Please write in Excel! Write the ways and formulas you used to get to these answers so I can learn and understand!

I am looking for someone to work through and fix my excel sheets for this problem:

Required:

The companys CFO has asked you to prepare the 2022 master budget. To fulfill this request, prepare the following budget schedules and financial statements.

HERE IS MY EXCEL WORK:

DATA:

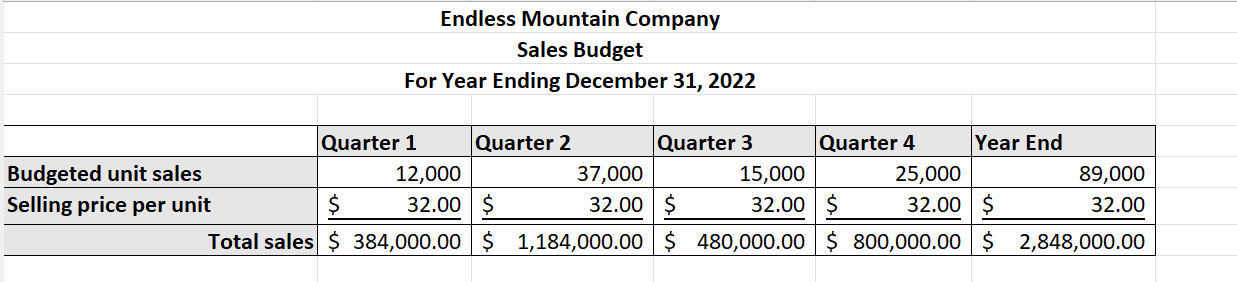

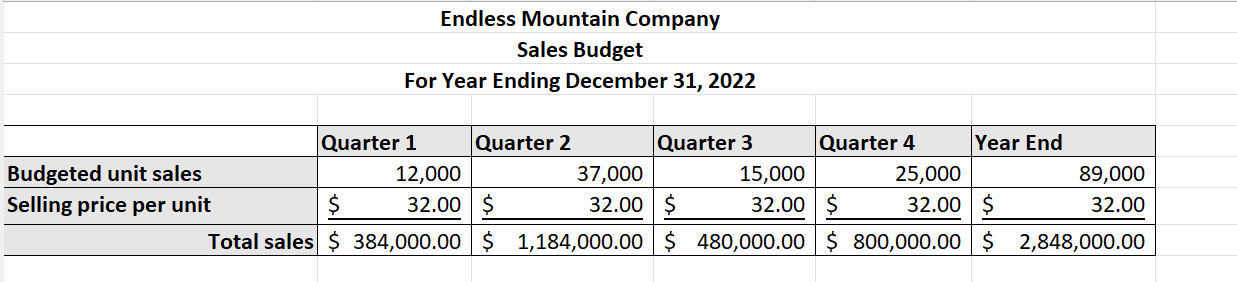

SALES BUDGET:

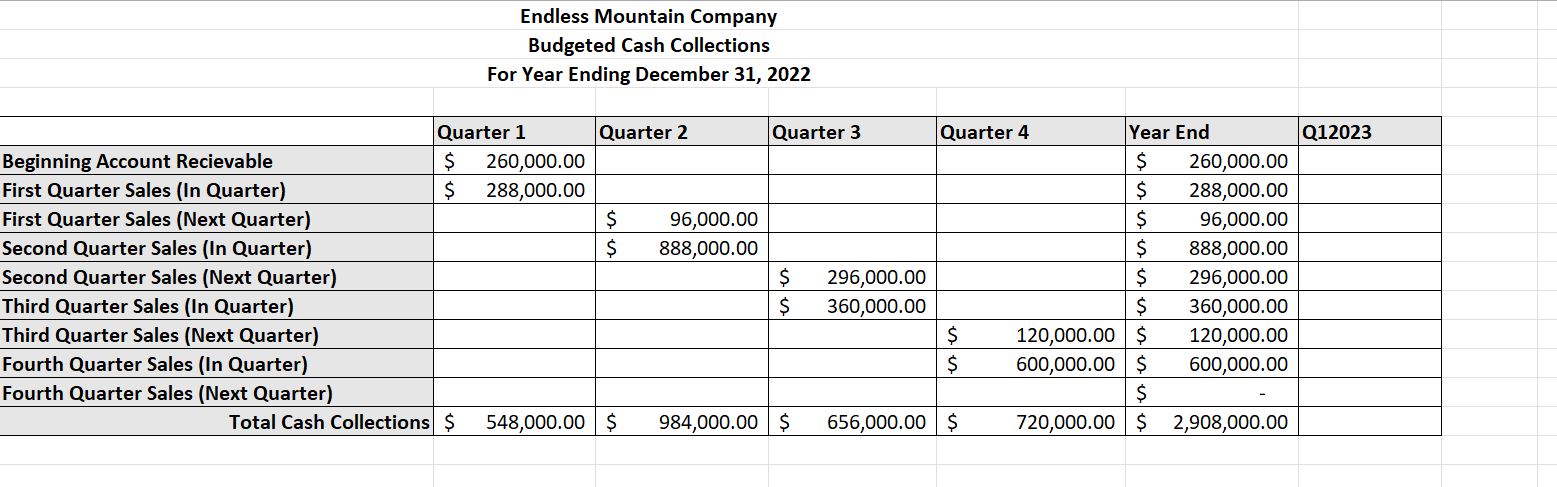

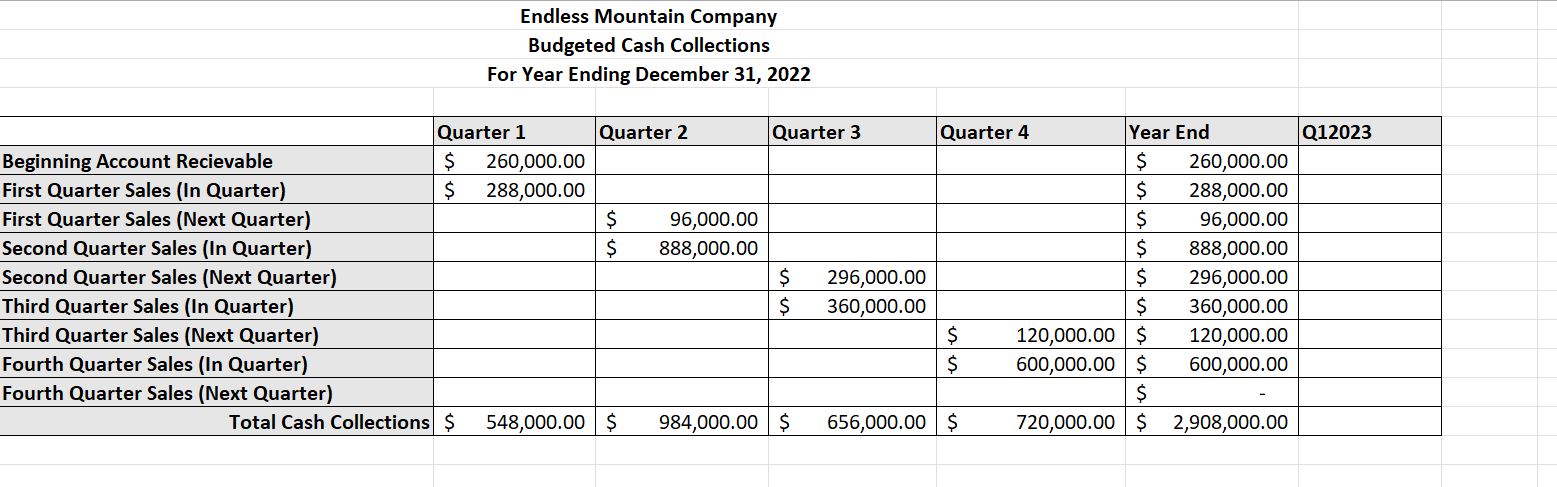

BUDGETED CASH COLLECTIONS (FIX AND CHECK):

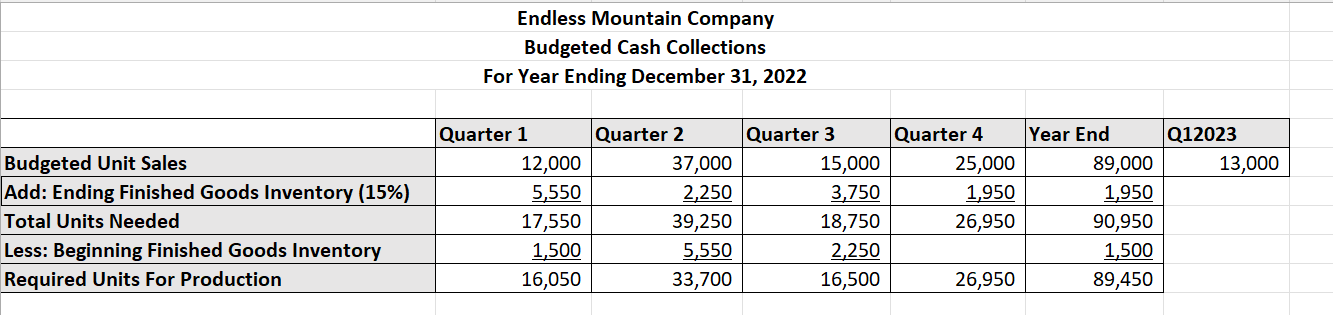

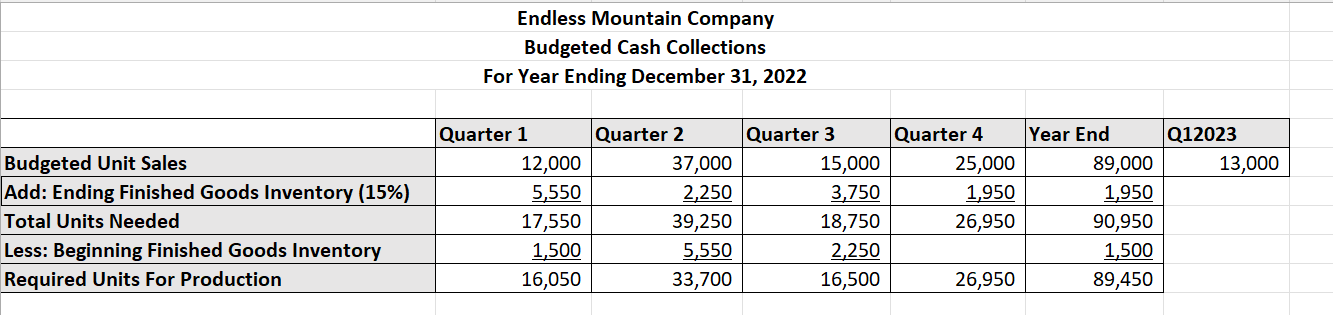

PRODUCTION BUDGET (FIX AND CHECK):

