Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the following options for the drop downs: CASH, INITIAL DIRECT COST, INVENTORY, PREPAID MAINTENANCE EXPENSE, EQUIPMENT, ACCUMULATED DEPRECIATION, LEASE RECEIVABLE, RIGHT-OF-USE ASSET, ACCRUED

Please use the following options for the drop downs:

CASH, INITIAL DIRECT COST, INVENTORY, PREPAID MAINTENANCE EXPENSE, EQUIPMENT, ACCUMULATED DEPRECIATION, LEASE RECEIVABLE, RIGHT-OF-USE ASSET, ACCRUED LEGAL EXPENSE, DEFERRED LEASE REVENUE, DEPOSIT LIABILITY, LEASE INCENTIVE PAYABLE, LEASE LIABILITY, SALES REVENUE, INTEREST REVENUE, LEASE REVENUE, COST OF GOODS SOLD, AMORTIZATION EXPENSE, INTEREST EXPENSE, LEASE EXPENSE, LOSS ON LEASE, SELLING EXPENSE

Thank you!

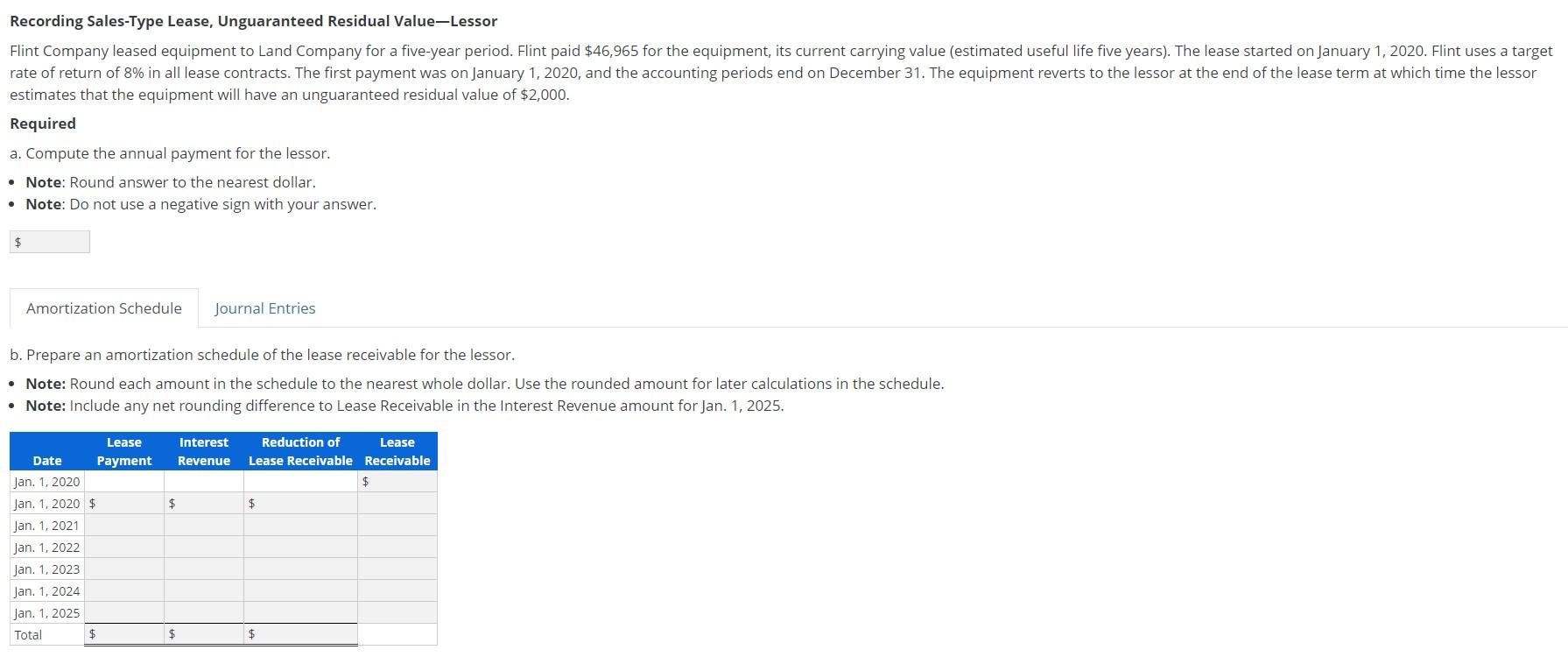

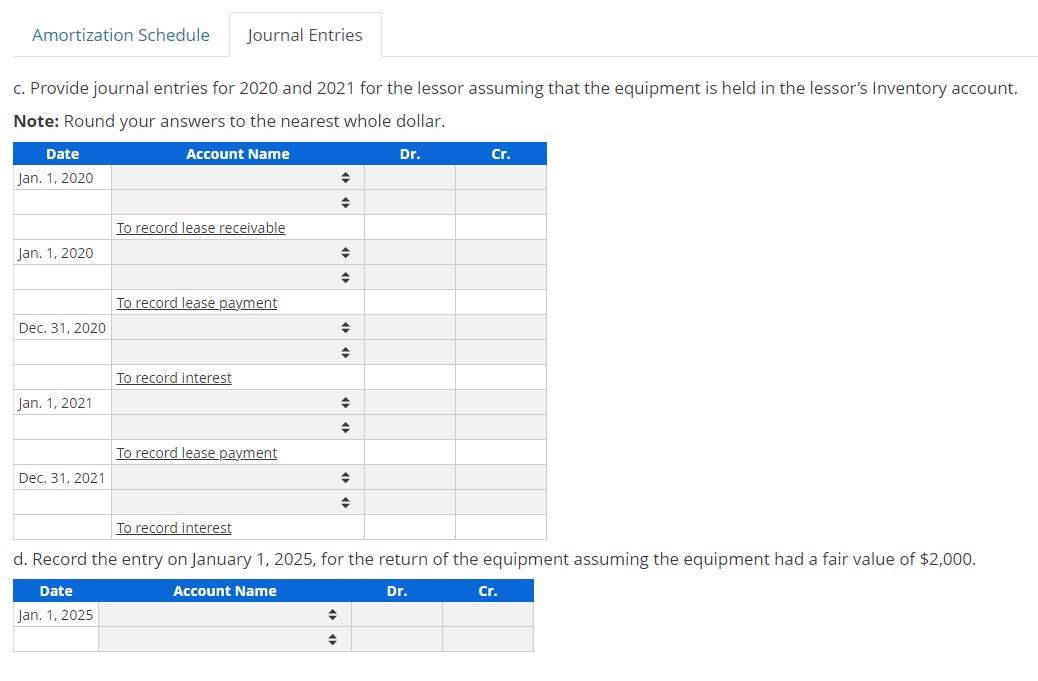

Recording Sales-Type Lease, Unguaranteed Residual Value-Lessor Flint Company leased equipment to Land Company for a five-year period. Flint paid $46,965 for the equipment, its current carrying value (estimated useful life five years). The lease started on January 1, 2020. Flint uses a target rate of return of 8% in all lease contracts. The first payment was on January 1, 2020, and the accounting periods end on December 31. The equipment reverts to the lessor at the end of the lease term at which time the lessor estimates that the equipment will have an