Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use financial calculator Use this information for the following two problems. You turned 25 years old today and have decided that it is time

Please use financial calculator

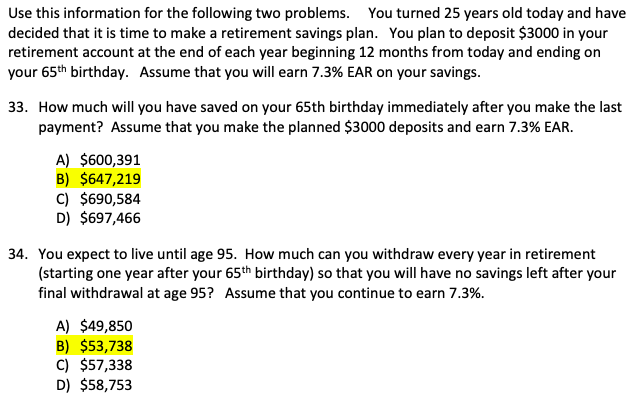

Use this information for the following two problems. You turned 25 years old today and have decided that it is time to make a retirement savings plan. You plan to deposit $3000 in your retirement account at the end of each year beginning 12 months from today and ending on your 65th birthday. Assume that you will earn 7.3% EAR on your savings. 33. How much will you have saved on your 65th birthday immediately after you make the last payment? Assume that you make the planned $3000 deposits and earn 7.3% EAR. A) $600,391 B) $647,219 C) $690,584 D) $697,466 34. You expect to live until age 95. How much can you withdraw every year in retirement (starting one year after your 65th birthday) so that you will have no savings left after your final withdrawal at age 95? Assume that you continue to earn 7.3%. A) $49,850 B) $53,738 C) $57,338 D) $58,753Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started