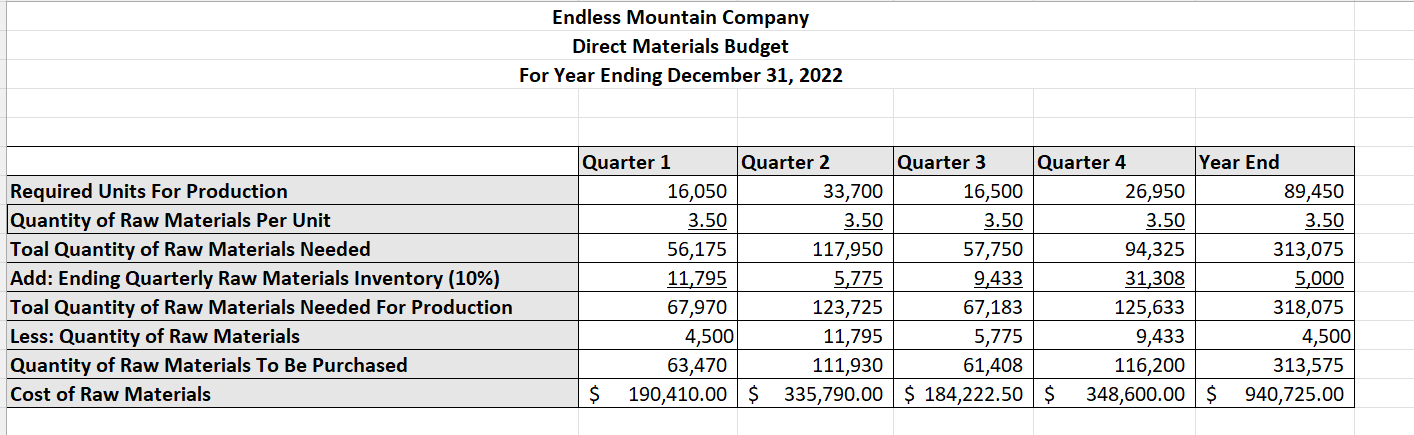

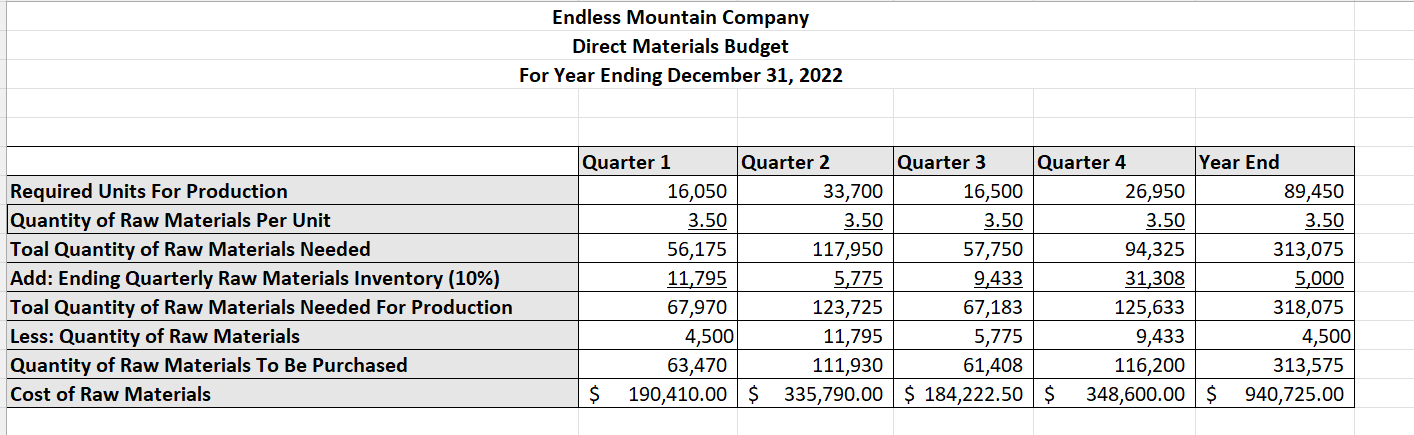

DIRECT MATERIALS BUDGET (FIX AND CHECK):

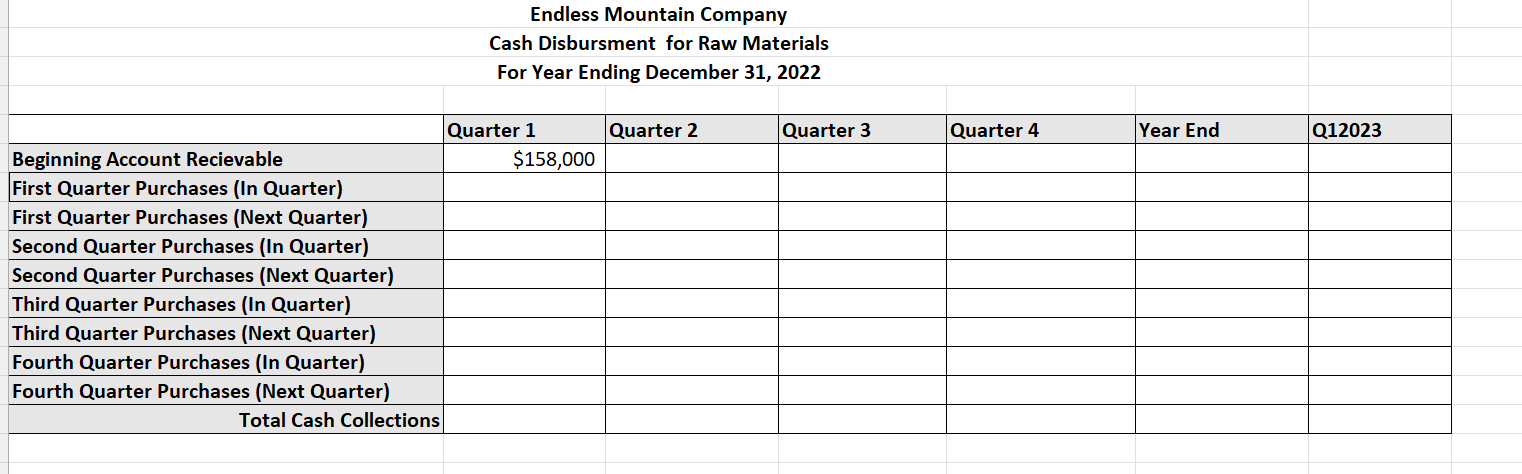

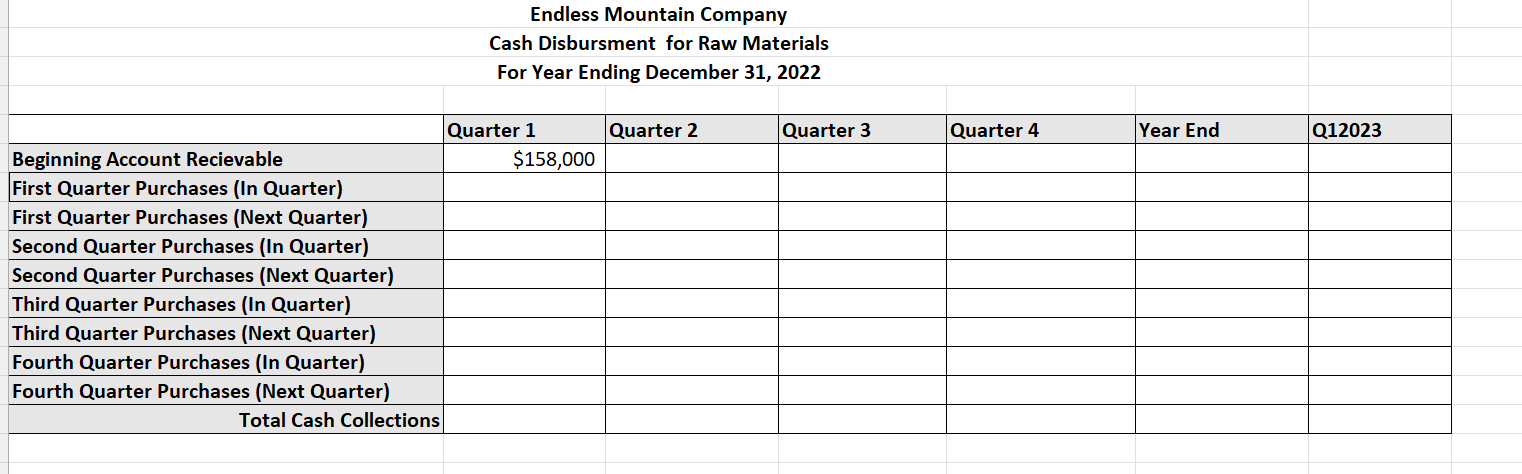

CASH DISTRIBUMENT FOR RAW MATERIALS (WORK):

