Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use the provided excel to work on the problem and show work / formula in working cell for a thumb up. Please use the

Please use the provided excel to work on the problem and show work / formula in working cell for a thumb up.

Please use the provided excel to work on the problem and show work / formula in working cell for a thumb up.

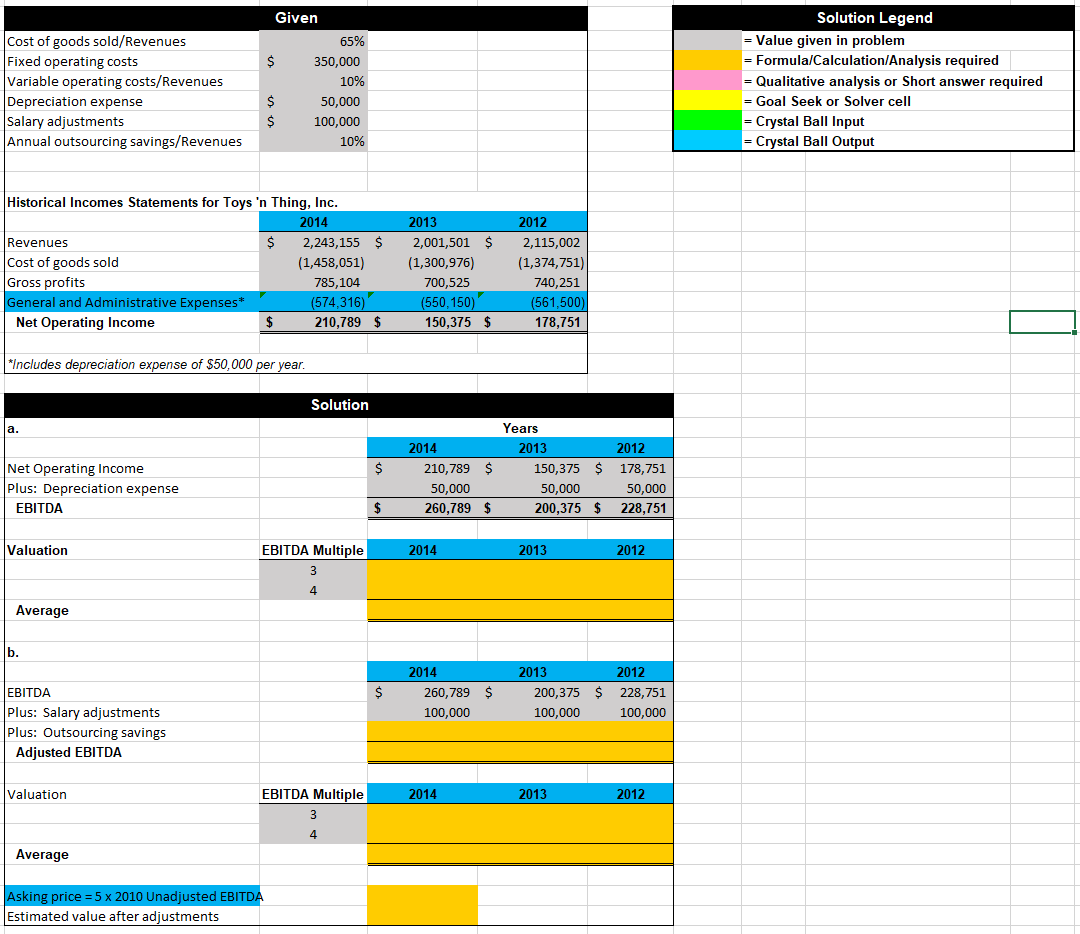

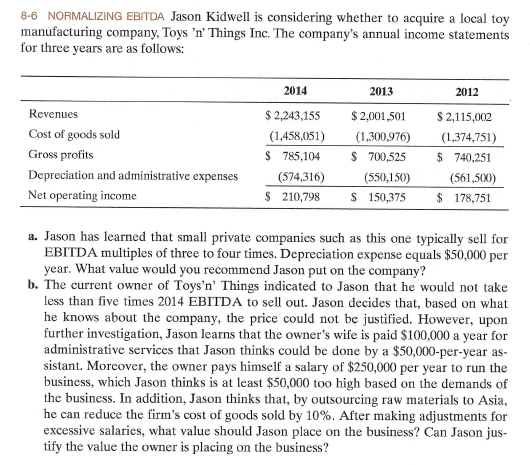

Given $ Cost of goods sold/Revenues Fixed operating costs Variable operating costs/Revenues Depreciation expense Salary adjustments Annual outsourcing savings/Revenues 65% 350,000 10% 50,000 100,000 10% Solution Legend = Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input Crystal Ball Output $ $ Historical Incomes Statements for Toys 'n Thing, Inc. 2014 Revenues $ 2,243,155 $ Cost of goods sold (1,458,051) Gross profits 785,104 General and Administrative Expenses* (574,316) Net Operating Income $ 210,789 $ 2013 2,001,501 $ (1,300,976) 700,525 (550,150) 150,375 $ 2012 2,115,002 (1,374,751) 740,251 (561,500) 178,751 *Includes depreciation expense of $50,000 per year. Solution a. $ Net Operating Income Plus: Depreciation expense EBITDA 2014 210,789 $ 50,000 260,789 $ Years 2013 2012 150,375 $ 178,751 50,000 50,000 200,375 $ 228,751 $ Valuation EBITDA Multiple 2014 2013 2012 Average b. $ 2014 260,789 $ 100,000 2013 2012 200,375 $ 228,751 100,000 100,000 EBITDA Plus: Salary adjustments Plus: Outsourcing savings Adjusted EBITDA Valuation EBITDA Multiple 2014 2013 2012 4 Average Asking price = 5 x 2010 Unadjusted EBITDA Estimated value after adjustments 8-6 NORMALIZING EBITDA Jason Kidwell is considering whether to acquire a local toy manufacturing company, Toys 'n' Things Inc. The company's annual income statements for three years are as follows: Revenues Cost of goods sold Gross profits Depreciation and administrative expenses Net operating income 2014 $2,243,155 (1,458,051) $ 785,104 (574,316) $ 210,798 2013 $ 2,001,501 (1,300,976) $ 700,525 (550,150) $ 150,375 2012 $ 2,115,002 (1,374,751) $ 740,251 (561,500) $ 178,751 a. Jason has learned that small private companies such as this one typically sell for EBITDA multiples of three to four times. Depreciation expense equals $50,000 per year. What value would you recommend Jason put on the company? b. The current owner of Toys'n' Things indicated to Jason that he would not take less than five times 2014 EBITDA to sell out. Jason decides that, based on what he knows about the company, the price could not be justified. However, upon further investigation, Jason learns that the owner's wife is paid $100,000 a year for administrative services that Jason thinks could be done by a $50,000-per-year as- sistant. Moreover, the owner pays himself a salary of $250,000 per year to run the business, which Jason thinks is at least $50,000 too high based on the demands of the business. In addition, Jason thinks that, by outsourcing raw materials to Asia, he can reduce the firm's cost of goods sold by 10%. After