Question

Please use RStudio script or RMarkdown for your analysis and clearly explain your steps and commands. Interpret all your findings. Please upload your scripts. Please

Please use RStudio script or RMarkdown for your analysis and clearly explain your steps and commands. Interpret all your findings. Please upload your scripts.

Please upload your answers with interpretations and necessary explications for the steps of analysis that you did (using pdf, free office, or Word format).

Use the subset of 401KSUBS with fsize = 1

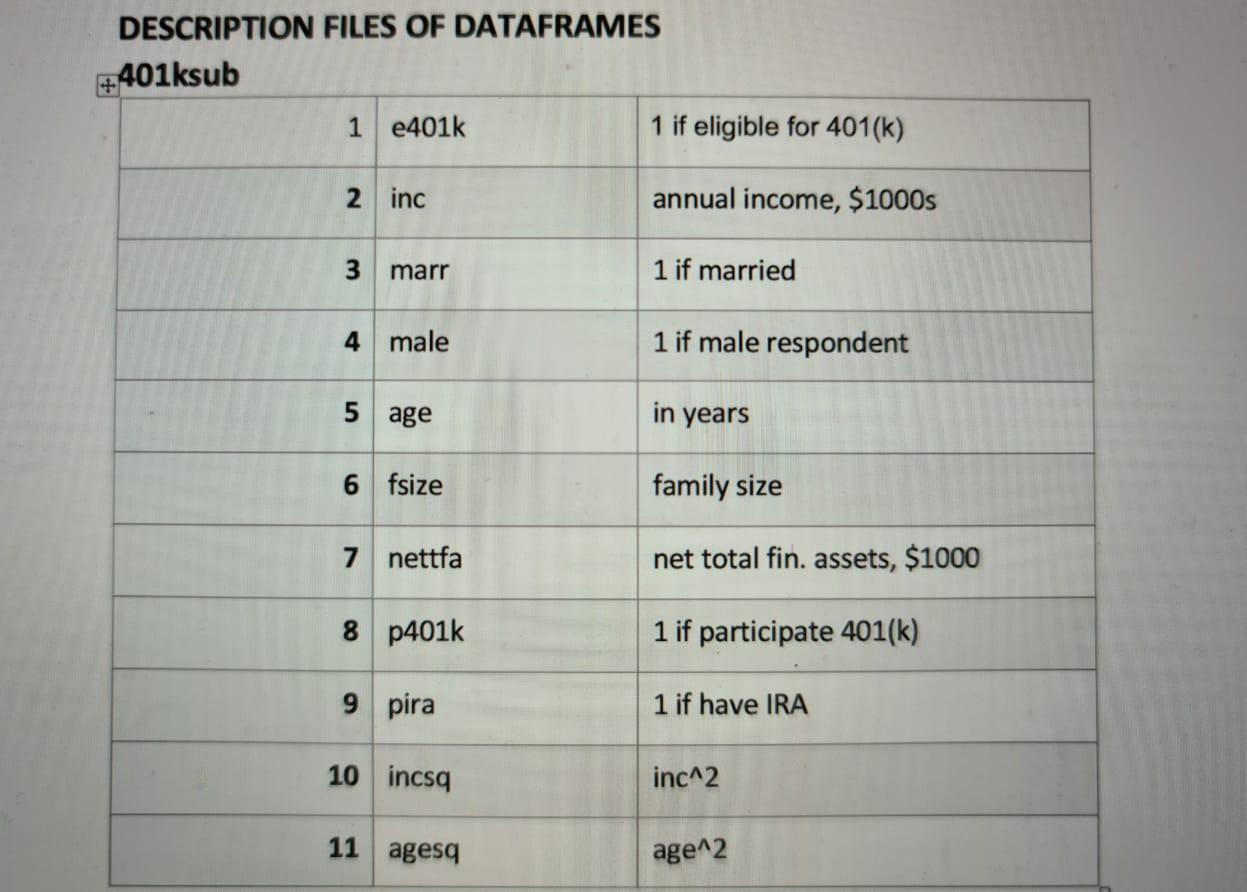

| 1 | e401k | 1 if eligible for 401(k) |

| 2 | inc | annual income, $1000s |

| 3 | marr | 1 if married |

| 4 | male | 1 if male respondent |

| 5 | age | in years |

| 6 | fsize | family size |

| 7 | nettfa | net total fin. assets, $1000 |

| 8 | p401k | 1 if participate 401(k) |

| 9 | pira | 1 if have IRA |

| 10 | incsq | inc^2 |

| 11 | agesq | age^2 |

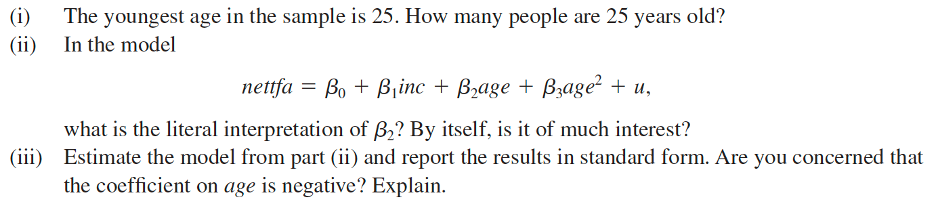

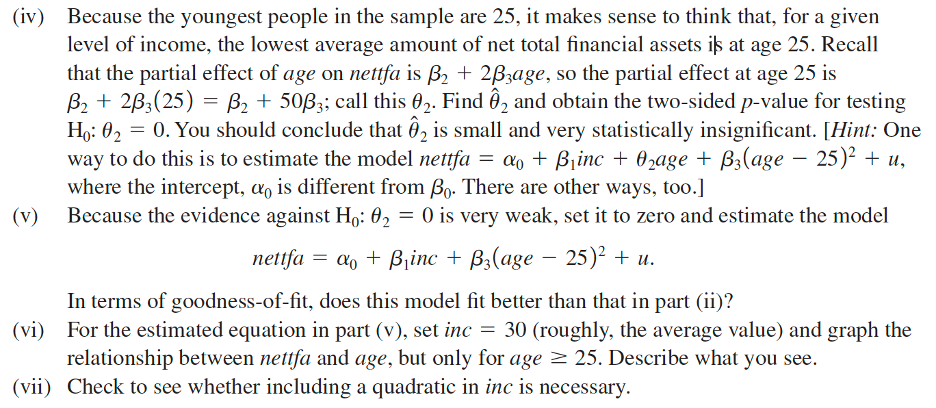

(i) The youngest age in the sample is 25. How many people are 25 years old? In the model (ii) nettfa = Bo + Binc + Bage + Bage + u, what is the literal interpretation of B? By itself, is it of much interest? (iii) Estimate the model from part (ii) and report the results in standard form. Are you concerned that the coefficient on age is negative? Explain. (iv) Because the youngest people in the sample are 25, it makes sense to think that, for a given level of income, the lowest average amount of net total financial assets is at age 25. Recall that the partial effect of age on nettfa is + 23age, so the partial effect at age 25 is B + 2B3(25) = B + 5083; call this 02. Find 2 and obtain the two-sided p-value for testing Ho: 02 0. You should conclude that 2 is small and very statistically insignificant. [Hint: One way to do this is to estimate the model nettfa = a + inc + 0age + (age 25) + u, where the intercept, ao is different from Bo. There are other ways, too.] = (v) Because the evidence against Ho: 0 = 0 is very weak, set it to zero and estimate the model nettfa = a + Binc + B3(age - 25) + u. In terms of goodness-of-fit, does this model fit better than that in part (ii)? (vi) For the estimated equation in part (v), set inc = 30 (roughly, the