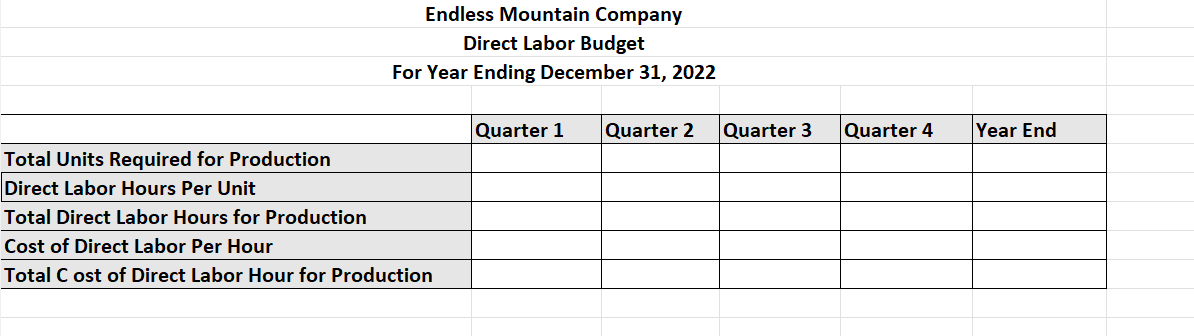

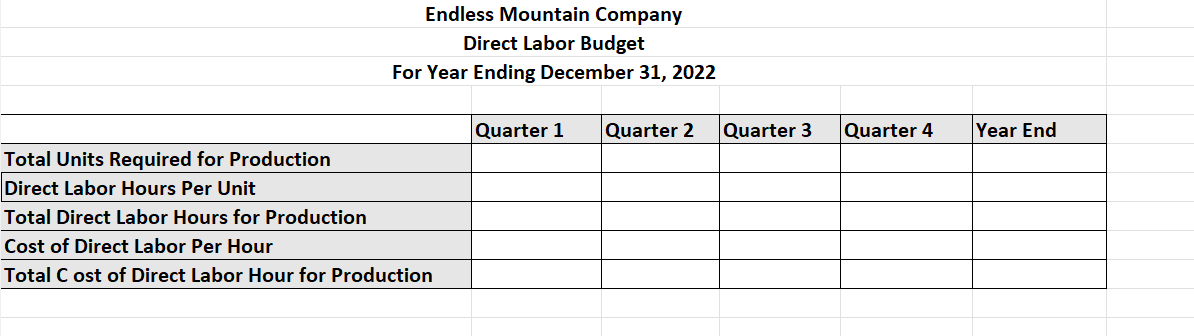

DIRECT LABOR BUDGET (WORK):

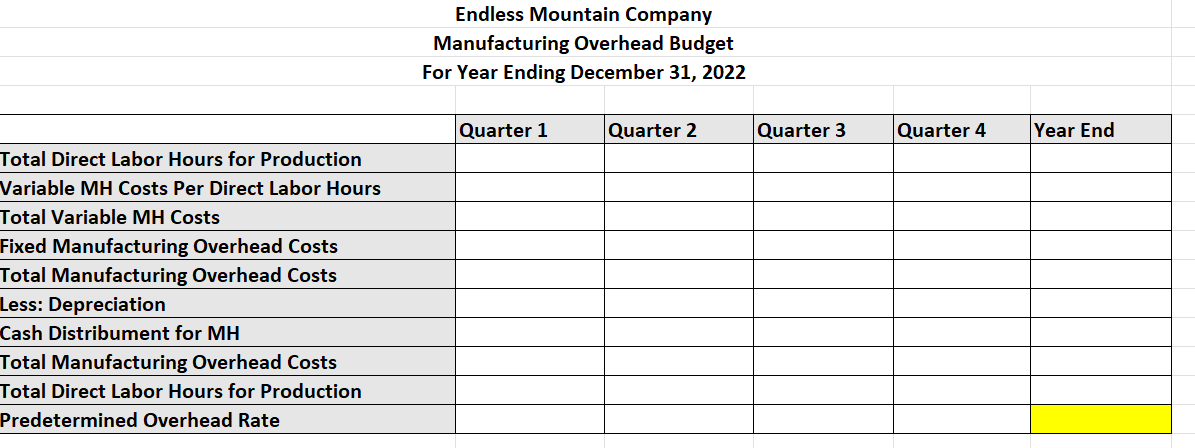

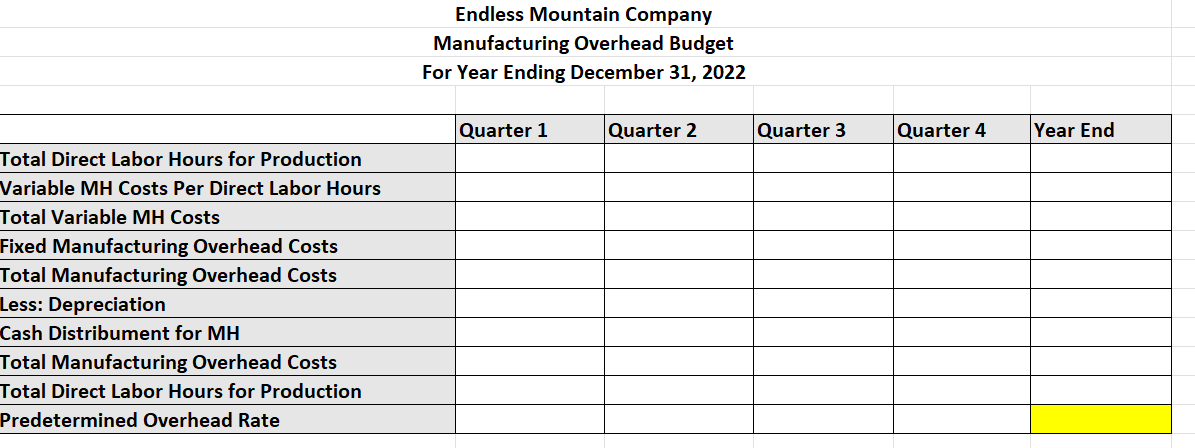

MANUFACTURING OVERHEAD BUDGET (WORK):

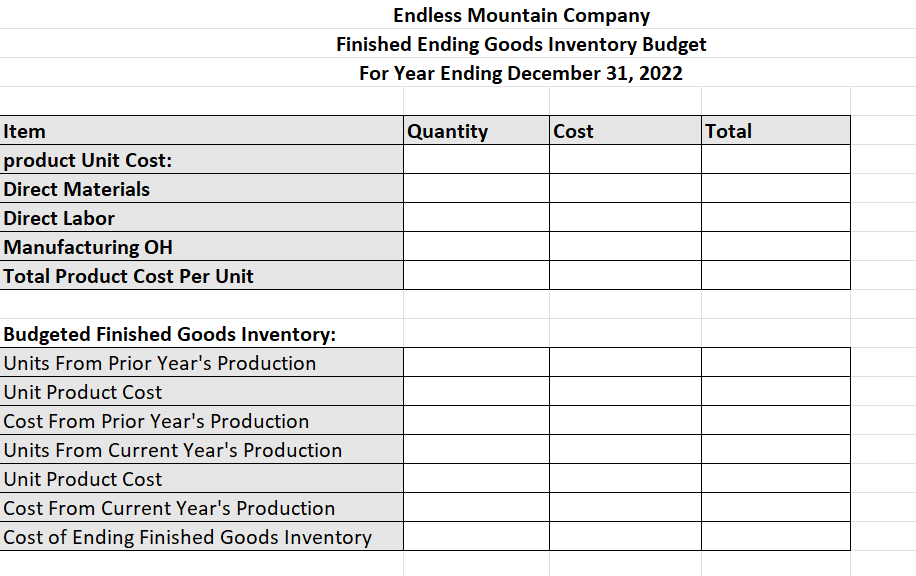

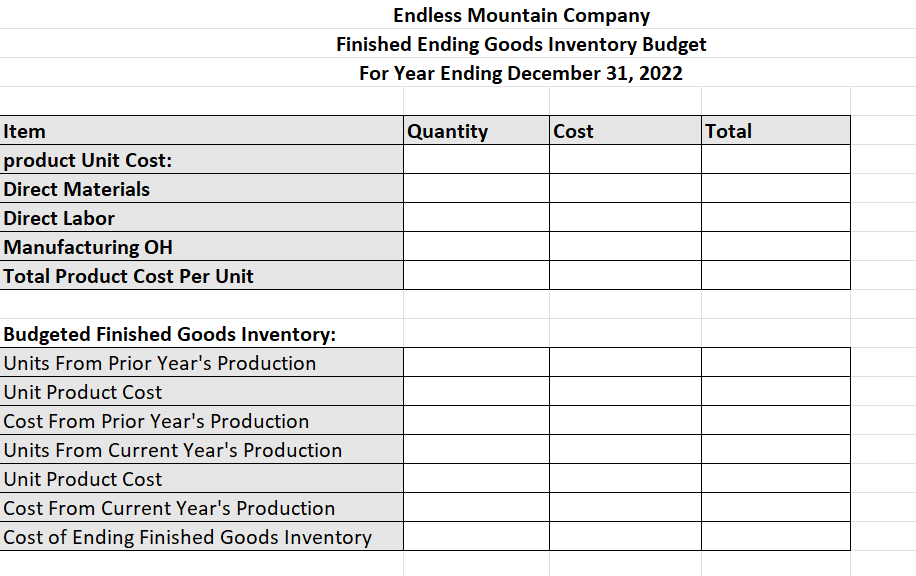

ENDING FINISHED GOODS INVENTORY BUDGET (WORK):

