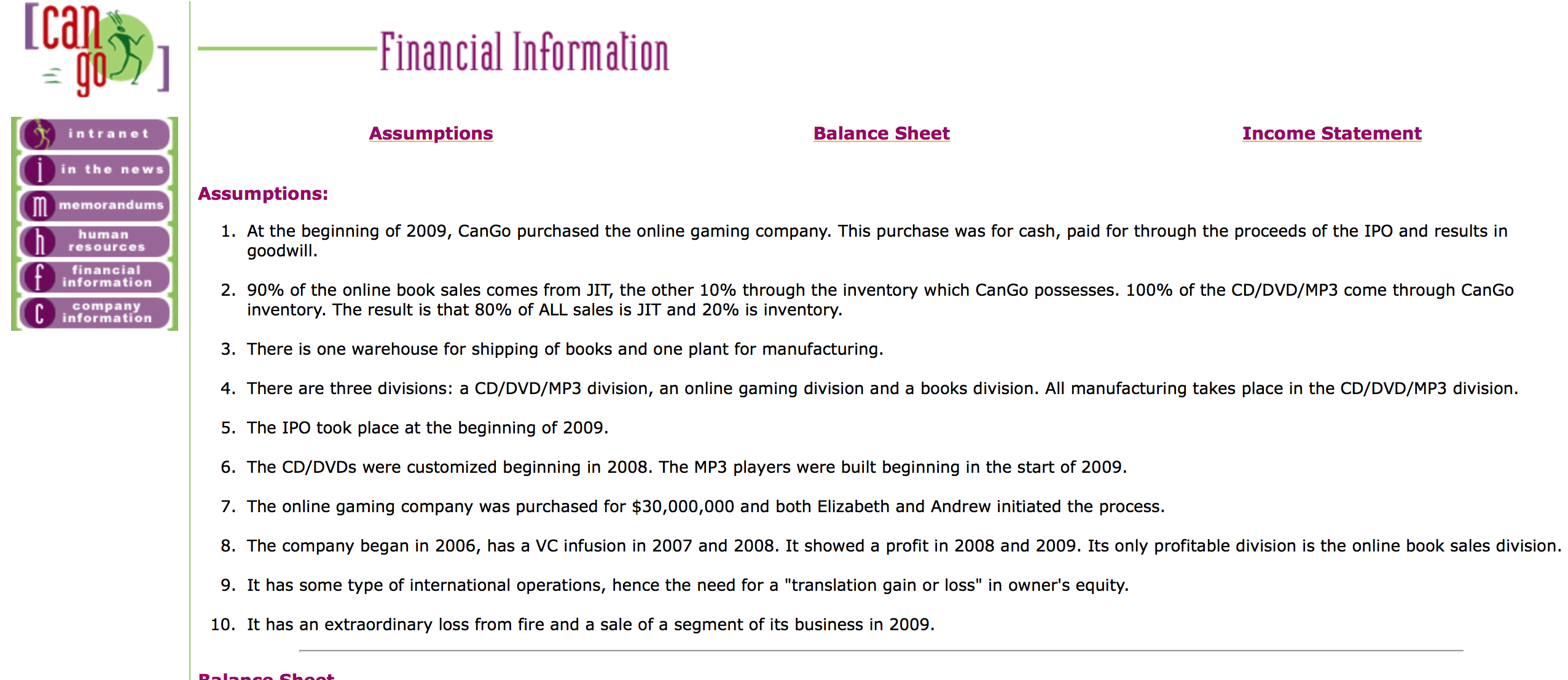

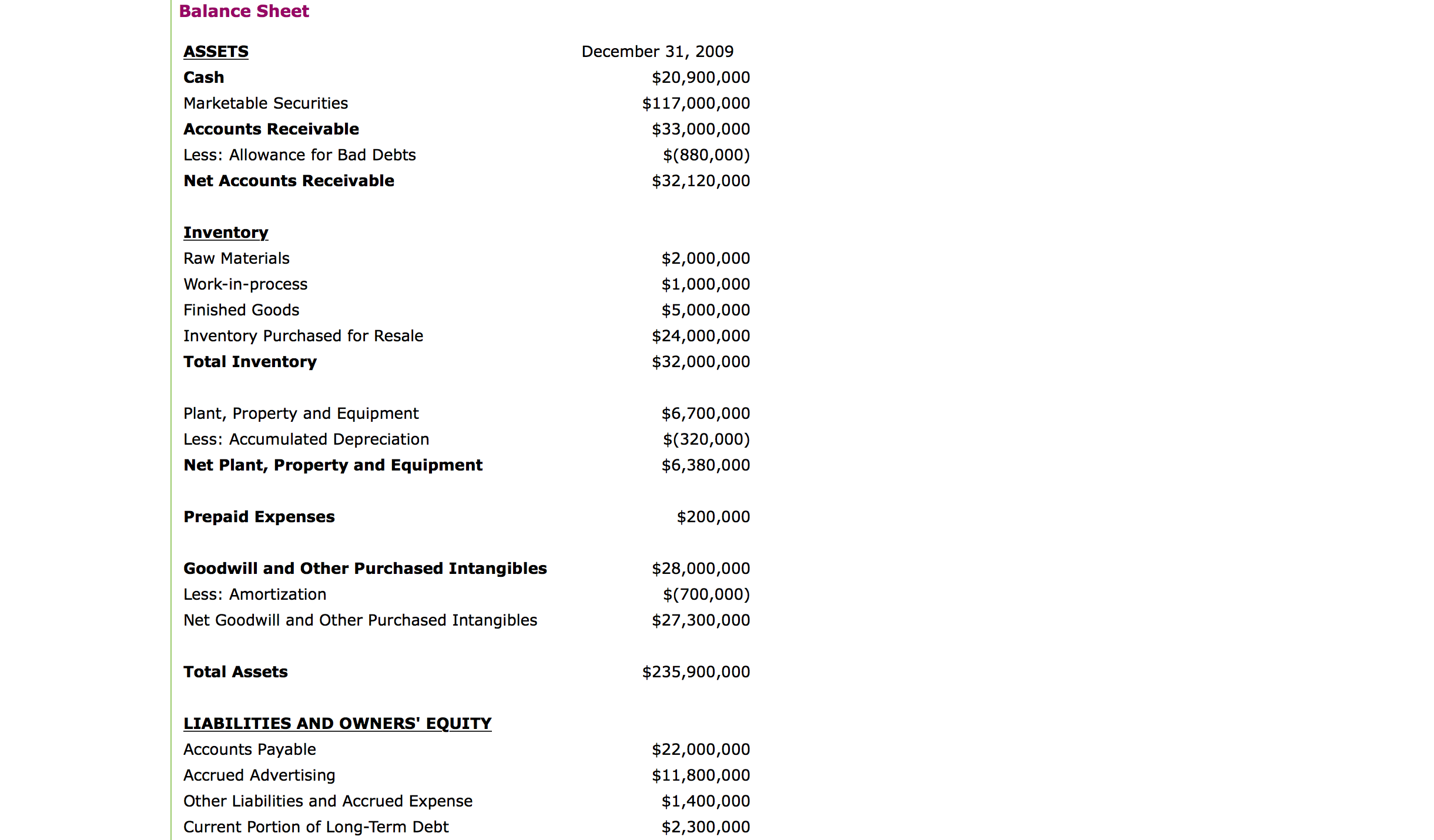

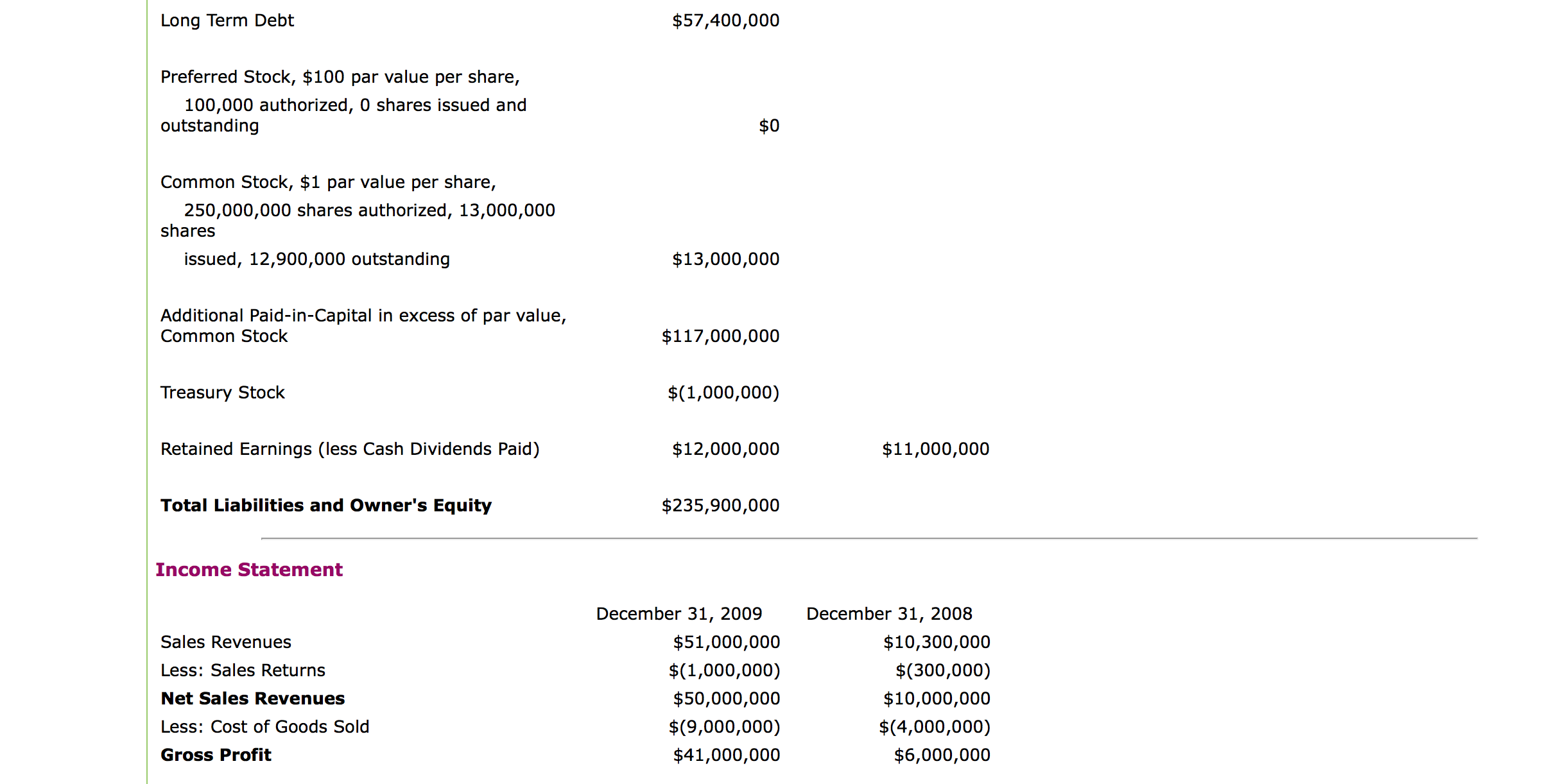

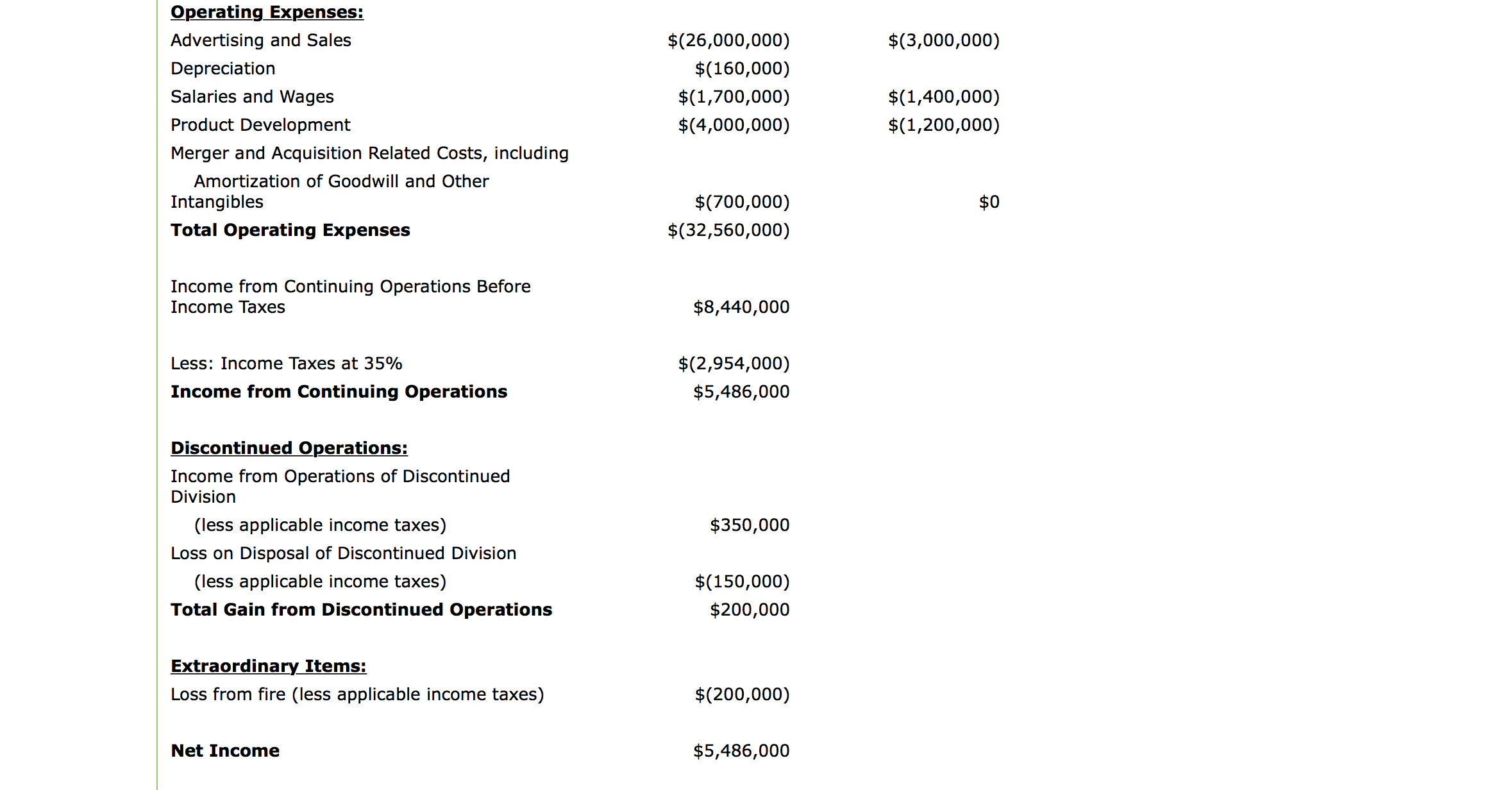

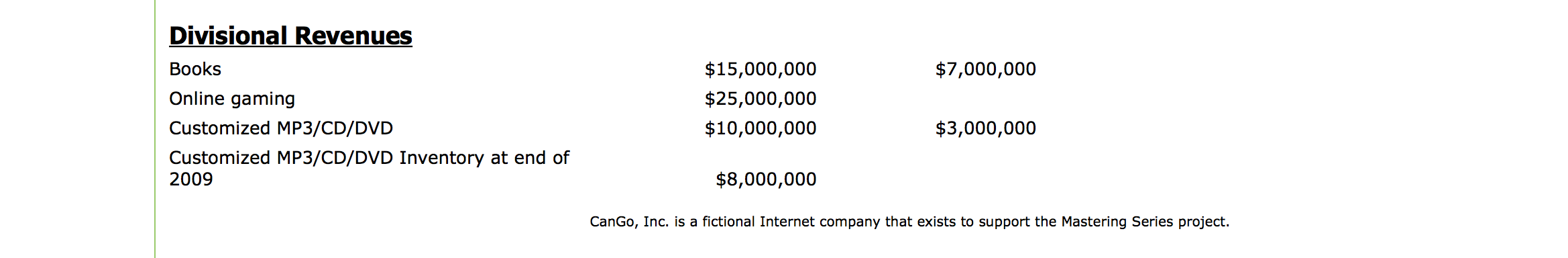

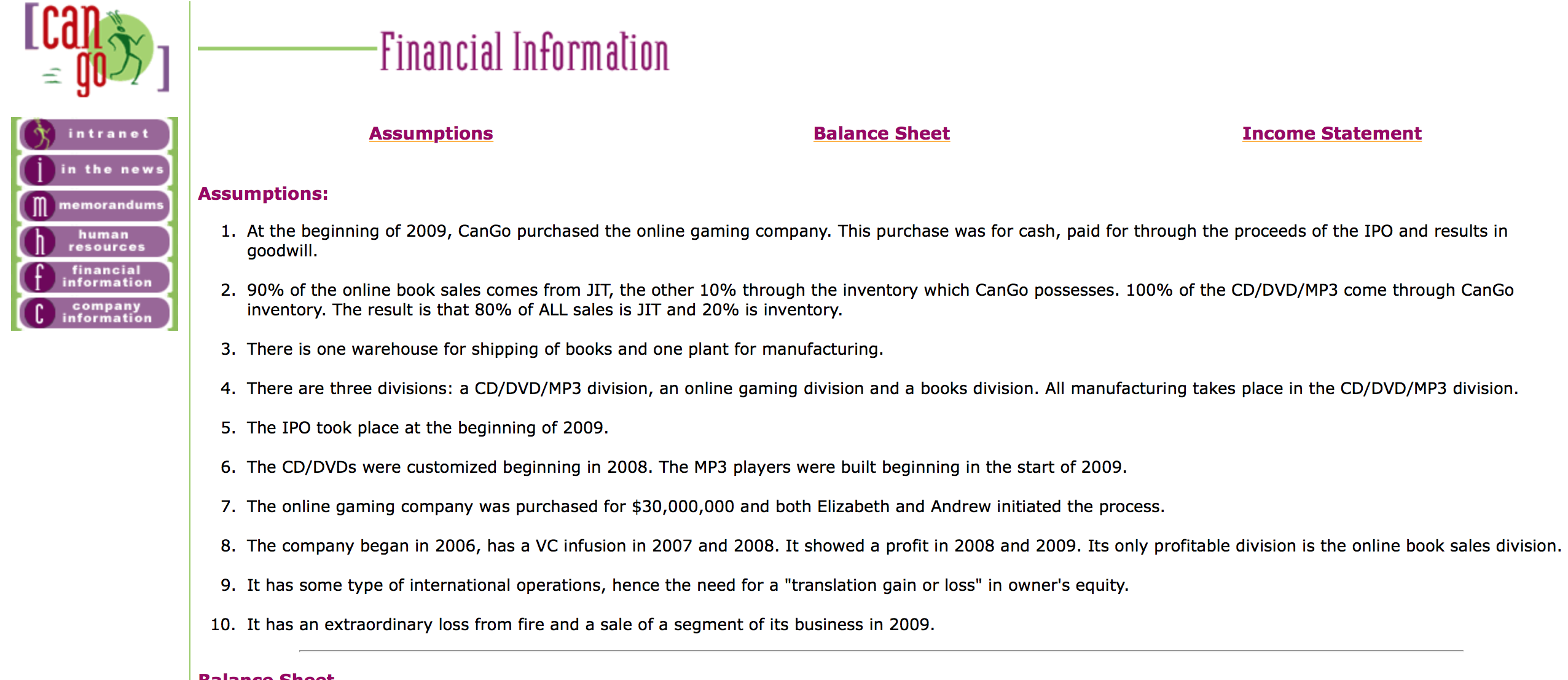

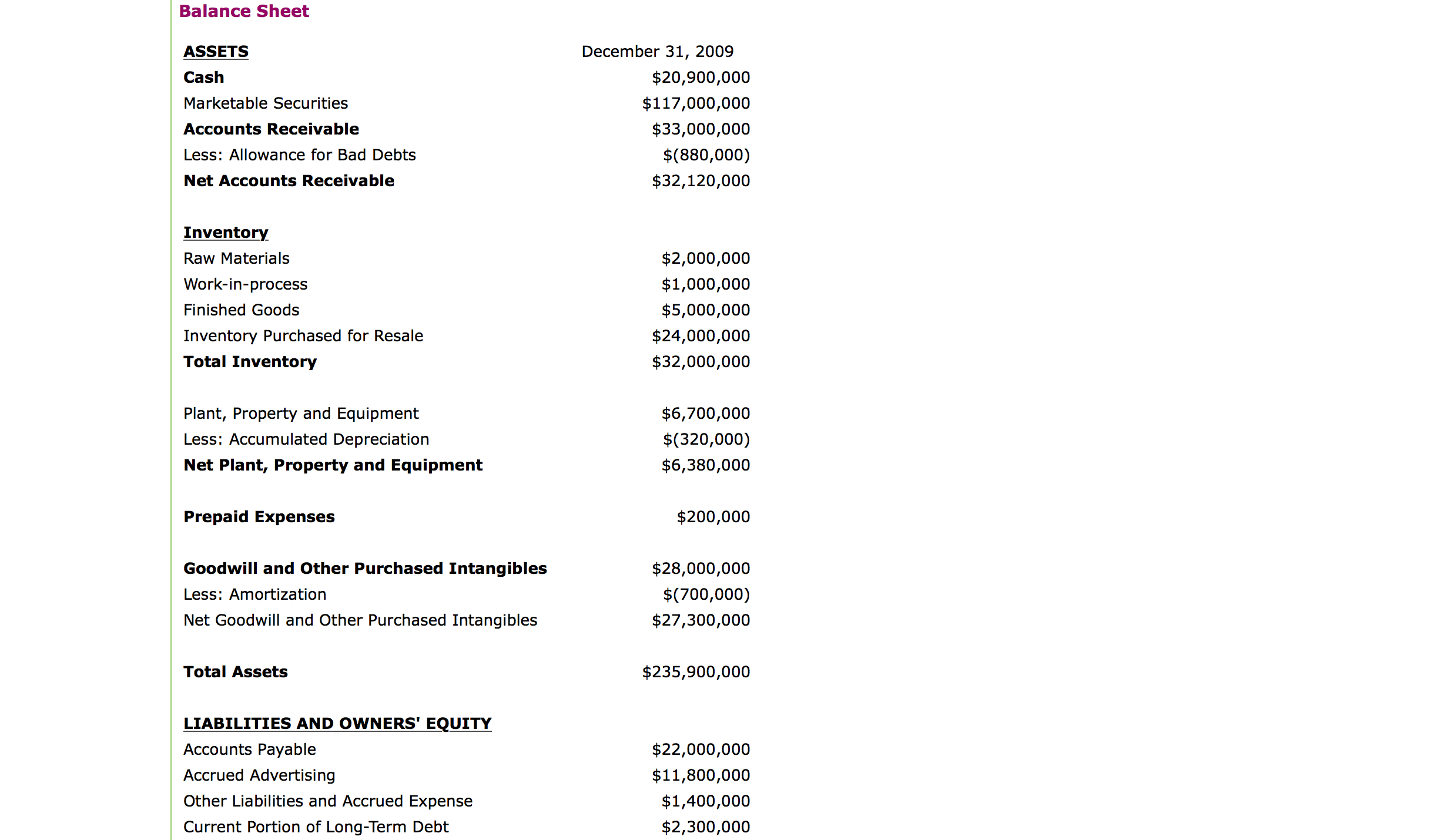

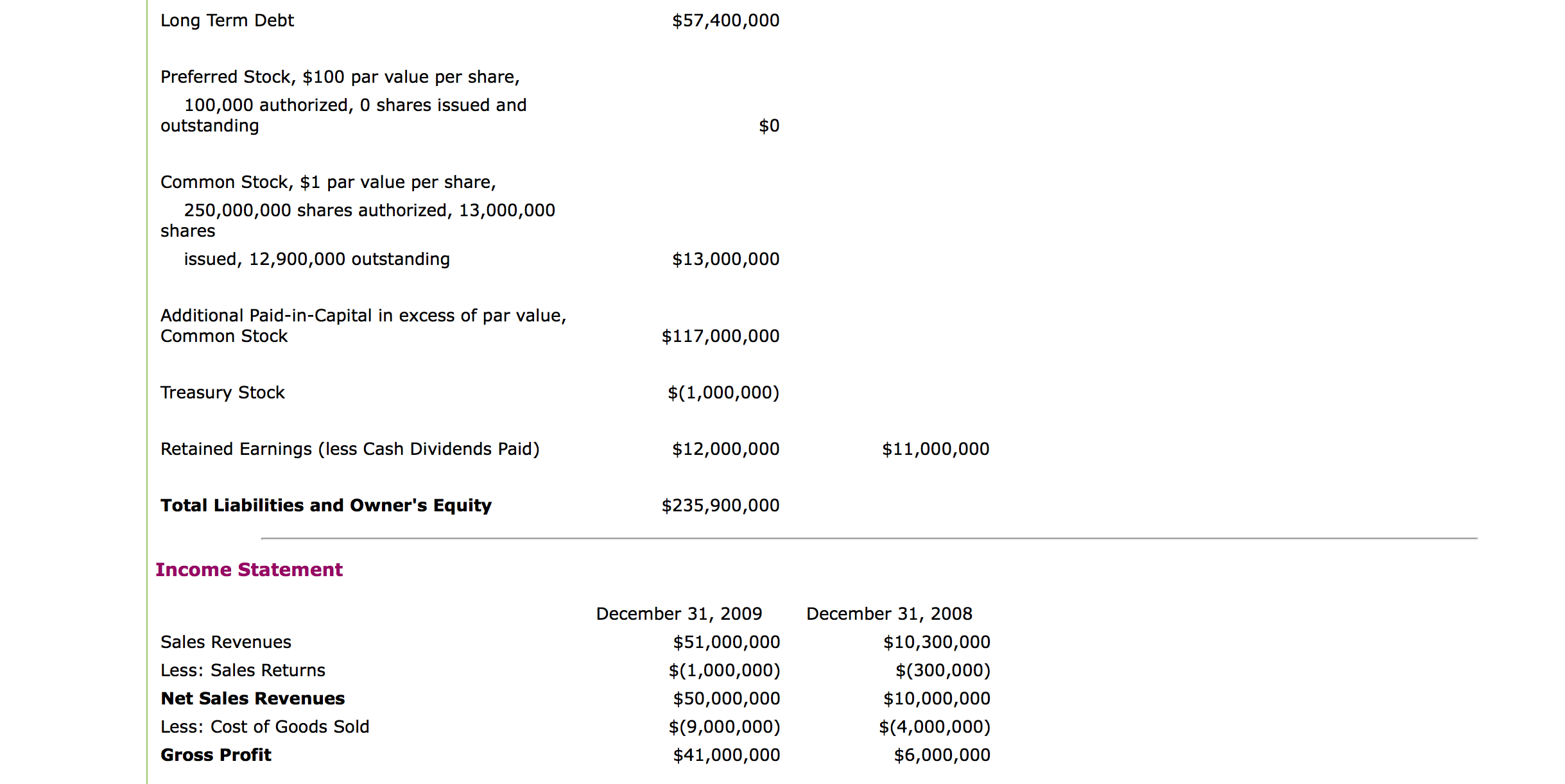

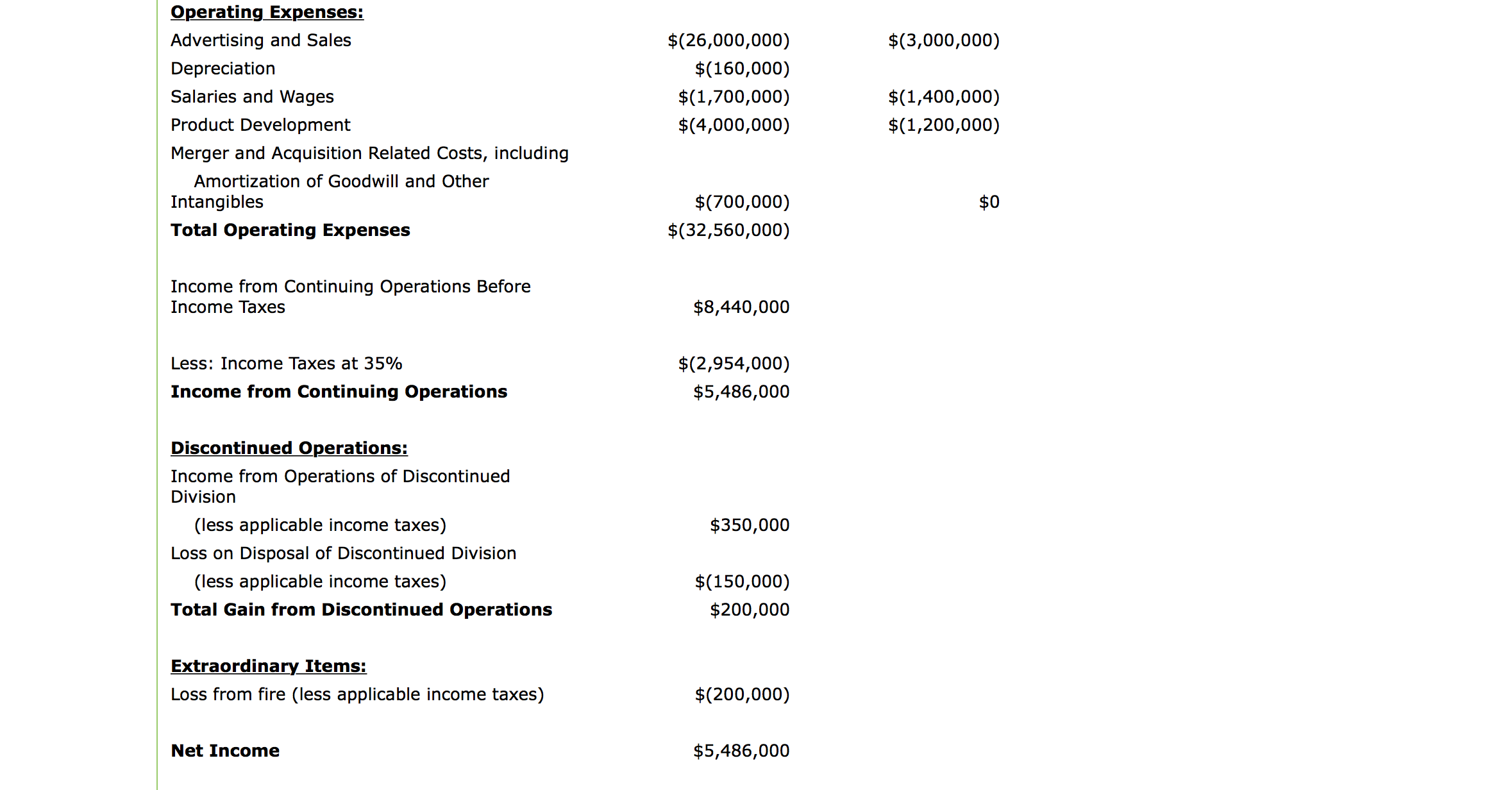

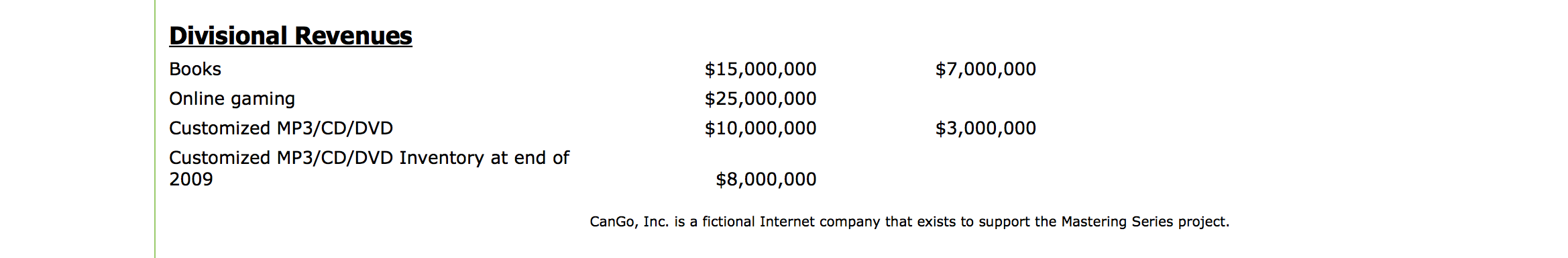

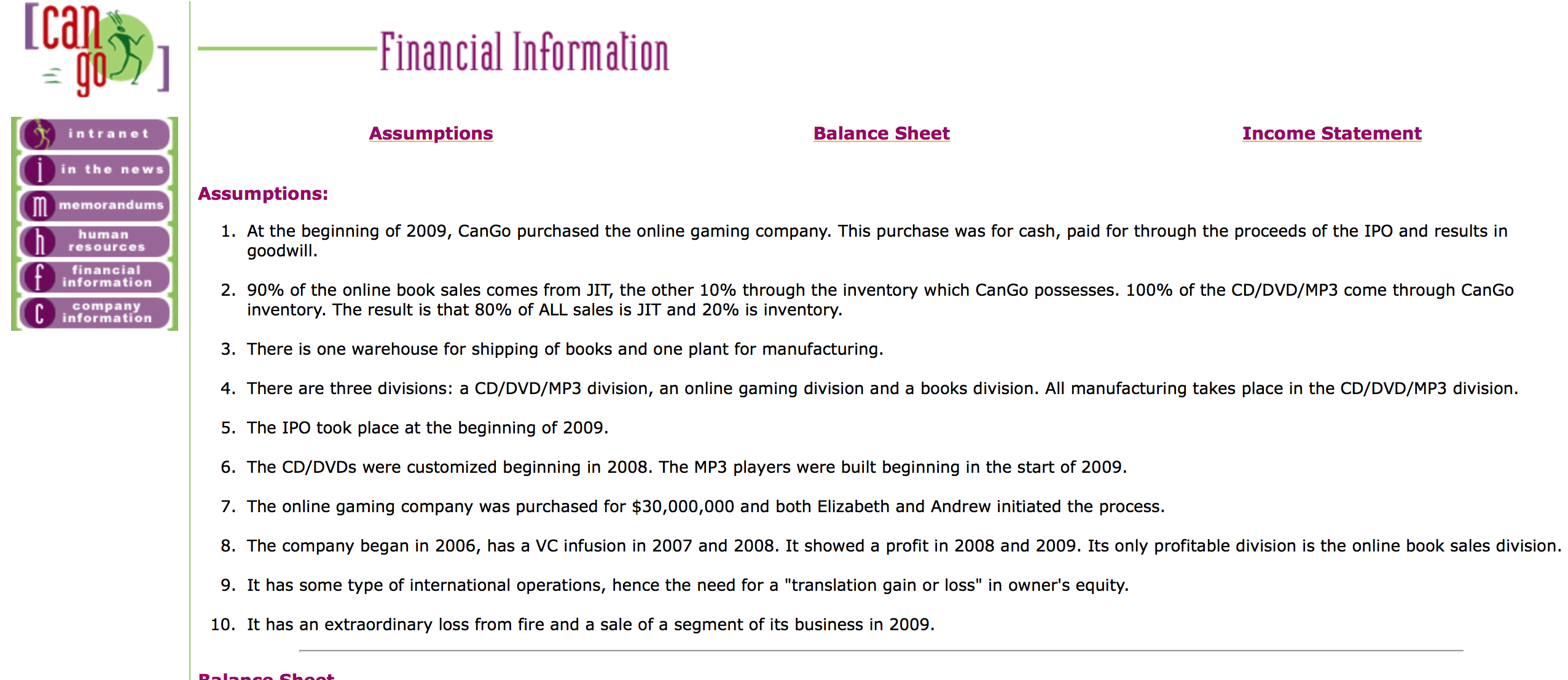

Balance Sheet ASSETS Cash Marketable Securities Accounts Receivable Less: Allowance for Bad Debts Net Accounts