average value) and graph the relationship between nettfa and age, but only for age 25. Describe what you see. (vii) Check to see whether including a quadratic in inc is necessary. DESCRIPTION FILES OF DATAFRAMES 401ksub 1 e401k 2 inc 3 marr 4 male 5 age 6 fsize 7 nettfa 8 p401k 9 pira 10 incsq 11 agesq 1 if eligible for 401(k) annual income, $1000s 1 if married 1 if male respondent in years family size net total fin. assets, $1000 1 if participate 401(k) 1 if have IRA inc^2 age^2 (i) The youngest age in the sample is 25. How many people are 25 years old? In the model (ii) nettfa = Bo + Binc + Bage + Bage + u, what is the literal interpretation of B? By itself, is it of much interest? (iii) Estimate the model from part (ii) and report the results in standard form. Are you concerned that the coefficient on age is negative? Explain. (iv) Because the youngest people in the sample are 25, it makes sense to think that, for a given level of income, the lowest average amount of net total financial assets is at age 25. Recall that the partial effect of age on nettfa is + 23age, so the partial effect at age 25 is B + 2B3(25) = B + 5083; call this 02. Find 2 and obtain the two-sided p-value for testing Ho: 02 0. You should conclude that 2 is small and very statistically insignificant. [Hint: One way to do this is to estimate the model nettfa = a + inc + 0age + (age 25) + u, where the intercept, ao is different from Bo. There are other ways, too.] = (v) Because the evidence against Ho: 0 = 0 is very weak, set it to zero and estimate the model nettfa = a + Binc + B3(age - 25) + u. In terms of goodness-of-fit, does this model fit better than that in part (ii)? (vi) For the estimated equation in part (v), set inc = 30 (roughly, the average value) and graph the relationship between nettfa and age, but only for age 25. Describe what you see. (vii) Check to see whether including a quadratic in inc is necessary. DESCRIPTION FILES OF DATAFRAMES 401ksub 1 e401k 2 inc 3 marr 4 male 5 age 6 fsize 7 nettfa 8 p401k 9 pira 10 incsq 11 agesq 1 if eligible for 401(k) annual income, $1000s 1 if married 1 if male respondent in years family size net total fin. assets, $1000 1 if participate 401(k) 1 if have IRA inc^2 age^2

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started