Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please use engineering economics formulas rather than excel or anything else. thank you. 1. Equipment maintenance costs for manufacturing explosion-proof pressure switches are projected to

please use engineering economics formulas rather than excel or anything else. thank you.

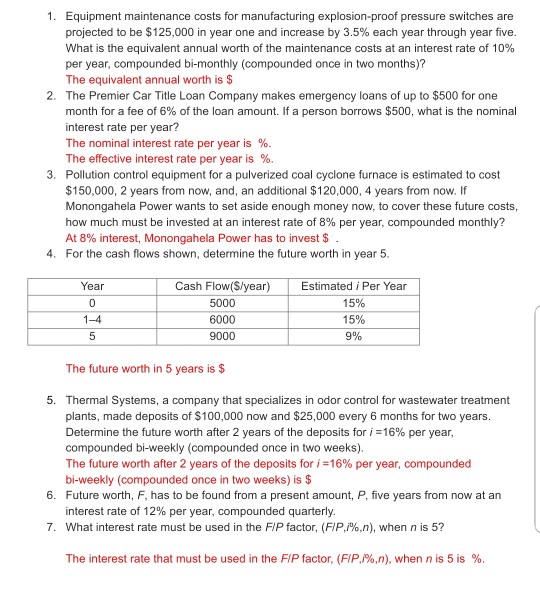

1. Equipment maintenance costs for manufacturing explosion-proof pressure switches are projected to be $125,000 in year one and increase by 3.5% each year through year five What is the equivalent annual worth of the maintenance costs at an interest rate of 10% per year, compounded bi-monthly (compounded once in two months)? The equivalent annual worth is $ The Premier Car Title Loan Company makes emergency loans of up to $500 for one month for a fee of 6% of the loan amount. If a person borrows $500, what is the nominal interest rate per year? The nominal interest rate per year is %. The effective interest rate per year is 96. Pollution control equipment for a pulverized coal cyclone furnace is estimated to cost $150,000, 2 years from now, and, an additional $120,000, 4 years from now. If Monongahela Power wants to set aside enough money now, to cover these future costs how much must be invested at an interest rate of 8% per year, compounded monthly? At 8% interest, Monongahela Power has to invest $ 2. 3. 4. For the cash flows shown, determine the future worth in year 5 d i Per Year 15% 15% 9% Year Cash Flow(S/year) Estimate 5000 6000 9000 1-4 The future worth in 5 years is$ 5. Thermal Systems, a company that specializes in odor control for wastewater treatment plants, made deposits of $100,000 now and $25,000 every 6 months for two years. Determine the future worth after 2 years of the deposits for j:16% per year compounded bi-weekly (compounded once in two weeks). The future worth after 2 years of the deposits for ,-16% per year, compounded bi-weekly (compounded once in two weeks) is $ Future worth, F, has to be found from a present amount, P, five years from now at an interest rate of 12% per year, compounded quarterly What interest rate must be used in the FIP factor, (FIP,i%,n), when n is 5? 6. 7. The interest rate that must be used in the FIP factor, (F/P,)%,n), when n is 5 is %Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started