Receivable Inventory Raw Materials Work-in-process Finished Goods Inventory Purchased for Resale Total Inventory Plant, Property and Equipment Less: Accumulated Depreciation Net Plant, Property and Equipment Prepaid Expenses Goodwill and Other Purchased Intangibles Less: Amortization Net Goodwill and Other Purchased Intangibles Total Assets LIABILITIES AND OWNERS' EQUITY Accounts Payable Accrued Advertising Other Liabilities and Accrued Expense Current Portion of Long-Term Debt December 31, 2009 $20,900,000 $117,000,000 $33,000,000 $(880,000) $32,120,000 $2,000,000 $1,000,000 $5,000,000 $24,000,000 $32,000,000 $6,700,000 $(320,000) $6,380,000 $200,000 $28,000,000 $000,000) $27,300,000 $235,900,000 $22,000,000 $11,800,000 $1,400,000 $2,300,000 Long Term Debt Preferred Stock, $100 par value per share, 100,000 authorized, 0 shares issued and outstanding Common Stock, $1 par value per share, 250,000,000 shares authorized, 13,000,000 shares issued, 12,900,000 outstanding Additional Paid-in-Capital in excess of par value, Common Stock Treasury Stock Retained Earnings (less Cash Dividends Paid) Total Liabilities and Owner's Equity $57,400,000 $0 $13,000,000 $117,000,000 $(1,ooo,000) $12,000,000 $235,900,000 $11,000,000 Income Statement Sales Revenues Less: Sales Returns Net Sales Revenues Less: Cost of Goods Sold Gross Prot December 31, 2009 $51,000,000 $(1,000,000) $50,000,000 $(9,000,000) $41,000,000 December 31, 2008 $10,300,000 $(300,000) $10,000,000 $(4,000,000) $6,000,000 Qperatingpenses: Advertising and Sales Depreciation Salaries and Wages Product Development Merger and Acquisition Related Costs, including Amortization of Goodwill and Other Intangibles Total Operating Expenses Income from Continuing Operations Before Income Taxes Less: Income Taxes at 35% Income from Continuing Operations Discontinued Operations: Income from Operations of Discontinued Division (less applicable income taxes) Loss on Disposal of Discontinued Division (less applicable income taxes) Total Gain from Discontinued Operations Extraordinagy Items: Loss from fire (less applicable income taxes) Net Income $(26,000,000) $(160,000) $(1,7oo,000) $(4,000,000) $000,000) $(32,560,000) $8,440,000 $(2,954,000) $5,486,000 $350,000 $(150,000) $200,000 $(2oo,000) $5,486,000 $(3,000,000) $(1,400,000) $(1,200,000) $0 