Please write answer in memo format. Thank you!

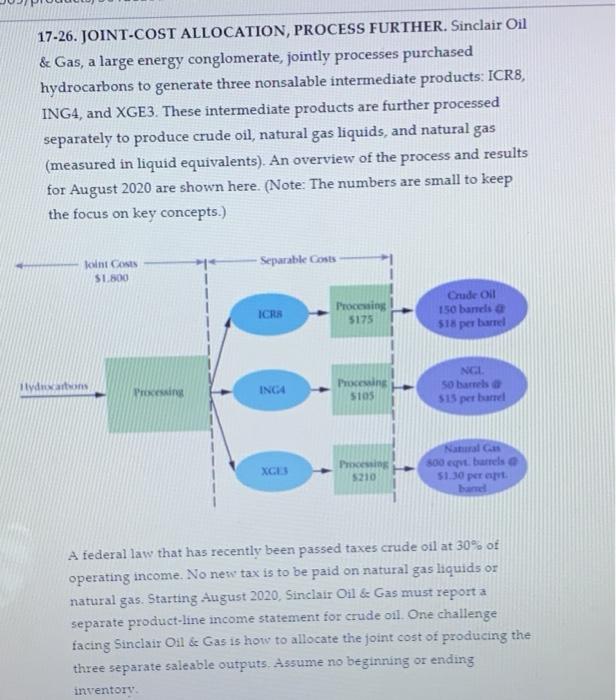

17.25. JOINT.COST ALLOCATION PROCESSFURTHER SO & Gas a large energy compressed Daydrocarbons to generate the date podat INGL and XGES These internet products are the party to produce crude and edildil Anware for August 2000 shown on the color thu trocasnice) Please submit your answer to In this problem, you are asked to write a letter to the action wthorities As background, you should know that your letter is because of a brief conversation by telephone with a spent who was assigned to answer phone calls from corporations seeking initiation office perspectives. You phoned to ask about the Sinclair Oil and Gas choice of joint cost locations as described in Problem 17 26. In the phone call the agent did not comment on the costing methods and asked that you write the letter to the tax authorities that addresses the issues described in problem 17 261 One thing that you to concerned about is that the agent mentioned the IMA Statement of Ethics Professional Practice 17 of the text Because of your pursuit to minimize the company the pointed out the according to the IMA Statement's Integrity and there seems to be a conflict of interest between your employment with the company and yourse to reduce the corporate citieshi taxes. Please resson your letter to the authorities in your subsion of the letters PART 4 PROBLEM 17.36 Crude Oil 150 barrels $18 per barrel NGL 50 barrels @ $15 ber barrel Natural Gas 800 eqvt. barrels @ $1.30 per eqvt. barrel 17-26. JOINT-COST ALLOCATION, PROCESS FURTHER. Sinclair Oil & Gas, a large energy conglomerate, jointly processes purchased hydrocarbons to generate three nonsalable intermediate products: ICR8, ING4, and XGE3. These intermediate products are further processed separately to produce crude oil, natural gas liquids, and natural gas (measured in liquid equivalents). An overview of the process and results for August 2020 are shown here. (Note: The numbers are small to keep the focus on key concepts.) Separable Gosts Joint Costs $1.800 ICRO Processing 5175 Crude Oil 150 barelia 518 per barrel Hydrations Processing INGA Processing SIOS NEL So barrelse 515 pet barrel Natal 500 g. barrels 51.30 per XGES Processing 5210 A federal law that has recently been passed taxes crude oil at 30% of operating income. No new tax is to be paid on natural gas liquids or natural gas. Starting August 2020, Sinclair Oil & Gas must report a separate product-line income statement for crude oil. One challenge facing Sinclair Oil & Gas is how to allocate the joint cost of producing the separate saleable outputs. Assume no beginning or ending inventor three Please submit your answer to In this problem, you are asked to write a letter to the taxation authorities, As background, you should know that your letter is because of a brief conversation by telephone with an IRS agent who was assigned to answer phone calls from corporations seeking initial taxation office perspectives. You phoned to ask about the Sinclair Oil and Gas choice of joint cost allocations as described in Problem 17- 26. In the phone call, the agent did not comment on the costing methods and asked that you write the letter to the tax authorities that addresses the issue (as described in problem 17-26). One thing that you are also concerned about is that the agent mentioned the IMA Statement of Ethical Professional Practice (p. 17 of the text). Because of your pursuit to minimize the company's tax liability, he pointed out the according to the IMA Statement's Integrity standard, there seems to be a conflict of interest between your employment with the company and your seeking to reduce the company's corporate citizenship tax responsibilities. Please also address this concern in your letter to the tax authorities. In your submission of the letter as requested in PART 4 of PROBLEM 17-26, make sure you keep in mind the grading scheme for these written E&E questions: Grades are assigned out of 3 points: (1) Are there no spelling/grammar and other similar errors, and is the letter of a proper format: (1) Does the letter have an appropriate tone and level of explanation and discussion for the intended audience; (1) Is the question completely addressed and answered