Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please using the followinf data from each company to answer the following questions Starbucks- Nike Costco please alswer the following using the data above for

please using the followinf data from each company to answer the following questions

Starbucks-

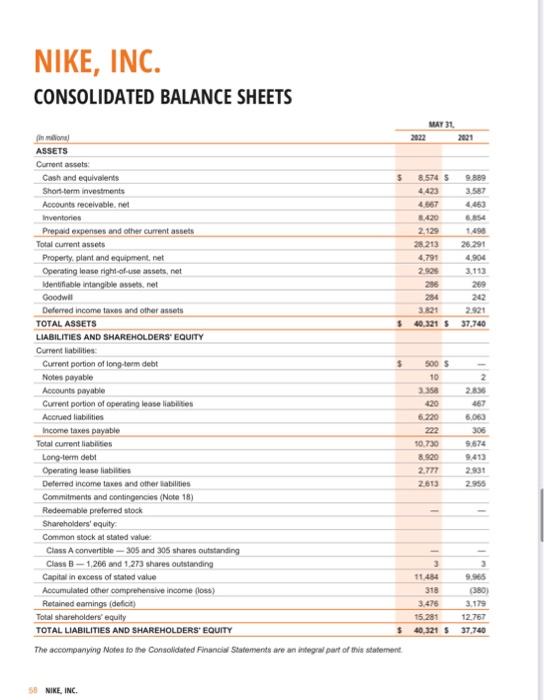

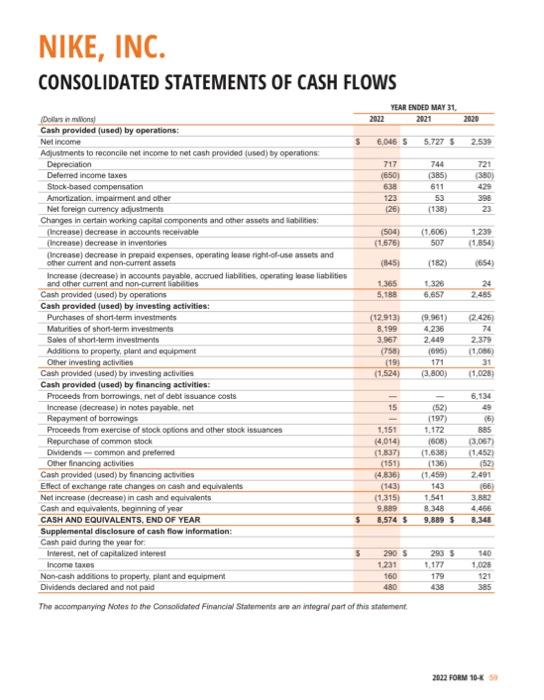

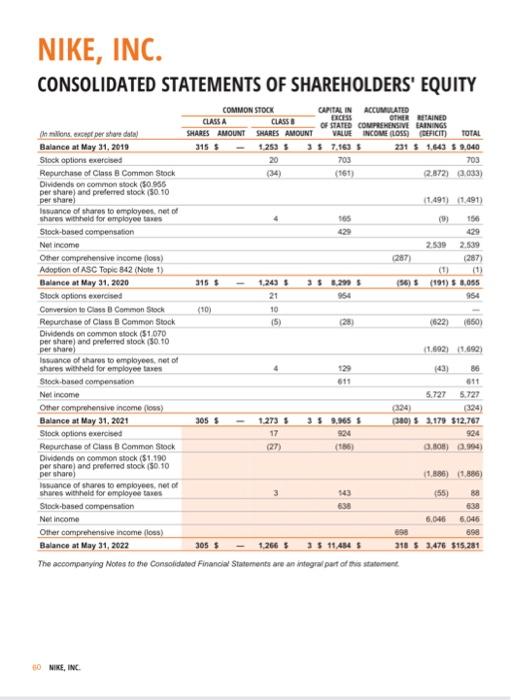

Nike

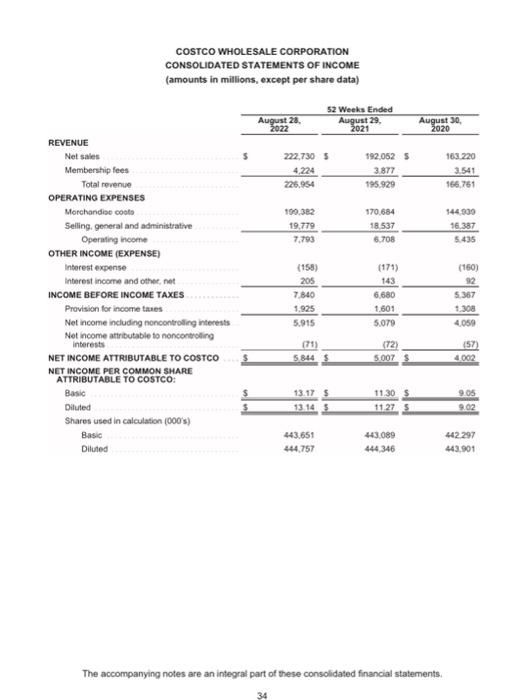

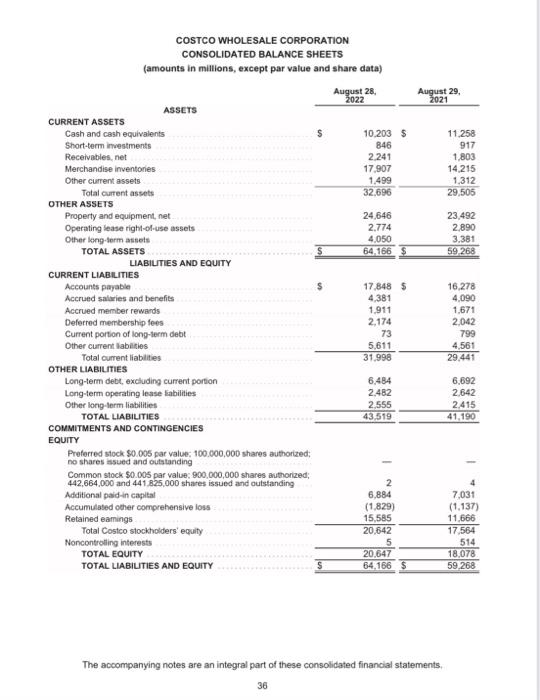

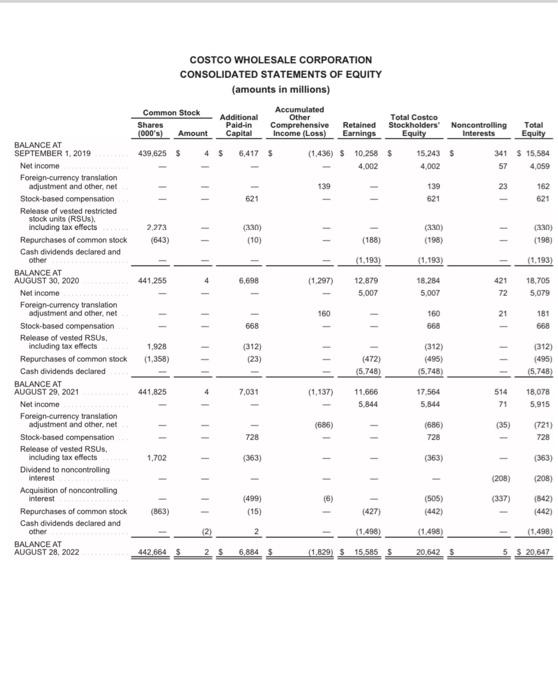

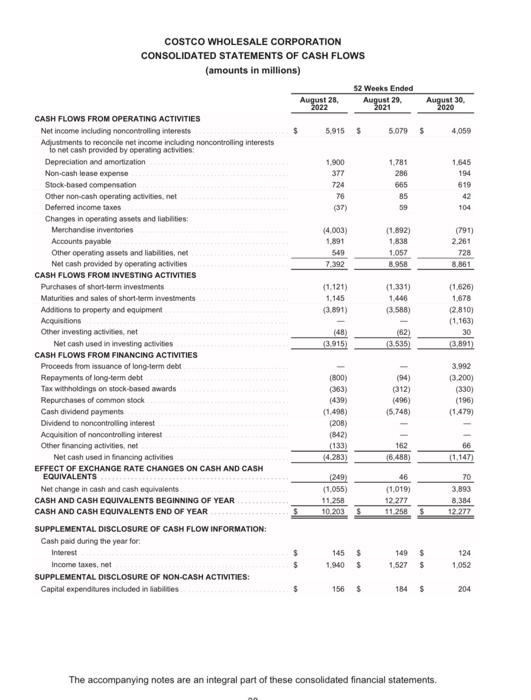

Costco

please alswer the following using the data above for eacho company.

- You will access the financial statements for Starbucks, Costco, and Nike (2022 fiscal year) using the links provided (see below). Please Note: the links will take you to the annual reports for each company. Once in the annual report, you will need to find the financial statements. You should be able to find these quite easily by looking at the table of contents. The financial statements normally show up somewhere in the middle of the report.

- Follow these guidelines for rounding: decimals to the nearest 100th (example: .2564 = .26) and percentages to the nearest 10th of a percent (example: .2564 = 25.6%). Compute the following ratios for each company for 2022. You will need to show your work.

- Current Ratio

- Quick Ratio

- Accounts Receivable Turnover

- Days' Sales in receivables

- Inventory Turnover

- Days' sales in inventory

- Ratio of Fixed Assets to Long-Term Liabilities

- Ratio of Liabilities to Stockholders' Equity

- Asset Turnover

- Return on Total Assets

- Return on Stockholders' Equity

- Price-Earnings Ratio (you will need to look up the current stock price for each company)

- After reviewing and comparing the ratios, decide on which company you want to invest in and provide a written rationale based on the company's comparative measures to the other companies. For your analysis, you must base your rationale and speak to the company's comparative measures of liquidity, solvency, and profitability. You will need to include some of the numbers you computed in your written rationale to help support your rationale.

- You will want to do your computations either by hand or on the computer. If you choose to do the work by hand, you will need to take a picture of your work and collate it into a single file that also includes your written rationale of which company you choose.

please caluclate the following for each company above using the information given

