Please use same format in response.

Please use same format in response.

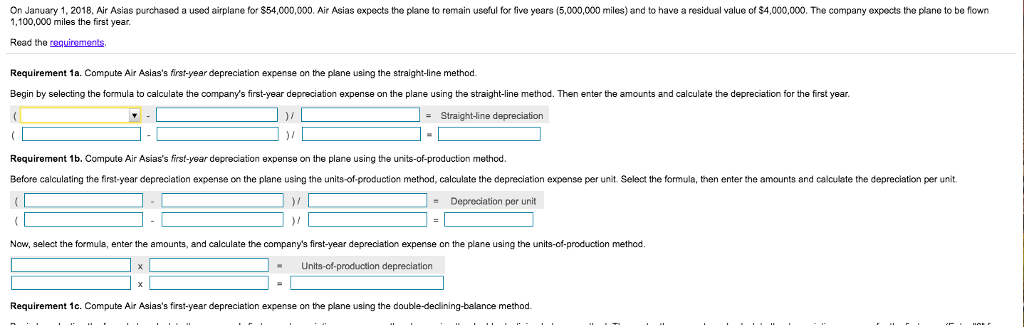

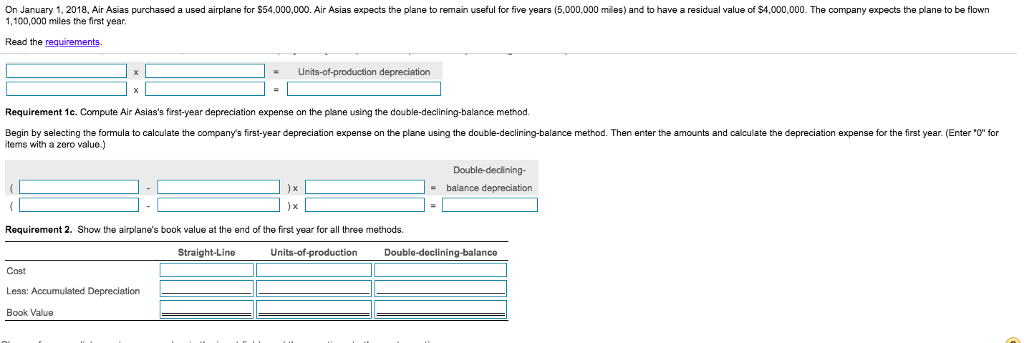

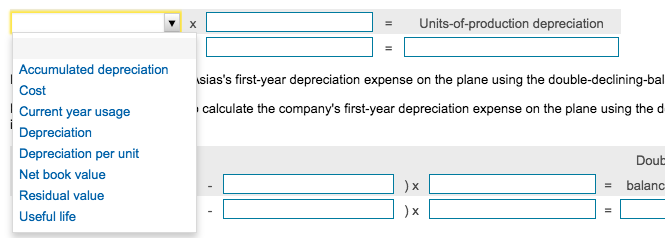

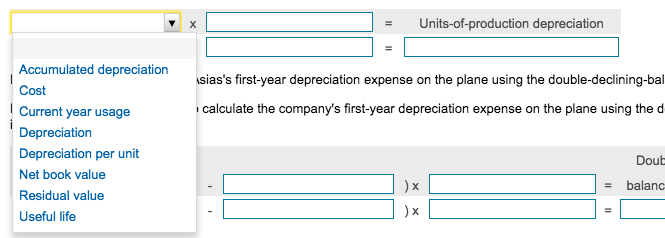

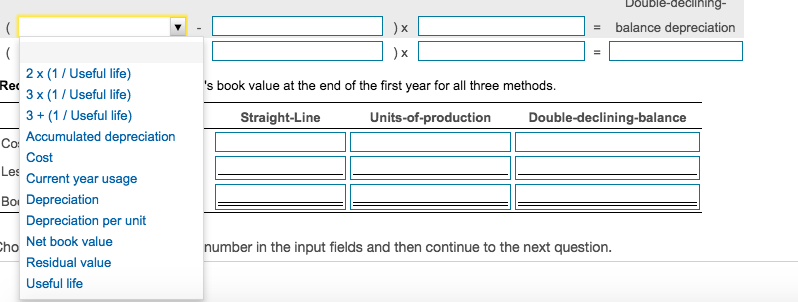

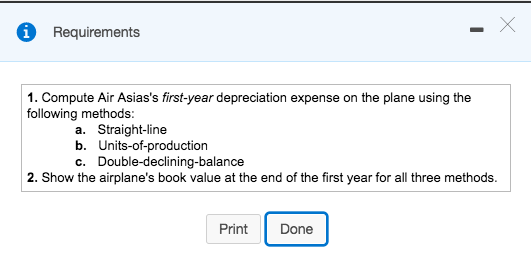

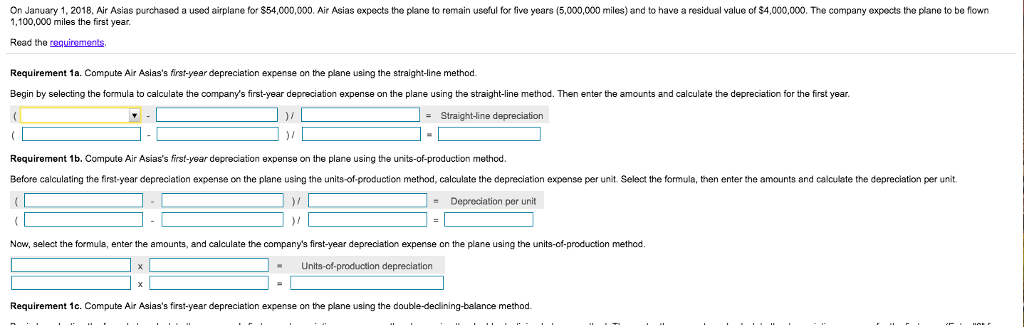

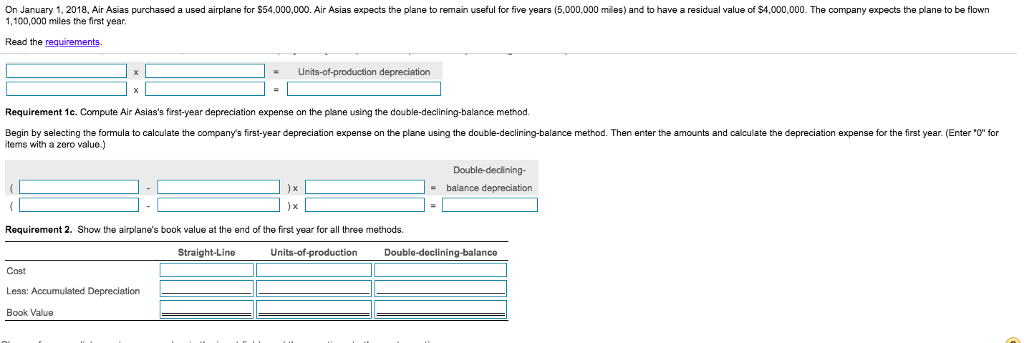

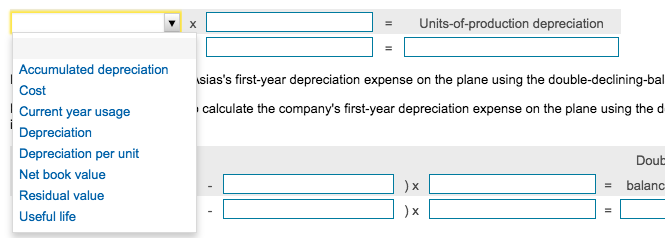

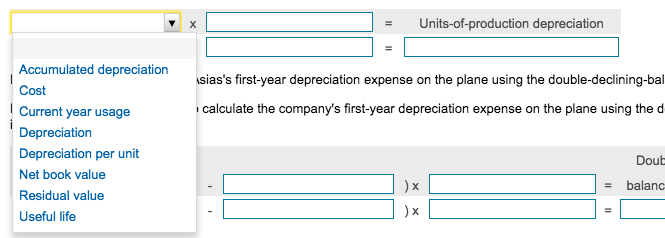

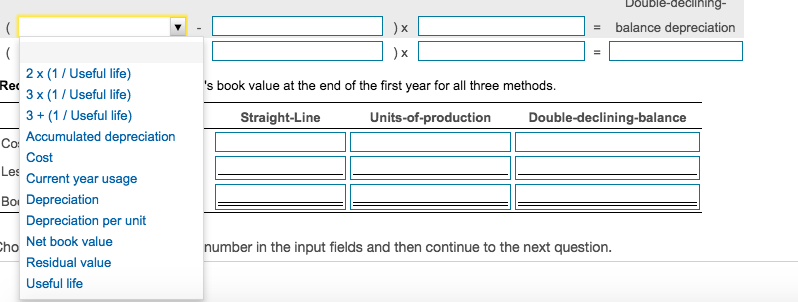

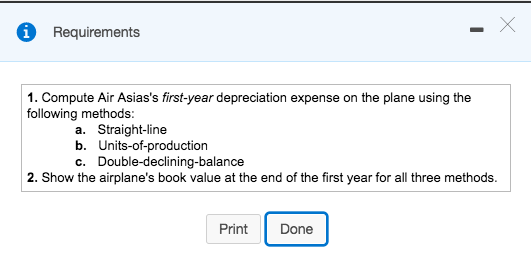

On January 1, 2018, Air Asias purchased a used airplane for $54,000,000. Air Asias expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,000,000. The company expects the plane to be flown 1,100,000 miles the first year. Read the requirements Requirement 1a. Compute Air Aslas's first-year depreciation expense on the plane using the straight-line method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the straight-line method. Then enter the amounts and calculate the depreciation for the first year. -Straight-line depreciation )1 Requirement 1b. Compute Air Asias's firsf-ysar depreciation expense on the plane using the units-of-production method Before calculating the first-year depreciation expense on the plane using the units-of-production method, calculate the depreciation expense per unit. Select