making adjustments for excessive salaries, what value should Jason place on the business? Can Jason jus- tify the value the owner is placing on the business? Given $ Cost of goods sold/Revenues Fixed operating costs Variable operating costs/Revenues Depreciation expense Salary adjustments Annual outsourcing savings/Revenues 65% 350,000 10% 50,000 100,000 10% Solution Legend = Value given in problem = Formula/Calculation/Analysis required = Qualitative analysis or Short answer required = Goal Seek or Solver cell = Crystal Ball Input Crystal Ball Output $ $ Historical Incomes Statements for Toys 'n Thing, Inc. 2014 Revenues $ 2,243,155 $ Cost of goods sold (1,458,051) Gross profits 785,104 General and Administrative Expenses* (574,316) Net Operating Income $ 210,789 $ 2013 2,001,501 $ (1,300,976) 700,525 (550,150) 150,375 $ 2012 2,115,002 (1,374,751) 740,251 (561,500) 178,751 *Includes depreciation expense of $50,000 per year. Solution a. $ Net Operating Income Plus: Depreciation expense EBITDA 2014 210,789 $ 50,000 260,789 $ Years 2013 2012 150,375 $ 178,751 50,000 50,000 200,375 $ 228,751 $ Valuation EBITDA Multiple 2014 2013 2012 Average b. $ 2014 260,789 $ 100,000 2013 2012 200,375 $ 228,751 100,000 100,000 EBITDA Plus: Salary adjustments Plus: Outsourcing savings Adjusted EBITDA Valuation EBITDA Multiple 2014 2013 2012 4 Average Asking price = 5 x 2010 Unadjusted EBITDA Estimated value after adjustments 8-6 NORMALIZING EBITDA Jason Kidwell is considering whether to acquire a local toy manufacturing company, Toys 'n' Things Inc. The company's annual income statements for three years are as follows: Revenues Cost of goods sold Gross profits Depreciation and administrative expenses Net operating income 2014 $2,243,155 (1,458,051) $ 785,104 (574,316) $ 210,798 2013 $ 2,001,501 (1,300,976) $ 700,525 (550,150) $ 150,375 2012 $ 2,115,002 (1,374,751) $ 740,251 (561,500) $ 178,751 a. Jason has learned that small private companies such as this one typically sell for EBITDA multiples of three to four times. Depreciation expense equals $50,000 per year. What value would you recommend Jason put on the company? b. The current owner of Toys'n' Things indicated to Jason that he would not take less than five times 2014 EBITDA to sell out. Jason decides that, based on what he knows about the company, the price could not be justified. However, upon further investigation, Jason learns that the owner's wife is paid $100,000 a year for administrative services that Jason thinks could be done by a $50,000-per-year as- sistant. Moreover, the owner pays himself a salary of $250,000 per year to run the business, which Jason thinks is at least $50,000 too high based on the demands of the business. In addition, Jason thinks that, by outsourcing raw materials to Asia, he can reduce the firm's cost of goods sold by 10%. After making adjustments for excessive salaries, what value should Jason place on the business? Can Jason jus- tify the value the owner is placing on the businessStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started