Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use manitoba tax information. cpp 4.95. EI 4.95 Please help MULTIPLE CHOICE (20 marks) Choose the one alternative that best completes the statement or

Please use manitoba tax information. cpp 4.95. EI 4.95

Please use manitoba tax information. cpp 4.95. EI 4.95

Please help

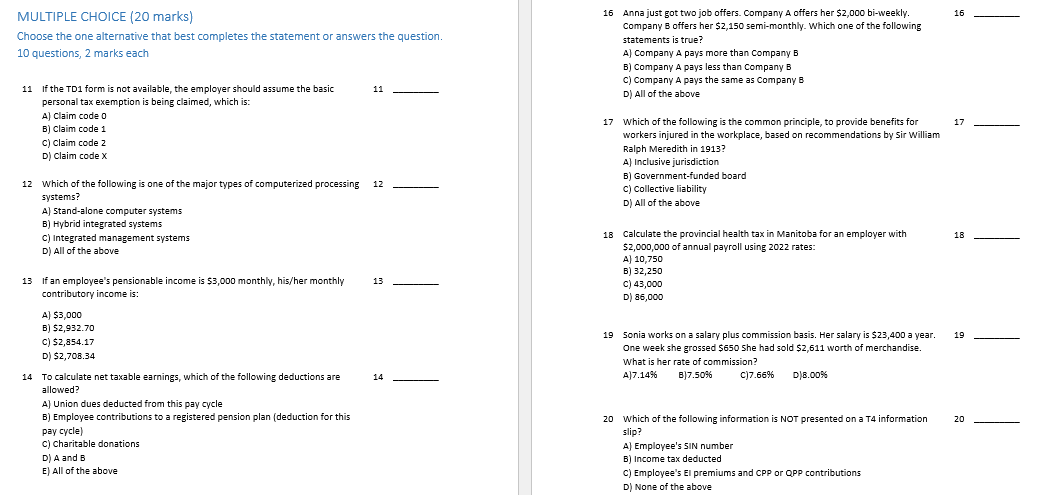

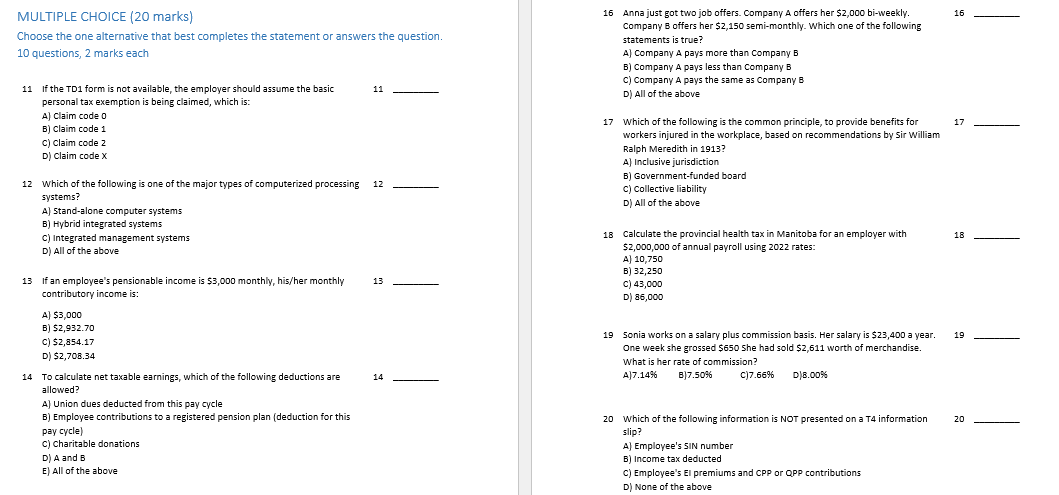

MULTIPLE CHOICE (20 marks) Choose the one alternative that best completes the statement or answers the question. 10 questions, 2 marks each 11 11 If the TD1 form is not available, the employer should assume the basic personal tax exemption is being claimed, which is: A) Claim code 0 B) Claim code 1 c) claim code 2 D) Claim code X 12 12 Which of the following is one of the major types of computerized processing systems? A) Stand-alone computer systems B) Hybrid integrated systems C) Integrated management systems D) All of the above 13 13 If an employee's pensionable income is $3,000 monthly, his/her monthly contributory income is: A) $3,000 B) $2,932.70 c) $2,854.17 D) $2,708.34 14 14 To calculate net taxable earnings, which of the following deductions are allowed? A) Union dues deducted from this pay cycle B) Employee contributions to a registered pension plan (deduction for this pay cycle) c) Charitable donations D) A and B E) All of the above 16 16 Anna just got two job offers. Company A offers her $2,000 bi-weekly. Company B offers her $2,150 semi-monthly. Which one of the following statements is true? A) Company A pays more than Company B B) Company A pays less than Company B C) Company A pays the same as Company B D) All of the above 17 17 Which of the following is the common principle, to provide benefits for workers injured in the workplace, based on recommendations by Sir William Ralph Meredith in 1913? A) Inclusive jurisdiction B) Government-funded board c) Collective liability D) All of the above 18 18 Calculate the provincial health tax in Manitoba for an employer with $2,000,000 of annual payroll using 2022 rates: A) 10,750 B) 32,250 C) 43,000 D) 86,000 19 19 Sonia works on a salary plus commission basis. Her salary is $23,400 a year. One week she grossed $650 She had sold $2,611 worth of merchandise. What is her rate of commission? A)7.14% B)7.50% C)7.66% D)8.00% 20 20 Which of the following information is NOT presented on a T4 information slip? A) Employee's SIN number B) Income tax deducted C) Employee's El premiums and CPP or QPP contributions D) None of the above MULTIPLE CHOICE (20 marks) Choose the one alternative that best completes the statement or answers the question. 