Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use excel QUESTION 2 (70 Points) A company acquired a bus for $110,000, which had a $3,000 delivery fee, $2,000/year maintenance cost, and contributes

Please use excel

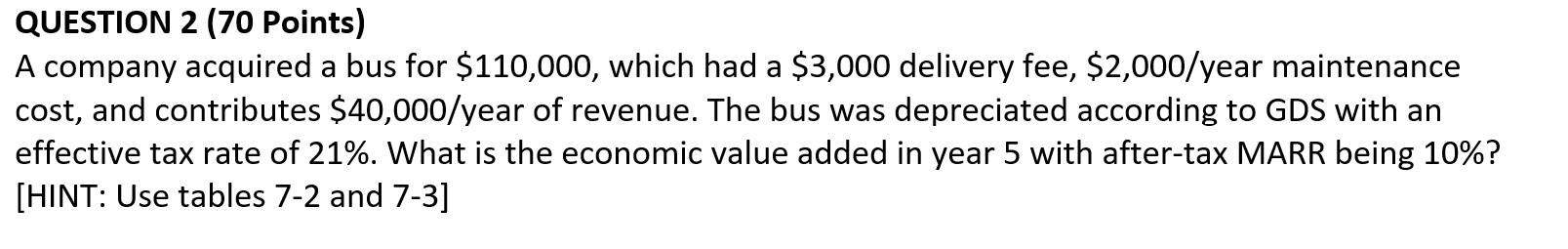

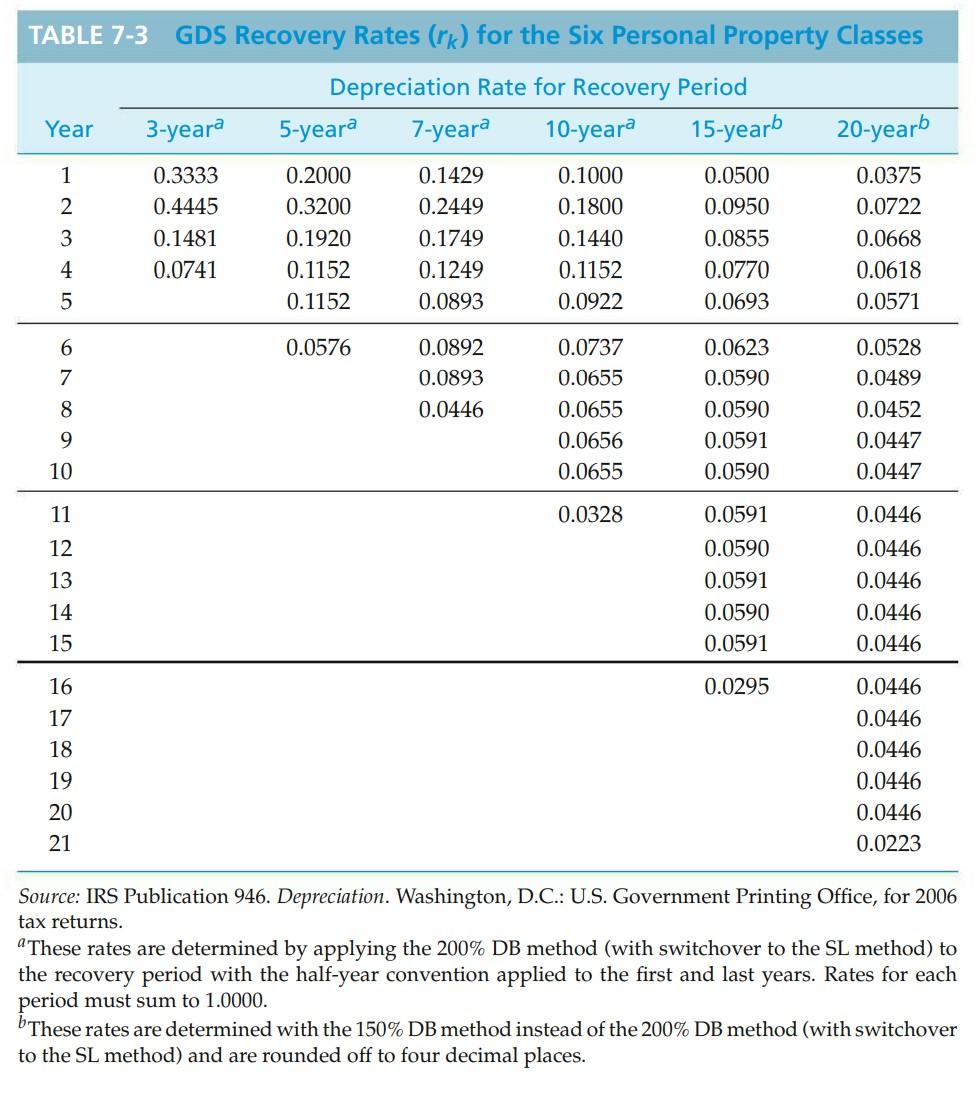

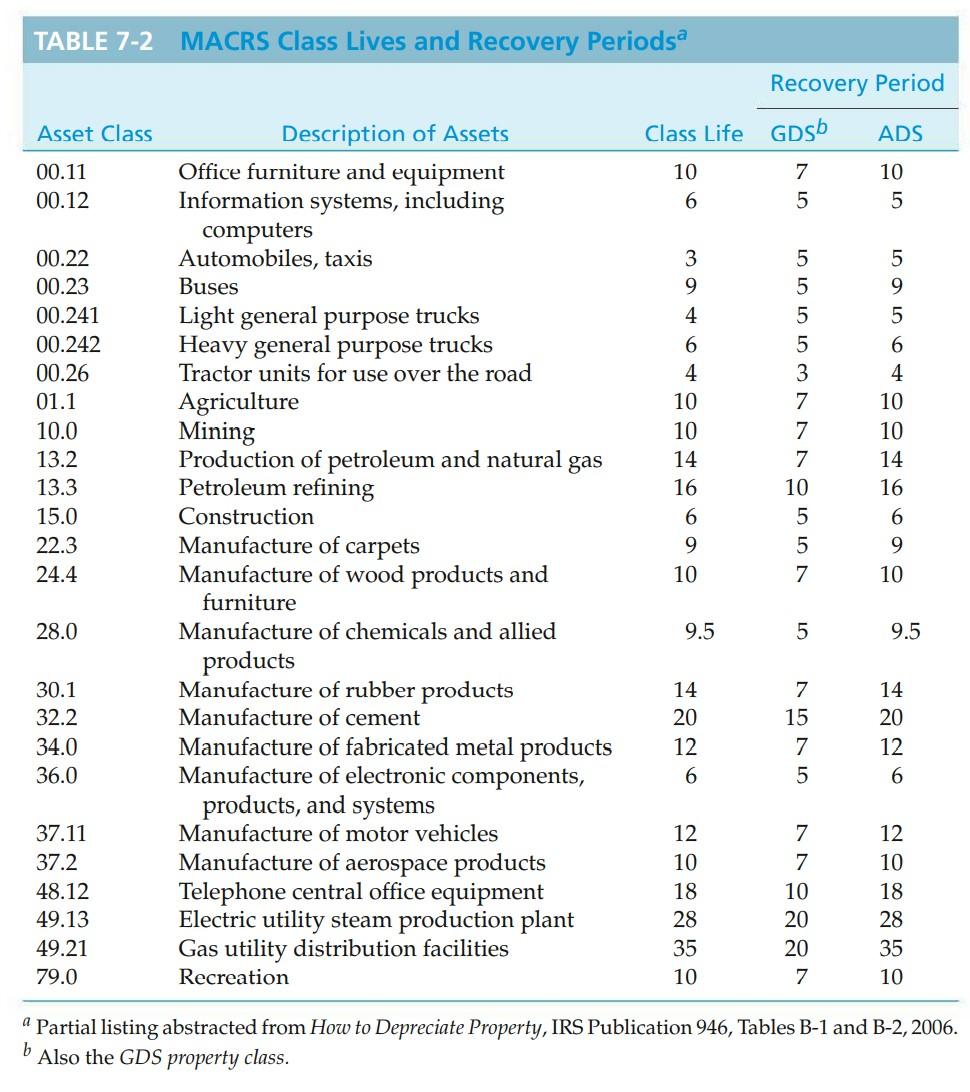

QUESTION 2 (70 Points) A company acquired a bus for $110,000, which had a $3,000 delivery fee, $2,000/year maintenance cost, and contributes $40,000/year of revenue. The bus was depreciated according to GDS with an effective tax rate of 21%. What is the economic value added in year 5 with after-tax MARR being 10%? [HINT: Use tables 7-2 and 7-3] TABLE 7-3 GDS Recovery Rates (r) for the Six Personal Property Classes Depreciation Rate for Recovery Period Year 3-yeara 5-yeara 7-yeara 10-yeara 15-yearb 20-yearb 1 2 0.3333 0.4445 0.1481 0.0741 3 0.2000 0.3200 0.1920 0.1152 0.1152 0.1429 0.2449 0.1749 0.1249 0.0893 0.1000 0.1800 0.1440 0.1152 0.0922 0.0500 0.0950 0.0855 0.0770 0.0693 0.0375 0.0722 0.0668 0.0618 0.0571 4 5 6 0.0576 0.0892 0.0893 0.0446 7 8 9 10 0.0737 0.0655 0.0655 0.0656 0.0655 0.0623 0.0590 0.0590 0.0591 0.0590 0.0528 0.0489 0.0452 0.0447 0.0447 11 0.0328 12 13 14 15 0.0591 0.0590 0.0591 0.0590 0.0591 0.0446 0.0446 0.0446 0.0446 0.0446 0.0295 16 17 18 19 20 21 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 Source: IRS Publication 946. Depreciation. Washington, D.C.: U.S. Government Printing Office, for 2006 tax returns. These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000. These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places. TABLE 7-2 MACRS Class Lives and Recovery Periodsa Recovery Period Asset Class Description of Assets Class Life GDSb ADS 00.11 Office furniture and equipment 10 7 10 00.12 Information systems, including 6 5 5 computers 00.22 Automobiles, taxis 3 5 5 00.23 Buses 9 5 9 00.241 Light general purpose trucks 4 5 5 00.242 Heavy general purpose