Please use the information and fill out a 1040 document! thank you!

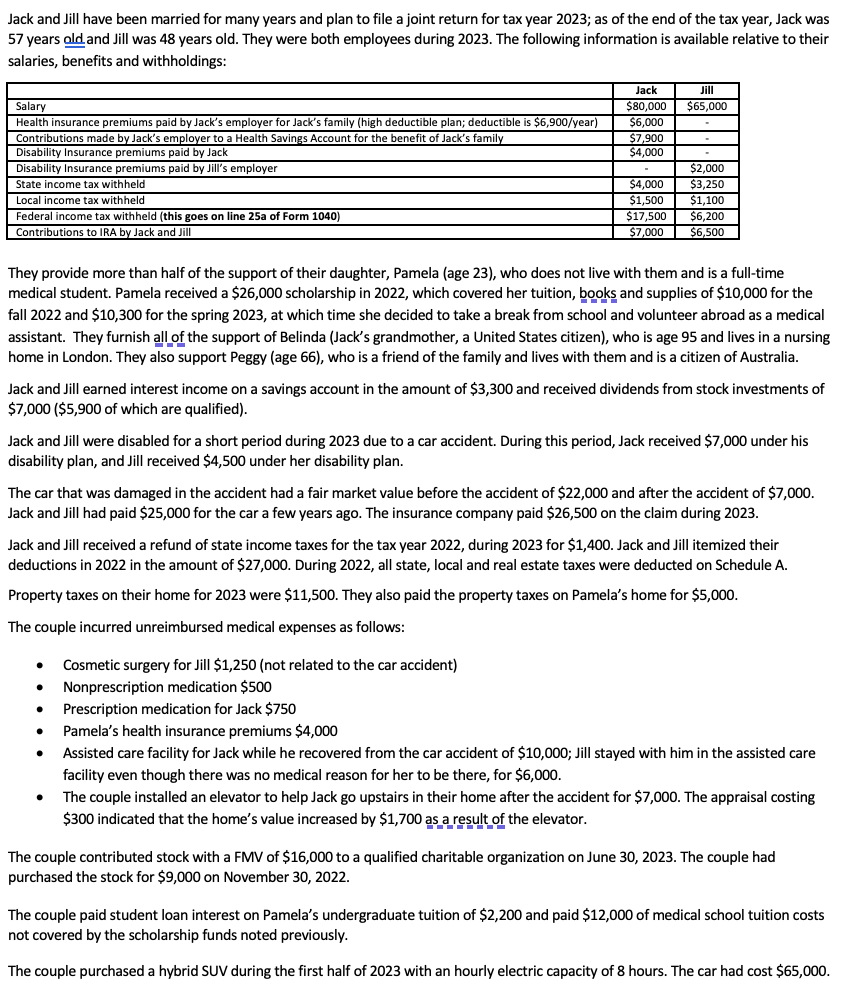

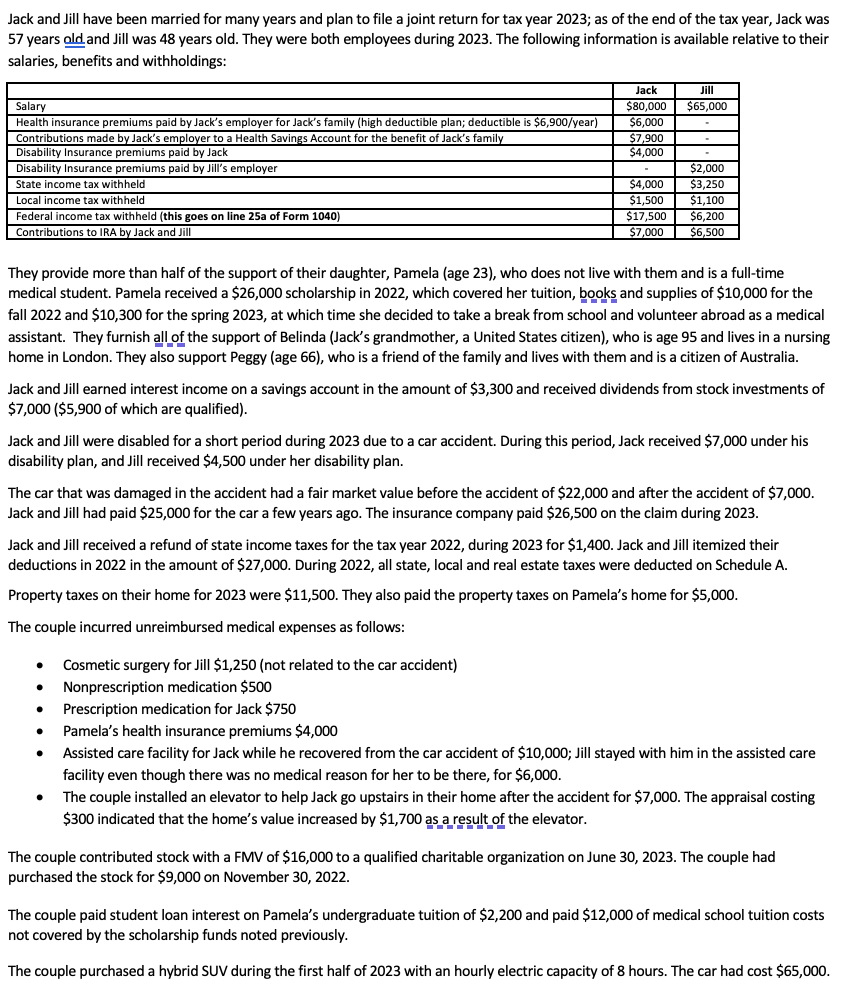

Jack and Jill have been married for many years and plan to file a joint return for tax year 2023; as of the end of the tax year, Jack was 57 years old and Jill was 48 years old. They were both employees during 2023 . The following information is available relative to their salaries, benefits and withholdings: They provide more than half of the support of their daughter, Pamela (age 23), who does not live with them and is a full-time medical student. Pamela received a $26,000 scholarship in 2022, which covered her tuition, books and supplies of $10,000 for the fall 2022 and $10,300 for the spring 2023, at which time she decided to take a break from school and volunteer abroad as a medical assistant. They furnish all of the support of Belinda (Jack's grandmother, a United States citizen), who is age 95 and lives in a nursing home in London. They also support Peggy (age 66), who is a friend of the family and lives with them and is a citizen of Australia. Jack and Jill earned interest income on a savings account in the amount of $3,300 and received dividends from stock investments of $7,000 ( $5,900 of which are qualified). Jack and Jill were disabled for a short period during 2023 due to a car accident. During this period, Jack received $7,000 under his disability plan, and Jill received $4,500 under her disability plan. The car that was damaged in the accident had a fair market value before the accident of $22,000 and after the accident of $7,000. Jack and Jill had