Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the financial statement given below and apply the z-score to measure a company the possibility to file the bankruptcy. Instructions: 1] Provide the

Please use the financial statement given below and apply the z-score to measure a company the possibility to file the bankruptcy.

Please use the financial statement given below and apply the z-score to measure a company the possibility to file the bankruptcy.

Instructions:

1] Provide the supportive and clear calculation

2] Provide the interpretation to support your calculation.

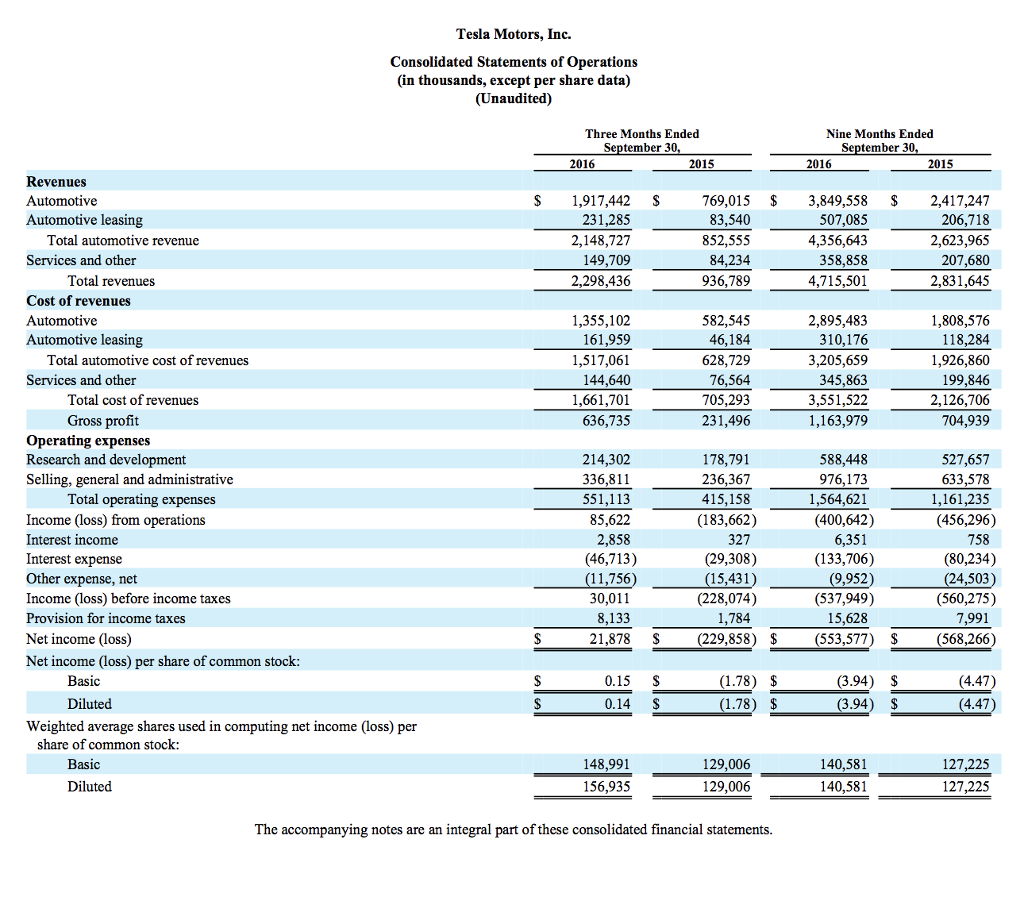

Tesla Motors, Inc. Consolidated Statements of Operations (in thousands, except per share data) (Unaudited) Three Months Ended September 30, 2016 2015 Nine Months Ended September 30, 2016 2015 $ $ $ 1,917,442 231,285 2,148,727 149,709 2,298,436 769,015 $ 83,540 852,555 84,234 936,789 3,849,558 507,085 4,356,643 358,858 4,715,501 2,417,247 206,718 2,623,965 207,680 2,831,645 1,355,102 161,959 1,517,061 582,545 46,184 628,729 76,564 705,293 231,496 2,895,483 310,176 3,205,659 345,863 3,551,522 1,163,979 1,808,576 118,284 1,926,860 199,846 2,126,706 704,939 144,640 1,661,701 636,735 Revenues Automotive Automotive leasing Total automotive revenue Services and other Total revenues Cost of revenues Automotive Automotive leasing Total automotive cost of revenues Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Total operating expenses Income (loss) from operations Interest income Interest expense Other expense, net Income (loss) before income taxes Provision for income taxes Net income (loss) Net income (loss) per share of common stock: Basic Diluted Weighted average shares used in computing net income (loss) per share of common stock: Basic Diluted 214,302 336,811 551,113 85,622 2,858 (46,713) (11,756 30,011 8,133 21,878 178,791 236,367 415,158 (183,662) 327 (29,308) (15,431) (228,074) 1,784 (229,858) 588,448 976,173 1,564,621 (400,642) 6,351 (133,706) (9,952) (537,949) 15,628 (553,577 527,657 633,578 1,161,235 (456,296) 758 (80,234) (24,503) (560,275) 7,991 (568,266) $ S 0.15 S $ (1.78) $ (1.78) $ (3.94 (3.94) (4.47) (4.47 $ 0.14 $ $ 148,991 156,935 129,006 129,006 140,581 140,581 127,225 127,225 The accompanying notes are an integral part of these consolidated financial statements. Tesla Motors, Inc. Consolidated Statements of Operations (in thousands, except per share data) (Unaudited) Three Months Ended September 30, 2016 2015 Nine Months Ended September 30, 2016 2015 $ $ $ 1,917,442 231,285 2,148,727 149,709 2,298,436 769,015 $ 83,540 852,555 84,234 936,789 3,849,558 507,085 4,356,643 358,858 4,715,501 2,417,247 206,718 2,623,965 207,680 2,831,645 1,355,102 161,959 1,517,061 582,545 46,184 628,729 76,564 705,293 231,496 2,895,483 310,176 3,205,659 345,863 3,551,522 1,163,979 1,808,576 118,284 1,926,860 199,846 2,126,706 704,939 144,640 1,661,701 636,735 Revenues Automotive Automotive leasing Total automotive revenue Services and other Total revenues Cost of revenues Automotive Automotive leasing Total automotive cost of revenues Services and other Total cost of revenues Gross profit Operating expenses Research and development Selling, general and administrative Total operating expenses Income (loss) from operations Interest income Interest expense Other expense, net Income (loss) before income taxes Provision for income taxes Net income (loss) Net income (loss) per share of common stock: Basic Diluted Weighted average shares used in computing net income (loss) per share of common stock: Basic Diluted 214,302 336,811 551,113 85,622 2,858 (46,713) (11,756 30,011 8,133 21,878 178,791 236,367 415,158 (183,662) 327 (29,308) (15,431) (228,074) 1,784 (229,858) 588,448 976,173 1,564,621 (400,642) 6,351 (133,706) (9,952) (537,949) 15,628 (553,577 527,657 633,578 1,161,235 (456,296) 758 (80,234) (24,503) (560,275) 7,991 (568,266) $ S 0.15 S $ (1.78) $ (1.78) $ (3.94 (3.94) (4.47) (4.47 $ 0.14 $ $ 148,991 156,935 129,006 129,006 140,581 140,581 127,225 127,225 The accompanying notes are an integral part of these consolidated financial statementsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started