please when posting the answer can you make sure the page doesnt cut out so i can see the full answer

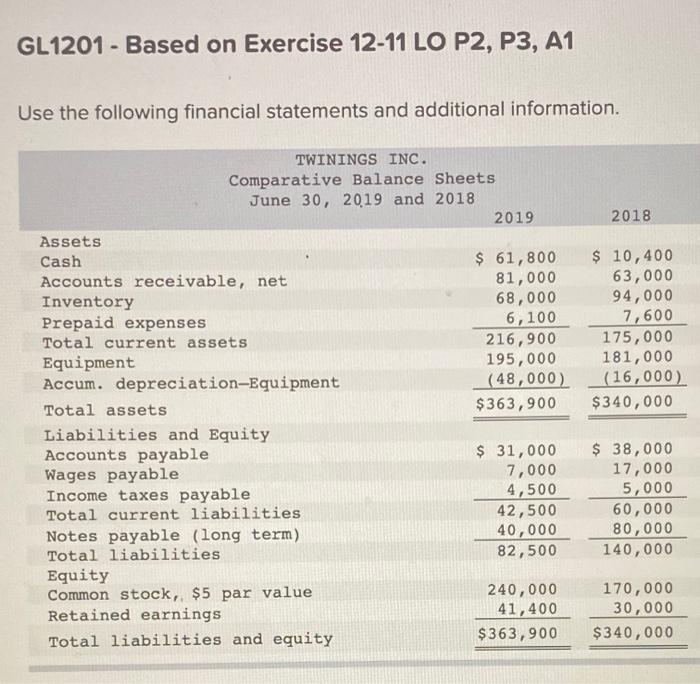

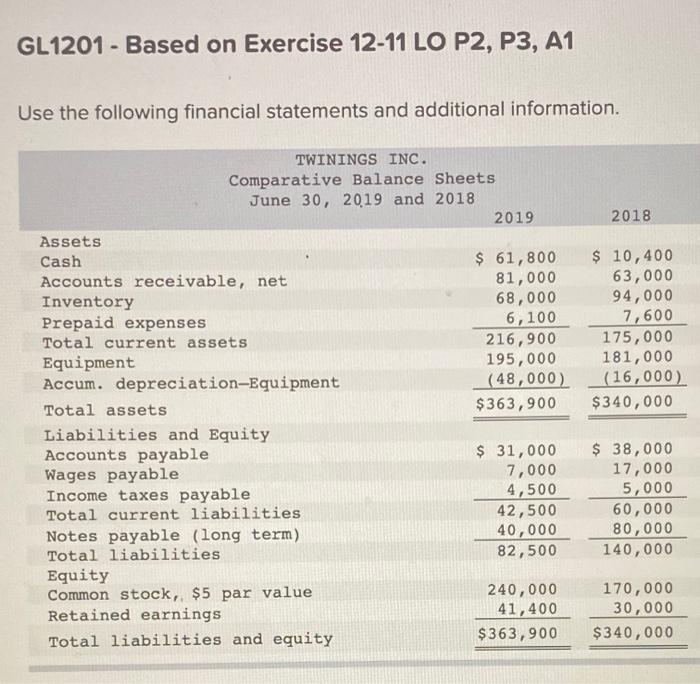

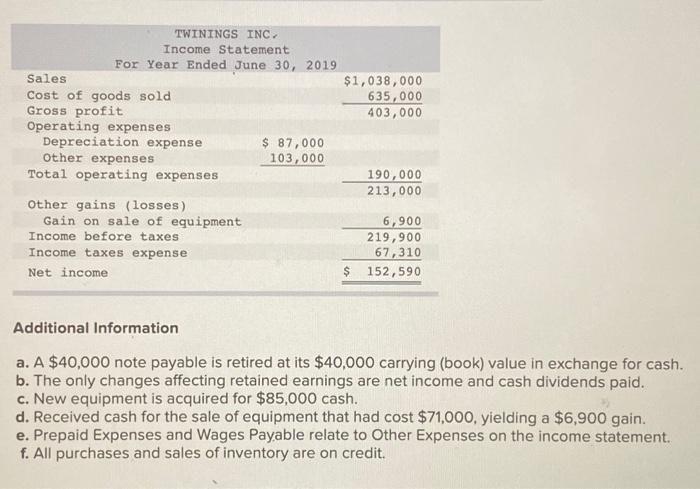

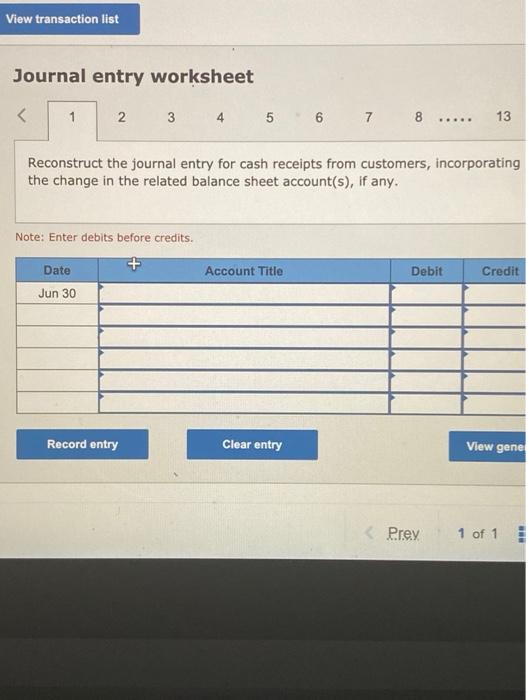

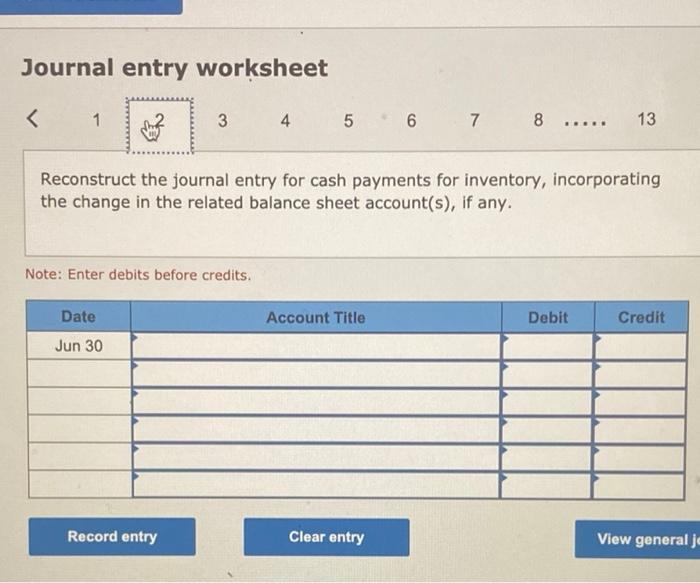

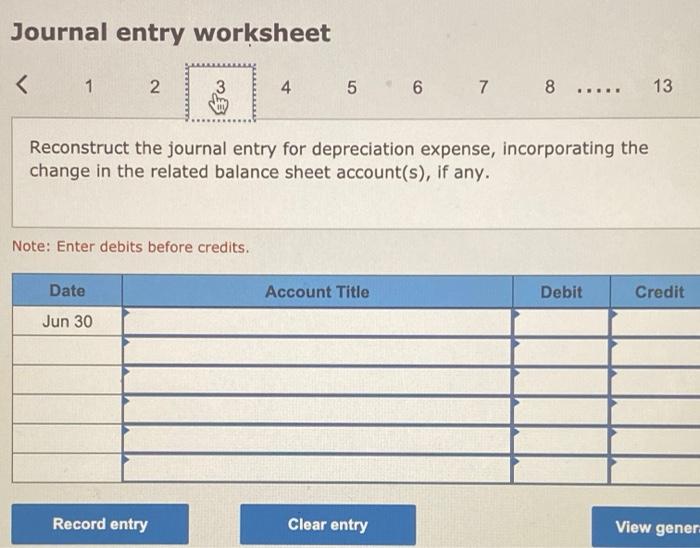

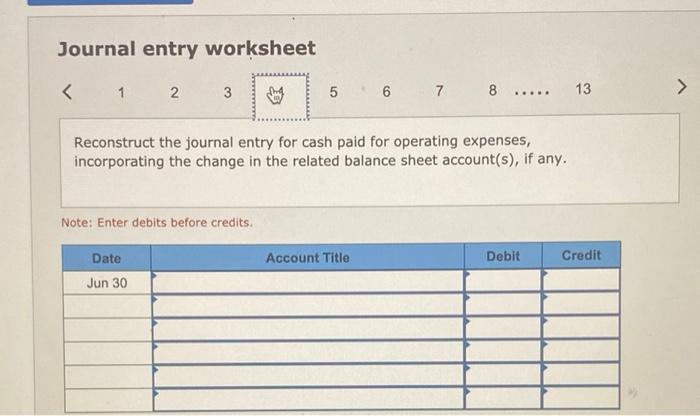

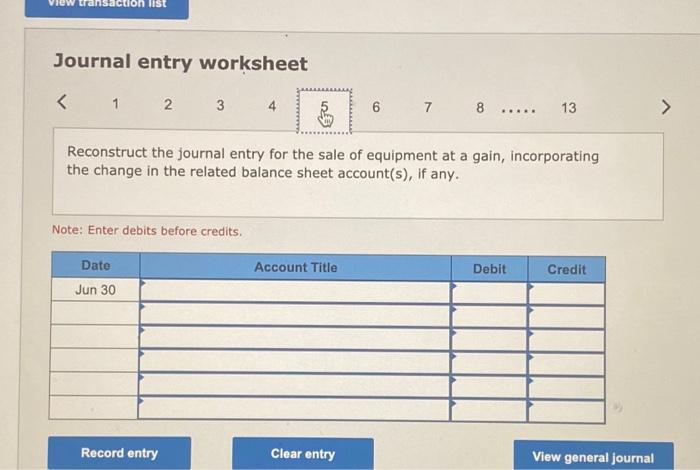

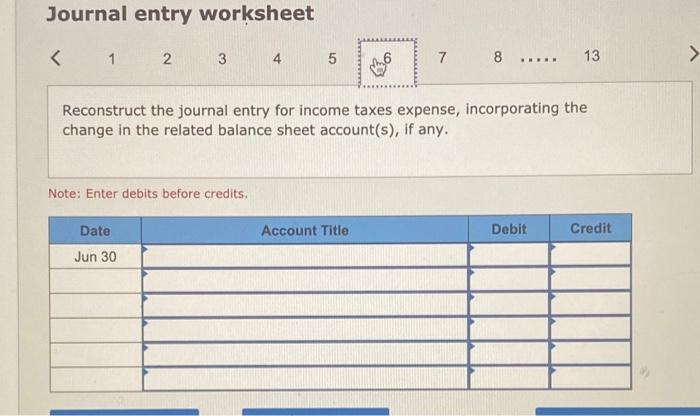

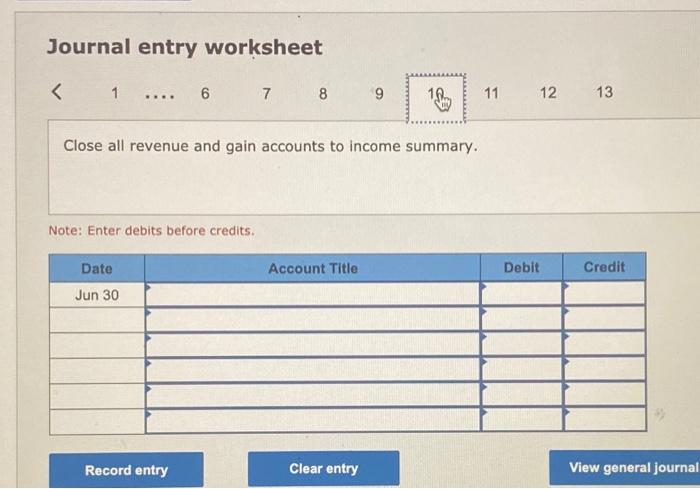

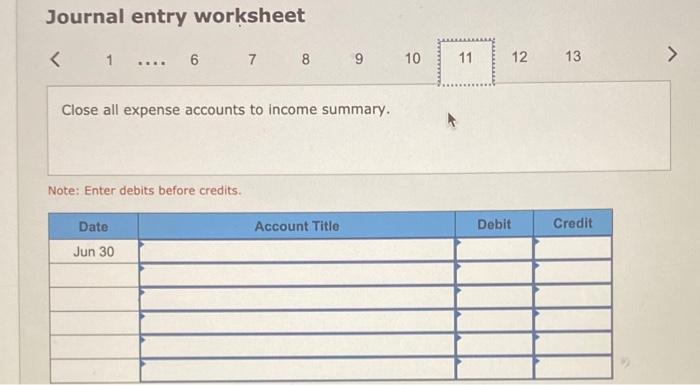

