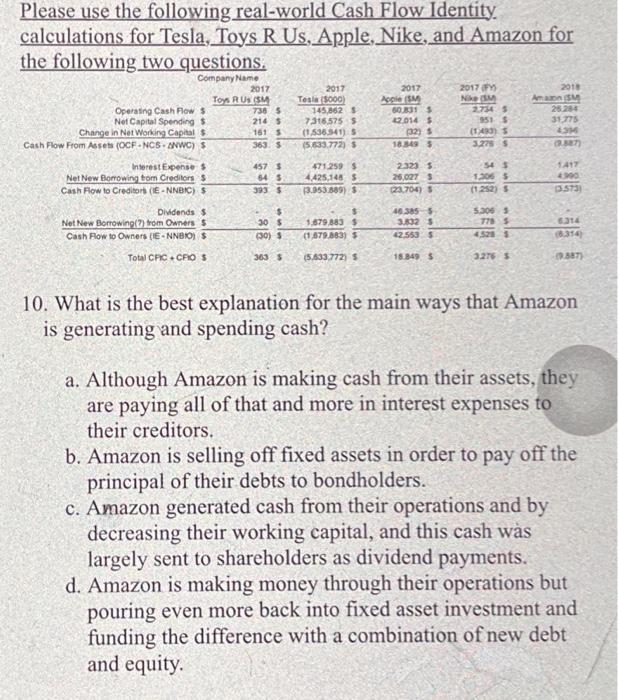

Please use the following real-world Cash Flow Identity. calculations for Tesla, Toys R Us, Apple, Nike, and Amazon for the following two questions. Company

Please use the following real-world Cash Flow Identity. calculations for Tesla, Toys R Us, Apple, Nike, and Amazon for the following two questions. Company Name Operating Cash Flow S Net Capital Spending $ Change in Net Working Capital S Cash Flow From Assets (OCF-NCS-ANWC) S Interest Expense $ Net New Borrowing from Creditors S Cash Flow to Creditors (E-NNBIC) S Dividends $ Net New Borrowing(7) from Owners 5 Cash Flow to Owners (E-NNBIO) S Total CFIC +CFIO S 2017 Toys R Us (SM 738 5 214 S 161 $ 363. S 457 $ 64 S 393 $ 30 $ (30) $ 363 S 2017 Tesla (5000) 145,862 $ 7316575 $ (1,536.941) S (5.633.772) S 471259 $ 4,425,148 S (3.953.589) $ 1,879,883 $ (1.679.883) $ (5.633,772) S 2017 Apple (SM) 60,831 $ 42.014 $ (32) S 18,349 2.323 S 26,027 $ (23,704) S 46.385 5 3.832 S 42,553 $ 18.849 S 2017 (FY) Nike M 2.754 5 951 S (1493) S 3,276 S 54 5 1,306 S (1.252) S 5,306 776 S 4,528 S 3.276 S 2018 Amazon (SM 26.284 31,775 43M (9.887) 1417 4990 (3.573) 6.314 (8.314) (9.887) 10. What is the best explanation for the main ways that Amazon is generating and spending cash? a. Although Amazon is making cash from their assets, they are paying all of that and more in interest expenses to their creditors. b. Amazon is selling off fixed assets in order to pay off the principal of their debts to bondholders. c. Amazon generated cash from their operations and by decreasing their working capital, and this cash was largely sent to shareholders as dividend payments. d. Amazon is making money through their operations but pouring even more back into fixed asset investment and funding the difference with a combination of new debt and equity. 11. What is the best explanation for the main ways that Tesla is generating and spending cash? a. Although Tesla is making cash from their assets, they are paying all of that and more in interest expenses to their creditors. b. Tesla runs a slightly positive operating cash flow and is investing heavily in fixed assets, funding these assets largely by issuing new debt. c. Tesla is selling off fixed assets in order to pay off the principal of their debts to bondholders. d. Tesla is freeing up net working capital in order to fund repurchases of shares of stock on the open market.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To analyze the cash flow generation and spending of the mentioned companies lets examine the provide...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started