trucks 6 5 6 00.26 Tractor units for use over the road 4 3 4 01.1 Agriculture 10 7 10 10.0 Mining 10 10 13.2 Production of petroleum and natural gas 14 7 14 13.3 Petroleum refining 16 10 16 15.0 Construction 6 5 6 22.3 Manufacture of carpets 9 5 9 24.4 Manufacture of wood products and 10 7 10 furniture 28.0 Manufacture of chemicals and allied 9.5 5 9.5 products 30.1 Manufacture of rubber products 14 14 32.2 Manufacture of cement 20 15 20 34.0 Manufacture of fabricated metal products 12 7 12 36.0 Manufacture of electronic components, 6 5 6 products, and systems 37.11 Manufacture of motor vehicles 12 12 37.2 Manufacture of aerospace products 10 7 10 48.12 Telephone central office equipment 18 10 18 49.13 Electric utility steam production plant 28 20 28 49.21 Gas utility distribution facilities 35 20 35 79.0 Recreation 10 7 10 voit Evvvwo o 1 1 voorv 0 var a Partial listing abstracted from How to Depreciate Property, IRS Publication 946, Tables B-1 and B-2, 2006. b Also the GDS property class. QUESTION 2 (70 Points) A company acquired a bus for $110,000, which had a $3,000 delivery fee, $2,000/year maintenance cost, and contributes $40,000/year of revenue. The bus was depreciated according to GDS with an effective tax rate of 21%. What is the economic value added in year 5 with after-tax MARR being 10%? [HINT: Use tables 7-2 and 7-3] TABLE 7-3 GDS Recovery Rates (r) for the Six Personal Property Classes Depreciation Rate for Recovery Period Year 3-yeara 5-yeara 7-yeara 10-yeara 15-yearb 20-yearb 1 2 0.3333 0.4445 0.1481 0.0741 3 0.2000 0.3200 0.1920 0.1152 0.1152 0.1429 0.2449 0.1749 0.1249 0.0893 0.1000 0.1800 0.1440 0.1152 0.0922 0.0500 0.0950 0.0855 0.0770 0.0693 0.0375 0.0722 0.0668 0.0618 0.0571 4 5 6 0.0576 0.0892 0.0893 0.0446 7 8 9 10 0.0737 0.0655 0.0655 0.0656 0.0655 0.0623 0.0590 0.0590 0.0591 0.0590 0.0528 0.0489 0.0452 0.0447 0.0447 11 0.0328 12 13 14 15 0.0591 0.0590 0.0591 0.0590 0.0591 0.0446 0.0446 0.0446 0.0446 0.0446 