Answered step by step

Verified Expert Solution

Question

1 Approved Answer

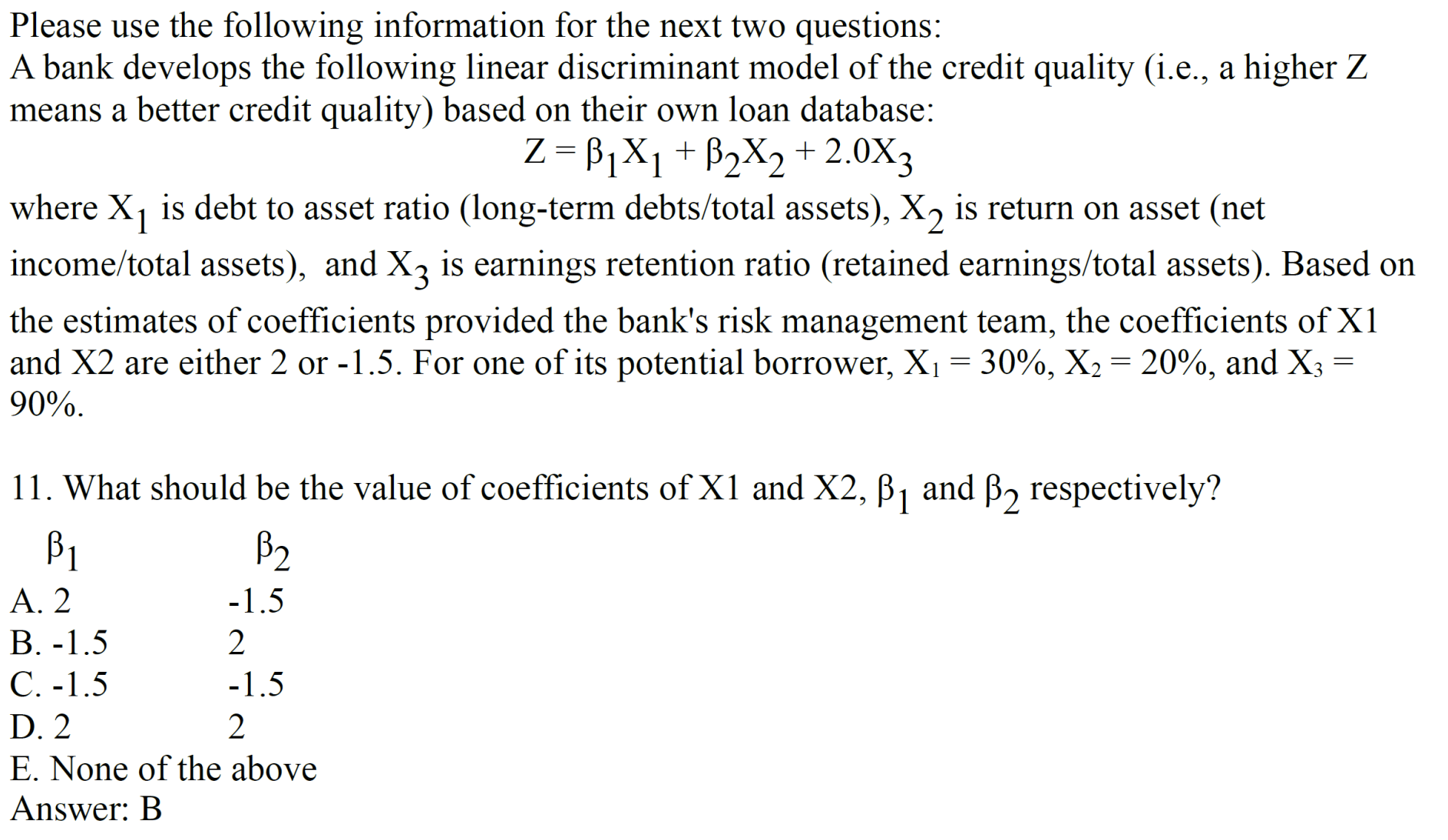

Please use the following information for the next two questions: A bank develops the following linear discriminant model of the credit quality ( i .

Please use the following information for the next two questions:

A bank develops the following linear discriminant model of the credit quality ie a higher Z

means a better credit quality based on their own loan database:

where is debt to asset ratio longterm debtstotal assets is return on asset net

incometotal assets and is earnings retention ratio retained earningstotal assets Based on

the estimates of coefficients provided the bank's risk management team, the coefficients of X

and X are either or For one of its potential borrower, and

What should be the value of coefficients of X and and respectively?

E None of the above

Answer: B

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started