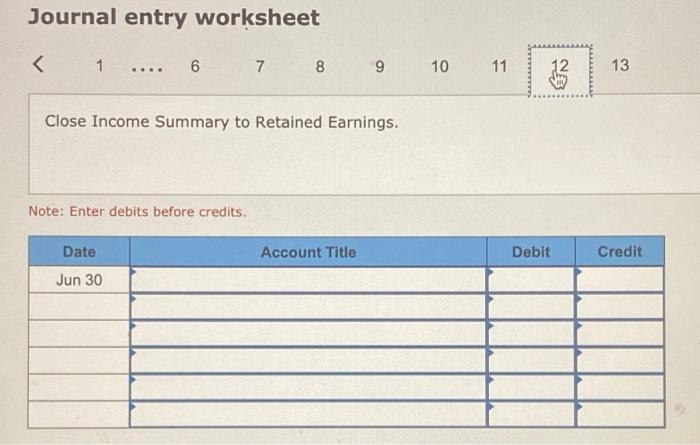

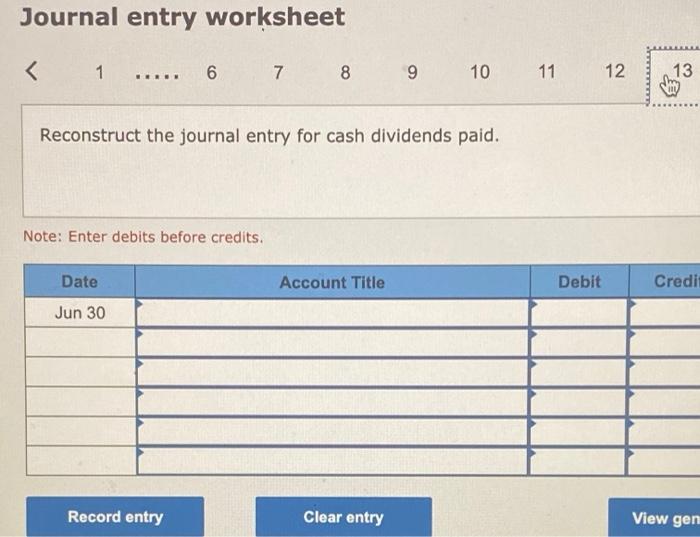

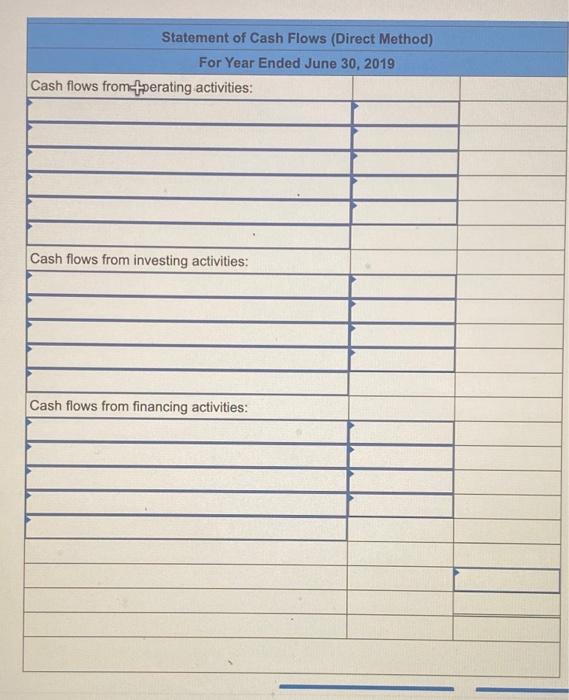

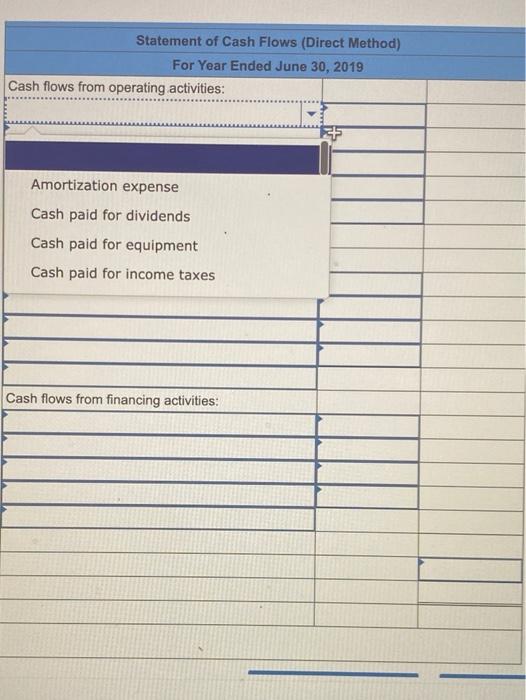

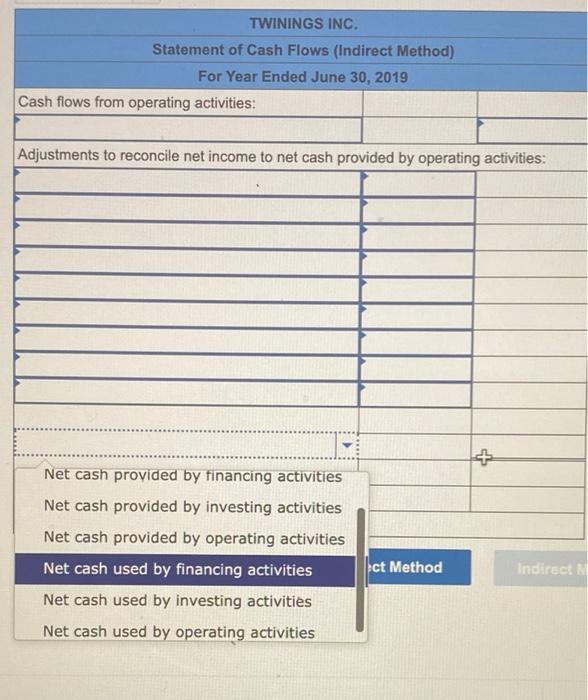

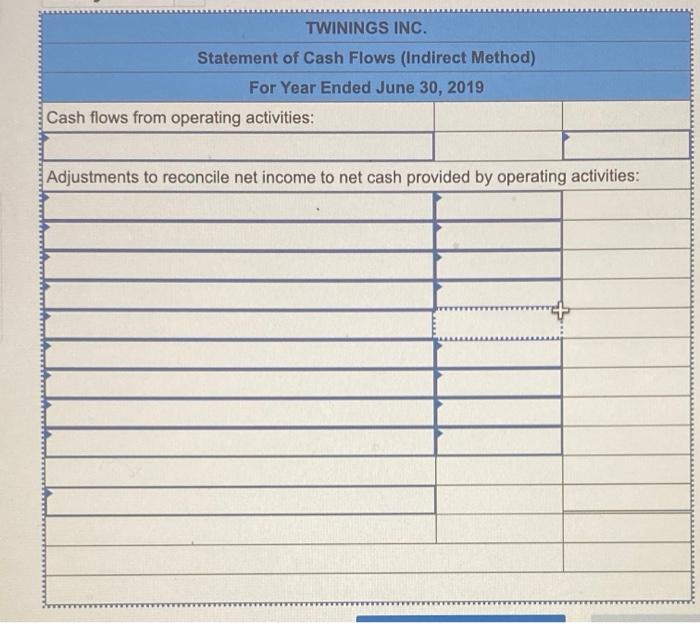

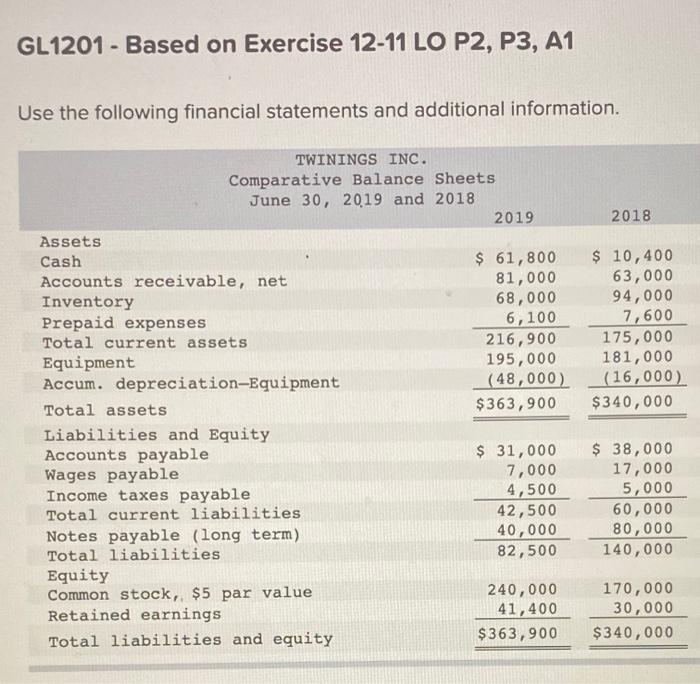

GL1201 - Based on Exercise 12-11 LO P2, P3, A1 Use the following financial statements and additional information. 2018 TWININGS INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 Assets Cash $ 61,800 Accounts receivable, net 81,000 Inventory 68,000 Prepaid expenses 6,100 Total current assets 216,900 