please use excel if possible, if not, please explain math. thanks.

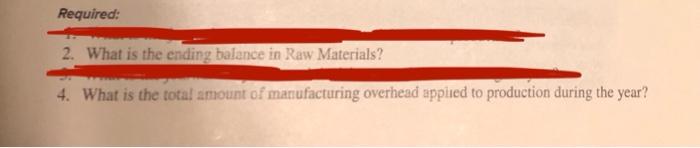

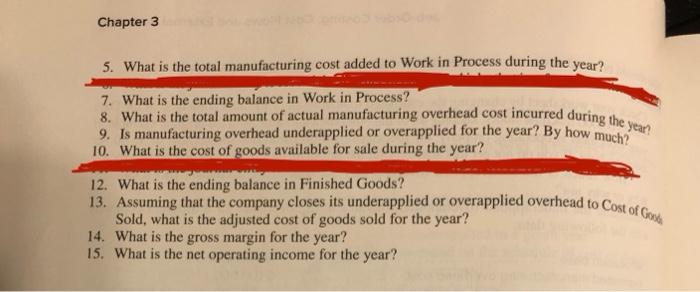

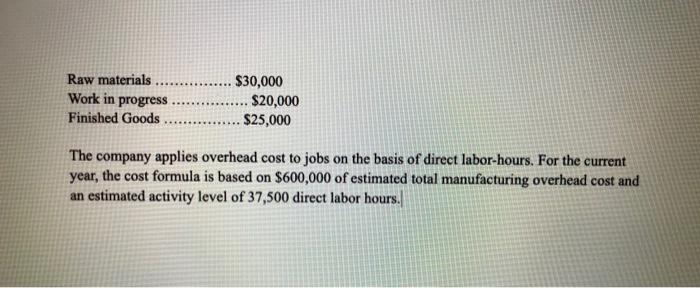

Raw materials Work in progress Finished Goods $30,000 $20,000 $25,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the cost formula is based on $600,000 of estimated total manufacturing overhead cost and an estimated activity level of 37,500 direct labor hours. Required: 2. What is the ending balance in Raw Materials? 4. What is the total amount of manufacturing overhead applied to production during the year? 8. What is the total amount of actual manufacturing overhead cost incurred during the year? 13. Assuming that the company closes its underapplied or overapplied overhead to Cost of God Chapter 3 5. What is the total manufacturing cost added to Work in Process during the year? 7. What is the ending balance in Work in Process? 9. Is manufacturing overhead underapplied or overapplied for the year? By how much? 10. What is the cost of goods available for sale during the year? 12. What is the ending balance in Finished Goods? Sold, what is the adjusted cost of goods sold for the year? 14. What is the gross margin for the year? 15. What is the net operating income for the year? Raw materials Work in progress Finished Goods $30,000 $20,000 $25,000 The company applies overhead cost to jobs on the basis of direct labor-hours. For the current year, the cost formula is based on $600,000 of estimated total manufacturing overhead cost and an estimated activity level of 37,500 direct labor hours. Required: 2. What is the ending balance in Raw Materials? 4. What is the total amount of manufacturing overhead applied to production during the year? 8. What is the total amount of actual manufacturing overhead cost incurred during the year? 13. Assuming that the company closes its underapplied or overapplied overhead to Cost of God Chapter 3 5. What is the total manufacturing cost added to Work in Process during the year? 7. What is the ending balance in Work in Process? 9. Is manufacturing overhead underapplied or overapplied for the year? By how much? 10. What is the cost of goods available for sale during the year? 12. What is the ending balance in Finished Goods? Sold, what is the adjusted cost of goods sold for the year? 14. What is the gross margin for the year? 15. What is the net operating income for the year