please use excel to fund answers

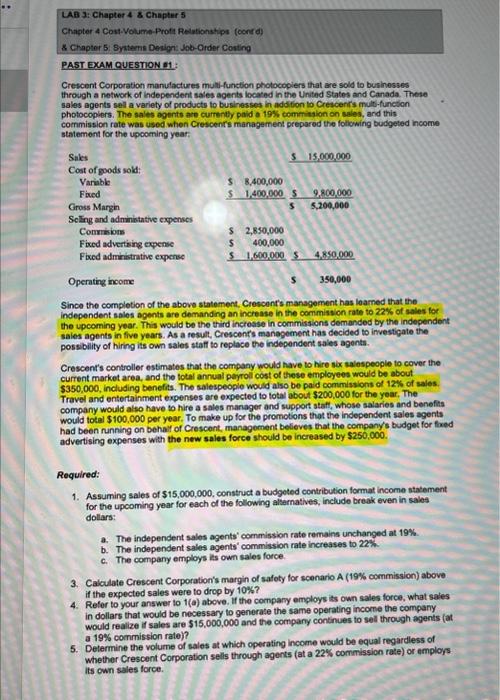

UAB 3: Chapter 4 \& Chapter 5 Chapter 4 Cost-Volume-Proft Relationshipt foons d) \& Chapter 5 . Bnterns Design: Job-Order Costing PAST EXAM QUESTION E1: Crescent Corporation manufactures muld-function photocopiers that are sold to businesses through a network of independent sales agents located in the United States and Canada. These sales agents sell a variety of products to businesset in addition lo Crescerifs mult-function photocoplers. The sales agents are currenty paid a 19% commitsion on sales, and this cornmission rate was used when Crescents management preparod the following budgeted income statement for the upcoming year: Since the completion of the above statement. Crescenfs management has loamed that the independent sales apents are demanding an increase in the commission rate to 22% of sales for independent sales agents are demanding an increase in the commiss on rate to 22% of sales loe the upcoming year. This would be the trifd increasse in commissions demanded by the independ possibility of hiring its own sales staff to replace the independent sales agents. Crescent's controller estimates that the company would have to hire six salospeople to cover the current market area, and the total annual payroli cost of these employees would be about $350,000, including benefits. The salespeople would also be paid commissions of 12% of sales. Travel and entertainment expenses are expected to total about $200,000 for the year, The company would alse have to hire a sales manager and support stafl, whose salaries and benefits would total $100,000 per year. To make up for the promotions that the independent sales agents had been nunning on behalf of Crescont, managoment believes that the company's budget for fixed advertising expenses with the new sales force should be increased by $250,000. Required: 1. Assuming sales of $15,000,000, construct a budgeted contribution format income statement for the upcoming year for each of the following alsernatives, include break even in sales dollars: a. The independent sales agents' commission rate remains unchanged at 19\%. b. The independent sales agents' commission rate increases to 22%. c. The company employs its own sales force