Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the following documents to answer: What. are the two kinds of accounting leases that Southwest reports on its balance sheet? Which balance sheet

Please use the following documents to answer:

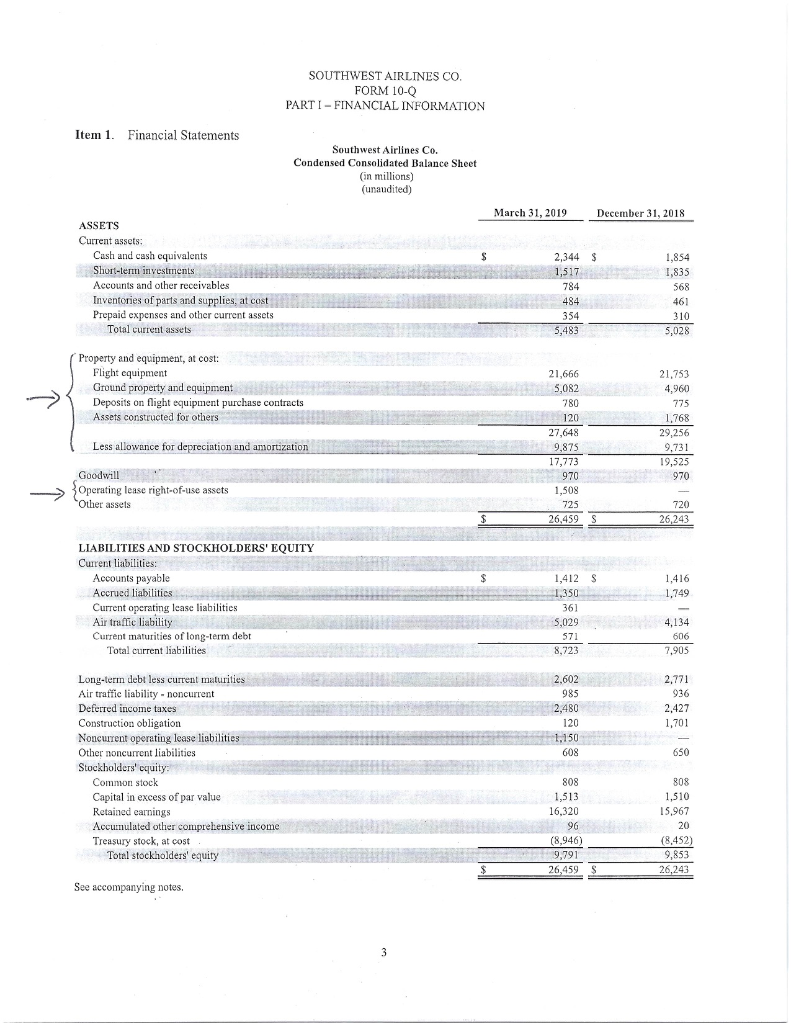

What. are the two kinds of accounting leases that Southwest reports on its balance sheet?

Which balance sheet account has changed most noticeably with the application of this standard? What about the new lease standard caused with this dramatic change?

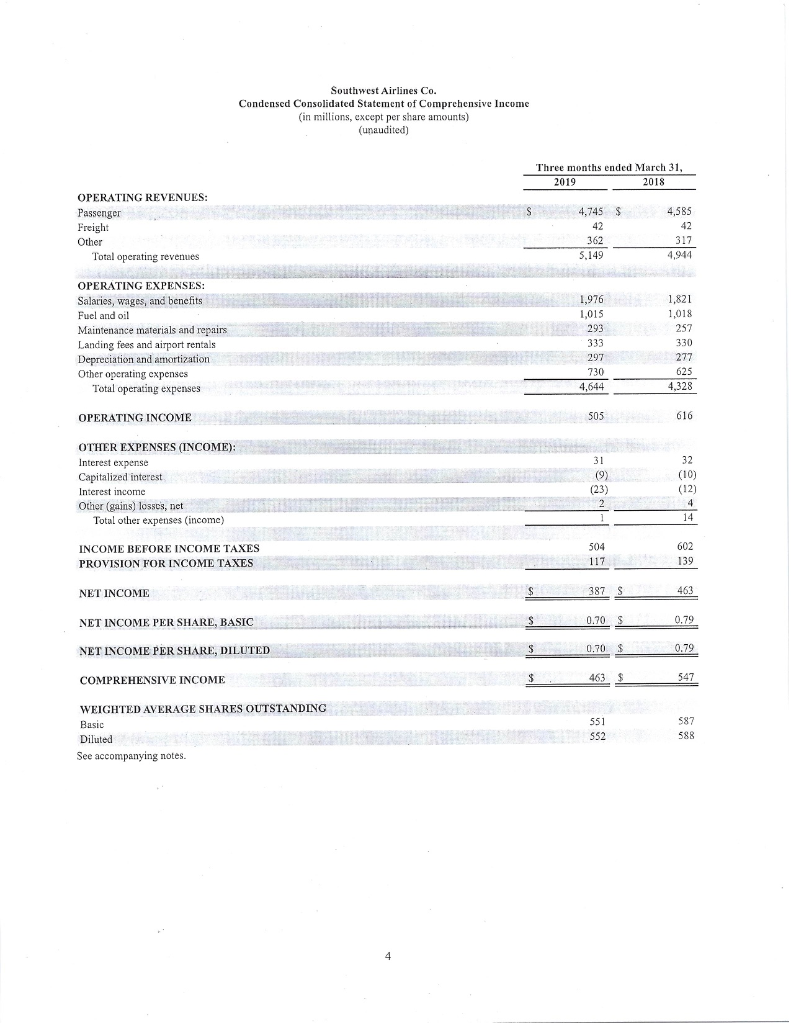

Which account line items reported on the income statement is southwest most likely to use to report both of the lease types?

