Please use & show the formulas to refill the complete spreadsheet (I want to learn), if you can't do it all, please don't do it at all.

Thank you in advance.

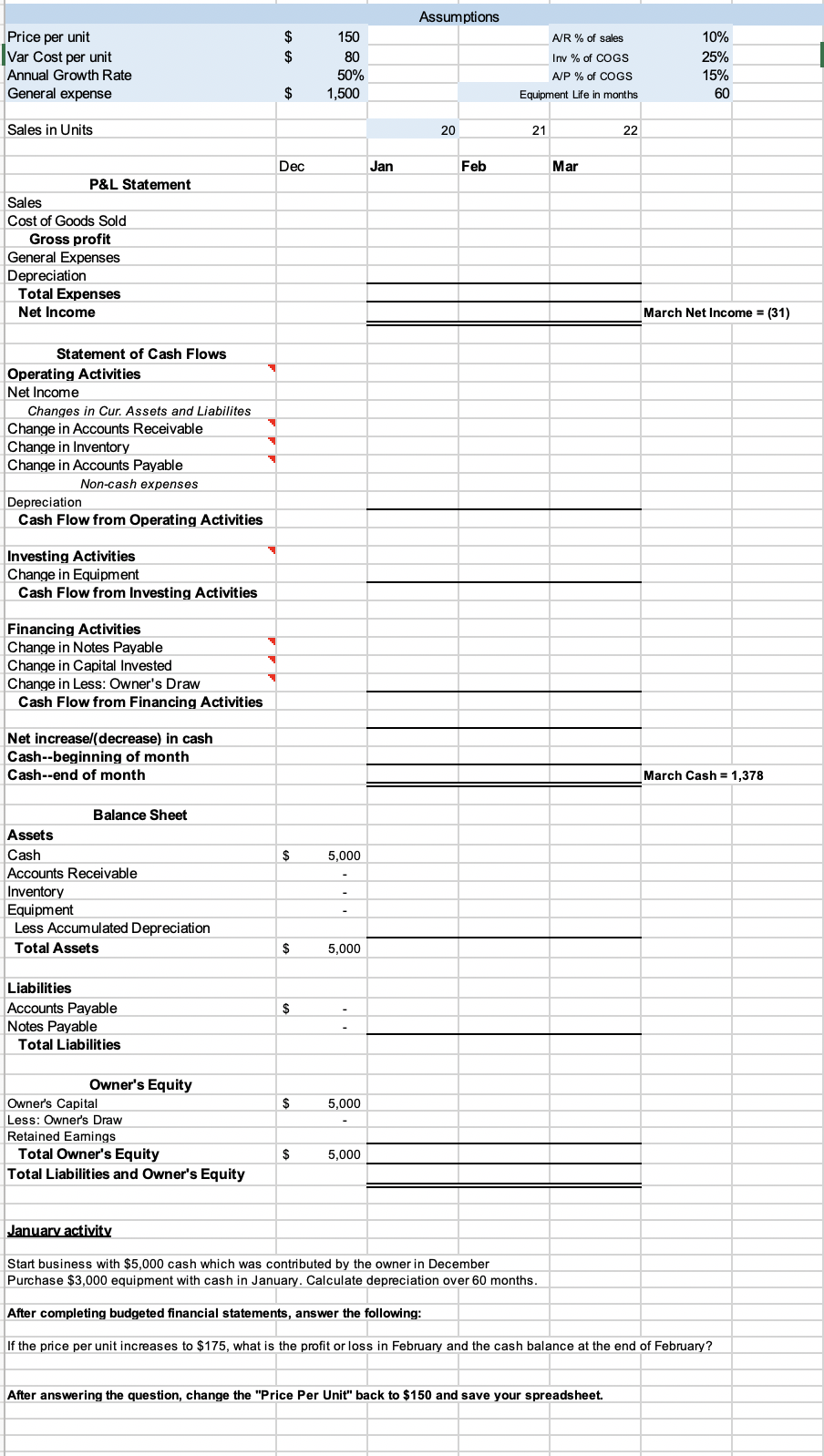

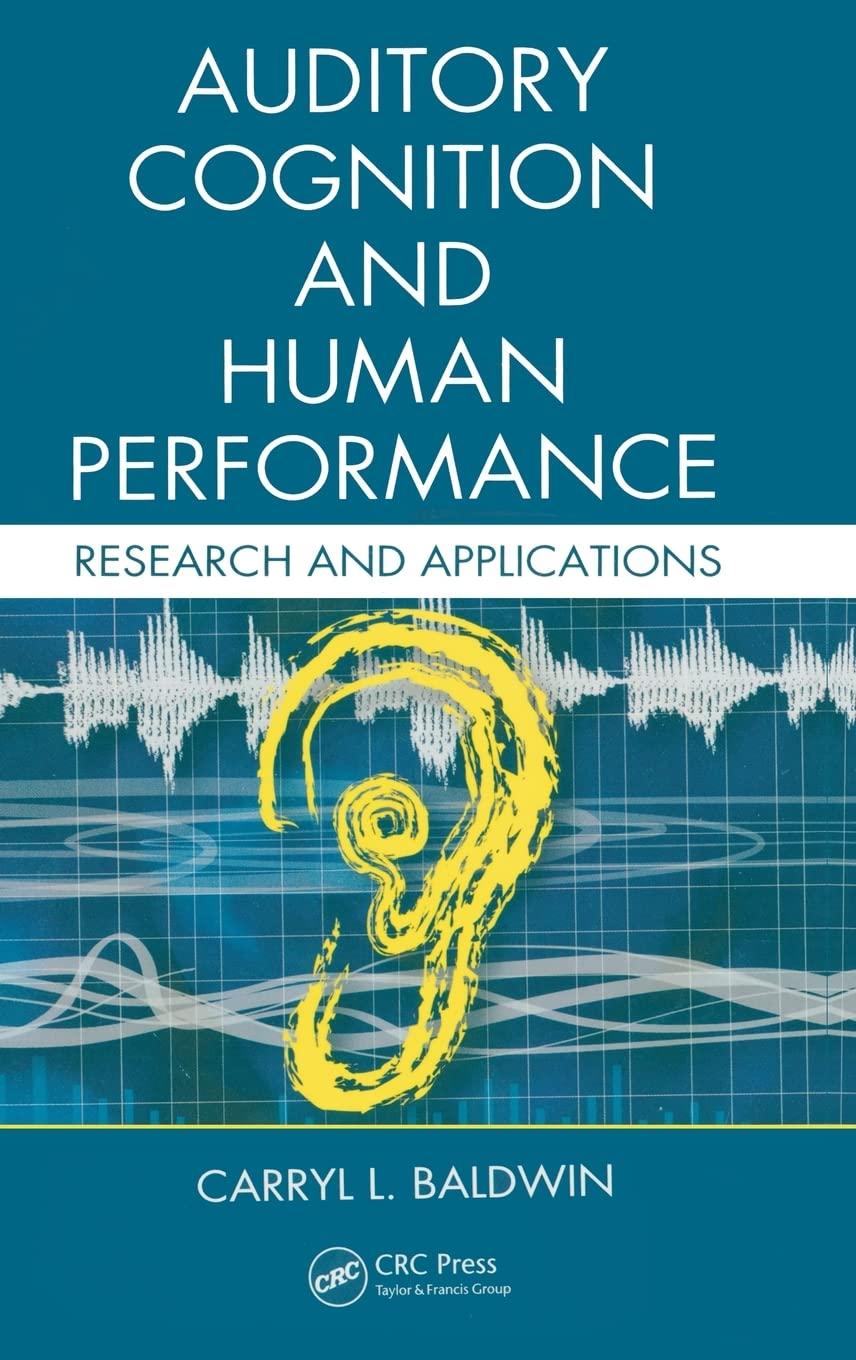

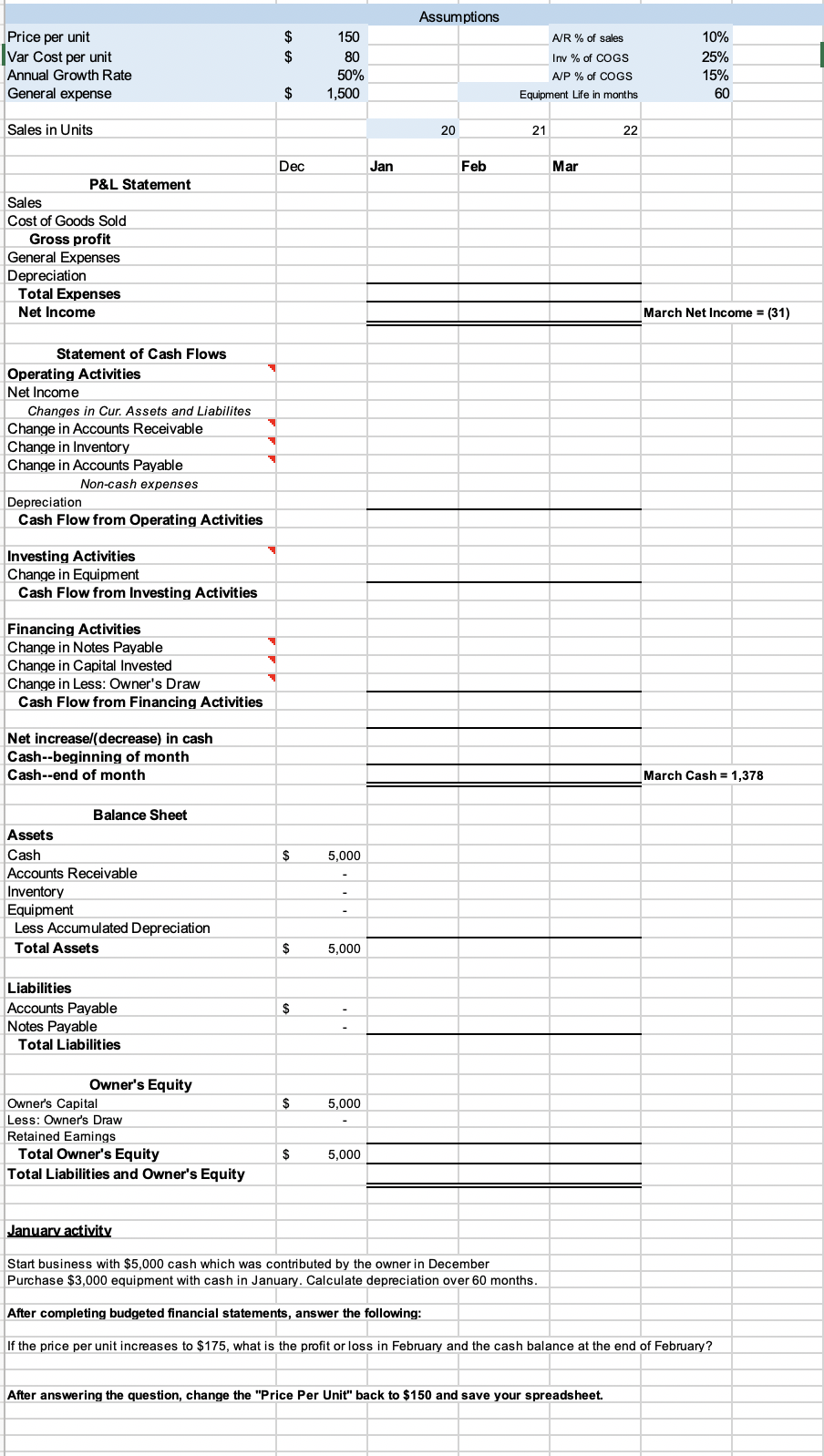

Assumptions A A Price per unit Var Cost per unit Annual Growth Rate General expense 150 80 50% 1,500 A/R % of sales Inv % of COGS A/P % of COGS Equipment Life in months 10% 25% 15% 60 $ Sales in Units 20 21 22 Dec Jan Feb Mar P&L Statement Sales Cost of Goods Sold Gross profit General Expenses Depreciation Total Expenses Net Income March Net Income = (31) Statement of Cash Flows Operating Activities Net Income Changes in Cur. Assets and Liabilites Change in Accounts Receivable Change in Inventory Change in Accounts Payable Non-cash expenses Depreciation Cash Flow from Operating Activities Investing Activities Change in Equipment Cash Flow from Investing Activities Financing Activities Change in Notes Payable Change in