Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use Excel and show and define your steps. Reconsider the data from Problem 62 a. Plot a graph of FW versus MARR, where MARR

Please use Excel and show and define your steps.

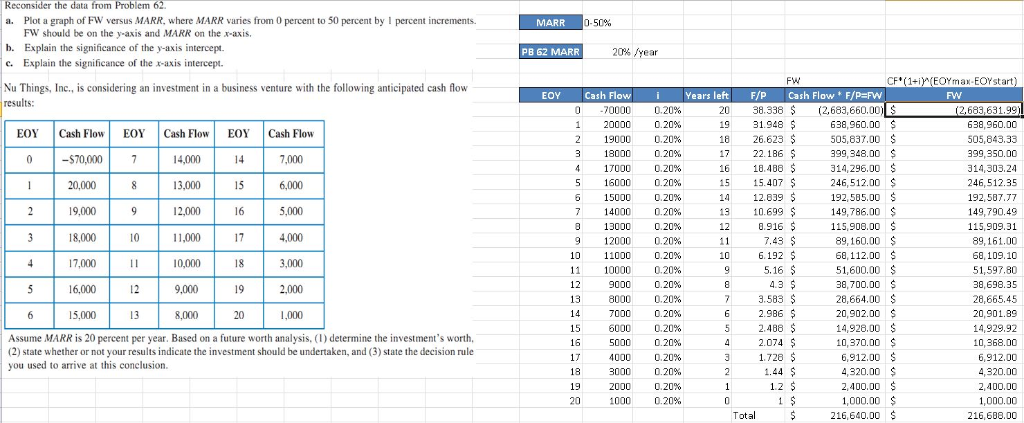

Reconsider the data from Problem 62 a. Plot a graph of FW versus MARR, where MARR varies from 0 percent to 50 percent by I percent increments. MARR 0-50% FW should be on the y-axis and MARR on the x-axis, b. Explain the significance of the y-axis intercept. c. Explain the significance of the x-axis intercept PB 62 MARR ar CF (1+i(EOYmax-EOrstart) Nu Things, Inc., is considering an investment in a business venture with the following anticipated cash flow EOY Cash FlowYears left F/P Cash Flow F/P-FMw 38.338 (2,683,660.00)S 0-70000 0.20% 1 20000 0.20% 19000 0.20% 3 18000 0.20% 4 17000 0.20% 16000 0.20% 6 15000 0.20% 7 14000 0.20% 3 13000 0.20% 12000 0.20% 10 11000 0.20% 11 10000 0.20% 12 9000 0.20% 8000 0.20% 7000 0.20% 6000 0.20% 5000 0.20% 4000 0.20% 3000 0.20% 2000 0.20% 1000 0.20% 683,631.99 638,960.00 505,843.33 399,350.00 314,303.24 246,512.35 192,587.77 149,790.49 115,909.31 89,161.00 68,109.10 51,597.80 38,698.35 28,665.45 20,901.89 14,929.92 10,368.00 6,912.00 4,320.00 2,400.00 1,000.00 216,688.00 19 31.948 18 26.623 638,960.00 $ 505,837.00 399,348.00 $ 314,296.00 246,512.00 $ 192,585.00 EOY Cash Flo EOY Cash FlowEOY Cash Flow $70,0007 14,000 13,000 12,000 11,000 10,000 9,000 7,000 15 15.407 $ 14 12.839 13 10.699149,786.00 6,000 19,000 18,000 17,000 16,000 15,000 115,908.00 89,160.00 $ 68,112.00 51,600.00 S 38,700.00 28,664.00 S 20,902.00 14,928.00S 17 3,000 2,000 20 15 16 Assume MARR is 20 percent per year. Based on a future worth analysis, (I) determine the investment's worth (2) state whether or not your results indicate the investment should be undertaken, and (3) state the decision rule you used to arrive at this conclusion 10,370.00 6,912.00 $ 4,320.00 $ 2,400.00 1,000.00 $ 19 216,640.00 $ Reconsider the data from Problem 62 a. Plot a graph of FW versus MARR, where MARR varies from 0 percent to 50 percent by I percent increments. MARR 0-50% FW should be on the y-axis and MARR on the x-axis, b. Explain the significance of the y-axis intercept. c. Explain the significance of the x-axis intercept PB 62 MARR ar CF (1+i(EOYmax-EOrstart) Nu Things, Inc., is considering an investment in a business venture with the following anticipated cash flow EOY Cash FlowYears left F/P Cash Flow F/P-FMw 38.338 (2,683,660.00)S 0-70000 0.20% 1 20000 0.20% 19000 0.20% 3 18000 0.20% 4 17000 0.20% 16000 0.20% 6 15000 0.20% 7 14000 0.20% 3 13000 0.20% 12000 0.20% 10 11000 0.20% 11 10000 0.20% 12 9000 0.20% 8000 0.20% 7000 0.20% 6000 0.20% 5000 0.20% 4000 0.20% 3000 0.20% 2000 0.20% 1000 0.20% 683,631.99 638,960.00 505,843.33 399,350.00 314,303.24 246,512.35 192,587.77 149,790.49 115,909.31 89,161.00 68,109.10 51,597.80 38,698.35 28,665.45 20,901.89 14,929.92 10,368.00 6,912.00 4,320.00 2,400.00 1,000.00 216,688.00 19 31.948 18 26.623 638,960.00 $ 505,837.00 399,348.00 $ 314,296.00 246,512.00 $ 192,585.00 EOY Cash Flo EOY Cash FlowEOY Cash Flow $70,0007 14,000 13,000 12,000 11,000 10,000 9,000 7,000 15 15.407 $ 14 12.839 13 10.699149,786.00 6,000 19,000 18,000 17,000 16,000 15,000 115,908.00 89,160.00 $ 68,112.00 51,600.00 S 38,700.00 28,664.00 S 20,902.00 14,928.00S 17 3,000 2,000 20 15 16 Assume MARR is 20 percent per year. Based on a future worth analysis, (I) determine the investment's worth (2) state whether or not your results indicate the investment should be undertaken, and (3) state the decision rule you used to arrive at this conclusion 10,370.00 6,912.00 $ 4,320.00 $ 2,400.00 1,000.00 $ 19 216,640.00 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started