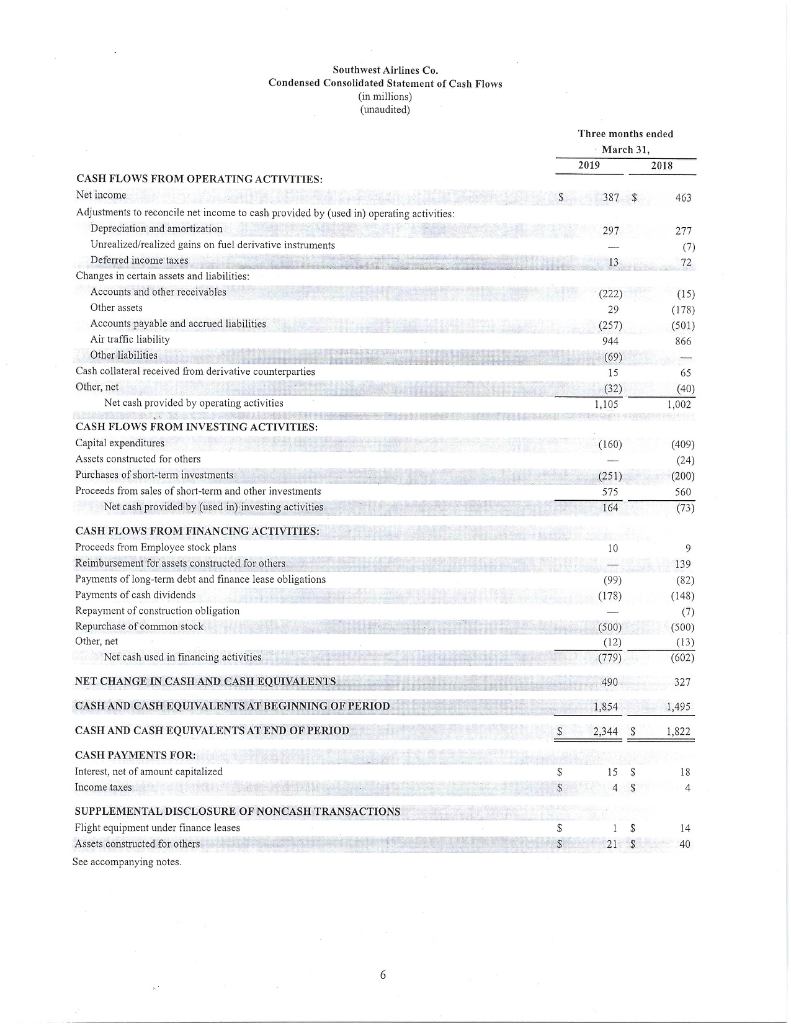

In which line items on the statement of Cash Flow should we expect to find lease information?

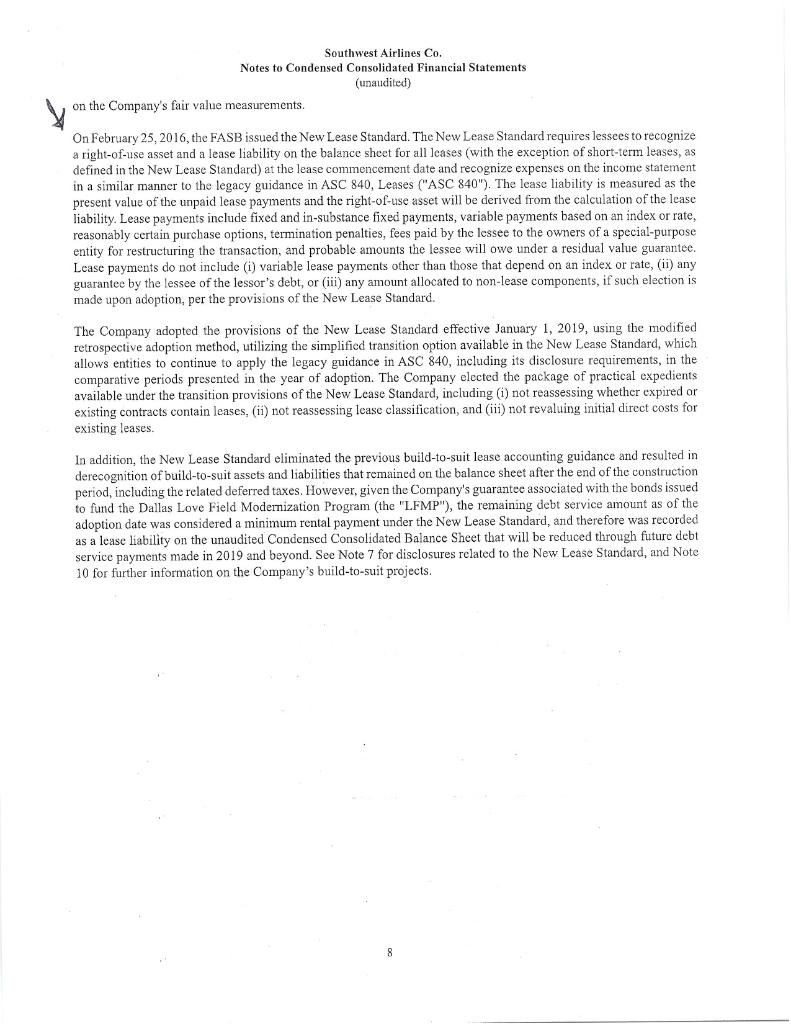

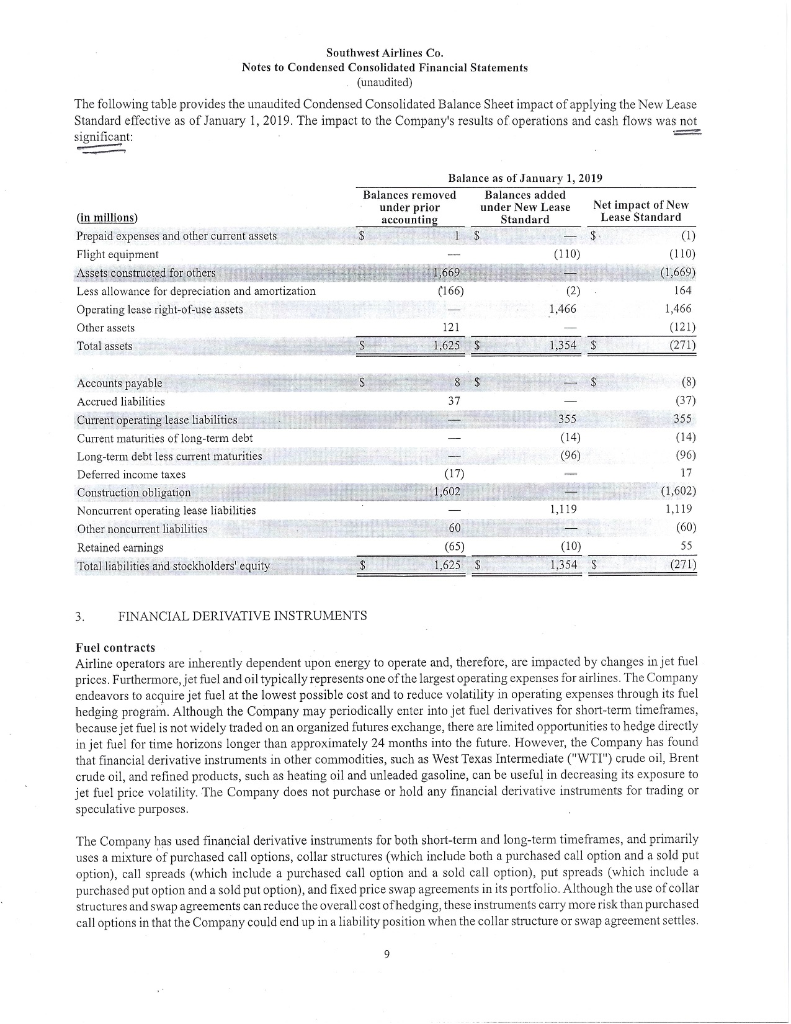

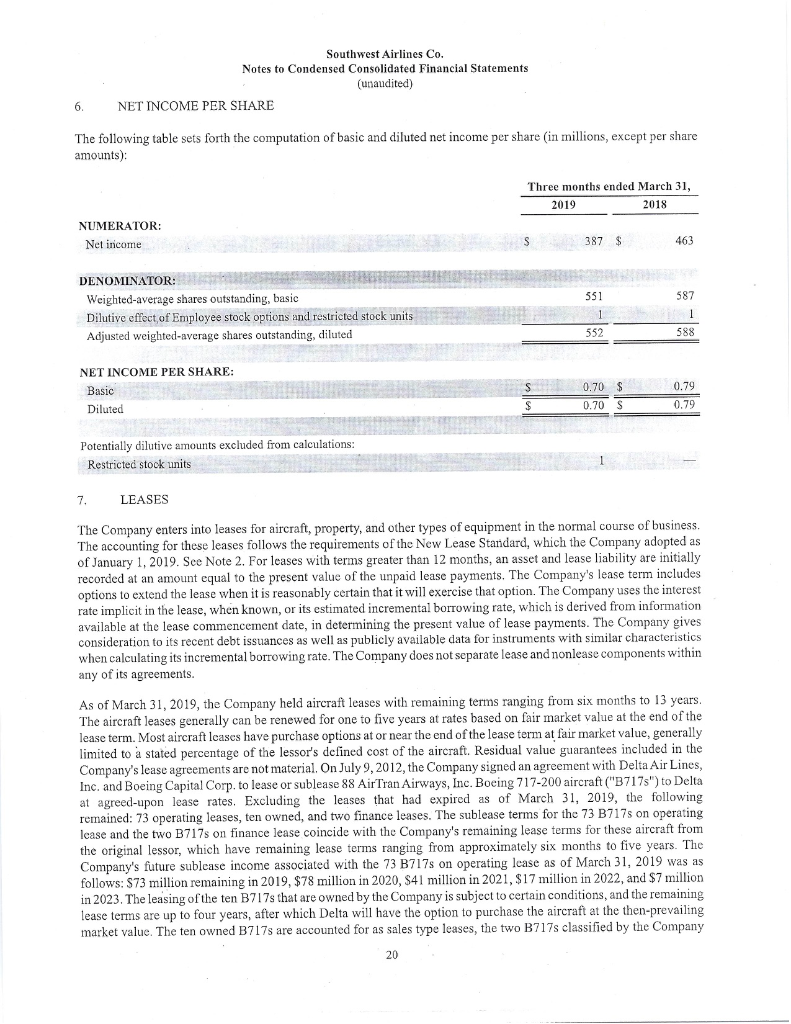

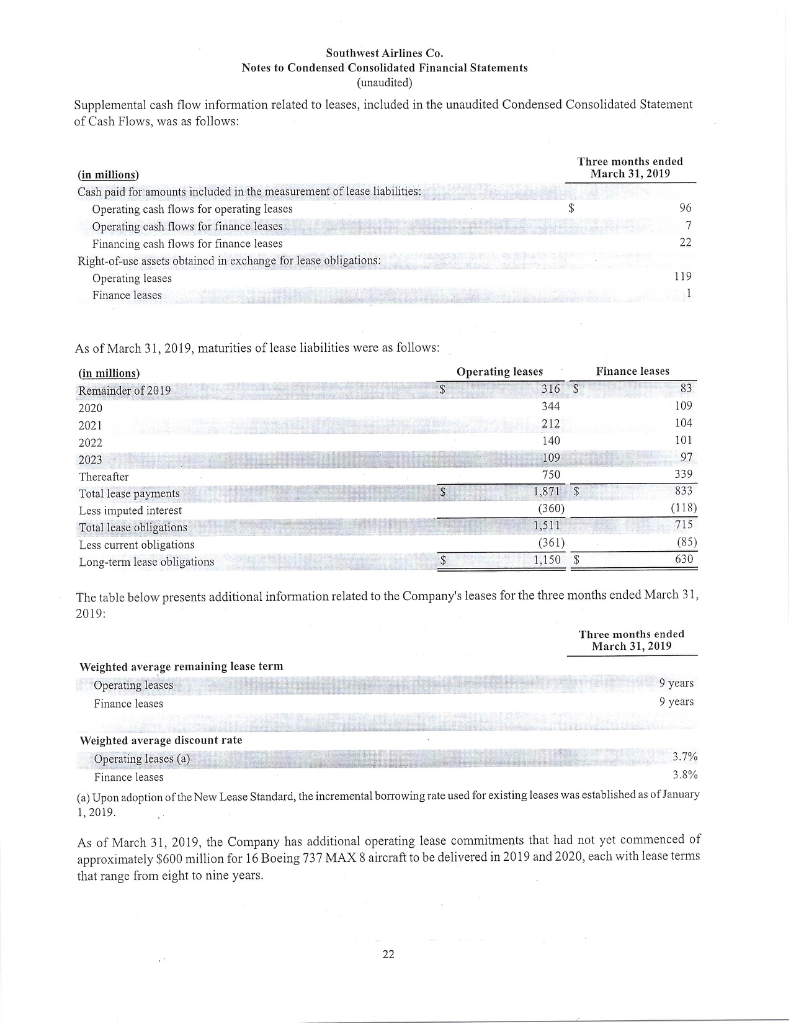

SOUTHWEST AIRLINES CO. FORM 10-Q PARTI - FINANCIAL INFORMATION Item 1. Financial Statements Southwest Airlines Co. Condensed Consolidated Balance Sheet (in millions) (unaudited) March 31, 2019 December 31, 2018 $ ASSETS Current assets: Cash and cash cquivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets 1,854 1,835 568 2,344 1,517 784 484 354 5,483 461 310 5,028 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 21,666 5,082 780 120 21.753 4,960 775 1,768 29,256 9,731 19,525 970 Less allowance for depreciation and amortization Goodwill 3 Operating lease right-of-use assets Other assets 27,648 9.875 17,773 970 1,508 725 26,459 720 26,243 S 1,416 1,749 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,412 1,350 361 5,029 571 8,723 4,134 606 7,905 2,602 985 2,480 120 1,150 608 2.771 936 2,427 1,701 650 Long-terin debt less current malurities Air traffic liability - noncurrent Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Stockholders' cquity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive income Treasury stock, at cost Total stockholders' equity 808 808 1,510 15,967 20 1,513 16,320 96 (8,946) 9,791 26,459 (8.452) 9,853 26,243 $ See accompanying notes. Southwest Airlines Co. Condensed Consolidated Statement of Comprehensive Income (in millions, except per share amounts) (unaudited) Three months ended March 31, 2019 2018 4,745 $ OPERATING REVENUES: Passenger Freight Other Total operating revenues 4,585 42 317 4.944 362 5.149 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Landing fees and airport rentals Depreciation and amortization Other operating expenses Total operating expenses 1,976 1,015 293 333 297 730 4,644 1,821 1,018 257 330 277 625 4,328 OPERATING INCOME 505 616 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) (10) (12) (23) 14 504 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES 117 139 NET INCOME $ 387 S 463 NET INCOME PER SHARE, BASIC $ 0.70 S 0.79 NET INCOME PER SHARE, DILUTED S 0 .70 $ 0.79 COMPREHENSIVE INCOME 4533 551 587 WEIGHTED AVERAGE SHARES OUTSTANDING Basic Diluted See accompanying notes. 588 Southwest Airlines Co. Condensed Consolidated Statement of Cash Flows (in millions) (unaudited) Three months ended March 31, 2018 2019 463 297 277 72 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to cash provided by (used in) operating activities! Depreciation and amortization Unrealized/realized gains on fuel derivative instruments Deferred income taxes Changes in certain assets and liabilities: Accounts and other receivables Other assets Accounts payable and accrued liabilities Air traffic liability Other liabilities Cash collateral received from derivative counterparties Othernet Net cash provided by operating activities (222) 29 (257) 944 (69) (15) (178) (501) 866 65 (40) (32) 1,105 1,002 (160) (409) (24) CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Assets constructed for others Purchases of short-term investments Proceeds from sales of short-term and other investments Net cash provided by used in) investing activities (200) (251) 575 CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from Employee stock plans Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Repayment of construction obligation Repurchase of common stock Other, net Net cash used in financing activities (99) (178) 139 (82) (148) (500) (12) (779) (500) (13) (602) 490 327 NET CHANGE IN CASII AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 1,854 1,495 CASH AND CASH EQUIVALENTS AT END OF PERIOD S 2,344 S 1,822 CASH PAYMENTS FOR: Interest, niet of amount capitalized Income taxes 15 s 18 1 S 14 SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS Flight equipment under finance leases Assets constructed for others See accompanying notes. Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) on the Company's fair value measurements. On February 25, 2016, the FASB issued the New Lease Standard. The New Lease Standard requires lessces to recognize a right-of-use asset and a lease liability on the balance sheet for all leases (with the exception of short-term leases, as defined in the New Lease Standard) at the lease commencement date and recognize expenses on the income statement in a similar manner to the legacy guidance in ASC 840, Leases ("ASC 840"). The lease liability is measured as the present value of the unpaid lease payments and the right-of-use asset will be derived from the calculation of the lease liability. Lease payments include fixed and in-substance fixed payments, variable payments based on an index or rate, reasonably certain purchase options, termination penalties, fees paid by the lessee to the owners of a special-purpose entity for restructuring the transaction, and probable amounts the lessee will owe under a residual value guarantee. Lease payments do not include (1) variable lease payments other than those that depend on an index or rate, (ii) any guarantee by the lessee of the lessor's debt, or (iii) any amount allocated to non-lease components, if such election is made upon adoption, per the provisions of the New Lease Standard. The Company adopted the provisions of the New Lease Standard effective January 1, 2019, using the modified retrospective adoption method, utilizing the simplified transition option available in the New Lease Standard, which allows entities to continue to apply the legacy guidance in ASC 840, including its disclosure requirements, in the comparative periods presented in the year of adoption. The Company elected the package of practical expedients available under the transition provisions of the New Lease Standard, including (i) not reassessing whether expired or existing contracts contain lcases, (ii) not reassessing lease classification, and (iii) not revaluing initial direct costs for existing leases. In addition, the New Lease Standard eliminated the previous build-to-suit lease accounting guidance and resulted in derecognition of build-to-suit assets and liabilities that remained on the balance sheet after the end of the construction period, including the related deferred taxes. However, given the Company's guarantee associated with the bonds issued to fund the Dallas Love Field Modernization Program (the "LFMP"), the remaining debt service amount as of the adoption date was considered a minimum rental payment under the New Lease Standard, and therefore was recorded as a lease liability on the unaudited Condensed Consolidated Balance Sheet that will be reduced through future debt service payments made in 2019 and beyond. See Note 7 for disclosures related to the New Lease Standard, and Note 10 for further information on the Company's build-to-suit projects Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) The following table provides the unaudited Condensed Consolidated Balance Sheet impact of applying the New Lease Standard effective as of January 1, 2019. The impact to the Company's results of operations and cash flows was not significant: (in millions) Prepaid expenses and other current assets Flight equipment Assets constructed for others Less allowance for depreciation and amortization Operating lease right-of-use assets Other assets Total assets Balance as of January 1, 2019 Balances removed Balances added under prior under New Lease Net impact of New accounting Standard Lease Standard 1 S (110) (110) 1,669 (1,669) (166) 164 1,466 1,466 121 (121) 1,625 $ 1,354 $ (271) (8) (37) 355 (14) (14) ITIES (96) Accounts payable Accrued liabilities Current operating lease liabilities Current maturities of long-term debt Long-term debt less current maturities Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Retained earnings Total liabilities and stockholders' equity (96) 1,119 (1,602) 1,119 (60) (65) (10) 1,354 1.625 S S 1271 3. FINANCIAL DERIVATIVE INSTRUMENTS Fuel contracts Airline operators are inherently dependent upon energy to operate and therefore, are impacted by changes in jet fuel prices. Furthermore, jet fuel and oil typically represents one of the largest operating expenses for airlines. The Company endeavors to acquire jet fuel at the lowest possible cost and to reduce volatility in operating expenses through its fuel hedging program. Although the Company may periodically enter into jet fuel derivatives for short-term timeframes, because jet fuel is not widely traded on an organized futures exchange, there