10 questions, 2 marks each 11 11 If the TD1 form is not available, the employer should assume the basic personal tax exemption is being claimed, which is: A) Claim code 0 B) Claim code 1 c) claim code 2 D) Claim code X 12 12 Which of the following is one of the major types of computerized processing systems? A) Stand-alone computer systems B) Hybrid integrated systems C) Integrated management systems D) All of the above 13 13 If an employee's pensionable income is $3,000 monthly, his/her monthly contributory income is: A) $3,000 B) $2,932.70 c) $2,854.17 D) $2,708.34 14 14 To calculate net taxable earnings, which of the following deductions are allowed? A) Union dues deducted from this pay cycle B) Employee contributions to a registered pension plan (deduction for this pay cycle) c) Charitable donations D) A and B E) All of the above 16 16 Anna just got two job offers. Company A offers her $2,000 bi-weekly. Company B offers her $2,150 semi-monthly. Which one of the following statements is true? A) Company A pays more than Company B B) Company A pays less than Company B C) Company A pays the same as Company B D) All of the above 17 17 Which of the following is the common principle, to provide benefits for workers injured in the workplace, based on recommendations by Sir William Ralph Meredith in 1913? A) Inclusive jurisdiction B) Government-funded board c) Collective liability D) All of the above 18 18 Calculate the provincial health tax in Manitoba for an employer with $2,000,000 of annual payroll using 2022 rates: A) 10,750 B) 32,250 C) 43,000 D) 86,000 19 19 Sonia works on a salary plus commission basis. Her salary is $23,400 a year. One week she grossed $650 She had sold $2,611 worth of merchandise. What is her rate of commission? A)7.14% B)7.50% C)7.66% D)8.00% 20 20 Which of the following information is NOT presented on a T4 information slip? A) Employee's SIN number B) Income tax deducted C) Employee's El premiums and CPP or QPP contributions D) None of the aboveStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started