Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please use these Initial Public Offering ( IPO ) : In this entry, CFG Bank issues 1 , 0 0 0 , 0 0 0

please use these Initial Public Offering IPO:

In this entry, CFG Bank issues shares to the public at a price of $ per share. The par value of each share is $ The total cash received from the sale of shares is $

The journal entry reflects the increase in Cash by $ the issuance of Common Stock at its par value of $ per share shares $ and the remaining amount as Additional Paidin Capital. This additional paidin capital represents the excess of the IPO price over the par value.

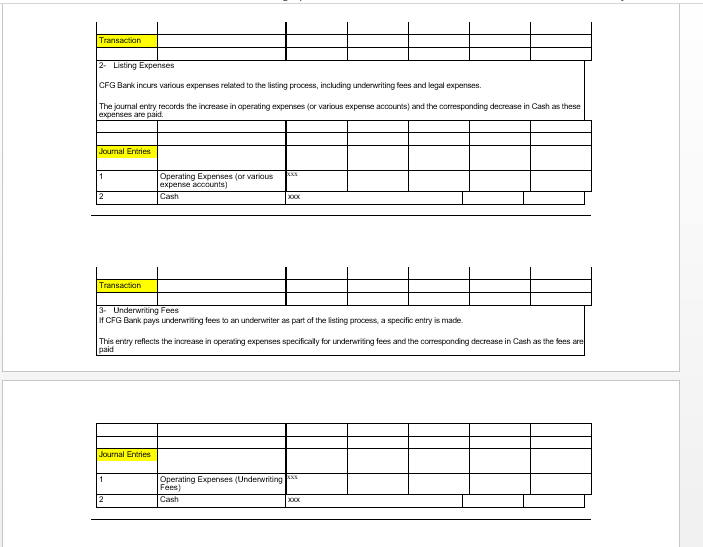

Listing Expenses:

CFG Bank incurs various expenses related to the listing process, including underwriting fees and legal expenses.

The journal entry records the increase in operating expenses or various expense accounts and the corresponding decrease in Cash as these expenses are paid.

Underwriting Fees:

If CFG Bank pays underwriting fees to an underwriter as part of the listing process, a specific entry is made.

This entry reflects the increase in operating expenses specificallyCFG bank has just been listed on the Casablanca stock Exchange. Your task consists of simulating the transaction that CFG did using real data and do the necessary journal entries.CFG bank has just been listed on the Casablanca stock Exchange. Your task consists of simulating the transaction that CFG did using real data and do the necessary journal entries.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started