are limited opportunities to hedge directly in jet fuel for time horizons longer than approximately 24 months into the future. However, the Company has found that financial derivative instruments in other commodities, such as West Texas Intermediate ("WTI") crude oil, Brent crude oil, and refined products, such as heating oil and unleaded gasoline, can be useful in decreasing its exposure to jet fuel price volatility. The Company does not purchase or hold any financial derivative instruments for trading or speculative purposes The Company has used financial derivative instruments for both short-term and long-term timeframes, and primarily uses a mixture of purchased call options, collar structures (which include both a purchased call option and a sold put option), call spreads (which include a purchased call option and a sold call option), put spreads (which include a purchased put option and a sold put option), and fixed price swap agreements in its portfolio. Although the use of collar structures and swap agreements can reduce the overall cost of hedging, these instruments carry more risk than purchased call options in that the Company could end up in a liability position when the collar structure or swap agreement settles. Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) NET INCOME PER SHARE 6. The following table sets forth the computation of basic and diluted net income per share (in millions, except per share amounts) Three months ended March 31, 2019 2018 NUMERATOR: Net income 551 DENOMINATOR: Weighted average shares outstanding, basic Dilutive effect of Employee stock options and restricted stock units Adjusted weighted-average shares outstanding, diluted 587 552 588 NET INCOME PER SHARE: Basic Diluted 0.70 S 0.70 S 0.79 0.79 Potentially dilutive amounts excluded from calculations: Restricted stock units 7. LEASES The Company enters into leases for aircraft, property, and other types of equipment in the normal course of business. The accounting for these leases follows the requirements of the New Lease Standard, which the Company adopted as of January 1, 2019. See Note 2. For leases with terms greater than 12 months, an asset and lease liability are initially recorded at an amount equal to the present value of the unpaid lease payments. The Company's lease term includes options to extend the lease when it is reasonably certain that it will exercise that option. The Company uses the interest rate implicit in the lease, when known, or its estimated incremental borrowing rate, which is derived from information available at the lease commencement date, in determining the present value of lease payments. The Company gives consideration to its recent debt issuances as well as publicly available data for instruments with similar characteristics when calculating its incremental borrowing rate. The Company does not separate lease and nonlease components within any of its agreements. As of March 31, 2019, the Company held aircraft leases with remaining terms ranging from six months to 13 years. The aircraft leases generally can be renewed for one to five years at rates based on fair market value at the end of the lease term. Most aircraft leases have purchase options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. Residual value guarantees included in the y's lease agreements are not material. On July 9, 2012, the Company signed an agreement with Delta Air Lines, Inc. and Boeing Capital Corp. to lease or sublease 88 Air Tran Airways, Inc. Boeing 717-200 aircraft ("B717s") to Delta at agreed-upon lease rates. Excluding the leases that had expired as of March 31, 2019, the following remained: 73 operating leases, ten owned, and two finance leases. The sublease terms for the 73 B7178 on operating lease and the two B717s on finance lease coincide with the Company's remaining lease terms for these aircraft from the original lessor, which have remaining lease terms ranging from approximately six months to five years. The Company's future sublcase income associated with the 73 B717s on operating lease as of March 31, 2019 was as follows: S73 million remaining in 2019, $78 million in 2020, S41 million in 2021, $ 17 million in 2022, and $7 million in 2023. The leasing of the ten B717s that are owned by the Company is subject to certain conditions, and the remaining