Question

Please use the attached tables to answer the following questions and show your work. 1)Assume that Ole Olson is a patron of the Taft Farmers

Please use the attached tables to answer the following questions and show your work.

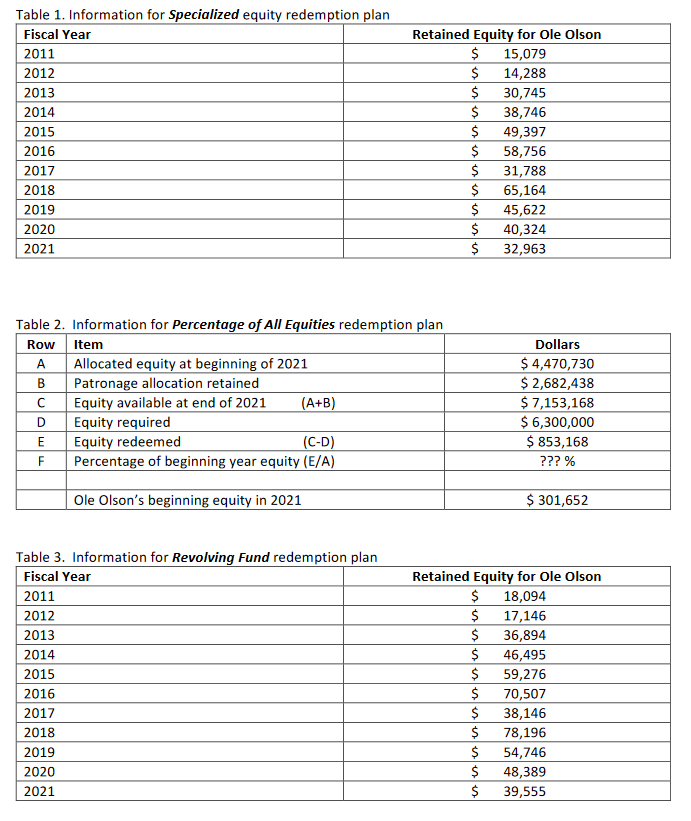

1)Assume that Ole Olson is a patron of the Taft Farmers Cooperative. The cooperatives Board of Directors uses a Specialized equity redemption plan that redeems the members entire retained equity at age 67. How much redeemed equity will Ole receive on his 67th birthday next week?(Please see Table 1)

2)Assume that Ole Olson is a patron of the Taft Farmers Cooperative. The cooperatives Board of Directors uses a Percentage of All Equities equity redemption plan. The Board of Directors has approved the allocation in Table 2. What percentage of all equity will be redeemed (Please round to six decimals; ex. 0.083416)? How much redeemed equity will Ole receive in 2021?(Please see Table 2)

3)Assume that Ole Olson is a patron of the Taft Farmers Cooperative. The cooperatives Board of Directors uses a Revolving Fund equity redemption plan. The Board of Directors has voted to redeem the retained equity from 2013. How much redeemed equity will Ole receive in 2021?(Please see Table 3)

4)Assume that Ole Olson is a patron of the Taft Farmers Cooperative. The cooperatives Board of Directors uses a Base Capital equity redemption plan. The Board of Directors has chosen a base capital level of $ 65,000,000. Please calculate Oles Adjusted Equity Obligation. Is Ole over invested or under invested? How much is Ole over invested or under invested?(Please see Table 4)

Table 1. Information for Specialized equity redemption plan Fiscal Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Retained Equity for Ole Olson $ 15,079 $ 14,288 $ 30,745 $ 38,746 $ 49,397 $ 58,756 $ 31,788 $ 65,164 $ 45,622 $ 40,324 $ 32,963 B Table 2. Information for Percentage of All Equities redemption plan Row Item . Allocated equity at beginning of 2021 Patronage allocation retained . Equity available at end of 2021 (A+B) D Equity required Equity redeemed (C-D) F Percentage of beginning year equity (E/A) Dollars $ 4,470,730 $ 2,682,438 $ 7,153,168 $ 6,300,000 $ 853,168 ??? % E Ole Olson's beginning equity in 2021 $ 301,652 Table 3. Information for Revolving Fund redemption plan Fiscal Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 Retained Equity for Ole Olson $ 18,094 $ 17,146 $ 36,894 $ 46,495 $ 59,276 $ 70,507 $ 38,146 $ 78,196 $ 54,746 $ 48,389 $ 39,555 2020 2021 Table 1. Information for Specialized equity redemption plan Fiscal Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 Retained Equity for Ole Olson $ 15,079 $ 14,288 $ 30,745 $ 38,746 $ 49,397 $ 58,756 $ 31,788 $ 65,164 $ 45,622 $ 40,324 $ 32,963 B Table 2. Information for Percentage of All Equities redemption plan Row Item . Allocated equity at beginning of 2021 Patronage allocation retained . Equity available at end of 2021 (A+B) D Equity required Equity redeemed (C-D) F Percentage of beginning year equity (E/A) Dollars $ 4,470,730 $ 2,682,438 $ 7,153,168 $ 6,300,000 $ 853,168 ??? % E Ole Olson's beginning equity in 2021 $ 301,652 Table 3. Information for Revolving Fund redemption plan Fiscal Year 2011 2012 2013 2014 2015 2016 2017 2018 2019 Retained Equity for Ole Olson $ 18,094 $ 17,146 $ 36,894 $ 46,495 $ 59,276 $ 70,507 $ 38,146 $ 78,196 $ 54,746 $ 48,389 $ 39,555 2020 2021

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started