please use the companies I have attached and follow the instructions. from the days I have there till end of March.

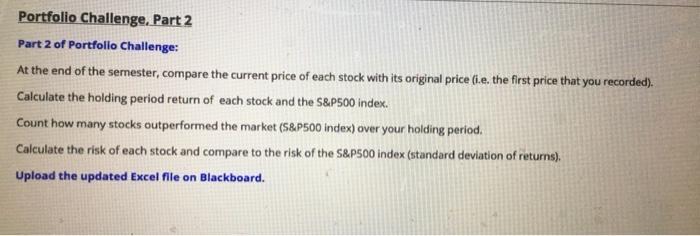

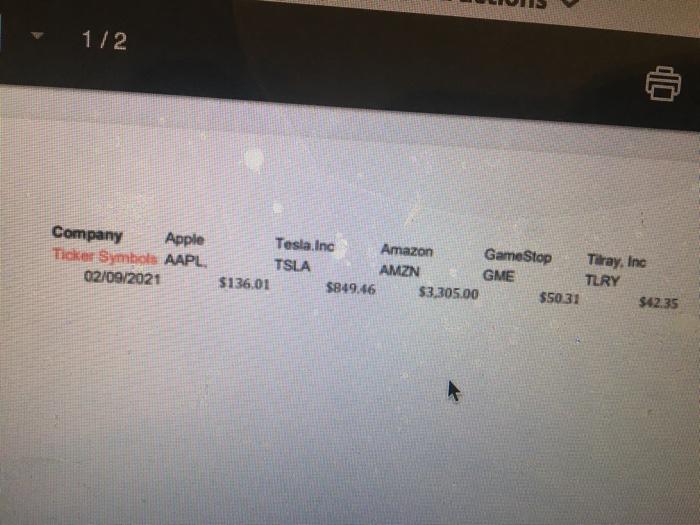

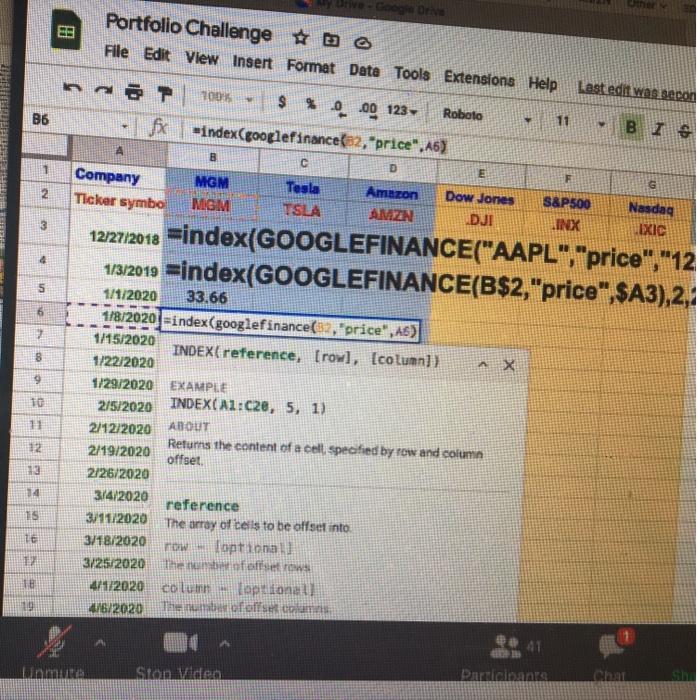

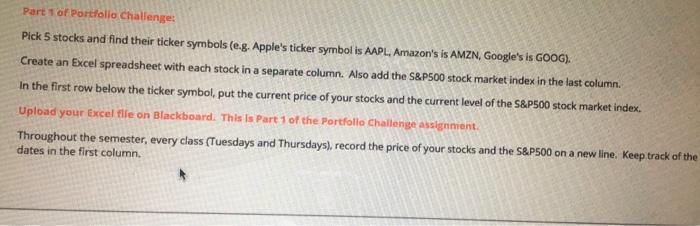

Part 1 of Portfolio Challenge: Pick 5 stocks and find their ticker symbols (e-g. Apple's ticker symbol is AAPL. Amazon's is AMZN, Google's is GOOG). Create an Excel spreadsheet with each stock in a separate column. Also add the S&P500 stock market index in the last column. In the first row below the ticker symbol, put the current price of your stocks and the current level of the S&P500 stock market index. Upload your Excel file on Blackboard. This Is Part 1 of the Portfolio Challenge assignment. Throughout the semester, every class (Tuesdays and Thursdays), record the price of your stocks and the S&P500 on a new line. Keep track of the dates in the first column. Portfolio Challenge, Part 2 Part 2 of Portfolio Challenge: At the end of the semester, compare the current price of each stock with its original price (i.e. the first price that you recorded). Calculate the holding period return of each stock and the S&P500 index. Count how many stocks outperformed the market (S&P500 Index) over your holding period. Calculate the risk of each stock and compare to the risk of the S&P500 index (standard deviation of returns). Upload the updated Excel file on Blackboard. 1/2 Company Apple Ticker Symbols AAPL. 02/09/2021 Tesla.inc Amazon GameStop Tilray, Inc TSLA AMZN GME TLRY $136.01 $849.46 $3,305.00 $5031 $42.35 S&P 500 INX 3.911 23 EB Portfolio Challenge D File Edit View Insert Format Date Tools Extensions Help Last edit was decor BRE 11 B 18 n 100% $% 0 .00 123- Robota B6 -index(googlefinance 62,"price", A6) D Company MGM Tesla Amazon Dow Jones 2 Ticker symbo MGM TSLA AMZN DJI B E F G S&P500 INX Nasdag IXIC 3 12/27/2018 =index(GOOGLEFINANCE("AAPL","price","12 113/2019 =index(GOOGLEFINANCE(B$2,"price",$A3), 2, 4 5 6 8 9 10 11 12 1/1/2020 33.66 1/8/2020) =index(googlefinance price, As) 1/15/2020 INDEX(reference, Crow], [column]) 1/22/2020 1/29/2020 EXAMPLE 2/5/2020 INDEXCAL:020, 5, 1) 2/12/2020 ABOUT Returns the content of a cell, specified by row and column 2/19/2020 offset 2/26/2020 3/4/2020 reference 3/11/2020 The array of cells to be offset into 3/18/2020 NOW