lease terms are up to four years, after which Delta will have the option to purchase the aircraft at the then-prevailing market value. The ten owned B717s are accounted for as sales type leases, the two B717s classified by the Company 20 Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) Supplemental cash flow information related to leases, included in the unaudited Condensed Consolidated Statement of Cash Flows, was as follows: Three months ended March 31, 2019 (in millions Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows for operating leases Operating cash flows for finance leases Financing cash flows for finance leases Right-of-use assets obtained in exchange for lease obligations: Operating leases Finance leases As of March 31, 2019, maturities of lease liabilities were as follows: Finance leases 109 104 101 (in millions) Remainder of 2019 2020 2021 2022 2023 Thereafter Total lease payments Less imputed interest Total lease obligations Less current obligations Long-term lease obligations Operating leases 316 S 344 212 140 109 750 1,871 (360) 1,511 (361) 1,150 $ 97 339 833 (118) 715 (85) 630 The table below presents additional information related to the Company's leases for the three months ended March 31, 2019: Three months ended March 31, 2019 Weighted average remaining lease term Operating leases Finance leases 9 years 9 years Weighted average discount rate Operating leases (a) 3.7% Finance leases 3.8% (a) Upon adoption of the New Lense Standard, the incremental borrowing rate used for existing losses was established as of January 1, 2019. As of March 31, 2019, the Company has additional operating lease commitments that had not yet commenced of approximately $600 million for 16 Boeing 737 MAX 8 aircraft to be delivered in 2019 and 2020, each with lease terms that range from eight to nine years. 22 SOUTHWEST AIRLINES CO. FORM 10-Q PARTI - FINANCIAL INFORMATION Item 1. Financial Statements Southwest Airlines Co. Condensed Consolidated Balance Sheet (in millions) (unaudited) March 31, 2019 December 31, 2018 $ ASSETS Current assets: Cash and cash cquivalents Short-term investments Accounts and other receivables Inventories of parts and supplies, at cost Prepaid expenses and other current assets Total current assets 1,854 1,835 568 2,344 1,517 784 484 354 5,483 461 310 5,028 Property and equipment, at cost: Flight equipment Ground property and equipment Deposits on flight equipment purchase contracts Assets constructed for others 21,666 5,082 780 120 21.753 4,960 775 1,768 29,256 9,731 19,525 970 Less allowance for depreciation and amortization Goodwill 3 Operating lease right-of-use assets Other assets 27,648 9.875 17,773 970 1,508 725 26,459 720 26,243 S 1,416 1,749 LIABILITIES AND STOCKHOLDERS' EQUITY Current liabilities: Accounts payable Accrued liabilities Current operating lease liabilities Air traffic liability Current maturities of long-term debt Total current liabilities 1,412 1,350 361 5,029 571 8,723 4,134 606 7,905 2,602 985 2,480 120 1,150 608 2.771 936 2,427 1,701 650 Long-terin debt less current malurities Air traffic liability - noncurrent Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Stockholders' cquity: Common stock Capital in excess of par value Retained earnings Accumulated other comprehensive income Treasury stock, at cost Total stockholders' equity 808 808 1,510 15,967 20 1,513 16,320 96 (8,946) 9,791 26,459 (8.452) 9,853 26,243 $ See accompanying notes. Southwest Airlines Co. Condensed Consolidated Statement of Comprehensive Income (in millions, except per share amounts) (unaudited) Three months ended March 31, 2019 2018 4,745 $ OPERATING REVENUES: Passenger Freight Other Total operating revenues 4,585 42 317 4.944 362 5.149 OPERATING EXPENSES: Salaries, wages, and benefits Fuel and oil Maintenance materials and repairs Landing fees and airport rentals Depreciation and amortization Other operating expenses Total operating expenses 1,976 1,015 293 333 297 730 4,644 1,821 1,018 257 330 277 625 4,328 OPERATING INCOME 505 616 OTHER EXPENSES (INCOME): Interest expense Capitalized interest Interest income Other (gains) losses, net Total other expenses (income) (10) (12) (23) 14 504 INCOME BEFORE INCOME TAXES PROVISION FOR INCOME TAXES 117 139 NET INCOME $ 387 S 463 NET INCOME PER SHARE, BASIC $ 0.70 S 0.79 NET INCOME PER SHARE, DILUTED S 0 .70 $ 0.79 COMPREHENSIVE INCOME 4533 551 587 WEIGHTED AVERAGE SHARES OUTSTANDING Basic Diluted See accompanying notes. 