- Current Ratio

- Quick Ratio

- Accounts Receivable Turnover

- Days' Sales in receivables

- Inventory Turnover

- Days' sales in inventory

- Ratio of Fixed Assets to Long-Term Liabilities

- Ratio of Liabilities to Stockholders' Equity

- Asset Turnover

- Return on Total Assets

- Return on Stockholders' Equity

- Price-Earnings Ratio (you will need to look up the current stock price for each company)

using the finance sheets above comput the following listed above

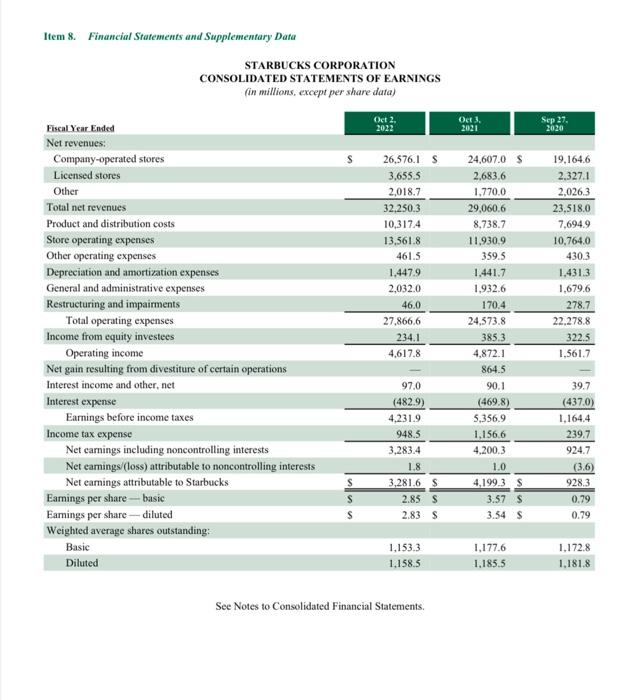

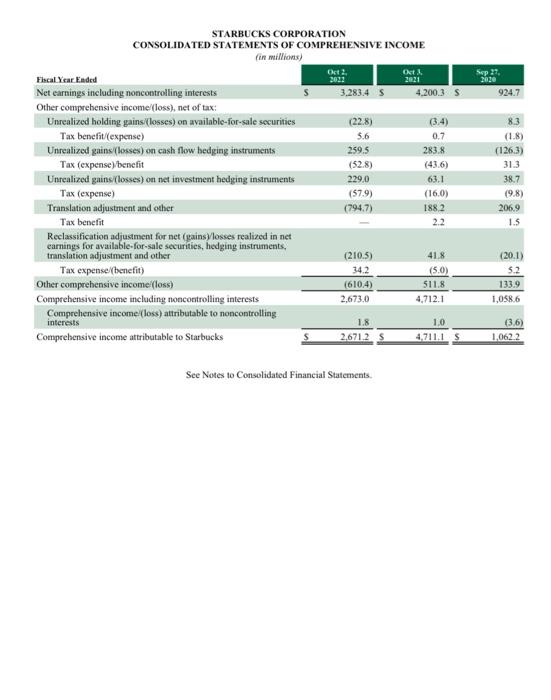

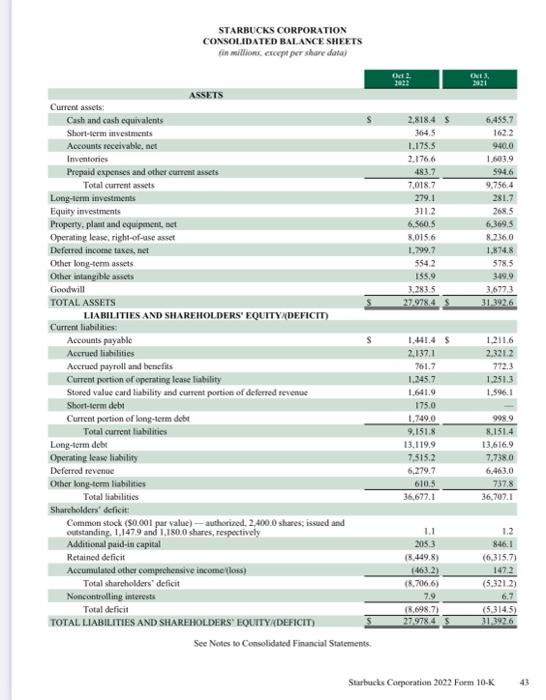

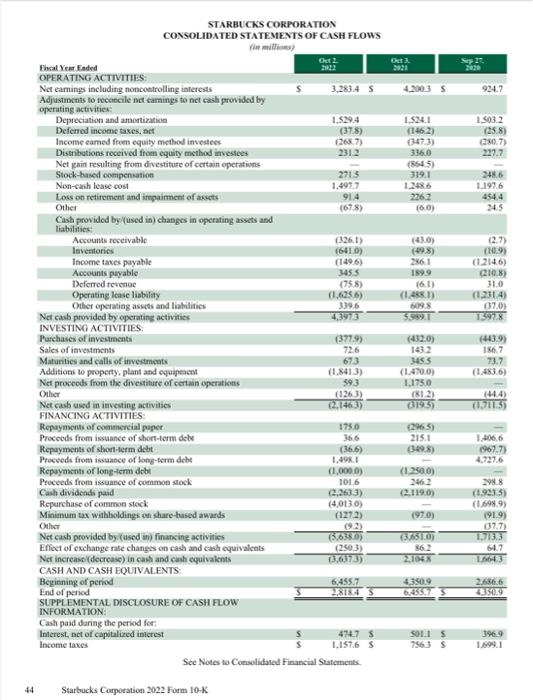

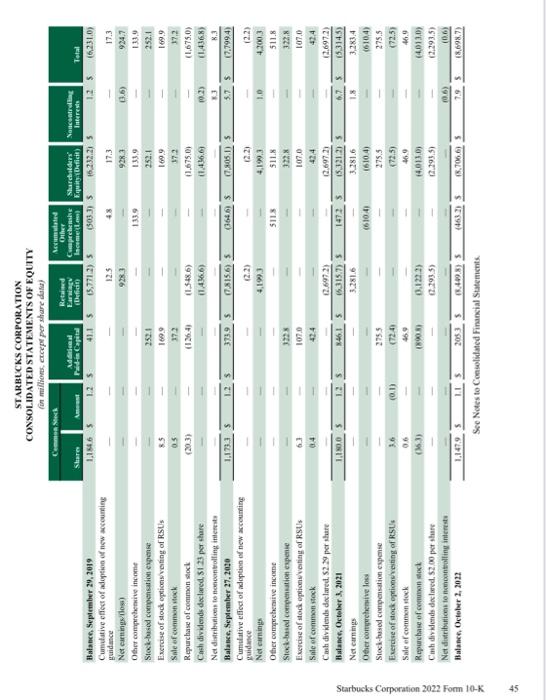

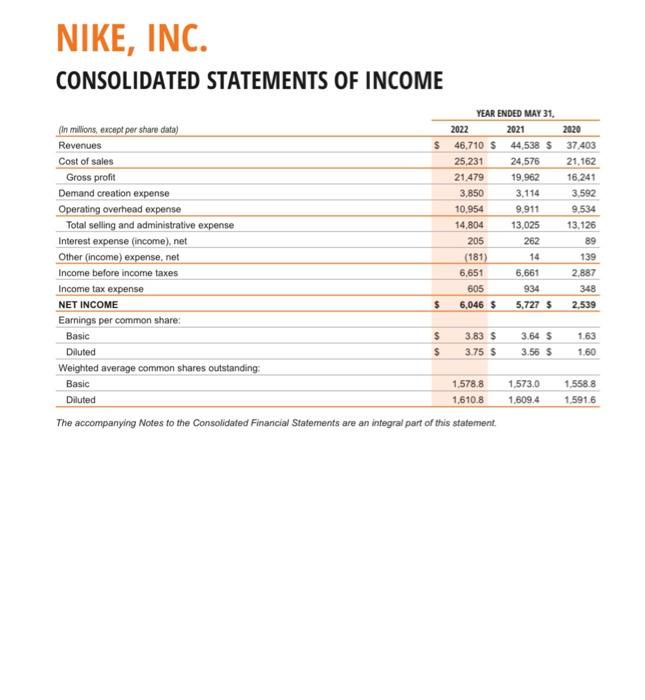

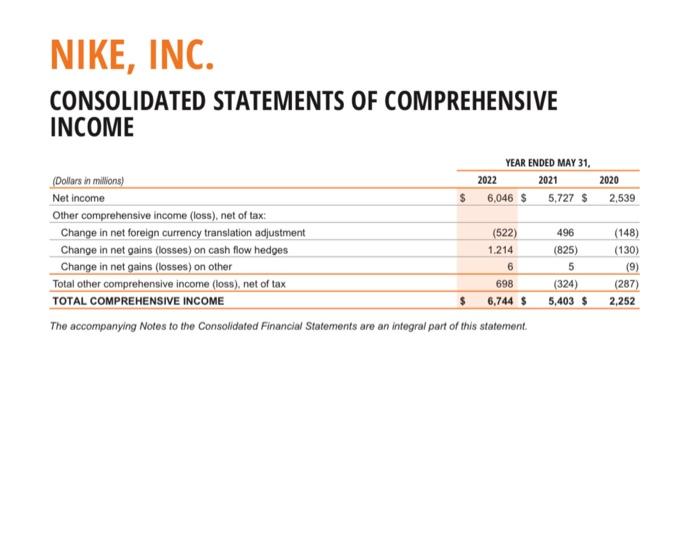

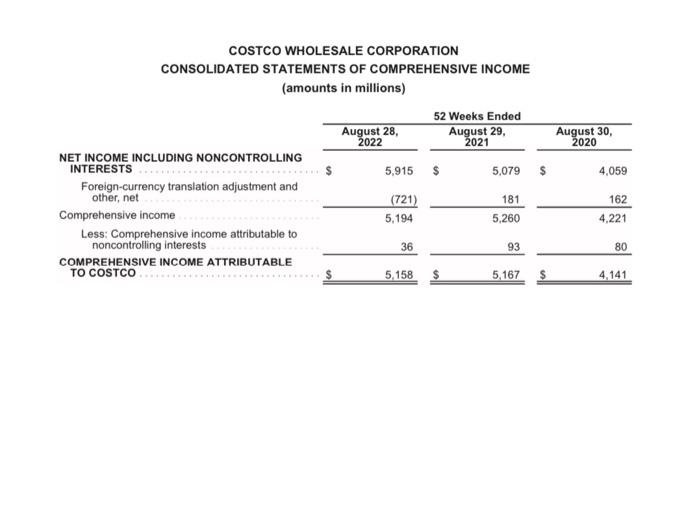

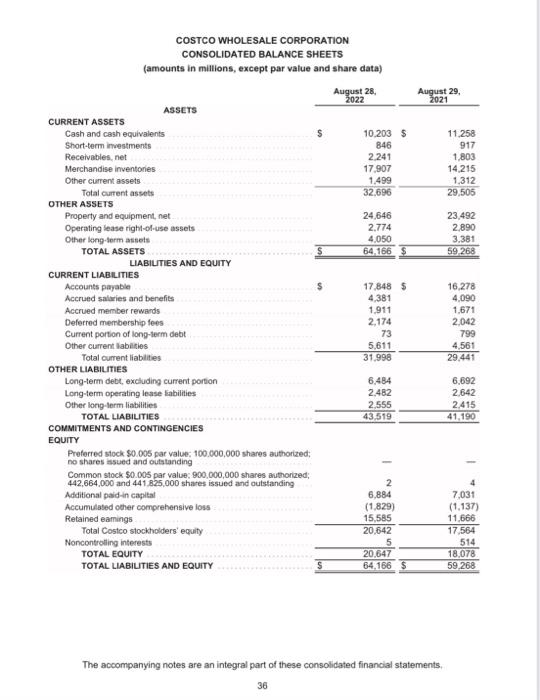

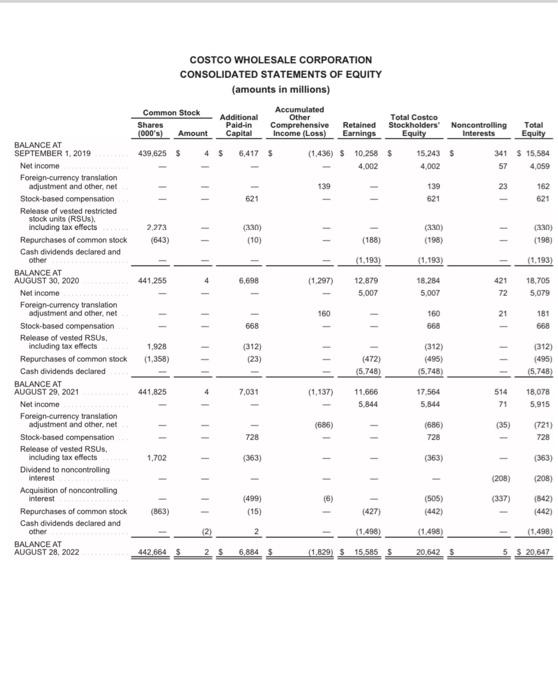

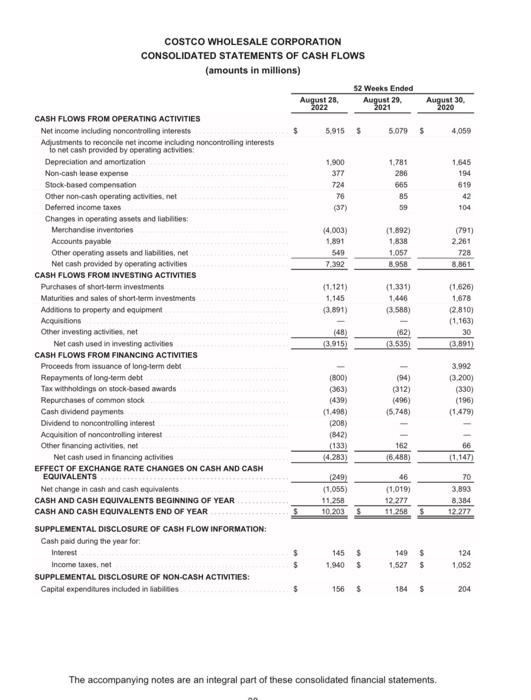

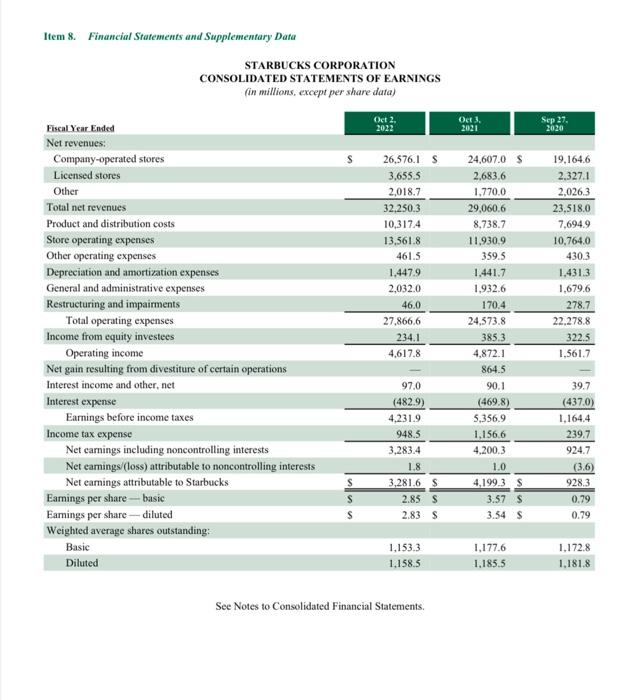

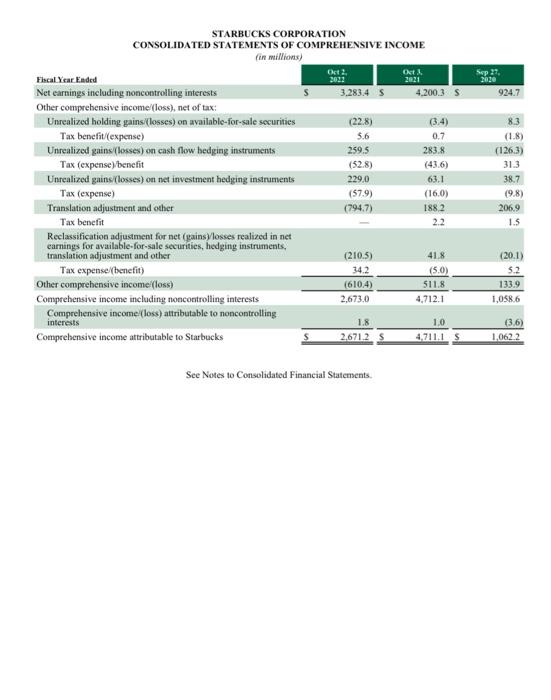

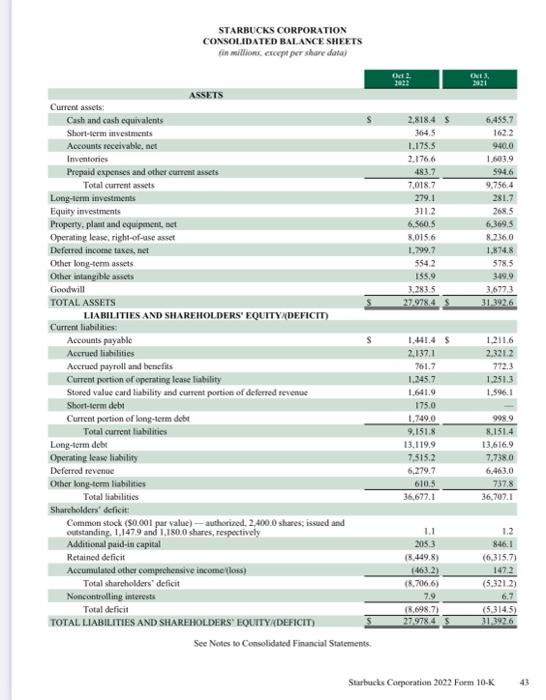

