Answered step by step

Verified Expert Solution

Question

1 Approved Answer

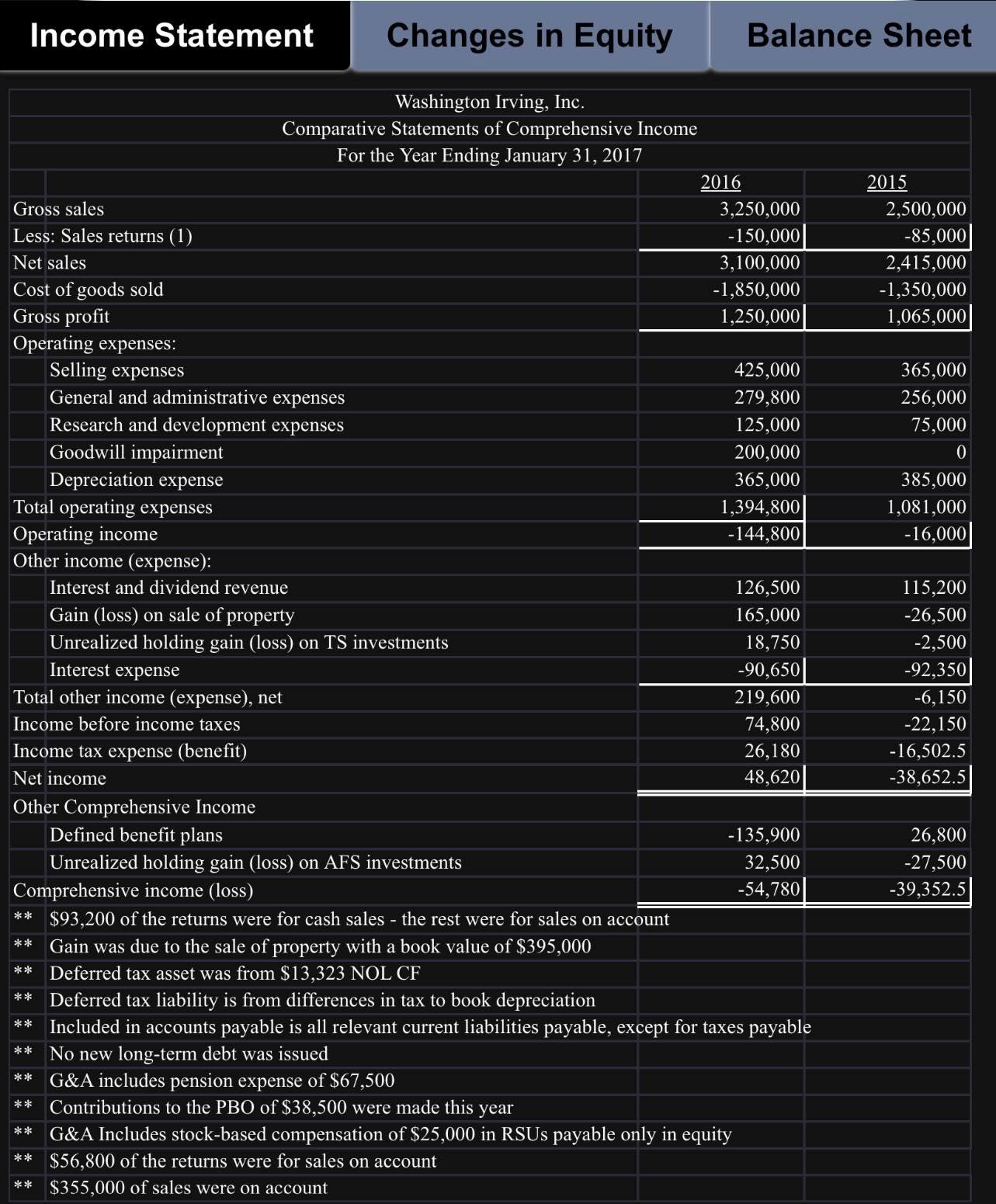

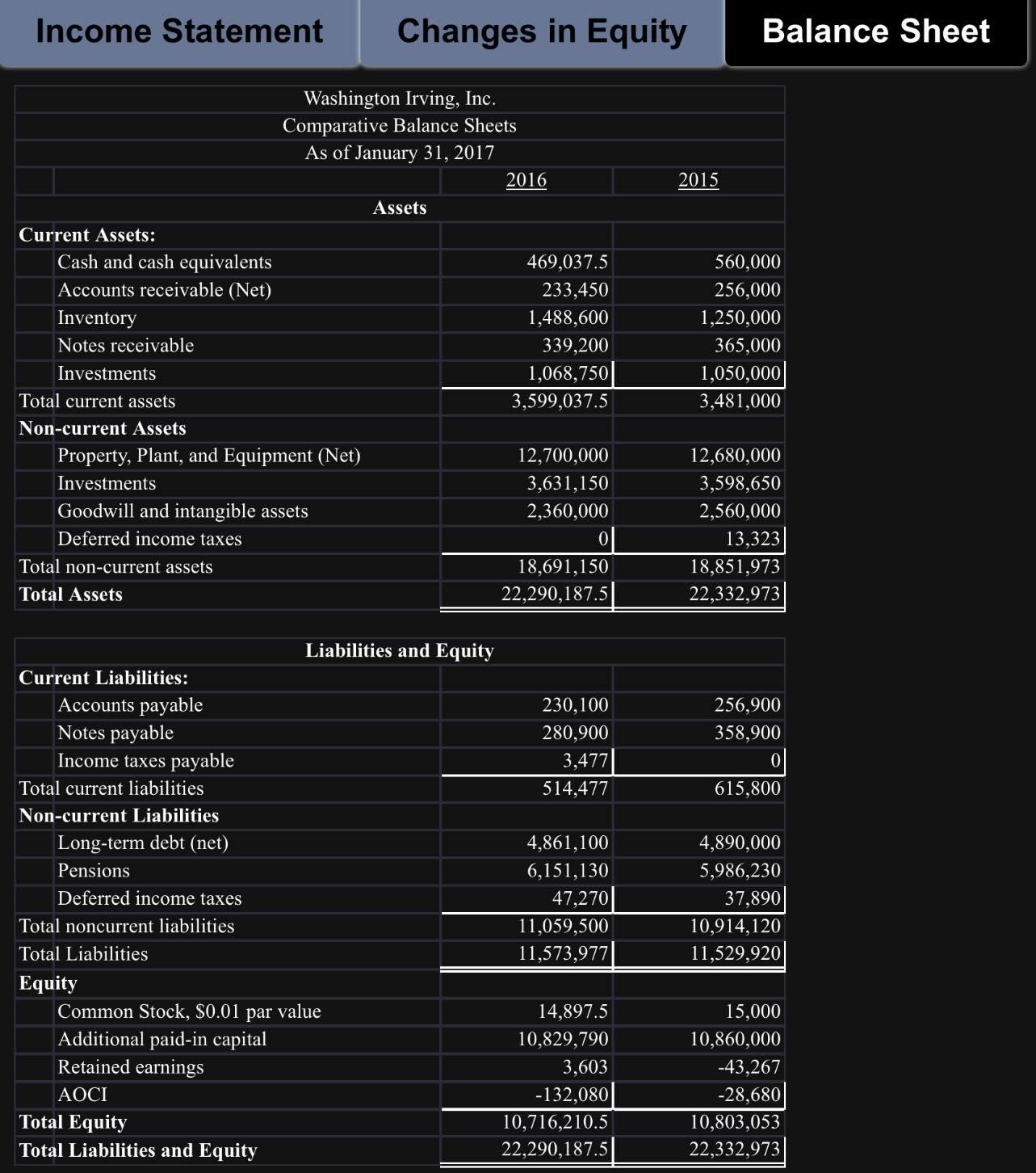

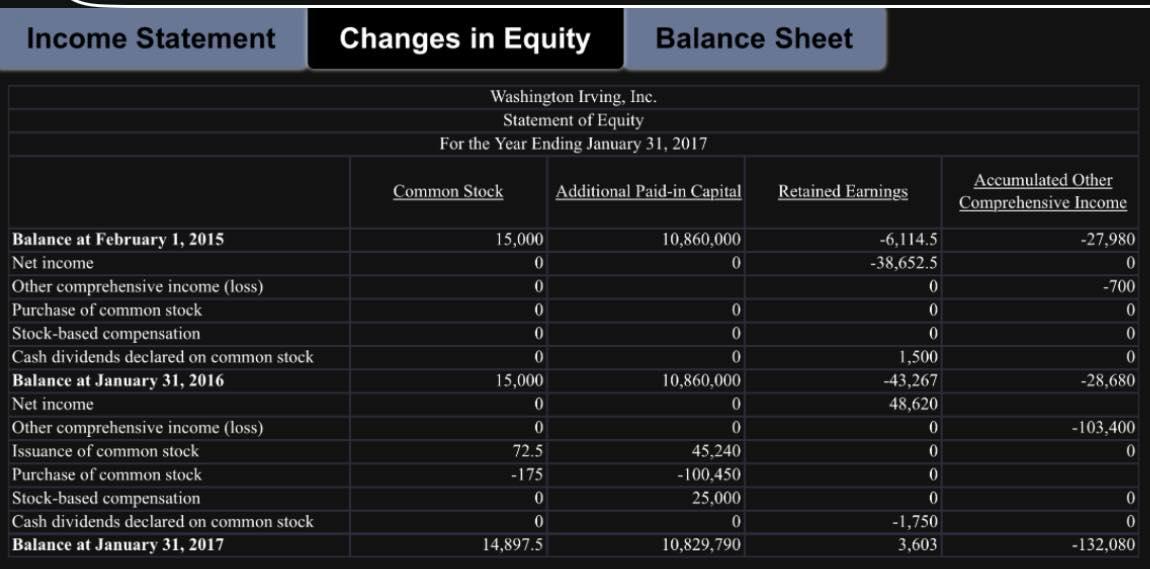

Please use the information in the following tabs to complete a direct method and indirect method statement of cash flows. Do not simply type in

Please use the information in the following tabs to complete a direct method and indirect method statement of cash flows.

Do not simply type in numbers into your statement of cash flows. Instead, use formulas, cell references, and etc. in order to create the statement of cash flows.

Income Statement Gross sales Less: Sales returns (1) Net sales Cost of goods sold Gross profit Operating expenses: Selling expenses General and administrative expenses Research and development expenses Goodwill impairment Depreciation expense Total