588 Southwest Airlines Co. Condensed Consolidated Statement of Cash Flows (in millions) (unaudited) Three months ended March 31, 2018 2019 463 297 277 72 CASH FLOWS FROM OPERATING ACTIVITIES: Net income Adjustments to reconcile net income to cash provided by (used in) operating activities! Depreciation and amortization Unrealized/realized gains on fuel derivative instruments Deferred income taxes Changes in certain assets and liabilities: Accounts and other receivables Other assets Accounts payable and accrued liabilities Air traffic liability Other liabilities Cash collateral received from derivative counterparties Othernet Net cash provided by operating activities (222) 29 (257) 944 (69) (15) (178) (501) 866 65 (40) (32) 1,105 1,002 (160) (409) (24) CASH FLOWS FROM INVESTING ACTIVITIES: Capital expenditures Assets constructed for others Purchases of short-term investments Proceeds from sales of short-term and other investments Net cash provided by used in) investing activities (200) (251) 575 CASH FLOWS FROM FINANCING ACTIVITIES: Proceeds from Employee stock plans Reimbursement for assets constructed for others Payments of long-term debt and finance lease obligations Payments of cash dividends Repayment of construction obligation Repurchase of common stock Other, net Net cash used in financing activities (99) (178) 139 (82) (148) (500) (12) (779) (500) (13) (602) 490 327 NET CHANGE IN CASII AND CASH EQUIVALENTS CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD 1,854 1,495 CASH AND CASH EQUIVALENTS AT END OF PERIOD S 2,344 S 1,822 CASH PAYMENTS FOR: Interest, niet of amount capitalized Income taxes 15 s 18 1 S 14 SUPPLEMENTAL DISCLOSURE OF NONCASH TRANSACTIONS Flight equipment under finance leases Assets constructed for others See accompanying notes. Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) on the Company's fair value measurements. On February 25, 2016, the FASB issued the New Lease Standard. The New Lease Standard requires lessces to recognize a right-of-use asset and a lease liability on the balance sheet for all leases (with the exception of short-term leases, as defined in the New Lease Standard) at the lease commencement date and recognize expenses on the income statement in a similar manner to the legacy guidance in ASC 840, Leases ("ASC 840"). The lease liability is measured as the present value of the unpaid lease payments and the right-of-use asset will be derived from the calculation of the lease liability. Lease payments include fixed and in-substance fixed payments, variable payments based on an index or rate, reasonably certain purchase options, termination penalties, fees paid by the lessee to the owners of a special-purpose entity for restructuring the transaction, and probable amounts the lessee will owe under a residual value guarantee. Lease payments do not include (1) variable lease payments other than those that depend on an index or rate, (ii) any guarantee by the lessee of the lessor's debt, or (iii) any amount allocated to non-lease components, if such election is made upon adoption, per the provisions of the New Lease Standard. The Company adopted the provisions of the New Lease Standard effective January 1, 2019, using the modified retrospective adoption method, utilizing the simplified transition option available in the New Lease Standard, which allows entities to continue to apply the legacy guidance in ASC 840, including its disclosure requirements, in the comparative periods presented in the year of adoption. The Company elected the package of practical expedients available under the transition provisions of the New Lease Standard, including (i) not reassessing whether expired or existing contracts contain lcases, (ii) not reassessing lease classification, and (iii) not revaluing initial direct costs for existing leases. In addition, the New Lease Standard eliminated the previous build-to-suit lease accounting guidance and resulted in derecognition of build-to-suit assets and liabilities that remained on the balance sheet after the end of the construction period, including the related deferred taxes. However, given the Company's guarantee associated with the bonds issued to fund