Please use beginner java coding and make sure it computes

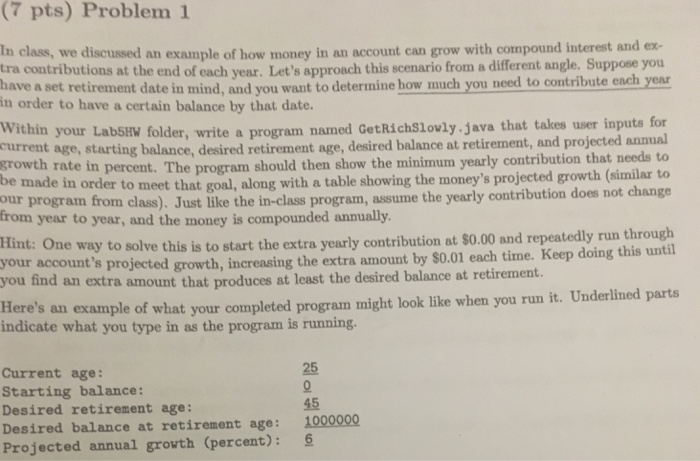

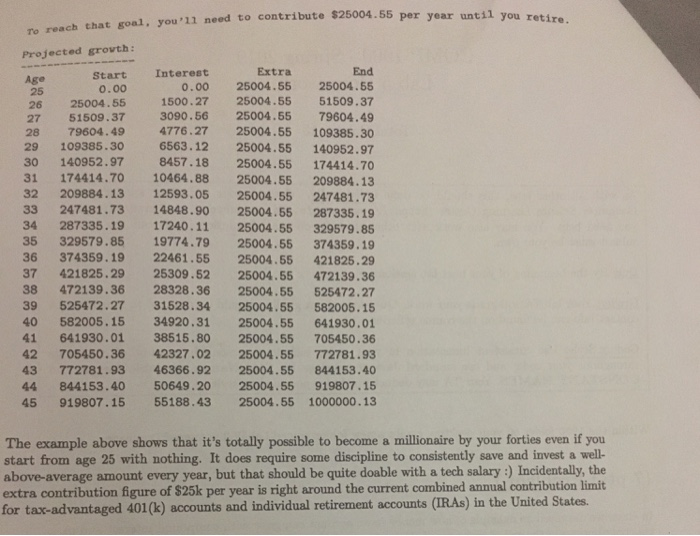

(7 pts) Problem1 In class, we discussed an example of how money in an account can grow with compound interest and ex- tra contributions at the end of each year. Let's approach this scenario from a different angle. Suppose you have a set retirement date in mind, and you want to determine how much you need to contribute ench year in order to have a certain balance by that date. Within your LabSHV folder, write a program named GetRichSlovly java that takes user inputs for eturrent age, starting balance, desired retirement age, desired balance at retirement, and projected anmu growth rate in percent. The program should then show the minimum yearly contribution that needs to be made in order to meet that goal, along with a table showing the money's projected growth (similar to our program from class). Just like the in-class program, assume the yearly contribution does not change from year to year, and the money is compounded annually. Hint: One way to solve this is to start the extra yearl your account's projected growth, increasing the extra amount by $0.01 each time. Keep doing this until ly contribution at $0.00 and repeatedly run through yo u find an ext ra amount that produces at least the desired balance at retirement. an example of what your completed program might look like when you run it. Underlined parts indicate what you type in as the program is running 25 Current age: Starting balance: Desired retirement age: Desired balance at retirement age: 1000000 Projected annual grovth (percent): 6 45 need to contribute $25004.55 per year until you retire. To reach that goal, you'11 Projected growt.h: Interest Extra Start o.00 25004.55 0.00 25004.55 25004.55 1500.27 25004.55 51509.37 27 51509.373090.56 25004.55 79604.49 28 79604.49 4776.27 25004.55 109385.30 29 109385.30 6563.12 25004.55 140952.97 30 140952.97 8457.18 25004.55 174414.70 31 174414.70 10464.8825004.55 209884.13 32 209884.13 12593.05 25004.55 247481.73 33 247481.73 14848.90 25004.55 287335.19 34 287335.19 17240.11 25004.55 329579.85 35 329579.85 19774.79 25004.55 374359.19 36 374359.19 22461.55 25004.55 421825.29 37 421825.29 25309.52 25004.55 472139.36 38 472139.3628328.36 25004.55 525472.27 39 525472.27 31528.34 25004.55582005.15 40 582005.15 34920.31 25004.55641930.01 41 641930.0138515.80 25004.55 705450.36 42 705450.3642327.02 25004.55 772781.93 43 772781.93 46366.92 25004.55 844153.40 44 844153.40 50649.20 25004.55 919807.15 45 919807.15 55188.43 25004.55 1000000.13 26 2 The example above shows that it's totally possible to become a millionaire by your forties even if you start from age 25 with nothing. It does require some discipline to consistently save and invest a well above-average amount every year, but that should be quite doable with a tech salary:) Incidentally, the extra contribution figure of $25k per year is right around the current combined annual contribution limit for tax-advantaged 401(k) accounts and individual retirement accounts (IRAs) in the United States