Please use excel for all the steps. Thank you.

Please use excel for all the steps. Thank you.

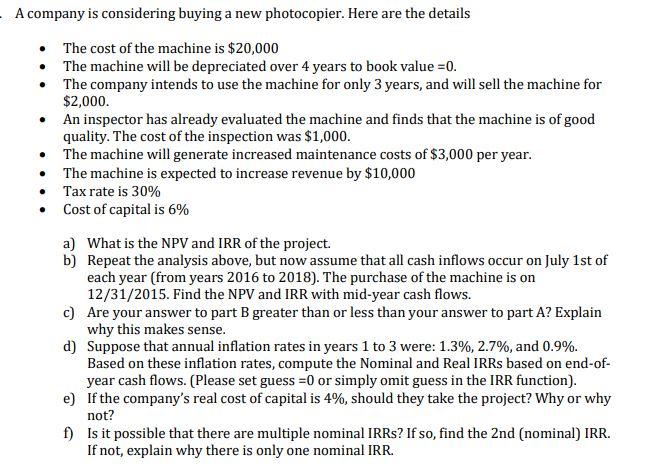

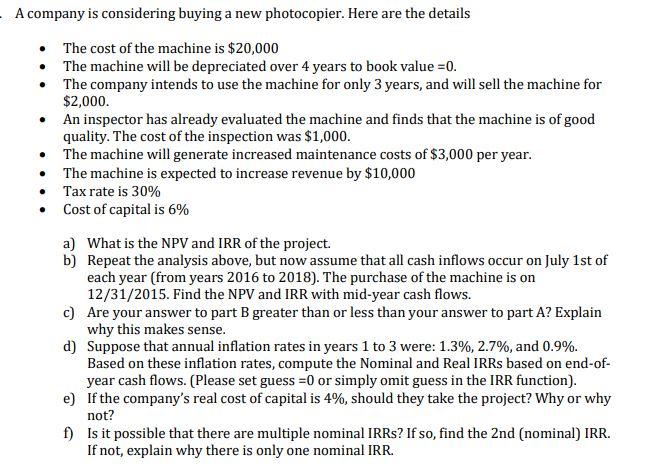

A company is considering buying a new photocopier. Here are the details The cost of the machine is $20,000 The machine will be depreciated over 4 years to book value=0. The company intends to use the machine for only 3 years, and will sell the machine for $2,000. An inspector has already evaluated the machine and finds that the machine is of good quality. The cost of the inspection was $1,000. The machine will generate increased maintenance costs of $3,000 per year. The machine is expected to increase revenue by $10,000 Tax rate is 30% Cost of capital is 6% a) What is the NPV and IRR of the project. b) Repeat the analysis above, but now assume that all cash inflows occur on July 1st of each year (from years 2016 to 2018). The purchase of the machine is on 12/31/2015. Find the NPV and IRR with mid-year cash flows. c) Are your answer to part B greater than or less than your answer to part A? Explain why this makes sense. d) Suppose that annual inflation rates in years 1 to 3 were: 1.3%, 2.7%, and 0.9%. Based on these inflation rates, compute the Nominal and Real IRRs based on end-of- year cash flows. (Please set guess =0 or simply omit guess in the IRR function). e) If the company's real cost of capital is 4%, should they take the project? Why or why not? f) Is it possible that there are multiple nominal IRRs? If so, find the 2nd (nominal) IRR. If not, explain why there is only one nominal IRR. A company is considering buying a new photocopier. Here are the details The cost of the machine is $20,000 The machine will be depreciated over 4 years to book value=0. The company intends to use the machine for only 3 years, and will sell the machine for $2,000. An inspector has already evaluated the machine and finds that the machine is of good quality. The cost of the inspection was $1,000. The machine will generate increased maintenance costs of $3,000 per year. The machine is expected to increase revenue by $10,000 Tax rate is 30% Cost of capital is 6% a) What is the NPV and IRR of the project. b) Repeat the analysis above, but now assume that all cash inflows occur on July 1st of each year (from years 2016 to 2018). The purchase of the machine is on 12/31/2015. Find the NPV and IRR with mid-year cash flows. c) Are your answer to part B greater than or less than your answer to part A? Explain why this makes sense. d) Suppose that annual inflation rates in years 1 to 3 were: 1.3%, 2.7%, and 0.9%. Based on these inflation rates, compute the Nominal and Real IRRs based on end-of- year cash flows. (Please set guess =0 or simply omit guess in the IRR function). e) If the company's real cost of capital is 4%, should they take the project? Why or why not? f) Is it possible that there are multiple nominal IRRs? If so, find the 2nd (nominal) IRR. If not, explain why there is only one nominal IRR

Please use excel for all the steps. Thank you.

Please use excel for all the steps. Thank you.