the Dallas Love Field Modernization Program (the "LFMP"), the remaining debt service amount as of the adoption date was considered a minimum rental payment under the New Lease Standard, and therefore was recorded as a lease liability on the unaudited Condensed Consolidated Balance Sheet that will be reduced through future debt service payments made in 2019 and beyond. See Note 7 for disclosures related to the New Lease Standard, and Note 10 for further information on the Company's build-to-suit projects Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) The following table provides the unaudited Condensed Consolidated Balance Sheet impact of applying the New Lease Standard effective as of January 1, 2019. The impact to the Company's results of operations and cash flows was not significant: (in millions) Prepaid expenses and other current assets Flight equipment Assets constructed for others Less allowance for depreciation and amortization Operating lease right-of-use assets Other assets Total assets Balance as of January 1, 2019 Balances removed Balances added under prior under New Lease Net impact of New accounting Standard Lease Standard 1 S (110) (110) 1,669 (1,669) (166) 164 1,466 1,466 121 (121) 1,625 $ 1,354 $ (271) (8) (37) 355 (14) (14) ITIES (96) Accounts payable Accrued liabilities Current operating lease liabilities Current maturities of long-term debt Long-term debt less current maturities Deferred income taxes Construction obligation Noncurrent operating lease liabilities Other noncurrent liabilities Retained earnings Total liabilities and stockholders' equity (96) 1,119 (1,602) 1,119 (60) (65) (10) 1,354 1.625 S S 1271 3. FINANCIAL DERIVATIVE INSTRUMENTS Fuel contracts Airline operators are inherently dependent upon energy to operate and therefore, are impacted by changes in jet fuel prices. Furthermore, jet fuel and oil typically represents one of the largest operating expenses for airlines. The Company endeavors to acquire jet fuel at the lowest possible cost and to reduce volatility in operating expenses through its fuel hedging program. Although the Company may periodically enter into jet fuel derivatives for short-term timeframes, because jet fuel is not widely traded on an organized futures exchange, there are limited opportunities to hedge directly in jet fuel for time horizons longer than approximately 24 months into the future. However, the Company has found that financial derivative instruments in other commodities, such as West Texas Intermediate ("WTI") crude oil, Brent crude oil, and refined products, such as heating oil and unleaded gasoline, can be useful in decreasing its exposure to jet fuel price volatility. The Company does not purchase or hold any financial derivative instruments for trading or speculative purposes The Company has used financial derivative instruments for both short-term and long-term timeframes, and primarily uses a mixture of purchased call options, collar structures (which include both a purchased call option and a sold put option), call spreads (which include a purchased call option and a sold call option), put spreads (which include a purchased put option and a sold put option), and fixed price swap agreements in its portfolio. Although the use of collar structures and swap agreements can reduce the overall cost of hedging, these instruments carry more risk than purchased call options in that the Company could end up in a liability position when the collar structure or swap agreement settles. Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) NET INCOME PER SHARE 6. The following table sets forth the computation of basic and diluted net income per share (in millions, except per share amounts) Three months ended March 31, 2019 2018 NUMERATOR: Net income 551 DENOMINATOR: Weighted average shares outstanding, basic Dilutive effect of Employee stock options and restricted stock units Adjusted weighted-average shares outstanding, diluted 587 552 588 NET INCOME PER SHARE: Basic Diluted 0.70 S 0.70 S 0.79 0.79 Potentially dilutive amounts excluded from calculations: Restricted stock units 7. LEASES The Company enters into leases for aircraft, property, and other types of equipment in the normal course of business. The accounting for these leases follows the requirements of the New Lease Standard, which the