Answered step by step

Verified Expert Solution

Question

1 Approved Answer

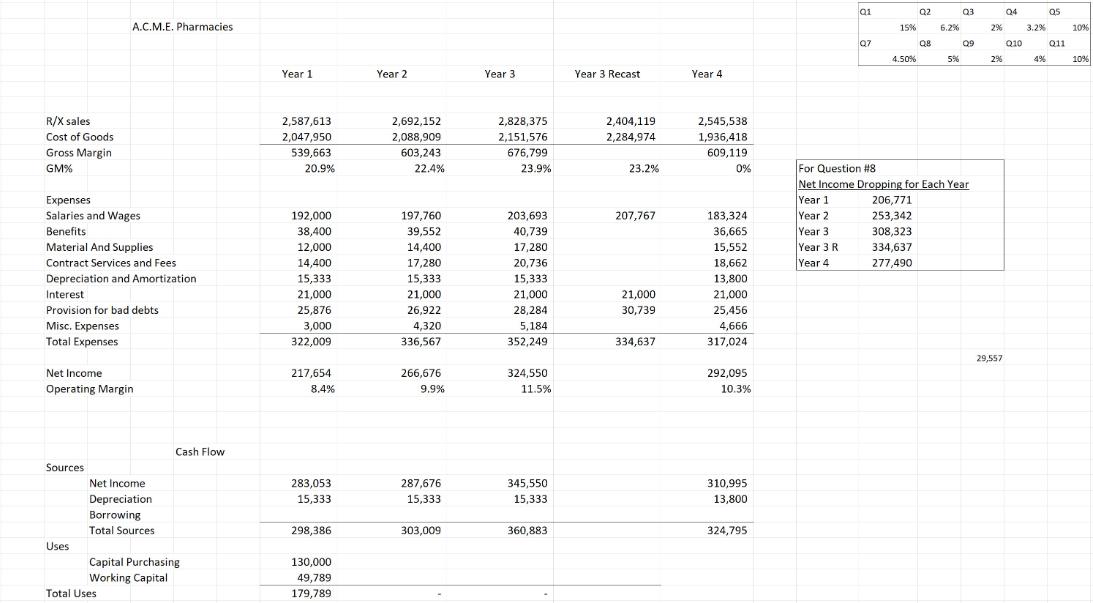

Use the spread sheet for A.C.M.E. Pharmacies. This company has three years of sales and profits. Given what is gone on with the pandemic several

Use the spread sheet for A.C.M.E. Pharmacies. This company has three years of sales and profits. Given what is gone on with the pandemic several companies have struggled as a result. This assignment calls for you to recast the financials given the following new criteria:

- RX sales drop 15%

- Cost of goods sold increase by 6.2%

- Salaries are increased by 2%

- GM drop by 3.2%

- Cast a year 4 with a 10% decrease in all categories from year 3.

- Interest is now $21000 a year

- Provision for bad debts increases by 4.5%

- Net Income drops by 5% for each year

- Number of prescriptions per day increases by 2%

- Bad Debt Percentage rises to 4%

- Inflation Rates rises by 10%

- Unexpected costs not currently accounted for each year $35,435

You need to recast the statement given the criteria listed above and answer the following questions.

- Is the company still economically viable why or why not?

- Is there any information that you think is missing? What do you think you need? Why?

- Is there any conflicting data? What is it?

- What happens when companies' profitability changes because of outside factors?

- What corrective action would you take? Why?

- What are the risks, assumptions, and unanswered questions?

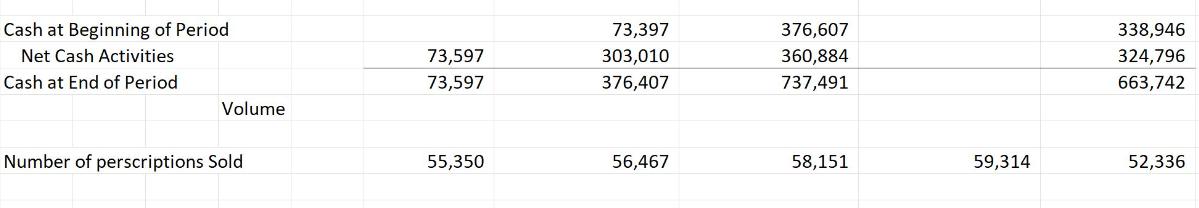

R/X sales Cost of Goods Gross Margin GM% Expenses Salaries and Wages Benefits Material And Supplies Material Contract Services and Fees Depreciation and Amortization Interest Provision for bad debts Misc. Expenses Total Expenses Net Income Operating Margin Sources A.C.M.E. Pharmacies Uses Net Income Depreciation Borrowing Total Sources Total Uses Cash Flow Capital Purchasing Working Capital Year 1 2,587,613 2,047,950 539,663 20.9% 192,000 38,400 12,000 2,000 14,400 FRANC 15,333 21,000 25,876 3,000 322,009 217,654 8.4% 283,053 15,333 298,386 130,000 49,789 179,789 Year 2 2,692,152 2,088,909 603,243 22.4% 197,760 39,552 14,400 17,280 15,333 21,000 26,922 4,320 336,567 266,676 9.9% 287,676 15,333 303,009 Year 3 2,828,375 2,151,576 676,799 23.9% 203,693 40,739 17,280 17,200 20,736 15,333 21,000 28,284 5,184 352,249 324,550 11.5% 345,550 15,333 360,883 Year 3 Recast 2,404,119 2,284,974 23.2% 207,767 21,000 30,739 334,637 Year 4 2,545,538 1,936,418 609,119 0% 183,324 36,665 15,552 18,662 19,002 13,800 21,000 25,456 4,666 317,024 292,095 10.3% 310,995 13,800 324,795 Q1 Q7 15% 4.50% Q2 206,771 253,342 308,323 334,637 277,490 Q8 6.2% 5% Q3 Q9 For Question #8 Net Income Dropping for Each Year Year 1 Year 2 Year 3 Year 3 R Year 4 2% 2% 29,557 Q4 Q10 3.2% 4% 05 Q11 10% 10%

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

To recast the financial statements for ACME Pharmacies based on the provided criteria we will make adjustments to the relevant figures Heres the recasting of the financial statements for Year 3 and Ye...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started