paid $25,000 for the car a few years ago. The insurance company paid $26,500 on the claim during 2023. Jack and Jill received a refund of state income taxes for the tax year 2022, during 2023 for $1,400. Jack and Jill itemized their deductions in 2022 in the amount of $27,000. During 2022, all state, local and real estate taxes were deducted on Schedule A. Property taxes on their home for 2023 were $11,500. They also paid the property taxes on Pamela's home for $5,000. The couple incurred unreimbursed medical expenses as follows: - Cosmetic surgery for Jill $1,250 (not related to the car accident) - Nonprescription medication $500 - Prescription medication for Jack $750 - Pamela's health insurance premiums $4,000 - Assisted care facility for Jack while he recovered from the car accident of $10,000; Jill stayed with him in the assisted care facility even though there was no medical reason for her to be there, for $6,000. - The couple installed an elevator to help Jack go upstairs in their home after the accident for $7,000. The appraisal costing $300 indicated that the home's value increased by $1,700 as a result of the elevator. The couple contributed stock with a FMV of $16,000 to a qualified charitable organization on June 30,2023 . The couple had purchased the stock for $9,000 on November 30, 2022. The couple paid student loan interest on Pamela's undergraduate tuition of $2,200 and paid $12,000 of medical school tuition costs not covered by the scholarship funds noted previously. The couple purchased a hybrid SUV during the first half of 2023 with an hourly electric capacity of 8 hours. The car had cost $65,000