please with the questions below

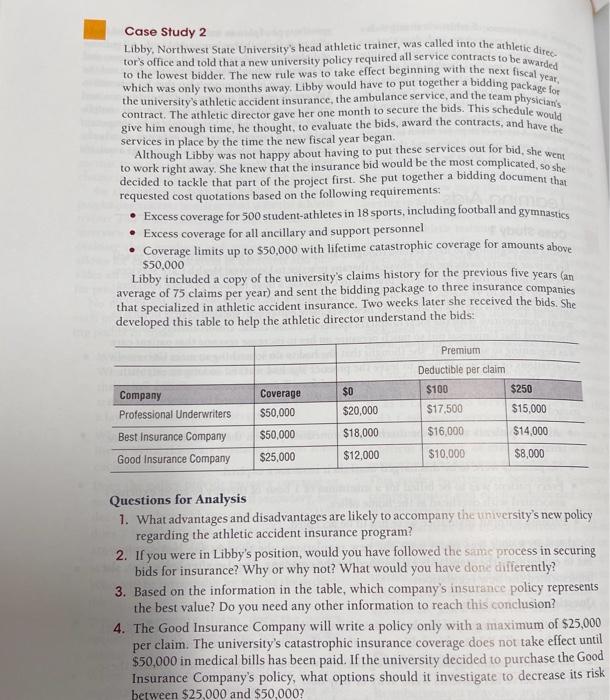

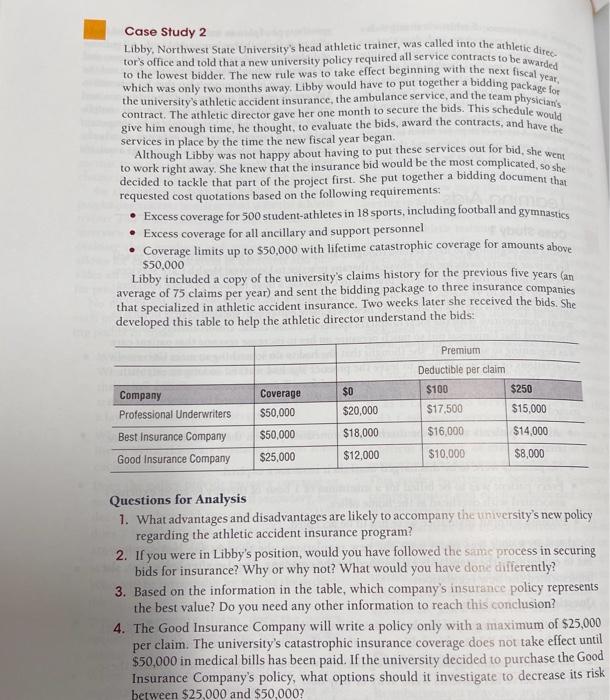

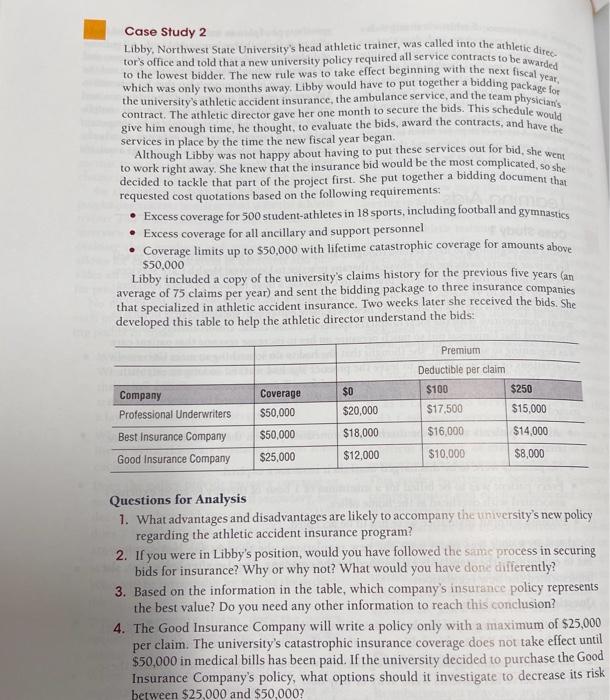

Case Study 2 Libby, Northwest State University's head athletic trainer, was called into the athletic direetor's office and told that a new university policy required all service contracts to be awarded to the lowest bidder. The new rule was to take effect beginning with the next fiscal year, which was only two months away. Libby would have to put together a bidding package for the university's athletic accident insurance, the ambulance service, and the team physician's contract. The athletic director gave her one month to secure the bids. This schedule would give him enough time, he thought, to evaluate the bids, award the contracts, and have the services in place by the time the new fiscal year began. Although Libby was not happy about having to put these services out for bid, she went to work right away. She knew that the insurance bid would be the most complicated, so she decided to tackle that part of the project first. She put together a bidding document that requested cost quotations based on the following requirements: - Excess coverage for 500 student-athletes in 18 sports, including football and gymnastics - Excess coverage for all ancillary and support personnel - Coverage limits up to $50,000 with lifetime catastrophic coverage for amounts above $50,000 Libby included a copy of the university's claims history for the previous five years (an average of 75 claims per year) and sent the bidding package to three insurance companies that specialized in athletic accident insurance. Two weeks later she received the bids. She developed this table to help the athletic director understand the bids: Questions for Analysis 1. What advantages and disadvantages are likely to accompany the university's new policy regarding the athletic accident insurance program? 2. If you were in Libby's position, would you have followed the same process in securing bids for insurance? Why or why not? What would you have done differently? 3. Based on the information in the table, which company's insurance policy represents the best value? Do you need any other information to reach this conclusion? 4. The Good Insurance Company will write a policy only with a maximum of $25,000 per claim. The university's catastrophic insurance coverage does not take effect until $50,000 in medical bills has been paid. If the university decided to purchase the Good Insurance Company's policy, what options should it investigate to decrease its risk between $25,000 and $50,000