operating expenses Operating income Other income (expense): Changes in Equity Washington Irving, Inc. Comparative Statements of Comprehensive Income For the Year Ending January 31, 2017 Interest and dividend revenue Gain (loss) on sale of property Unrealized holding gain (loss) on TS investments Interest expense Total other income (expense), net Income before income taxes Income tax expense (benefit) Net income Other Comprehensive Income Defined benefit plans Unrealized holding gain (loss) on AFS investments Comprehensive income (loss) ** $93,200 of the returns were for cash sales - the rest were for sales on account ** Gain was due to the sale of property with a book value of $395,000 ** Deferred tax asset was from $13,323 NOL CF 2016 Balance Sheet 3,250,000 -150,000 3,100,000 -1,850,000 1,250,000 425,000 279,800 125,000 200,000 365,000 1,394,800 -144,800 126,500 165,000 18,750 -90,650 219,600 74,800 26,180 48,620 -135,900 32,500 -54,780 G&A includes pension expense of $67,500 ** Contributions to the PBO of $38,500 were made this year ** G&A Includes stock-based compensation of $25,000 in RSUS payable only in equity ** $56,800 of the returns were for sales on account ** $355,000 of sales were on account ** Deferred tax liability is from differences in tax to book depreciation ** Included in accounts payable is all relevant current liabilities payable, except for taxes payable ** No new long-term debt was issued ** 2015 2,500,000 -85,000 2,415,000 -1,350,000 1,065,000 365,000 256,000 75,000 0 385,000 1,081,000 -16,000 115,200 -26,500 -2,500 -92,350 -6,150 -22,150 -16,502.5 -38,652.5 26,800 -27,500 -39,352.5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To prepare the Statement ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started