Answered step by step

Verified Expert Solution

Question

1 Approved Answer

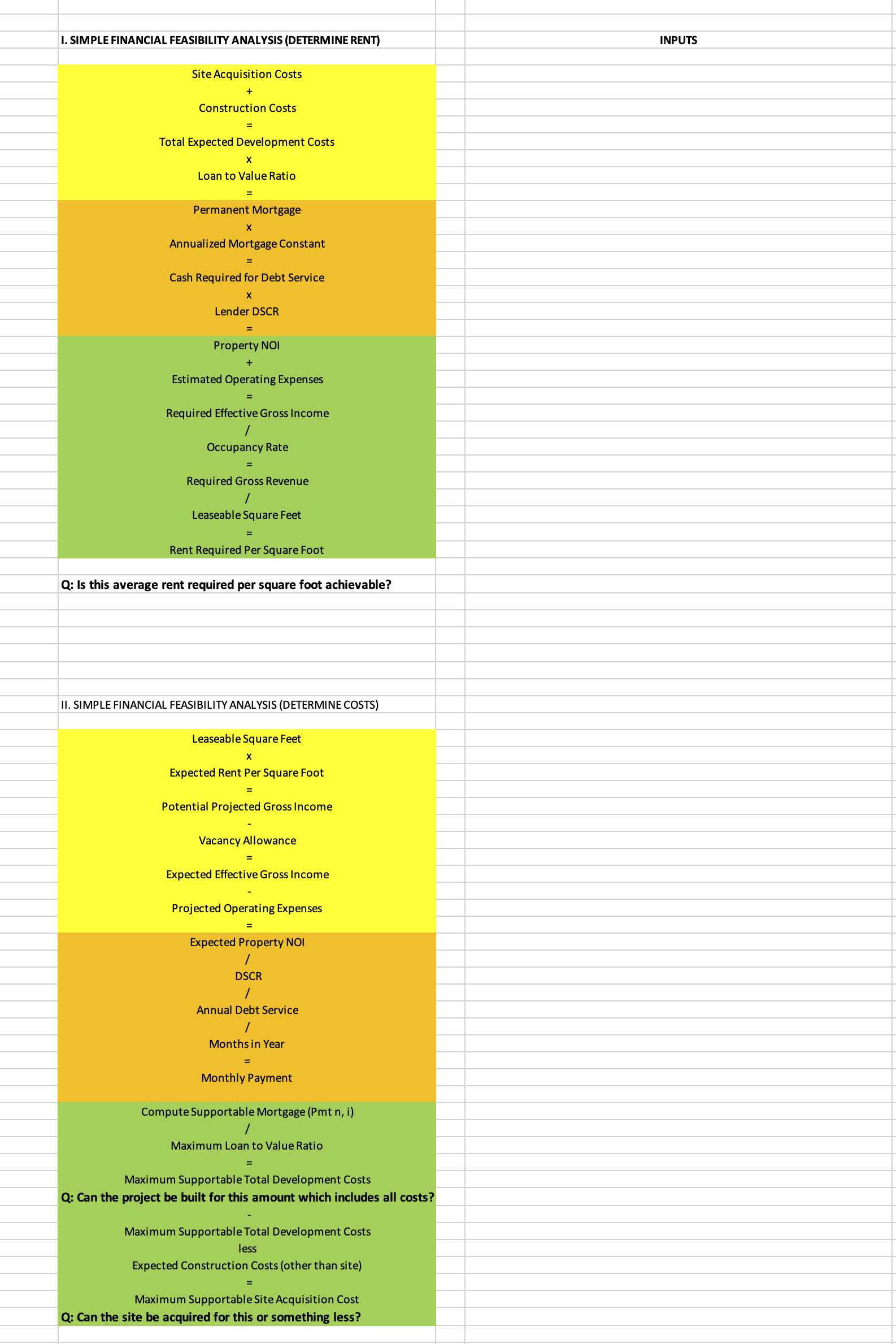

Please use the excel tamplate to complete, show calculation formula step by step and show solution. Site Acquisition Costs Construction Costs = Total Expected Development

Please use the excel tamplate to complete, show calculation formula step by step and show solution. Site Acquisition Costs

Construction Costs

Total Expected Development Costs

Loan to Value Ratio

Permanent Mortgage

Annualized Mortgage Constant

Cash Required for Debt Service

Lender DSCR

Property NOI

Estimated Operating Expenses

Required Effective Gross Income

I

Occupancy Rate

Required Gross Revenue

I

Leaseable Square Feet

Rent Required Per Square Foot

Q: Is this average rent required per square foot achievable?

II SIMPLE FINANCIAL FEASIBILITY ANALYSIS DETERMINE COSTS

Leaseable Square Feet

Expected Rent Per Square Foot

Potential Projected Gross Income

Vacancy Allowance

Expected Effective Gross Income

Projected Operating Expenses

Expected Property NOI

I

DSCR

Annual Debt Service

I

Months in Year

Monthly Payment

Compute Supportable Mortgage Pmt n i

Maximum Loan to Value Ratio

Maximum Supportable Total Development Costs

Q: Can the project be built for this amount which includes all costs?

Maximum Supportable Total Development Costs

less

Expected Construction Costs other than site

Maximum Supportable Site Acquisition Cost

Q: Can the site be acquired for this or something less?The investordeveloper would not be comfortable with a percent return on cost because the margin for error is too risky. If construction costs are higher or rents are lower than anticipated, the project may not be feasible.

Based on the fact that the project appears to have square feet of surface area in excess of zoning requirements, the developer could make an argument to the planning department for an additional units, units in total, or units per acre. How would this affect financial feasibility? What could be included in such an argument? Why would a public regulatory institution be interested in increasing density to units per acre? Why not?

Instead of a suppose the developer could build a unit luxury apartment complex with a cost of $ per unit. What would such a project have to rent for per square foot to make an percent return on total cost? What risk factors would the developer have to consider?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started