0.0295 16 17 18 19 20 21 0.0446 0.0446 0.0446 0.0446 0.0446 0.0223 Source: IRS Publication 946. Depreciation. Washington, D.C.: U.S. Government Printing Office, for 2006 tax returns. These rates are determined by applying the 200% DB method (with switchover to the SL method) to the recovery period with the half-year convention applied to the first and last years. Rates for each period must sum to 1.0000. These rates are determined with the 150% DB method instead of the 200% DB method (with switchover to the SL method) and are rounded off to four decimal places. TABLE 7-2 MACRS Class Lives and Recovery Periodsa Recovery Period Asset Class Description of Assets Class Life GDSb ADS 00.11 Office furniture and equipment 10 7 10 00.12 Information systems, including 6 5 5 computers 00.22 Automobiles, taxis 3 5 5 00.23 Buses 9 5 9 00.241 Light general purpose trucks 4 5 5 00.242 Heavy general purpose trucks 6 5 6 00.26 Tractor units for use over the road 4 3 4 01.1 Agriculture 10 7 10 10.0 Mining 10 10 13.2 Production of petroleum and natural gas 14 7 14 13.3 Petroleum refining 16 10 16 15.0 Construction 6 5 6 22.3 Manufacture of carpets 9 5 9 24.4 Manufacture of wood products and 10 7 10 furniture 28.0 Manufacture of chemicals and allied 9.5 5 9.5 products 30.1 Manufacture of rubber products 14 14 32.2 Manufacture of cement 20 15 20 34.0 Manufacture of fabricated metal products 12 7 12 36.0 Manufacture of electronic components, 6 5 6 products, and systems 37.11 Manufacture of motor vehicles 12 12 37.2 Manufacture of aerospace products 10 7 10 48.12 Telephone central office equipment 18 10 18 49.13 Electric utility steam production plant 28 20 28 49.21 Gas utility distribution facilities 35 20 35 79.0 Recreation 10 7 10 voit Evvvwo o 1 1 voorv 0 var a Partial listing abstracted from How to Depreciate Property, IRS Publication 946, Tables B-1 and B-2, 2006. b Also the GDS property classStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started