Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE USE EXCEL AND SHOW FORMULAS You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn's balance sheet is as

PLEASE USE EXCEL AND SHOW FORMULAS

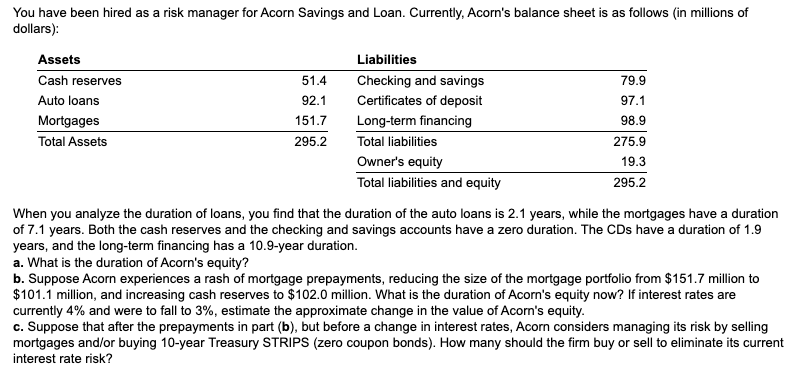

You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn's balance sheet is as follows (in millions of dollars): When you analyze the duration of loans, you find that the duration of the auto loans is 2.1 years, while the mortgages have a duration of 7.1 years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of 1.9 years, and the long-term financing has a 10.9-year duration. a. What is the duration of Acorn's equity? b. Suppose Acorn experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $151.7 million to $101.1 million, and increasing cash reserves to $102.0 million. What is the duration of Acorn's equity now? If interest rates are currently 4% and were to fall to 3%, estimate the approximate change in the value of Acorn's equity. c. Suppose that after the prepayments in part (b), but before a change in interest rates, Acorn considers managing its risk by selling mortgages and/or buying 10-year Treasury STRIPS (zero coupon bonds). How many should the firm buy or sell to eliminate its current interest rate risk? You have been hired as a risk manager for Acorn Savings and Loan. Currently, Acorn's balance sheet is as follows (in millions of dollars): When you analyze the duration of loans, you find that the duration of the auto loans is 2.1 years, while the mortgages have a duration of 7.1 years. Both the cash reserves and the checking and savings accounts have a zero duration. The CDs have a duration of 1.9 years, and the long-term financing has a 10.9-year duration. a. What is the duration of Acorn's equity? b. Suppose Acorn experiences a rash of mortgage prepayments, reducing the size of the mortgage portfolio from $151.7 million to $101.1 million, and increasing cash reserves to $102.0 million. What is the duration of Acorn's equity now? If interest rates are currently 4% and were to fall to 3%, estimate the approximate change in the value of Acorn's equity. c. Suppose that after the prepayments in part (b), but before a change in interest rates, Acorn considers managing its risk by selling mortgages and/or buying 10-year Treasury STRIPS (zero coupon bonds). How many should the firm buy or sell to eliminate its current interest rate riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started