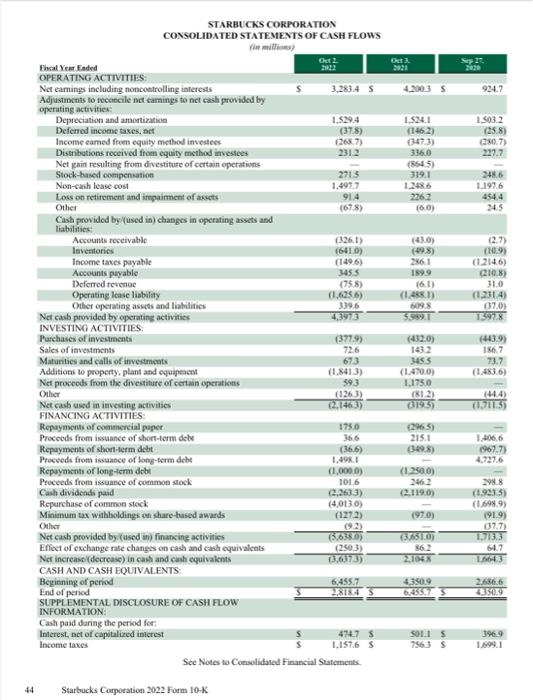

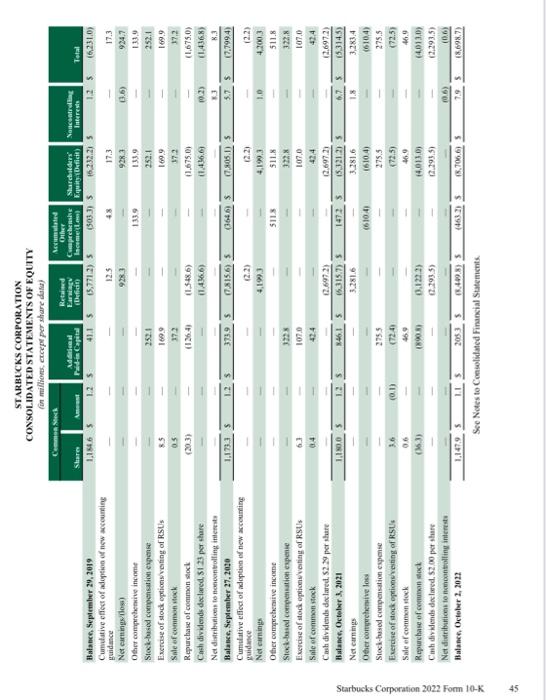

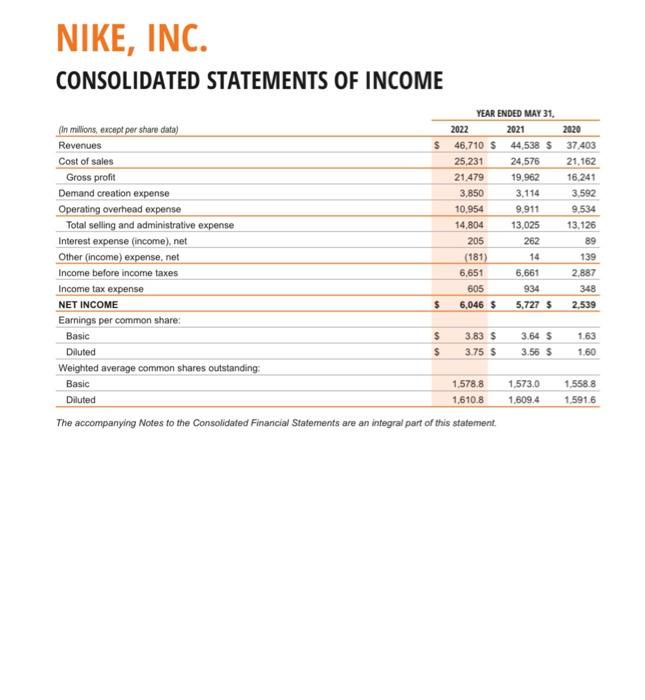

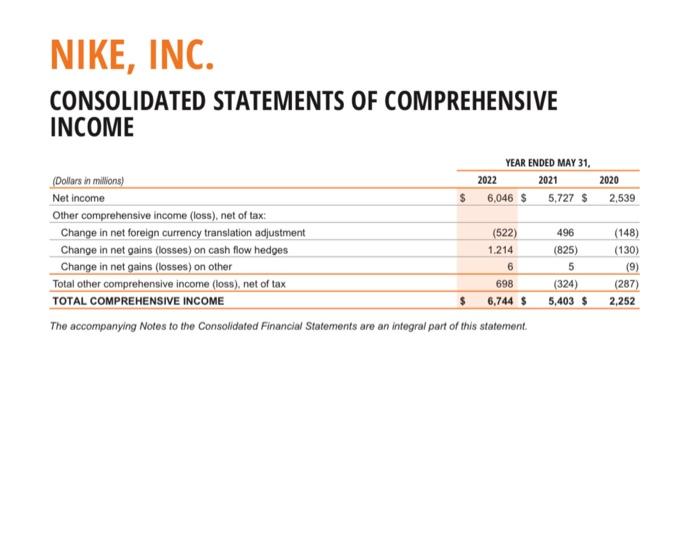

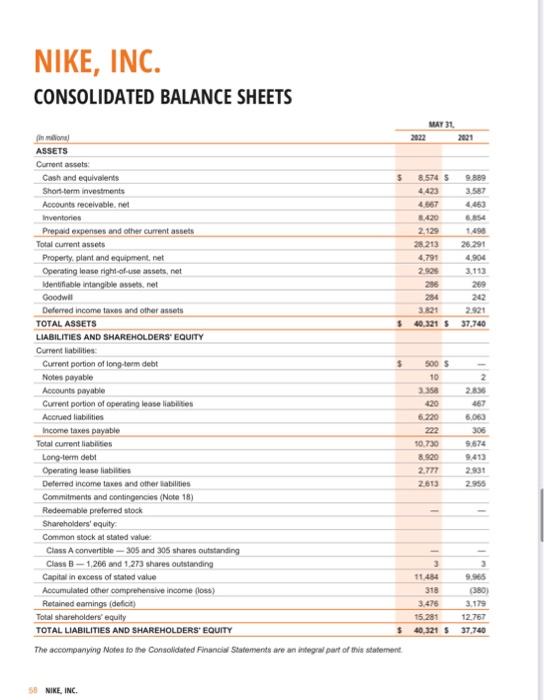

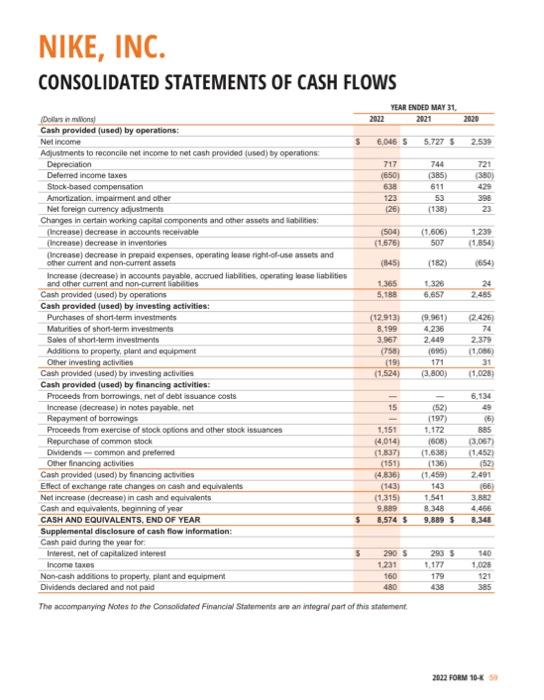

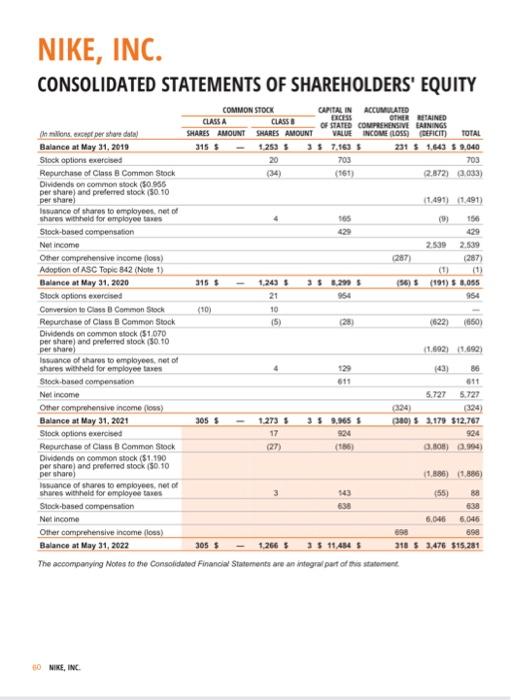

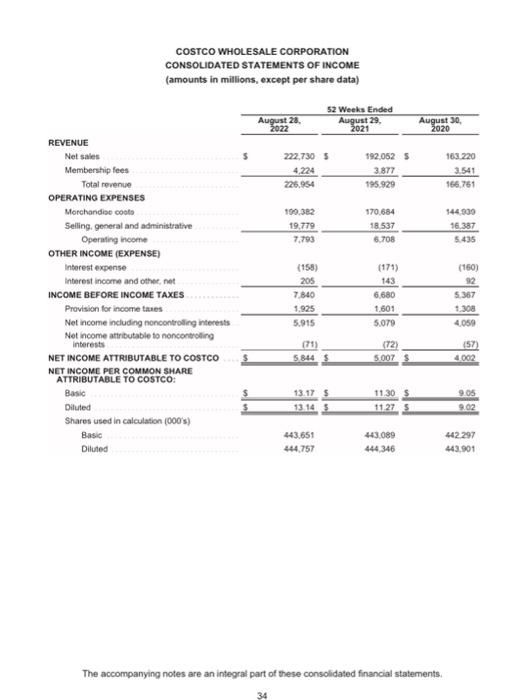

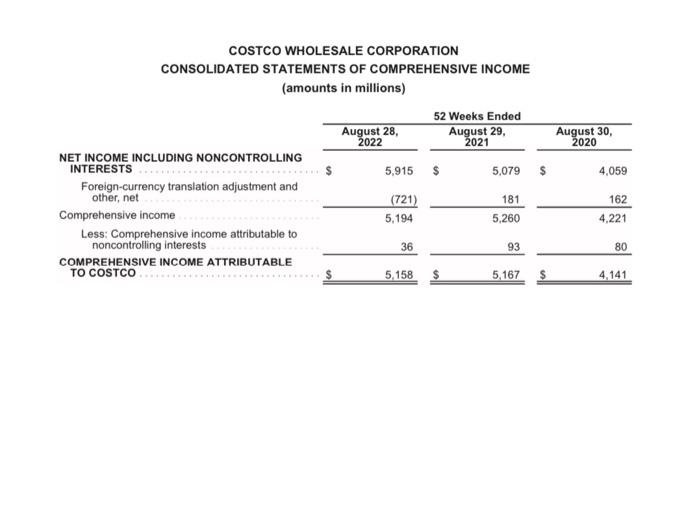

Item 8. Financial Statements and Supplementary Data STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, except per share data) See Notes to Consolidated Financial Statements. STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME an miminai See Notes to Consolidated Financial Statements. STARBUCKS CORPORATION CONSOL.IDATED BAL.ANEE SHEETS (iin millions erept per share datay) Starbacis Copperation 2022 Form 10K. 43 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (ian mittios) Fiscal Yrar Finded OPERATING ACTIVITIDS: Net earnings including noncontrolling iaterests Adjustments to feceecile net eamings to net cash provided by operating activities: Depreciation