loptional) 3/25/2020 The foto 4/1/2020 column optional 4/8/2020 Then of offset Columns 13 14 IS 16 TE 19 0.41 LIVE Sion Video Dunia banka Chat Part 1 of Portfolio Challenge: Pick 5 stocks and find their ticker symbols (e-g. Apple's ticker symbol is AAPL. Amazon's is AMZN, Google's is GOOG). Create an Excel spreadsheet with each stock in a separate column. Also add the S&P500 stock market index in the last column. In the first row below the ticker symbol, put the current price of your stocks and the current level of the S&P500 stock market index. Upload your Excel file on Blackboard. This Is Part 1 of the Portfolio Challenge assignment. Throughout the semester, every class (Tuesdays and Thursdays), record the price of your stocks and the S&P500 on a new line. Keep track of the dates in the first column. Portfolio Challenge, Part 2 Part 2 of Portfolio Challenge: At the end of the semester, compare the current price of each stock with its original price (i.e. the first price that you recorded). Calculate the holding period return of each stock and the S&P500 index. Count how many stocks outperformed the market (S&P500 Index) over your holding period. Calculate the risk of each stock and compare to the risk of the S&P500 index (standard deviation of returns). Upload the updated Excel file on Blackboard. 1/2 Company Apple Ticker Symbols AAPL. 02/09/2021 Tesla.inc Amazon GameStop Tilray, Inc TSLA AMZN GME TLRY $136.01 $849.46 $3,305.00 $5031 $42.35 S&P 500 INX 3.911 23 EB Portfolio Challenge D File Edit View Insert Format Date Tools Extensions Help Last edit was decor BRE 11 B 18 n 100% $% 0 .00 123- Robota B6 -index(googlefinance 62,"price", A6) D Company MGM Tesla Amazon Dow Jones 2 Ticker symbo MGM TSLA AMZN DJI B E F G S&P500 INX Nasdag IXIC 3 12/27/2018 =index(GOOGLEFINANCE("AAPL","price","12 113/2019 =index(GOOGLEFINANCE(B$2,"price",$A3), 2, 4 5 6 8 9 10 11 12 1/1/2020 33.66 1/8/2020) =index(googlefinance price, As) 1/15/2020 INDEX(reference, Crow], [column]) 1/22/2020 1/29/2020 EXAMPLE 2/5/2020 INDEXCAL:020, 5, 1) 2/12/2020 ABOUT Returns the content of a cell, specified by row and column 2/19/2020 offset 2/26/2020 3/4/2020 reference 3/11/2020 The array of cells to be offset into 3/18/2020 NOW loptional) 3/25/2020 The foto 4/1/2020 column optional 4/8/2020 Then of offset Columns 13 14 IS 16 TE 19 0.41 LIVE Sion Video Dunia banka Chat