Company adopted as of January 1, 2019. See Note 2. For leases with terms greater than 12 months, an asset and lease liability are initially recorded at an amount equal to the present value of the unpaid lease payments. The Company's lease term includes options to extend the lease when it is reasonably certain that it will exercise that option. The Company uses the interest rate implicit in the lease, when known, or its estimated incremental borrowing rate, which is derived from information available at the lease commencement date, in determining the present value of lease payments. The Company gives consideration to its recent debt issuances as well as publicly available data for instruments with similar characteristics when calculating its incremental borrowing rate. The Company does not separate lease and nonlease components within any of its agreements. As of March 31, 2019, the Company held aircraft leases with remaining terms ranging from six months to 13 years. The aircraft leases generally can be renewed for one to five years at rates based on fair market value at the end of the lease term. Most aircraft leases have purchase options at or near the end of the lease term at fair market value, generally limited to a stated percentage of the lessor's defined cost of the aircraft. Residual value guarantees included in the y's lease agreements are not material. On July 9, 2012, the Company signed an agreement with Delta Air Lines, Inc. and Boeing Capital Corp. to lease or sublease 88 Air Tran Airways, Inc. Boeing 717-200 aircraft ("B717s") to Delta at agreed-upon lease rates. Excluding the leases that had expired as of March 31, 2019, the following remained: 73 operating leases, ten owned, and two finance leases. The sublease terms for the 73 B7178 on operating lease and the two B717s on finance lease coincide with the Company's remaining lease terms for these aircraft from the original lessor, which have remaining lease terms ranging from approximately six months to five years. The Company's future sublcase income associated with the 73 B717s on operating lease as of March 31, 2019 was as follows: S73 million remaining in 2019, $78 million in 2020, S41 million in 2021, $ 17 million in 2022, and $7 million in 2023. The leasing of the ten B717s that are owned by the Company is subject to certain conditions, and the remaining lease terms are up to four years, after which Delta will have the option to purchase the aircraft at the then-prevailing market value. The ten owned B717s are accounted for as sales type leases, the two B717s classified by the Company 20 Southwest Airlines Co. Notes to Condensed Consolidated Financial Statements (unaudited) Supplemental cash flow information related to leases, included in the unaudited Condensed Consolidated Statement of Cash Flows, was as follows: Three months ended March 31, 2019 (in millions Cash paid for amounts included in the measurement of lease liabilities: Operating cash flows for operating leases Operating cash flows for finance leases Financing cash flows for finance leases Right-of-use assets obtained in exchange for lease obligations: Operating leases Finance leases As of March 31, 2019, maturities of lease liabilities were as follows: Finance leases 109 104 101 (in millions) Remainder of 2019 2020 2021 2022 2023 Thereafter Total lease payments Less imputed interest Total lease obligations Less current obligations Long-term lease obligations Operating leases 316 S 344 212 140 109 750 1,871 (360) 1,511 (361) 1,150 $ 97 339 833 (118) 715 (85) 630 The table below presents additional information related to the Company's leases for the three months ended March 31, 2019: Three months ended March 31, 2019 Weighted average remaining lease term Operating leases Finance leases 9 years 9 years Weighted average discount rate Operating leases (a) 3.7% Finance leases 3.8% (a) Upon adoption of the New Lense Standard, the incremental borrowing rate used for existing losses was established as of January 1, 2019. As of March 31, 2019, the Company has additional operating lease commitments that had not yet commenced of approximately $600 million for 16 Boeing 737 MAX 8 aircraft to be delivered in 2019 and 2020, each with lease terms that range from eight to nine years. 22Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started