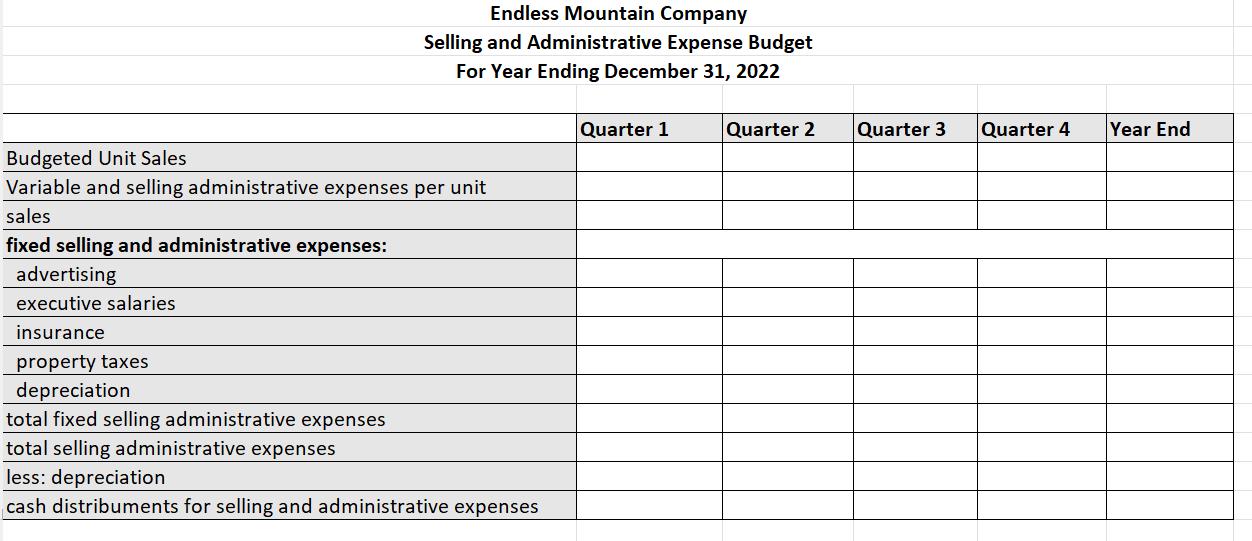

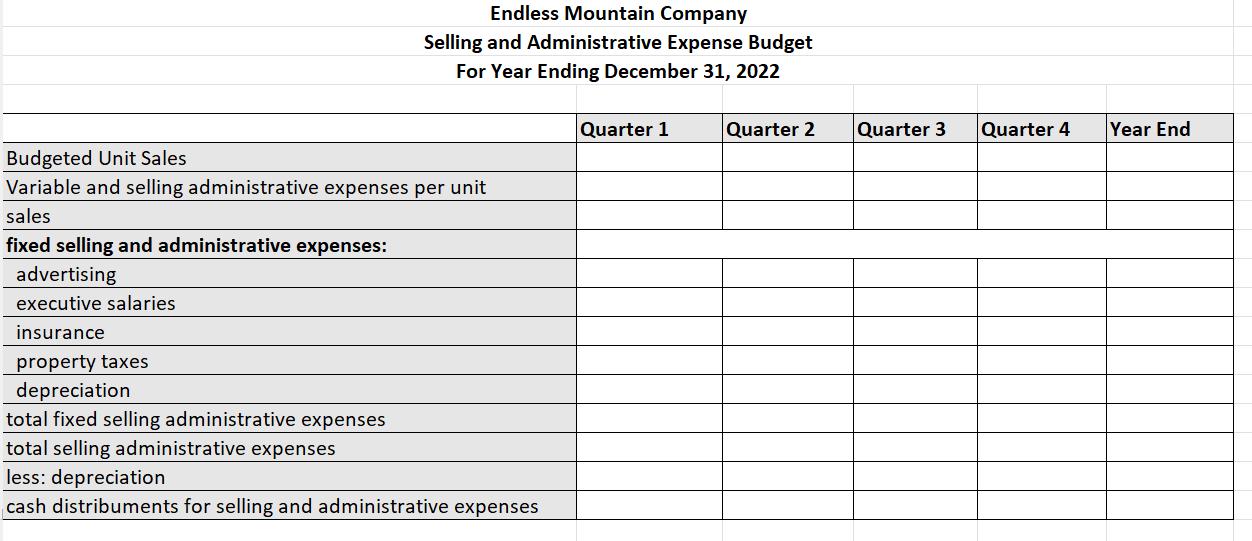

SELLING & ADMINISTRATIVE EXPENSE BUDGET (WORK):

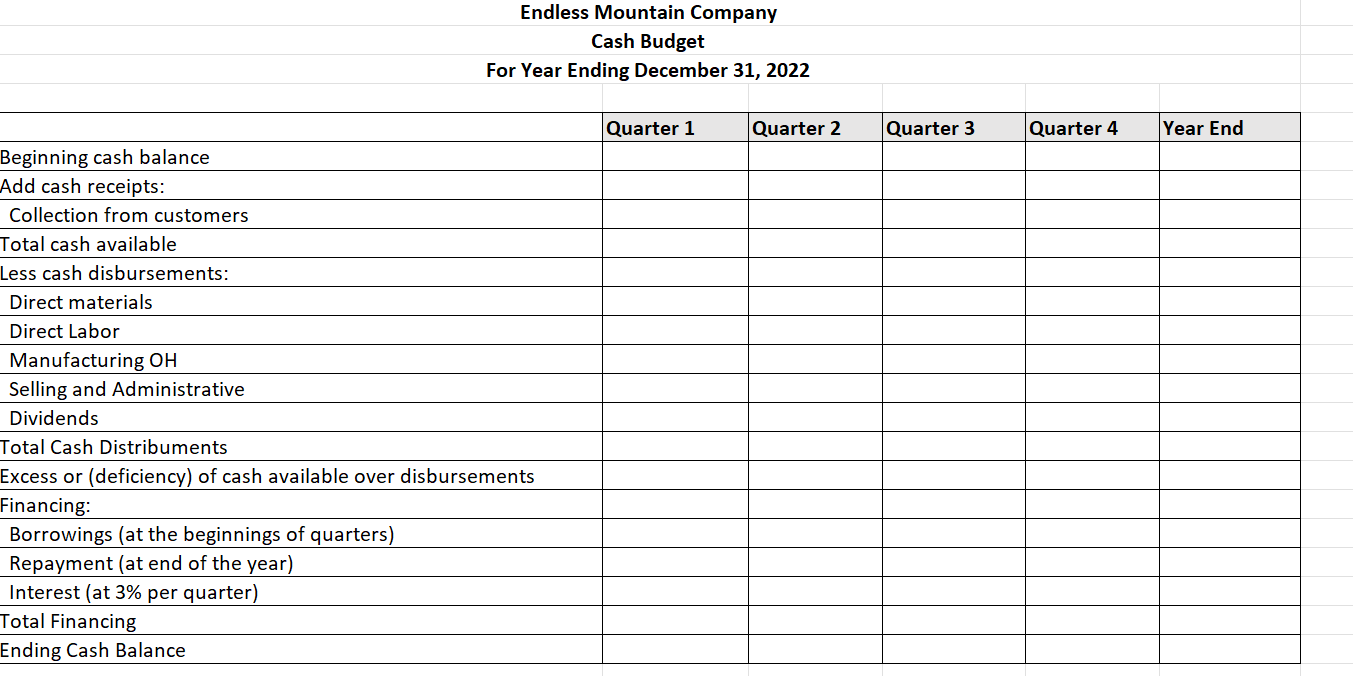

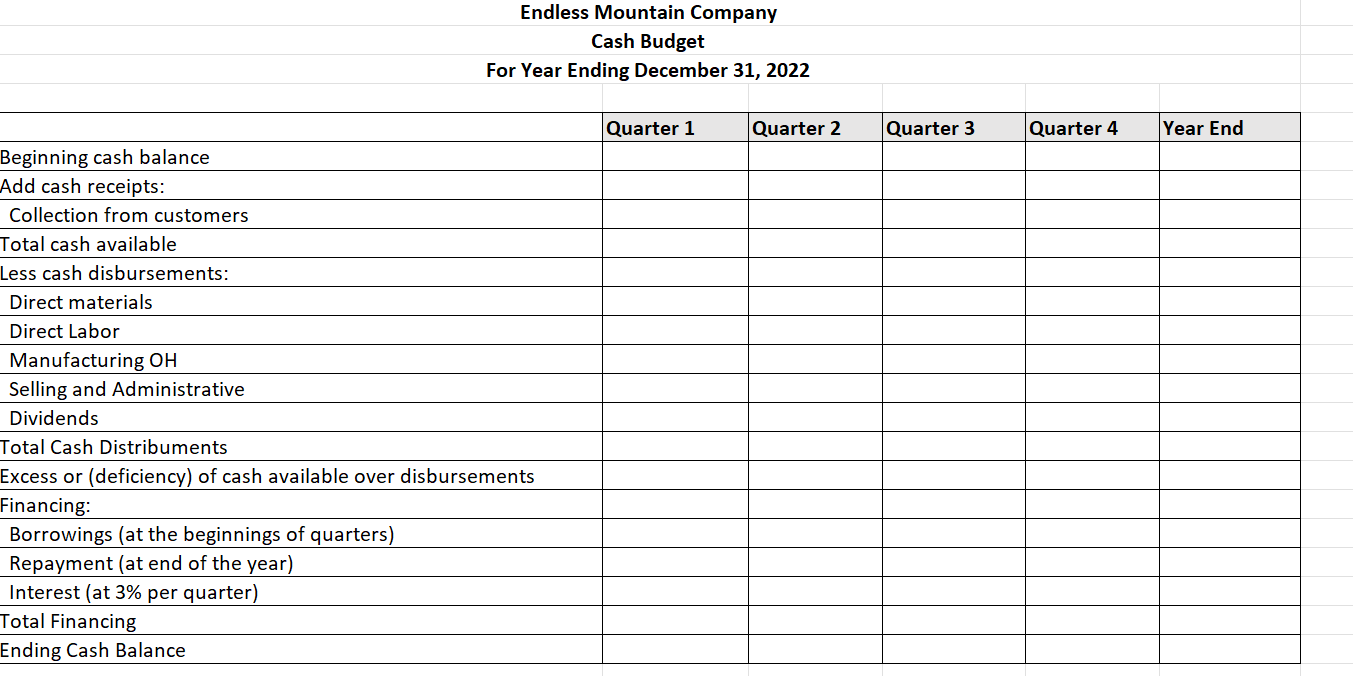

CASH BUDGET (WORK):

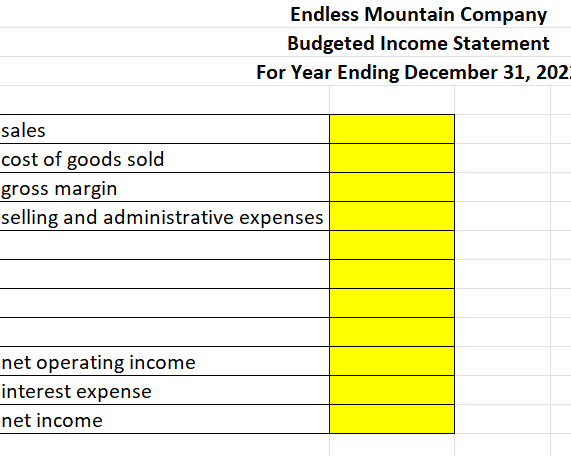

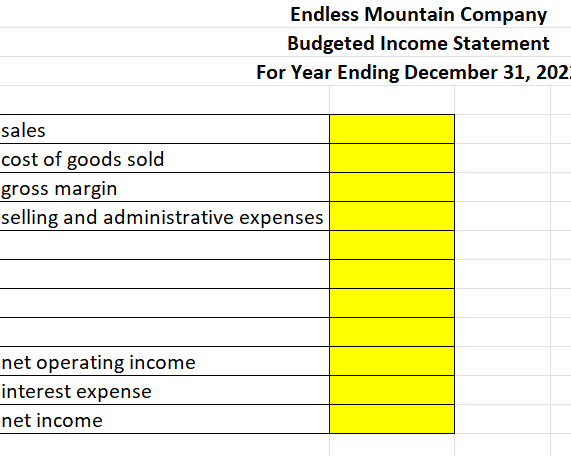

BUDGETED INCOME STATEMENT (WORK):