unguaranteed residual value of $2,000. Required a. Compute the annual payment for the lessor. Note: Round answer to the nearest dollar. Note: Do not use a negative sign with your answer. $ Amortization Schedule Journal Entries b. Prepare an amortization schedule of the lease receivable for the lessor. Note: Round each amount in the schedule to the nearest whole dollar. Use the rounded amount for later calculations in the schedule. Note: Include any net rounding difference to Lease Receiv ble in nt for Jan. 1, 2025. Interest Revenue Reduction of Lease Lease Receivable Receivable $ $ Lease Date Payment Jan. 1, 2020 Jan 1, 2020 $ Jan 1, 2021 Jan. 1.2022 Jan. 1. 2023 Jan. 1, 2024 Jan. 1, 2025 Total $ $ Amortization Schedule Journal Entries c. Provide journal entries for 2020 and 2021 for the lessor assuming that the equipment is held in the lessor's Inventory account. Note: Round your answers to the nearest whole dollar. Date Account Name Dr. Cr. Jan. 1, 2020 To record lease receivable Jan. 1, 2020 To record lease payment Dec 31, 2020 . To record interest Jan. 1, 2021 To record lease payment Dec. 31, 2021 To record interest d. Record the entry on January 1, 2025, for the return of the equipment assuming the equipment had a fair value of $2,000. Date Account Name Dr. Cr. Jan. 1. 2025Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started