the formula, then enter the amounts and calculete the depreciation per unit. Depreciation per unit Now, select the formula, enter the amounts, and calculate the company's first-year deprecilation expense on the plane using the units-of-production method Units-of-production depreciation Requirement 1c. Compute Air Asias's first-year depreciation expense on the plane using the double-declining-balance method On January 1, 2018, Air Asias purchased a used airplane for $54,000,000. Air Asias expects the plane to remain useful for five years (5,000,000 miles) and to have a residual value of $4,000,000. The company expects the plane to be flown 1,100,000 miles the first year Read the requirements. Requirement 1c. Compute Air Asias's first-year depreciation expense on the plane using the double-declining-balance method. Begin by selecting the formula to calculate the company's first-year depreciation expense on the plane using the double-declining-balance method. Then enter the amounts and calculate the depreciation expense for the first year. (Enter 'O" for items with a zero value.) ) x - balance depreciation Requirement 2. Show the airplane's book value at the end of the first year for all three methods. Straight-Line Units-of-production Double-declining-balance Cost Less: Accumulated Depreclation Book Value - Units-of-production depreciation Accumulated depreciation Cost Current year usage Depreciation Depreciation per unit Net book value Residual value Useful life sias's first-year depreciation expense on the plane using the double-declining-bal calculate the company's first-year depreciation expense on the plane using the d Doub - balanc - Units-of-production depreciation Accumulated depreciation Cost Current year usage Depreciation Depreciation per unit Net book value Residual value Useful life sias's first-year depreciation expense on the plane using the double-declining-bal calculate the company's first-year depreciation expense on the plane using the d Doub - balanc Double-declinino ) x - balance depreciation 2 x (1/Useful life) 3 x (1/Useful life) 3+(1/ Useful life) Accumulated depreciation Cost Current year usage Rec s book value at the end of the first year for all three method:s Straight-Line Units-of-production Double-declining-balance Co Les Bor Depreciation Depreciation per unit Net book value Residual value Useful life ho number in the input fields and then continue to the next question. Requirements 1 1. Compute Air Asias's first-year depreciation expense on the plane using the following methods a. Straight-line b. Units-of-production c. Double-declining-balance 2. Show the airplane's book value at the end of the first year for all three methods. Print Done

Please use same format in response.

Please use same format in response.