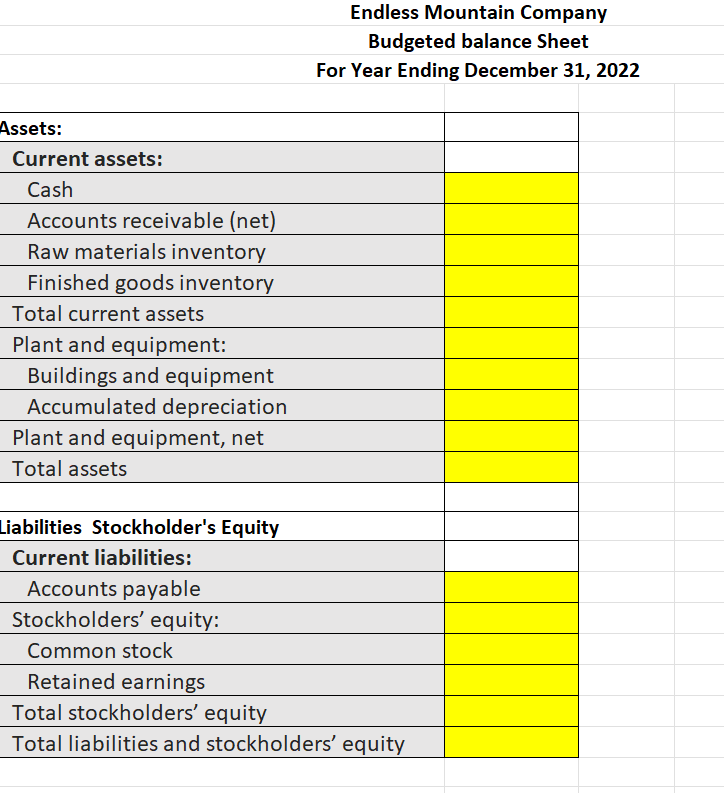

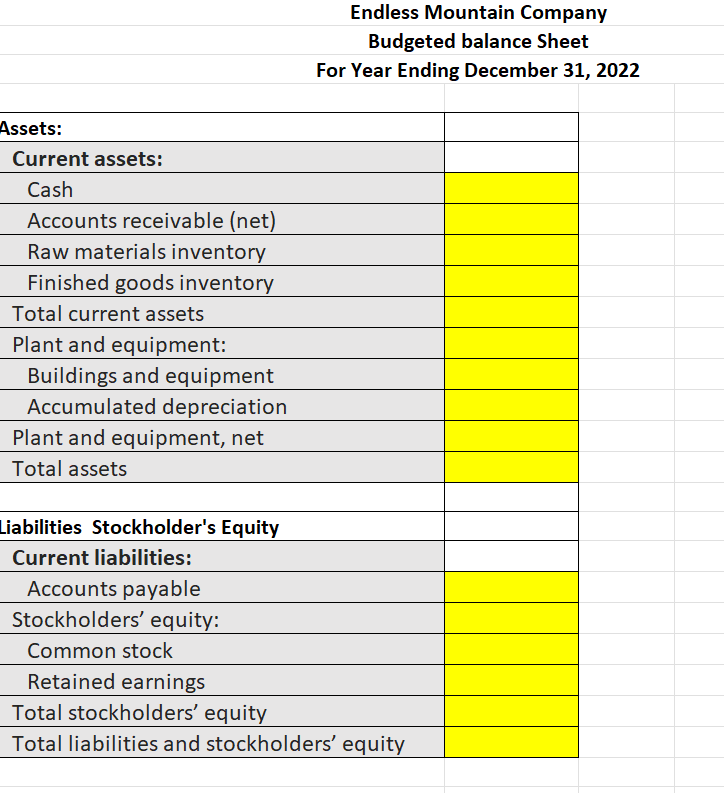

BUDGETED BALANCE SHEET (WORK):

