Question

Please Use Excel For This Question!!! Thanks Please Use Excel For This Question!!! Thanks Please Use Excel For This Question!!! Thanks To see the impact

Please Use Excel For This Question!!! Thanks

Please Use Excel For This Question!!! Thanks

Please Use Excel For This Question!!! Thanks

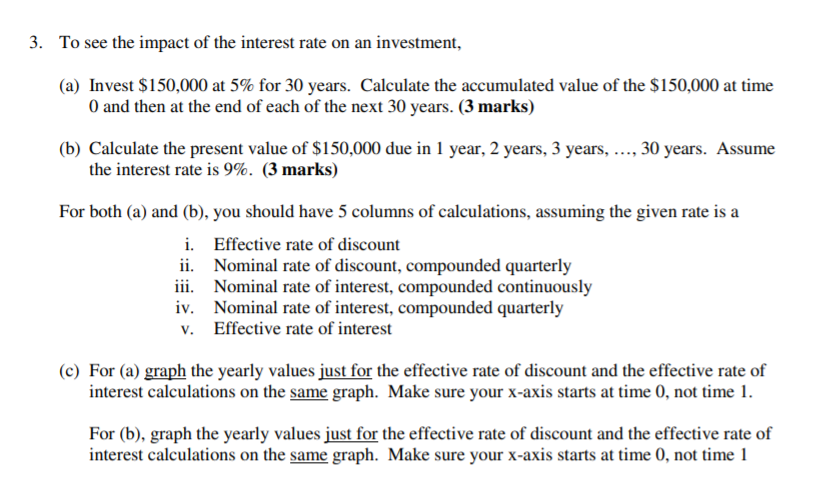

To see the impact of the interest rate on an investment, (a) Invest $150,000 at 5% for 30 years. Calculate the accumulated value of the $150,000 at time 0 and then at the end of each of the next 30 years. (3 marks) (b) Calculate the present value of $150,000 due in 1 year, 2 years, 3 years, , 30 years. Assume the interest rate is 9%. (3 marks) For both (a) and (b), you should have 5 columns of calculations, assuming the given rate is a i. Effective rate of discount ii. Nominal rate of discount, compounded quarterly iii. Nominal rate of interest, compounded continuously iv. Nominal rate of interest, compounded quarterly v. Effective rate of interest (c) For (a) graph the yearly values just for the effective rate of discount and the effective rate of interest calculations on the same graph. Make sure your x-axis starts at time 0, not time 1. For (b), graph the yearly values just for the effective rate of discount and the effective rate of interest calculations on the same graph. Make sure your x-axis starts at time 0, not time 1

3. To see the impact of the interest rate on an investment, (a) Invest $150,000 at 5% for 30 years. Calculate the accumulated value of the $150,000 at time O and then at the end of each of the next 30 years. (3 marks) (b) Calculate the present value of $150,000 due in 1 year, 2 years, 3 years, ..., 30 years. Assume the interest rate is 9%. (3 marks) For both (a) and (b), you should have 5 columns of calculations, assuming the given rate is a i. Effective rate of discount ii. Nominal rate of discount, compounded quarterly iii. Nominal rate of interest, compounded continuously iv. Nominal rate of interest, compounded quarterly v. Effective rate of interest (c) For (a) graph the yearly values just for the effective rate of discount and the effective rate of interest calculations on the same graph. Make sure your x-axis starts at time 0, not time 1. For (b), graph the yearly values just for the effective rate of discount and the effective rate of interest calculations on the same graph. Make sure your x-axis starts at time 0, not time 1 3. To see the impact of the interest rate on an investment, (a) Invest $150,000 at 5% for 30 years. Calculate the accumulated value of the $150,000 at time O and then at the end of each of the next 30 years. (3 marks) (b) Calculate the present value of $150,000 due in 1 year, 2 years, 3 years, ..., 30 years. Assume the interest rate is 9%. (3 marks) For both (a) and (b), you should have 5 columns of calculations, assuming the given rate is a i. Effective rate of discount ii. Nominal rate of discount, compounded quarterly iii. Nominal rate of interest, compounded continuously iv. Nominal rate of interest, compounded quarterly v. Effective rate of interest (c) For (a) graph the yearly values just for the effective rate of discount and the effective rate of interest calculations on the same graph. Make sure your x-axis starts at time 0, not time 1. For (b), graph the yearly values just for the effective rate of discount and the effective rate of interest calculations on the same graph. Make sure your x-axis starts at time 0, not time 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started