Question

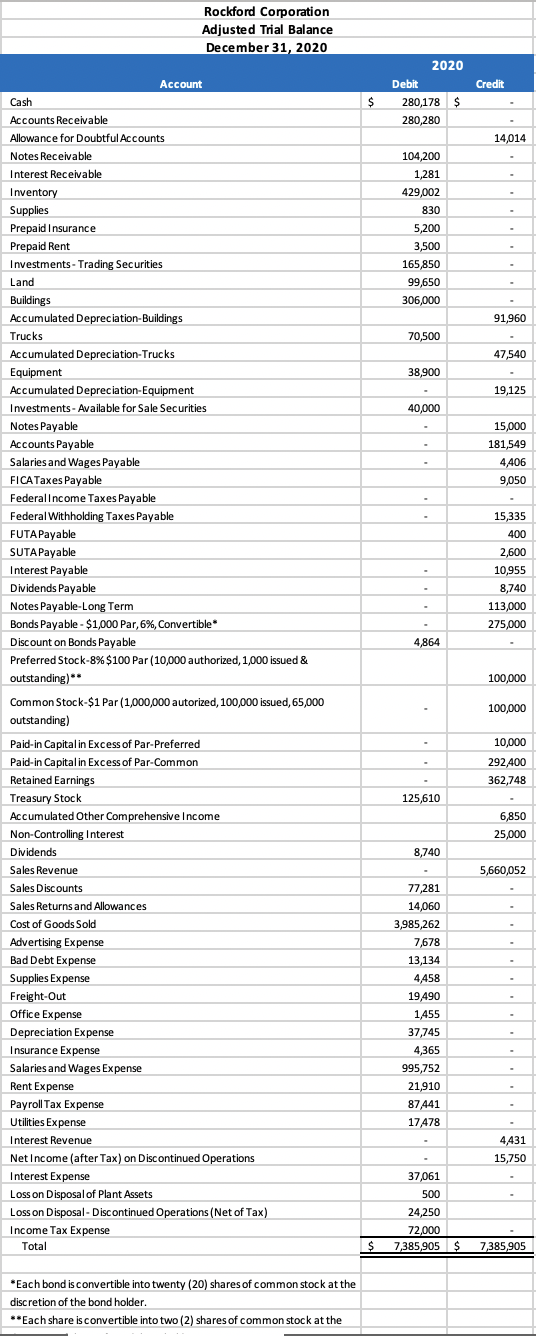

Please use the Adjusted Trial Balance for Rockford Corporation included as a separate Excel file to complete this assignment. Note that the Excel file contains

Please use the Adjusted Trial Balance for Rockford Corporation included as a separate Excel file to complete this assignment. Note that the Excel file contains tabs for the individual worksheets designated for each of the required statements or assignments. Please name the workbook you submit as specified below.

In addition to the content, you will be assessed on your mastery of the following skills: (1) correct data entry, (2) correct and accessible formulas, (3) formatting of column headings and labels, (4) merger and centering of titles, and (5) overall spreadsheet formatting and printing.

You are asked to prepare the following statements:

Income Statement for the year ending December 31, 2020

Statement of Retained Earnings for the year ending December 31, 2020

Statement of Stockholders Equity for the year ending December 31, 2020

Balance Sheet at December 31, 2020

In addition to the above statements, you are to prepare the journal entries necessary to close the books for Rockford Corporation on December 31, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started