Question

Please use this information to answer the questions below: Over the three years ending on 5/31/2022, the Zoom stock and the S&P500 monthly returns showed

Please use this information to answer the questions below:

Over the three years ending on 5/31/2022, the Zoom stock and the S&P500 monthly returns showed the following statistics:

| Investment | E(R) | σ(R) | ρ |

| Zoom | 2.4894% | 19.1942% | -0.179480 |

| S&P500 | 1.2690% | 5.2253% |

Q1: What was the beta of Zoom over this time period?

Group of answer choices

a. 0.6593.

b. -0.0344.

c. -0.6593.

d. 1.9617.

Q2: Florist Gump company has two divisions with positive investment in each: floral arrangements and seafood restaurant supply. The overall company has a beta of 1.25. You estimate that the floral arrangement division has a beta of 0.9. What should the beta of the seafood supply division be?

Group of answer choices

a. More than 1.25.

b. Between 0.9 and 1.25.

c. Less than 0.9.

d. Cannot be determined without knowing the investment weights.

Q3

Image transcription text

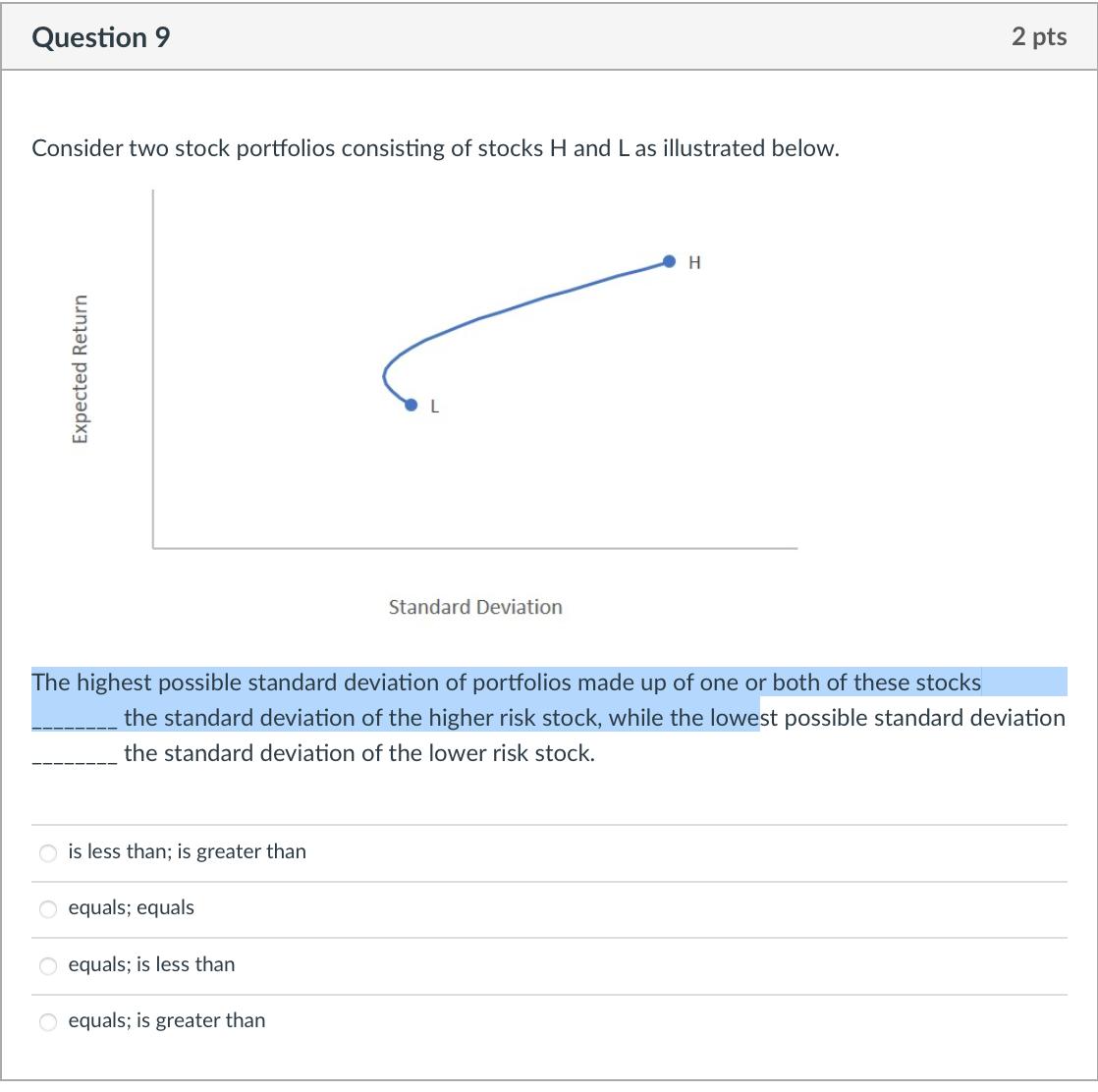

Question 9 2 pts Consider two stock portfolios consisting of stocks H and L as illustrated below. Expected Return Standard Deviation The highest possible standard deviation of portfolios made up of one or both of these stocks the standard deviation of the higher risk stock, while the lowest possible standard deviation the standard deviation of the lower risk stock. is less than; is greater than equals; equals equals; is less than equals; is greater than

Question 9 Consider two stock portfolios consisting of stocks H and L as illustrated below. Expected Return Standard Deviation H The highest possible standard deviation of portfolios made up of one or both of these stocks the standard deviation of the higher risk stock, while the lowest possible standard deviation the standard deviation of the lower risk stock. O is less than; is greater than equals; equals Oequals; is less than equals; is greater than 2 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started