Please work the problem ASAP

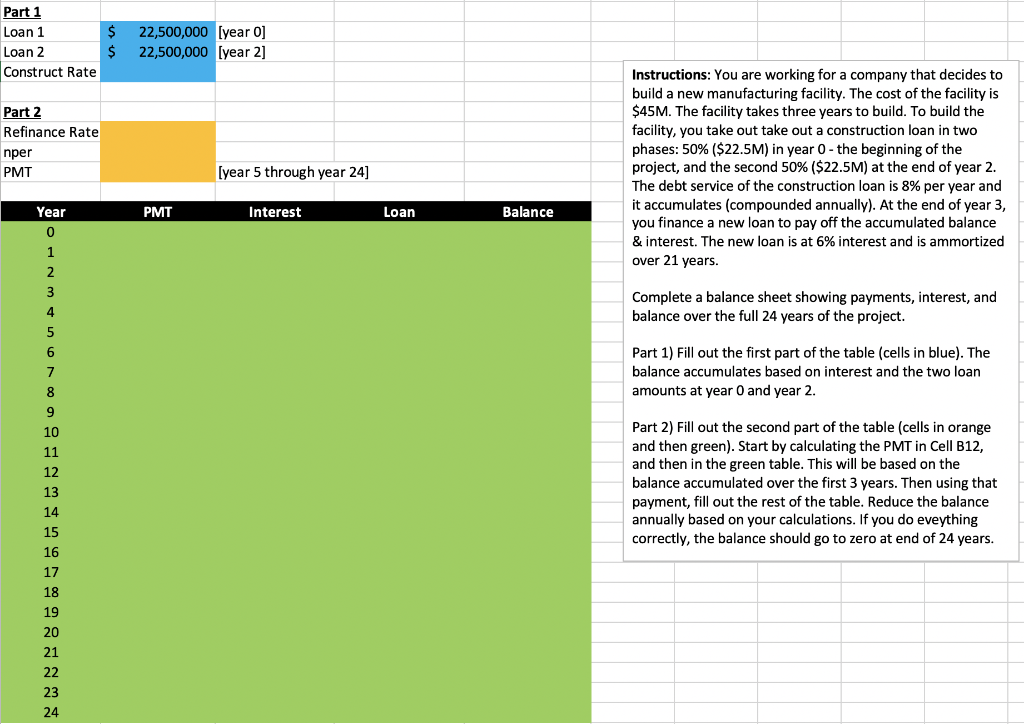

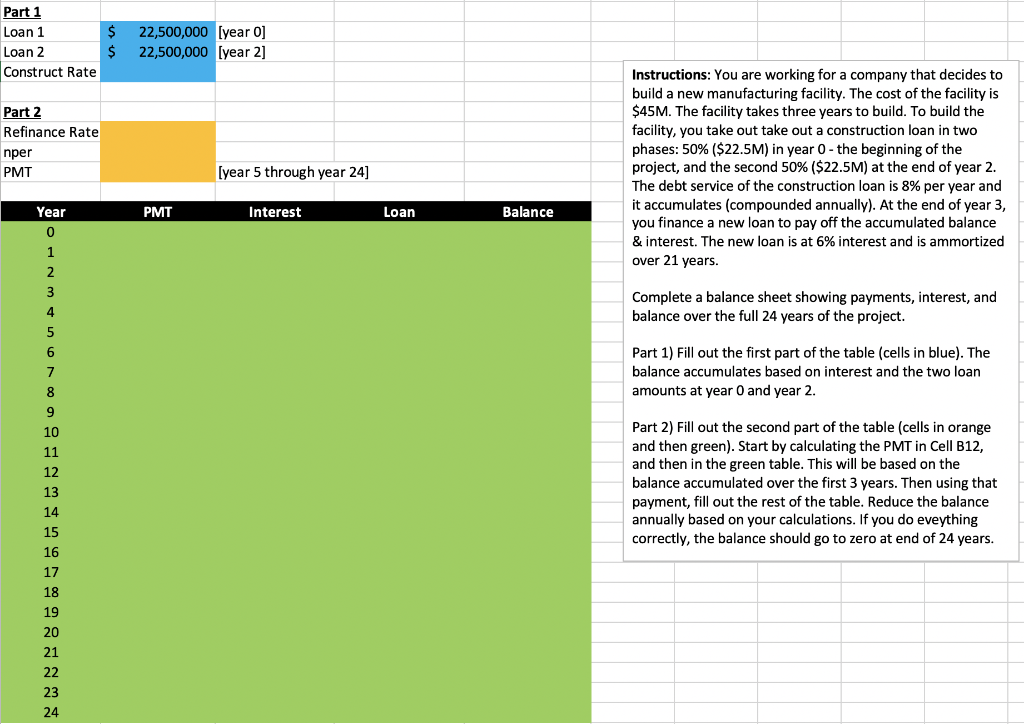

Part 1 Loan 1 Loan 2 Construct Rate $ $ 22,500,000 [year 0] 22,500,000 [year 2] Part 2 Refinance Rate nper PMT [year 5 through year 24] Instructions: You are working for a company that decides to build a new manufacturing facility. The cost of the facility is $45M. The facility takes three years to build. To build the facility, you take out take out a construction loan in two phases: 50% ($22.5M) in year 0 - the beginning of the project, and the second 50% ($22.5M) at the end of year 2. The debt service of the construction loan is 8% per year and it accumulates (compounded annually). At the end of year 3, you finance a new loan to pay off the accumulated balance & interest. The new loan is at 6% interest and is ammortized over 21 years. Year PMT Interest Loan Balance Complete a balance sheet showing payments, interest, and balance over the full 24 years of the project. Part 1) Fill out the first part of the table (cells in blue). The balance accumulates based on interest and the two loan amounts at year 0 and year 2. Part 2) Fill out the second part of the table (cells in orange and then green). Start by calculating the PMT in Cell B12, and then in the green table. This will be based on the balance accumulated over the first 3 years. Then using that payment, fill out the rest of the table. Reduce the balance annually based on your calculations. If you do eveything correctly, the balance should go to zero at end of 24 years. Part 1 Loan 1 Loan 2 Construct Rate $ $ 22,500,000 [year 0] 22,500,000 [year 2] Part 2 Refinance Rate nper PMT [year 5 through year 24] Instructions: You are working for a company that decides to build a new manufacturing facility. The cost of the facility is $45M. The facility takes three years to build. To build the facility, you take out take out a construction loan in two phases: 50% ($22.5M) in year 0 - the beginning of the project, and the second 50% ($22.5M) at the end of year 2. The debt service of the construction loan is 8% per year and it accumulates (compounded annually). At the end of year 3, you finance a new loan to pay off the accumulated balance & interest. The new loan is at 6% interest and is ammortized over 21 years. Year PMT Interest Loan Balance Complete a balance sheet showing payments, interest, and balance over the full 24 years of the project. Part 1) Fill out the first part of the table (cells in blue). The balance accumulates based on interest and the two loan amounts at year 0 and year 2. Part 2) Fill out the second part of the table (cells in orange and then green). Start by calculating the PMT in Cell B12, and then in the green table. This will be based on the balance accumulated over the first 3 years. Then using that payment, fill out the rest of the table. Reduce the balance annually based on your calculations. If you do eveything correctly, the balance should go to zero at end of 24 years