and amomtization Deferred income taxes, ect Income eamed from equity method investees Distributions received from equity method itvestees Net gain resulting from divestiture of certain eperativns Stock-based compensation Non-caih lease cost Loss ob retirement and ingaiment of asuets Other Cash provided by (used in) changes in eperating assots and liabilstics: INVESTINO ACTIVITIES: Purehases of investmenti Sales of investments Maturities and calls of invedments Additions to property, plant and equipeacnt Net procceds from the divestiture of certain operations Oiher Nct cash usd in iavesting activitics FINANCING ACTIVITIES: CASH AND CASH EQUTVALENTS: Beginning of period End of pericd SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid daring the periad fer: Inerest, net of capitalized interest lnceme tases Starbucks Corporation 2022 Fom 10K. 45 CONSOLIDATED STATEMENTS OF INCOME The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement NIKE, INC. CONSOLIDATED BALANCE SHEETS NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) The accompanying notes are an integrat part of these consolidated financial statements. COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (amounts in millions) COSTCO WHOLESALE CORPORATION CONSOU IDATED RAI ANCE SHFFTS The accompanying notes are an integral part of these consolidated financial statements. COSTCO WHOI FSAI F CORPORATION COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (amounts in millions) The accompanying notes are an integral part of these consolidated financial statements. Item 8. Financial Statements and Supplementary Data STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF EARNINGS (in millions, except per share data) See Notes to Consolidated Financial Statements. STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME an miminai See Notes to Consolidated Financial Statements. STARBUCKS CORPORATION CONSOL.IDATED BAL.ANEE SHEETS (iin millions erept per share datay) Starbacis Copperation 2022 Form 10K. 43 STARBUCKS CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (ian mittios) Fiscal Yrar Finded OPERATING ACTIVITIDS: Net earnings including noncontrolling iaterests Adjustments to feceecile net eamings to net cash provided by operating activities: Depreciation and amomtization Deferred income taxes, ect Income eamed from equity method investees Distributions received from equity method itvestees Net gain resulting from divestiture of certain eperativns Stock-based compensation Non-caih lease cost Loss ob retirement and ingaiment of asuets Other Cash provided by (used in) changes in eperating assots and liabilstics: INVESTINO ACTIVITIES: Purehases of investmenti Sales of investments Maturities and calls of invedments Additions to property, plant and equipeacnt Net procceds from the divestiture of certain operations Oiher Nct cash usd in iavesting activitics FINANCING ACTIVITIES: CASH AND CASH EQUTVALENTS: Beginning of period End of pericd SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION: Cash paid daring the periad fer: Inerest, net of capitalized interest lnceme tases Starbucks Corporation 2022 Fom 10K. 45 CONSOLIDATED STATEMENTS OF INCOME The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement. NIKE, INC. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME The accompanying Notes to the Consolidated Financial Statements are an integral part of this statement NIKE, INC. CONSOLIDATED BALANCE SHEETS NIKE, INC. CONSOLIDATED STATEMENTS OF CASH FLOWS NIKE, INC. CONSOLIDATED STATEMENTS OF SHAREHOLDERS' EQUITY COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF INCOME (amounts in millions, except per share data) The accompanying notes are an integrat part of these consolidated financial statements. COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (amounts in millions) COSTCO WHOLESALE CORPORATION CONSOU IDATED RAI ANCE SHFFTS The accompanying notes are an integral part of these consolidated financial statements. COSTCO WHOI FSAI F CORPORATION COSTCO WHOLESALE CORPORATION CONSOLIDATED STATEMENTS OF CASH FLOWS (amounts in millions) The accompanying notes are an integral part of these consolidated financial statements Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started