Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please use this template to answer the question! Preferably typed up so I can read it 3. Budgeting: 11 marks Sales John Wilson is the

Please use this template to answer the question! Preferably typed up so I can read it

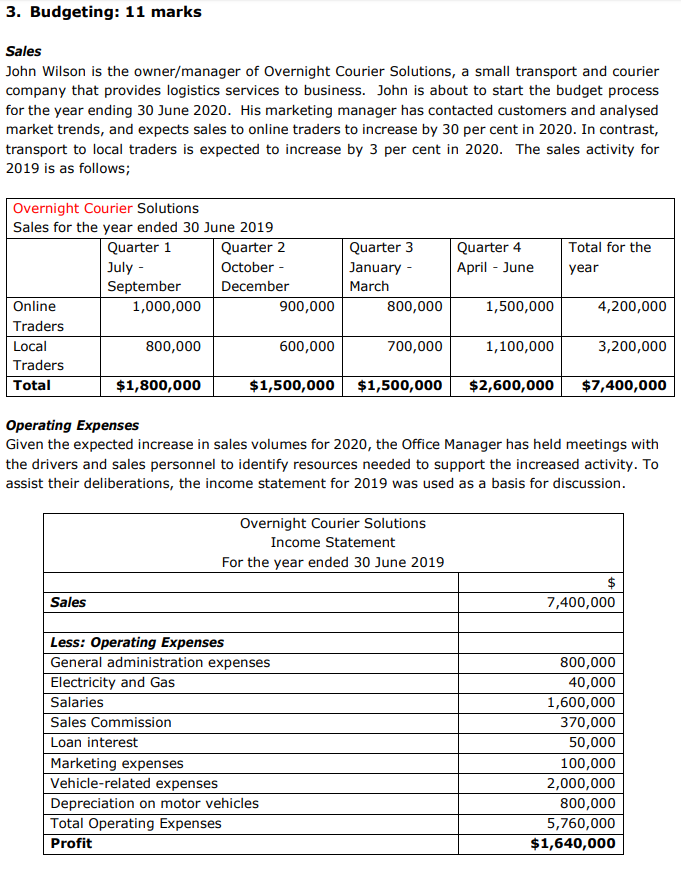

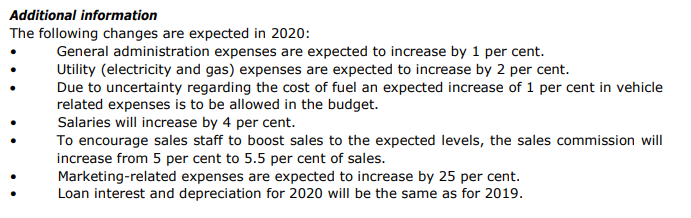

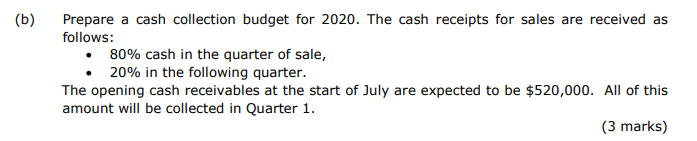

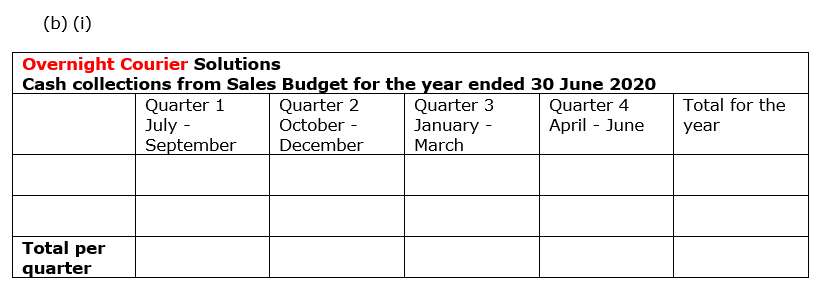

3. Budgeting: 11 marks Sales John Wilson is the owner/manager of Overnight Courier Solutions, a small transport and courier company that provides logistics services to business. John is about to start the budget process for the year ending 30 June 2020. His marketing manager has contacted customers and analysed market trends, and expects sales to online traders to increase by 30 per cent in 2020. IIn contrast, transport to local traders is expected to increase by 3 per cent in 2020. The sales activity for 2019 is as follows; Overnight Courier Solutions Sales for the year ended 30 June 2019 Quarter 1 Quarter 4 Quarter 2 Quarter 3 Total for the October July September January April June year December March 900,000 800,000 1,500,000 Online 1,000,000 4,200,000 Traders Local 800,000 600,000 700,000 1,100,000 3,200,000 Traders Total $1,800,000 $1,500,000 $1,500,000 $2,600,000 $7,400,000 Operating Expenses Given the expected increase in sales volumes for 2020, the Office Manager has held meetings with the drivers and sales personnel to identify resources needed to support the increased activity. To assist their deliberations, the income statement for 2019 was used as a basis for discussion Overnight Courier Solutions Income Statement For the year ended 30 June 2019 Sales 7,400,000 Less: Operating Expenses General administration expenses 800,000 40,000 1,600,000 370,000 50,000 Electricity and Gas Salaries Sales Commission Loan interest Marketing expenses Vehicle-related expenses 100,000 2,000,000 Depreciation on motor vehicles Total Operating Expenses 800,000 5,760,000 Profit $1,640,000 Additional information The following changes are expected in 2020: General administration expenses are expected to increase by 1 per cent. Utility (electricity and gas) expenses are expected to increase by 2 per cent. Due to uncertainty regarding the cost of fuel an expected increase of 1 per cent in vehicle related expenses is to be allowed in the budget. Salaries will increase by 4 per cent To encourage sales staff to boost sales to the expected levels, the sales commission will increase from 5 per cent to 5.5 per cent of sales. Marketing-related expenses are expected to increase by 25 per cent. Loan interest and depreciation for 2020 will be the same as for 2019. (b) Prepare a cash collection budget for 2020. The cash receipts for sales are received as follows: 80% cash in the quarter of sale, 20% in the following quarter. The opening cash receivables at the start of July are expected to be $520,000. All of this amount will be collected in Quarter 1 (3 marks) (b) (i) Overnight Courier Solutions Cash collections from Sales Budget for the year ended 30 June 2020 Quarter 2 October Quarter 3 January March Quarter 1 July - September Quarter 4 April June Total for the year December Total per quarter

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started