Question

Please use Yahoo Finance The first yellow field is the stockholders equity reported on the last annual report released by the firm. You should enter

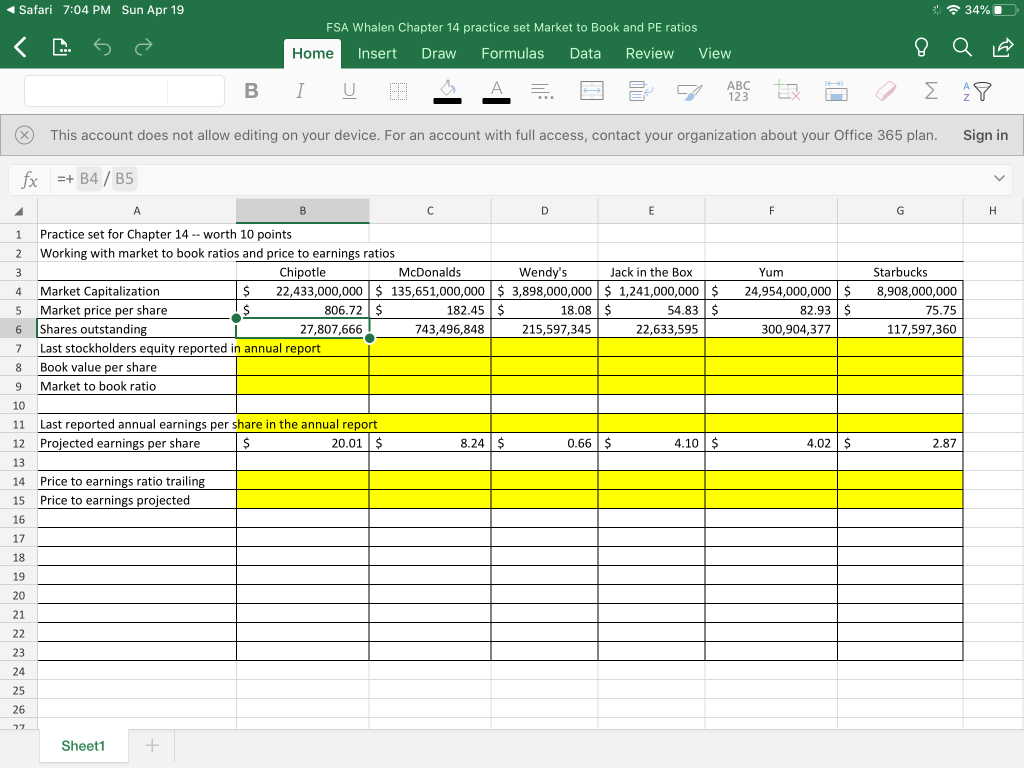

Please use Yahoo Finance The first yellow field is the stockholders equity reported on the last annual report released by the firm. You should enter this as a dollar amount. You can find this on the balance sheet.

The second yellow row of numbers is the book value per share and can be calculated by dividing the stockholders equity by the number of shares outstanding (that is supplied in the spreadsheet). This number is in dollars per share.

The third yellow field is the market value per share to the book value per share and is calculated by dividing the market price per share by the book value per share. Note that some of these numbers will be negative because the book values for some of these companies are negative.

The fourth yellow field is the last reported earnings per share as reported in the last annual report.

The next yellow field is the price to trailing earnings ratio which is calculated by taking the market price per share divided by the trailing earnings per share.

The last yellow field is the price to projected earnings ratio. This is calculated by dividing the market price per share by the projected earnings per share.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started