Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use this excel form to answer. 37. Payback Period Calculation. Heston Farming Company would like to purchase a harvesting machine for $100,000. The machine

Please use this excel form to answer.

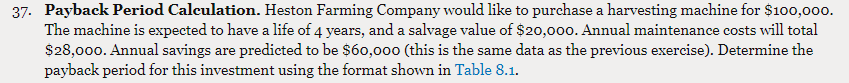

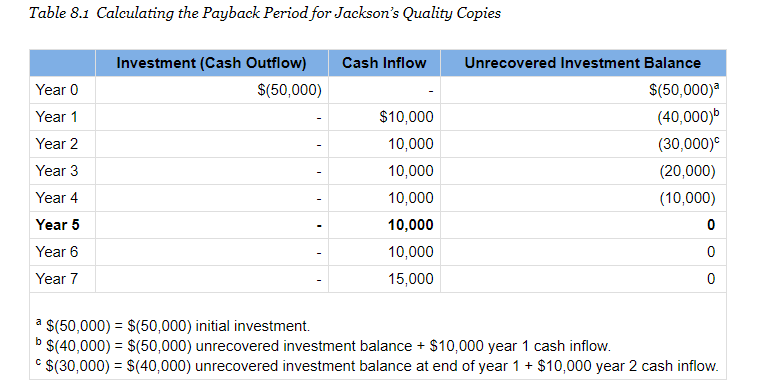

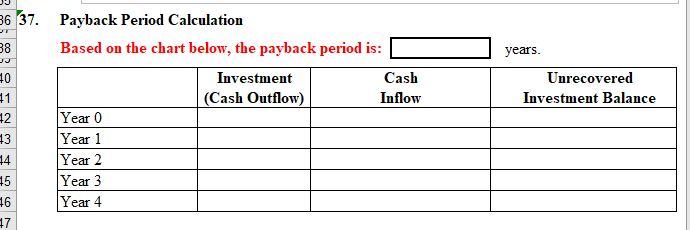

37. Payback Period Calculation. Heston Farming Company would like to purchase a harvesting machine for $100,000. The machine is expected to have a life of 4 years, and a salvage value of $20,000. Annual maintenance costs will total $28,000. Annual savings are predicted to be $60,000 (this is the same data as the previous exercise). Determine the payback period for this investment using the format shown in Table 8.1. Table 8.1 Calculating the Payback Period for Jackson's Quality Copies Cash Inflow Investment (Cash Outflow) $(50,000) Year 0 Year 1 Year 2 Year 3 Unrecovered Investment Balance $(50,000) (40,000) (30,000) (20,000) (10,000) 0 $10,000 10,000 10,000 10,000 10,000 10,000 15,000 Year 4 Year 5 Year 6 0 Year 7 0 a b $(50,000) = $(50,000) initial investment. $(40,000) = $(50,000) unrecovered investment balance + $10,000 year 1 cash inflow. $(30,000) = $(40,000) unrecovered investment balance at end of year 1 + $10,000 year 2 cash inflow. years. Unrecovered Investment Balance 36 37. Payback Period Calculation 38 Based on the chart below, the payback period is: 40 Investment Cash 41 (Cash Outflow) Inflow 42 Year 0 43 Year 1 14 Year 2 45 Year 3 46 Year 4 47Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started