Divisional Revenues Books $15,000,000 $7,000,000 Online gaming $25,000,000 Customized MP3/CD/DVD $10,000,000 $3,000,000 Customized MP3/CD/DVD Inventory at end of 2009 $8,000,000 CanGo, Inc. is a ctional Internet company that exists to support the Mastering Series project. [Eb] Financiallnfnrmaliun Assumptions Balance Sheet Income Statement i_ he 11 9w 5 m _emovandums Assumpt'ms' _uman 1. At the beginning of 2009, CanGo purchased the online gaming company. This purchase was for cash, paid for through the proceeds of the IPO and results in _esouvces goodwill. _inancnnl _"'"""'" 2. 90% of the online book sales comes from JIT, the other 10% through the inventory which CanGo possesses. 100% of the CD/DVD/MP3 come through CanGo _",';T':;'ln inventory. The result is that 80% of ALL sales is JlT and 20% is inventory. 3. There is one warehouse for shipping of books and one plant for manufacturing. 4. There are three divisions: a CD/DVD/MP3 division, an online gaming division and a books division. All manufacturing takes place in the CD/DVD/MP3 division. 5. The IPO took place at the beginning of 2009. 6. The CD/DVDs were customized beginning in 2008. The MP3 players were built beginning in the start of 2009. 7. The online gaming company was purchased for $30,000,000 and both Elizabeth and Andrew initiated the process. 8. The company began in 2006, has a VG infusion in 2007 and 2008. It showed a prot in 2008 and 2009. Its only protable division is the online book sales division. 9. It has some type of international operations, hence the need for a "translation gain or loss" in owner's equity. 10. It has an extraordinary loss from re and a sale of a segment of its business in 2009. n..|-...... an