Capital Invested Change in Less: Owner's Draw Cash Flow from Financing Activities Net increasel( decrease) in cash Cash--beginning of month Cash--end of month March Cash = 1,378 $ 5,000 Balance Sheet Assets Cash Accounts Receivable Inventory Equipment Less Accumulated Depreciation Total Assets $ 5,000 $ Liabilities Accounts Payable Notes Payable Total Liabilities $ 5,000 Owner's Equity Owner's Capital Less: Owner's Draw Retained Eamings Total Owner's Equity Total Liabilities and Owner's Equity $ 5,000 January activity Start business with $5,000 cash which was contributed by the owner in December Purchase $3,000 equipment with cash in January. Calculate depreciation over 60 months. After completing budgeted financial statements, answer the following: If the price per unit increases to $175, what is the profit or loss in February and the cash balance at the end of February? After answering the question, change the "Price Per Unit" back to $150 and save your spreadsheet. Appropriate line items for each of the financial statements are included in the spreadsheet. Ensure the following tips and hints are applied to your spreadsheet: o You need Net Income from the P&L statement to complete Retained Earnings on the Balance Sheet. o The Balance Sheet accounts, including Accounts Receivable, Inventory and Accounts Payable are to be populated with formulas linking the percent assumption for each account with the corresponding sales or COGS amount for each month. o The Balance Sheet includes zero balances for the month prior to the beginning month to assist in completing the formulas in the Statement of Cash Flows that require the change from one month to another. o Regarding the Statement of Cash Flows, remember the change formulas for Assets are previous month minus current month and for Liabilities and Capital it is the reverse: current month minus previous month. o For the Cash on the Balance Sheet, enter a formula in that line item equal to Ending Cash from the Statement of Cash Flows for each month