Equipment 195,000 Accum. depreciation-Equipment (48,000) Total assets $363,900 Liabilities and Equity Accounts payable $ 31,000 Wages payable 7,000 Income taxes payable 4,500 Total current liabilities 42,500 Notes payable (long term) 40,000 Total liabilities 82,500 Equity Common stock, $5 par value 240,000 Retained earnings 41,400 Total liabilities and equity $363,900 $ 10,400 63,000 94,000 7,600 175,000 181,000 (16,000) $340,000 $ 38,000 17,000 5,000 60,000 80,000 140,000 170,000 30,000 $340,000 TWININGS INC Income Statement For Year Ended June 30, 2019 Sales $1,038,000 Cost of goods sold 635,000 Gross profit 403,000 Operating expenses Depreciation expense $ 87,000 Other expenses 103,000 Total operating expenses 190,000 213,000 Other gains (losses) Gain on sale of equipment 6,900 Income before taxes 219,900 Income taxes expense 67,310 Net income $ 152,590 Additional Information a. A $40,000 note payable is retired at its $40,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $85,000 cash. d. Received cash for the sale of equipment that had cost $71,000, yielding a $6,900 gain. e. Prepaid Expenses and Wages Payable relate to Other Expenses on the income statement. f. All purchases and sales of inventory are on credit. View transaction list Journal entry worksheet Reconstruct the journal entry for cash paid for operating expenses, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Account Title Debit Credit Date Jun 30 Journal entry worksheet .... Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 meton.com thTZGLL 9 0 1 That Lee Using the income watement the combine the crue the entries The mained activity of the current cal year. om mother to those agree with the 20, 2019 Journal entry worksheet Reconstruct the journal entry for cash paid for operating expenses, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Account Title Debit Credit Date Jun 30 Journal entry worksheet .... Reconstruct the journal entry for income taxes expense, incorporating the change in the related balance sheet account(s), if any. Note: Enter debits before credits. Date Account Title Debit Credit Jun 30 meton.com thTZGLL 9 0 1 That Lee Using the income watement the combine the crue the entries The mained activity of the current cal year. om mother to those agree with the 20, 2019 Journal entry worksheet