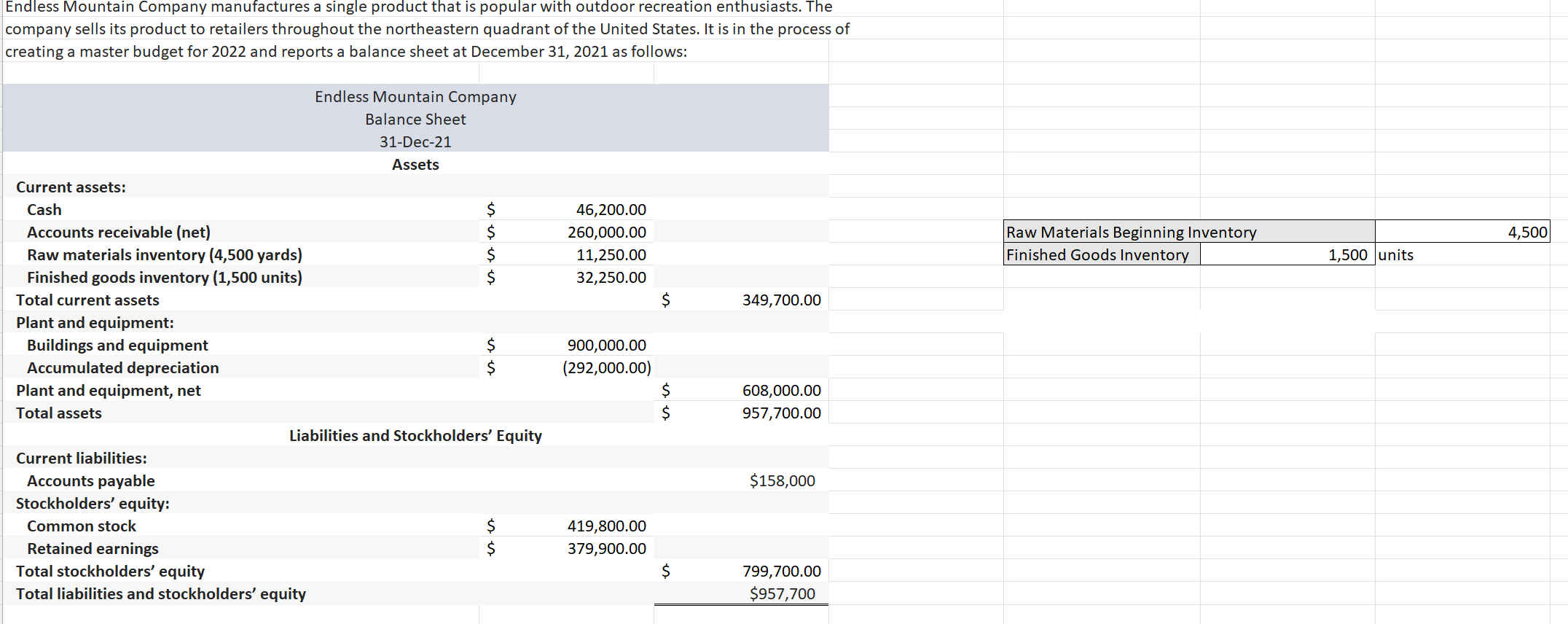

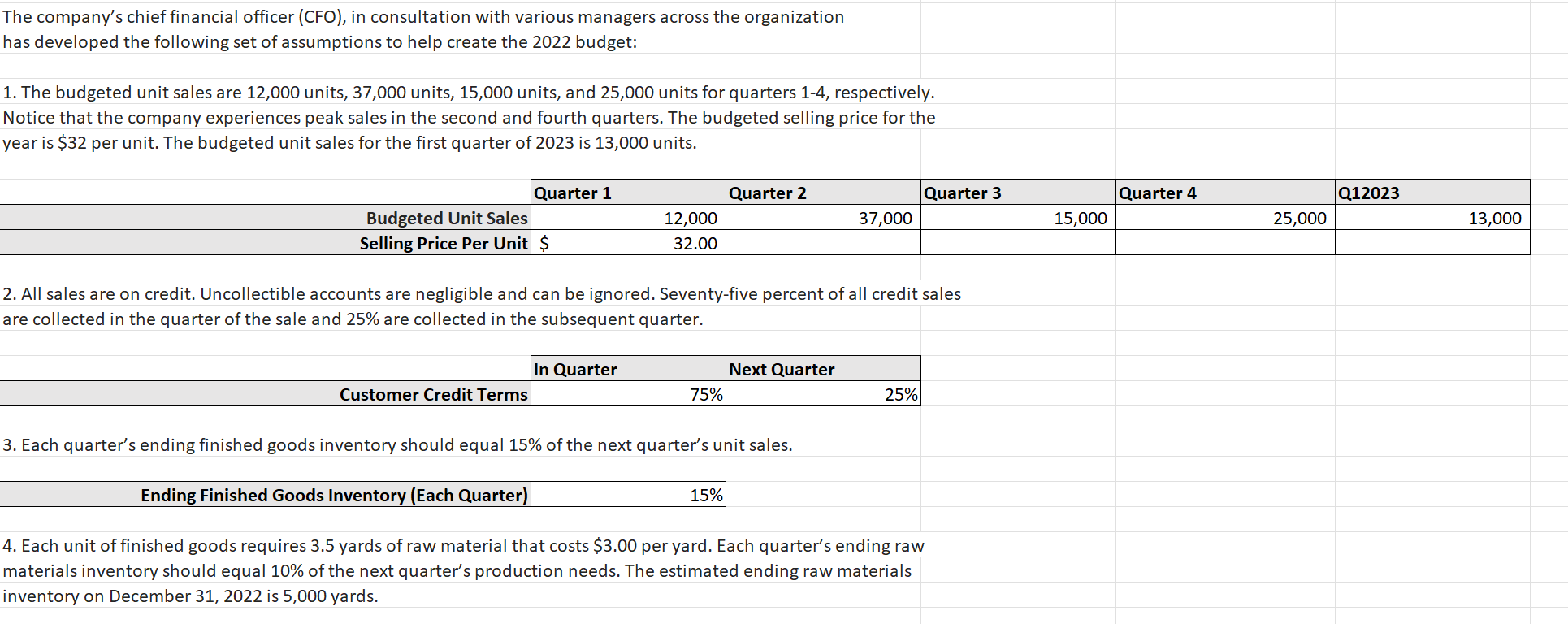

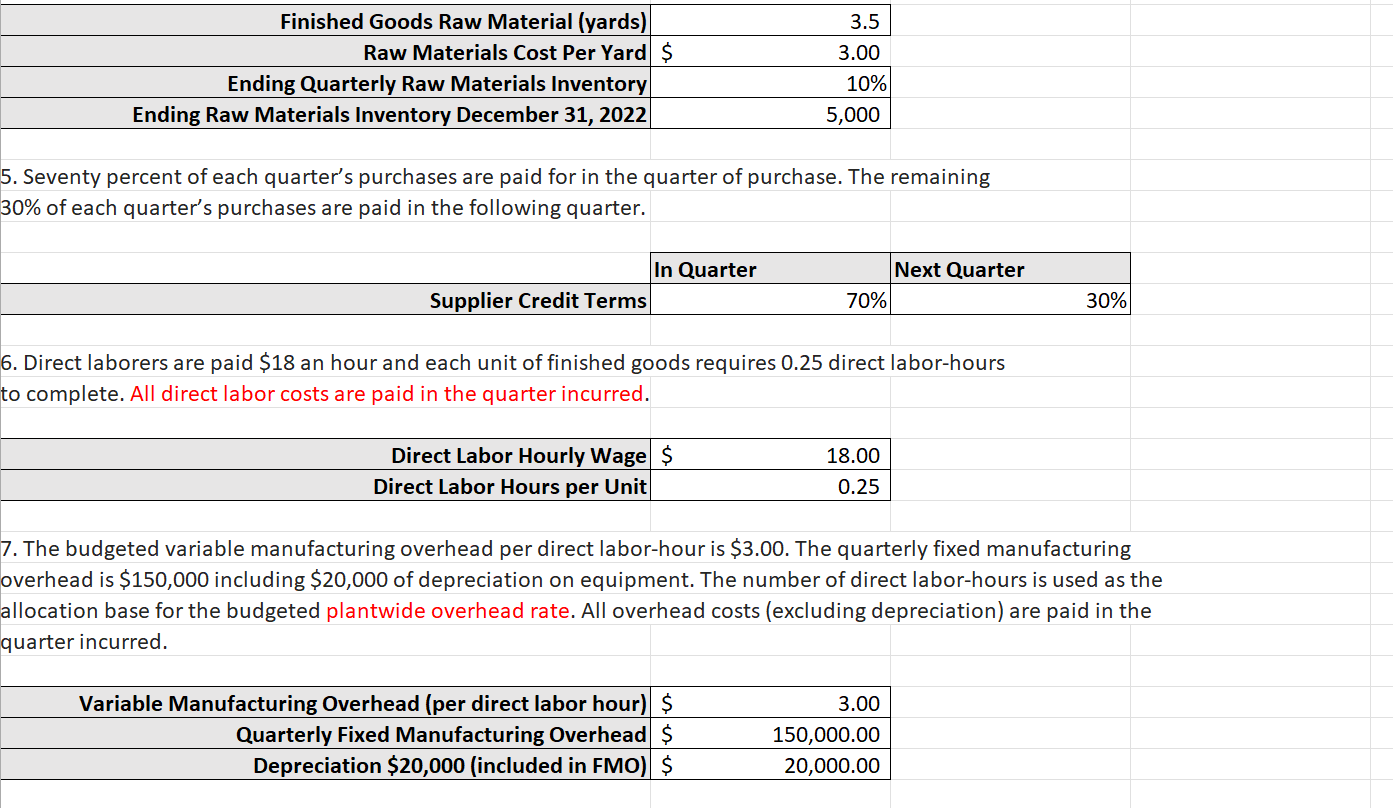

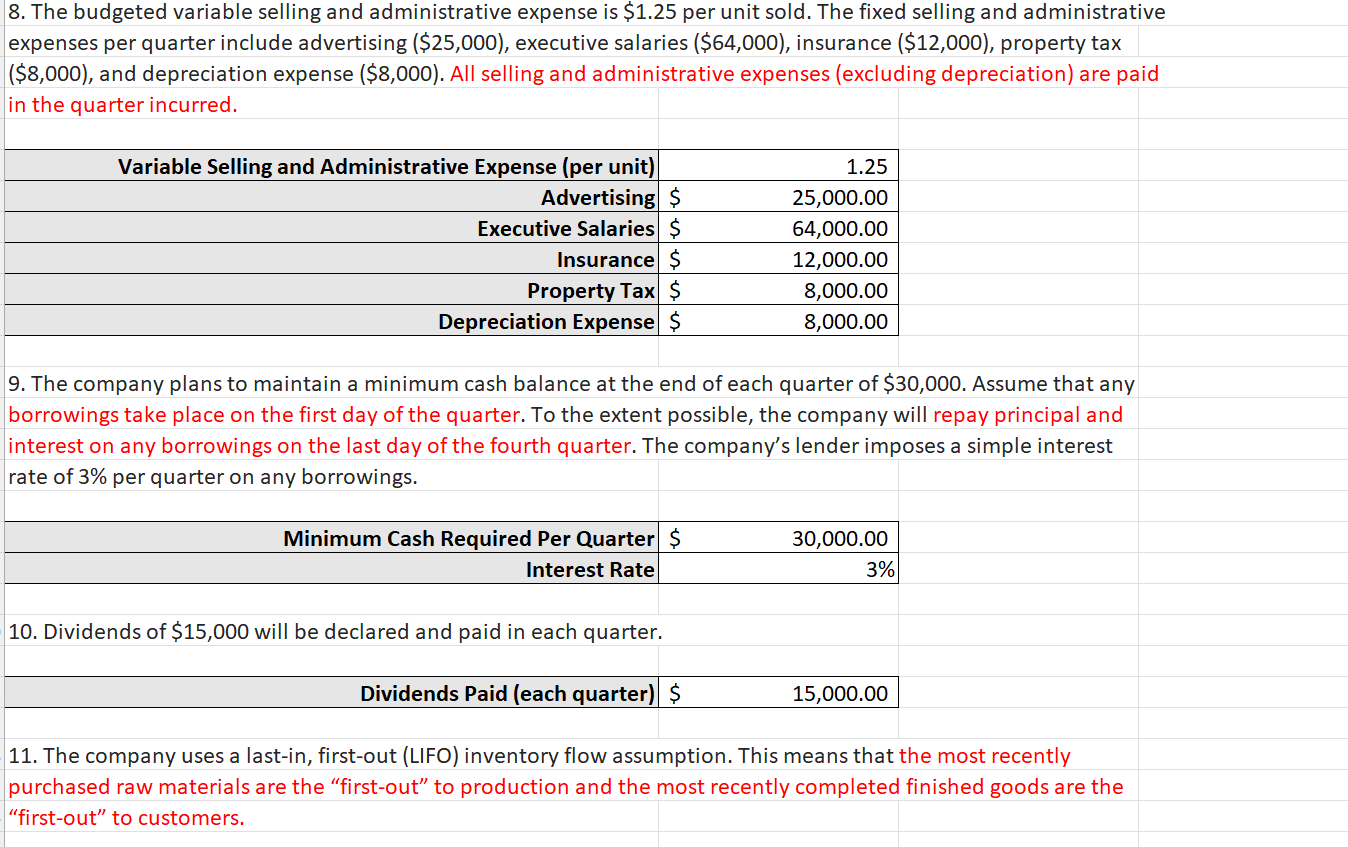

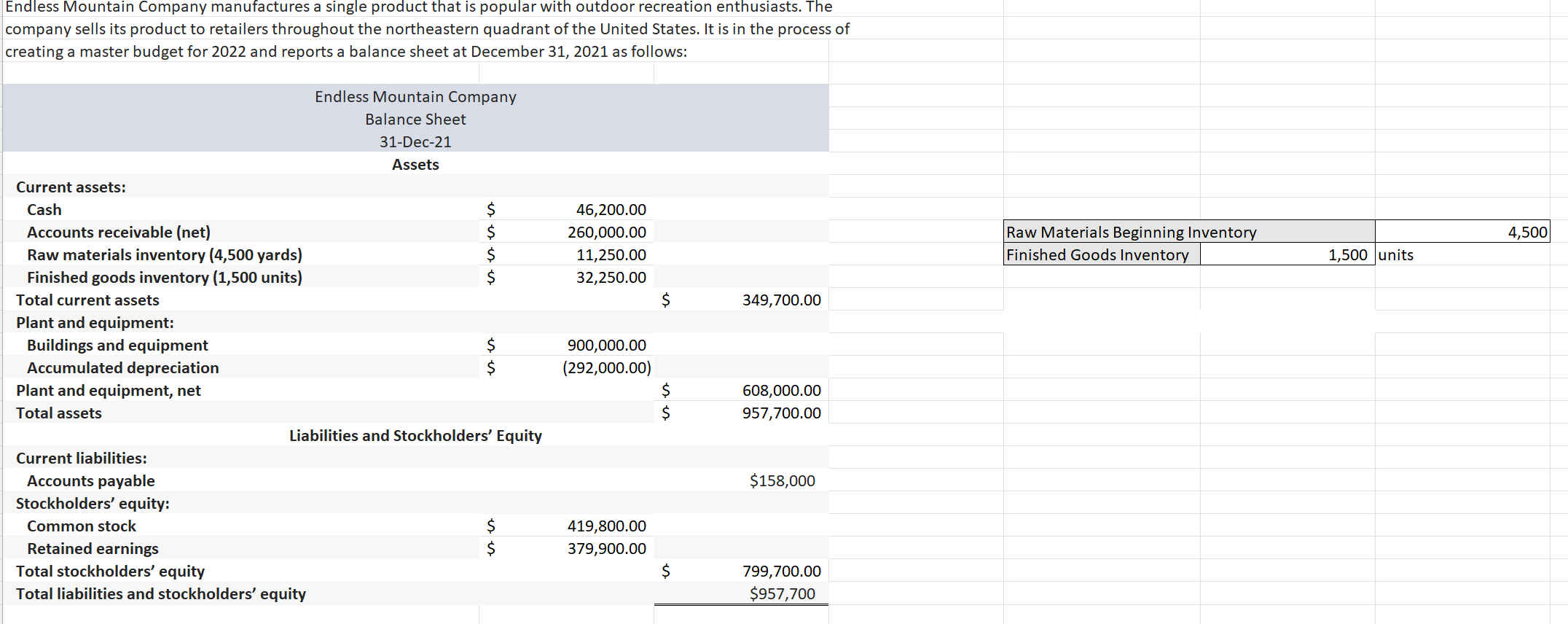

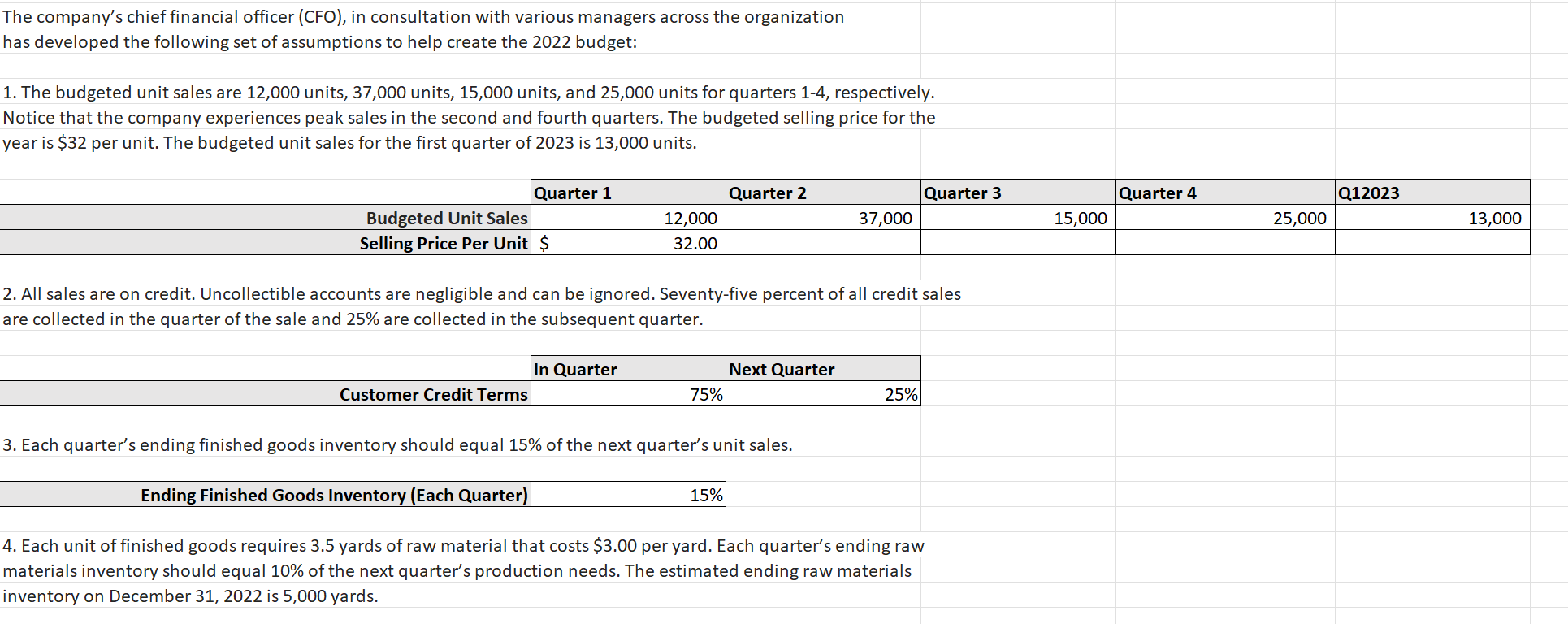

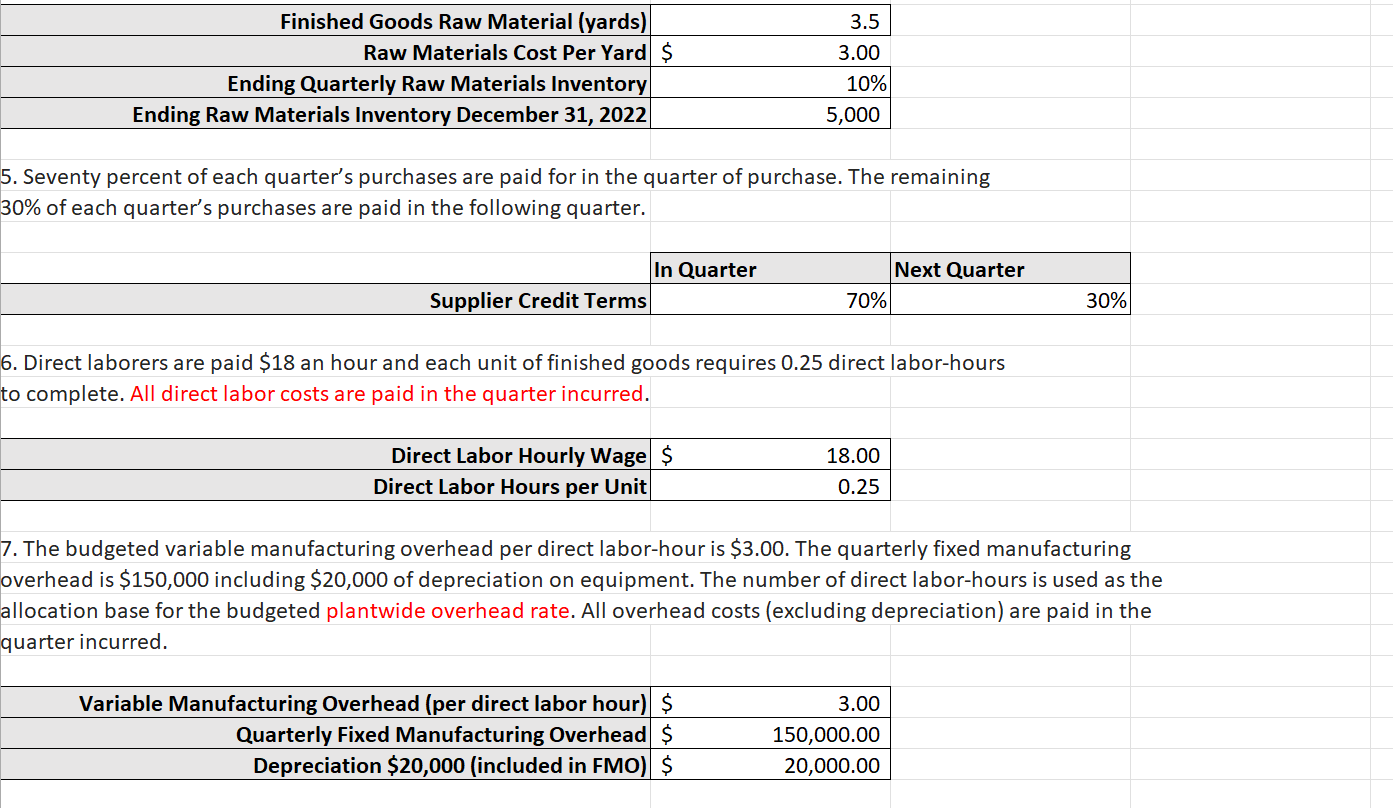

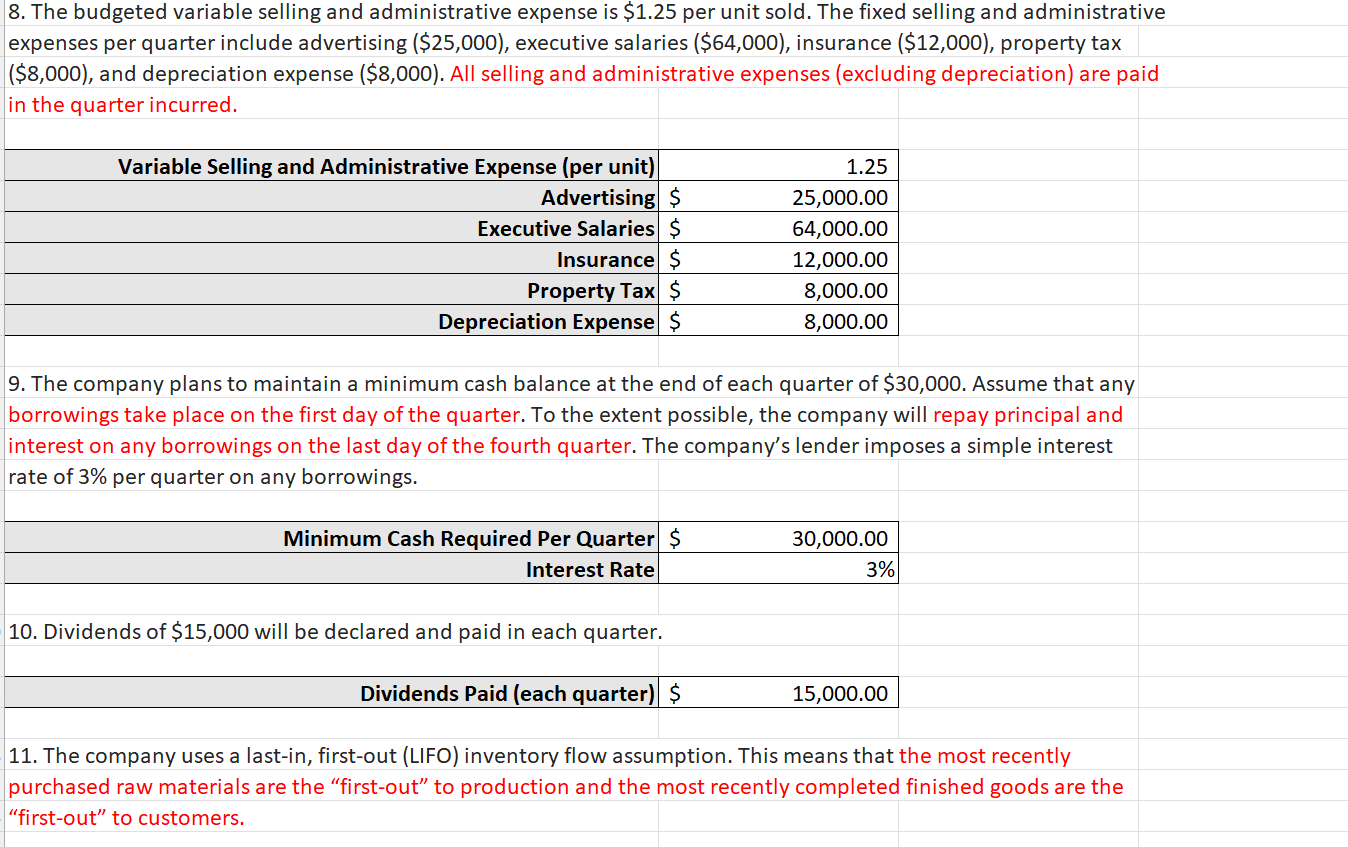

Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The The company's chief financial officer (CFO), in consultation with various managers across the organization has developed the following set of assumptions to help create the 2022 budget: 1. The budgeted unit sales are 12,000 units, 37,000 units, 15,000 units, and 25,000 units for quarters 14, respectively. Notice that the company experiences peak sales in the second and fourth quarters. The budgeted selling price for the year is $32 per unit. The budgeted unit sales for the first quarter of 2023 is 13,000 units. 2. All sales are on credit. Uncollectible accounts are negligible and can be ignored. Seventy-five percent of all credit sales are collected in the quarter of the sale and 25% are collected in the subsequent quarter. \begin{tabular}{|l|l|l|} \hline & In Quarter & Next Quarter \\ \hline Customer Credit Terms & 75% & 25% \\ \hline \end{tabular} 3. Each quarter's ending finished goods inventory should equal 15% of the next quarter's unit sales. \begin{tabular}{|r|r|} Ending Finished Goods Inventory (Each Quarter) & 15% \\ \hline \end{tabular} 4. Each unit of finished goods requires 3.5 yards of raw material that costs $3.00 per yard. Each quarter's ending raw materials inventory should equal 10% of the next quarter's production needs. The estimated ending raw materials inventory on December 31,2022 is 5,000 yards. Seventy percent of each quarter's purchases are paid for in the quarter of purchase. The remaining 30% of each quarter's purchases are paid in the following quarter. 5. Direct laborers are paid $18 an hour and each unit of finished goods requires 0.25 direct labor-hours o complete. All direct labor costs are paid in the quarter incurred. 7. The budgeted variable manufacturing overhead per direct labor-hour is $3.00. The quarterly fixed manufacturing verhead is $150,000 including $20,000 of depreciation on equipment. The number of direct labor-hours is used as the llocation base for the budgeted plantwide overhead rate. All overhead costs (excluding depreciation) are paid in the quarter incurred. 8. The budgeted variable selling and administrative expense is $1.25 per unit sold. The fixed selling and administrative expenses per quarter include advertising ($25,000), executive salaries ($64,000), insurance ($12,000), property tax ($8,000), and depreciation expense (\$8,000). All selling and administrative expenses (excluding depreciation) are paid in the quarter incurred. 9. The company plans to maintain a minimum cash balance at the end of each quarter of $30,000. Assume that any borrowings take place on the first day of the quarter. To the extent possible, the company will repay principal and interest on any borrowings on the last day of the fourth quarter. The company's lender imposes a simple interest rate of 3% per quarter on any borrowings. MinimumCashRequiredPerQuarterInterestRate$3%30,000.00 10. Dividends of $15,000 will be declared and paid in each quarter. DividendsPaid(eachquarter)$15,000.00 11. The company uses a last-in, first-out (LIFO) inventory flow assumption. This means that the most recently purchased raw materials are the "first-out" to production and the most recently completed finished goods are the "first-out" to customers. Endless Mountain Company Sales Budget For Year Ending December 31, 2022 Endless Mountain Company Budgeted Cash Collections For Year Ending December 31, 2022 Endless Mountain Company Budgeted Cash Collections For Year Ending December 31, 2022 Endless Mountain Combanv Endless Mountain Company Cash Disbursment for Raw Materials For Year Ending December 31, 2022 Endless Mountain Company Direct Labor Budget For Year Ending December 31, 2022 \begin{tabular}{|l|l|l|l|l|l|} \hline & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 & Year End \\ \hline Total Units Required for Production & & & & & \\ \hline Direct Labor Hours Per Unit & & & & & \\ \hline Total Direct Labor Hours for Production & & & & & \\ \hline Cost of Direct Labor Per Hour & & & & & \\ \hline Total C ost of Direct Labor Hour for Production & & & & & \\ \hline \end{tabular} Endless Mountain Company Manufacturing Overhead Budget For Year Ending December 31, 2022 \begin{tabular}{|l|l|l|l|l|l|} \hline & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 & Year End \\ \hline Total Direct Labor Hours for Production & & & & & \\ \hline Variable MH Costs Per Direct Labor Hours & & & & \\ \hline Total Variable MH Costs & & & & \\ \hline Fixed Manufacturing Overhead Costs & & & & \\ \hline Total Manufacturing Overhead Costs & & & & \\ \hline Less: Depreciation & & & & \\ \hline Cash Distribument for MH & & & & \\ \hline Total Manufacturing Overhead Costs & & & & \\ \hline Potal Direct Labor Hours for Production & & & & \\ \hline \end{tabular} Endless Mountain Company Finished Ending Goods Inventory Budget For Year Ending December 31, 2022 \begin{tabular}{|l|l|l|l|} \hline Item & Quantity & Cost & Total \\ \hline product Unit Cost: & & & \\ \hline Direct Materials & & & \\ \hline Direct Labor & & & \\ \hline Manufacturing OH & & & \\ \hline Total Product Cost Per Unit & & & \\ \hline \end{tabular} Budgeted Finished Goods Inventory: \begin{tabular}{|l|l|l|l|} \hline Units From Prior Year's Production & & & \\ \hline Unit Product Cost & & & \\ \hline Cost From Prior Year's Production & & & \\ \hline Units From Current Year's Production & & & \\ \hline Unit Product Cost & & & \\ \hline Cost From Current Year's Production & & & \\ \hline Cost of Ending Finished Goods Inventory & & & \\ \hline \end{tabular} Endless Mountain Company Selling and Administrative Expense Budget For Year Ending December 31, 2022 Endless Mountain Company Cash Budget For Year Ending December 31, 2022 Endless Mountain Company Budgeted Income Statement For Year Ending December 31, 202 \begin{tabular}{|l|l|} \hline sales & \\ \hline cost of goods sold & \\ \hline gross margin & \\ \hline selling and administrative expenses & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline net operating income & \\ \hline interest expense & \\ \hline \end{tabular} Endless Mountain Company Budgeted balance Sheet For Year Ending December 31, 2022 Assets: Current assets: \begin{tabular}{|l|l|} \hline Cash & \\ \hline Accounts receivable (net) & \\ \hline Raw materials inventory & \\ \hline Finished goods inventory & \\ \hline Total current assets & \\ \hline Plant and equipment: & \\ \hline Buildings and equipment & \\ \hline Accumulated depreciation & \\ \hline Plant and equipment, net & \\ \hline Total assets & \\ \hline & \\ \hline Liabilities Stockholder's Equity & \\ \hline Current liabilities: & \\ \hline Accounts payable & \\ \hline Stockholders' equity: & \\ \hline Common stock & \\ \hline Retained earnings & \\ \hline Total stockholders' equity & \\ \hline Total liabilities and stockholders' equity & \\ \hline \end{tabular} Endless Mountain Company manufactures a single product that is popular with outdoor recreation enthusiasts. The The company's chief financial officer (CFO), in consultation with various managers across the organization has developed the following set of assumptions to help create the 2022 budget: 1. The budgeted unit sales are 12,000 units, 37,000 units, 15,000 units, and 25,000 units for quarters 14, respectively. Notice that the company experiences peak sales in the second and fourth quarters. The budgeted selling price for the year is $32 per unit. The budgeted unit sales for the first quarter of 2023 is 13,000 units. 2. All sales are on credit. Uncollectible accounts are negligible and can be ignored. Seventy-five percent of all credit sales are collected in the quarter of the sale and 25% are collected in the subsequent quarter. \begin{tabular}{|l|l|l|} \hline & In Quarter & Next Quarter \\ \hline Customer Credit Terms & 75% & 25% \\ \hline \end{tabular} 3. Each quarter's ending finished goods inventory should equal 15% of the next quarter's unit sales. \begin{tabular}{|r|r|} Ending Finished Goods Inventory (Each Quarter) & 15% \\ \hline \end{tabular} 4. Each unit of finished goods requires 3.5 yards of raw material that costs $3.00 per yard. Each quarter's ending raw materials inventory should equal 10% of the next quarter's production needs. The estimated ending raw materials inventory on December 31,2022 is 5,000 yards. Seventy percent of each quarter's purchases are paid for in the quarter of purchase. The remaining 30% of each quarter's purchases are paid in the following quarter. 5. Direct laborers are paid $18 an hour and each unit of finished goods requires 0.25 direct labor-hours o complete. All direct labor costs are paid in the quarter incurred. 7. The budgeted variable manufacturing overhead per direct labor-hour is $3.00. The quarterly fixed manufacturing verhead is $150,000 including $20,000 of depreciation on equipment. The number of direct labor-hours is used as the llocation base for the budgeted plantwide overhead rate. All overhead costs (excluding depreciation) are paid in the quarter incurred. 8. The budgeted variable selling and administrative expense is $1.25 per unit sold. The fixed selling and administrative expenses per quarter include advertising ($25,000), executive salaries ($64,000), insurance ($12,000), property tax ($8,000), and depreciation expense (\$8,000). All selling and administrative expenses (excluding depreciation) are paid in the quarter incurred. 9. The company plans to maintain a minimum cash balance at the end of each quarter of $30,000. Assume that any borrowings take place on the first day of the quarter. To the extent possible, the company will repay principal and interest on any borrowings on the last day of the fourth quarter. The company's lender imposes a simple interest rate of 3% per quarter on any borrowings. MinimumCashRequiredPerQuarterInterestRate$3%30,000.00 10. Dividends of $15,000 will be declared and paid in each quarter. DividendsPaid(eachquarter)$15,000.00 11. The company uses a last-in, first-out (LIFO) inventory flow assumption. This means that the most recently purchased raw materials are the "first-out" to production and the most recently completed finished goods are the "first-out" to customers. Endless Mountain Company Sales Budget For Year Ending December 31, 2022 Endless Mountain Company Budgeted Cash Collections For Year Ending December 31, 2022 Endless Mountain Company Budgeted Cash Collections For Year Ending December 31, 2022 Endless Mountain Combanv Endless Mountain Company Cash Disbursment for Raw Materials For Year Ending December 31, 2022 Endless Mountain Company Direct Labor Budget For Year Ending December 31, 2022 \begin{tabular}{|l|l|l|l|l|l|} \hline & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 & Year End \\ \hline Total Units Required for Production & & & & & \\ \hline Direct Labor Hours Per Unit & & & & & \\ \hline Total Direct Labor Hours for Production & & & & & \\ \hline Cost of Direct Labor Per Hour & & & & & \\ \hline Total C ost of Direct Labor Hour for Production & & & & & \\ \hline \end{tabular} Endless Mountain Company Manufacturing Overhead Budget For Year Ending December 31, 2022 \begin{tabular}{|l|l|l|l|l|l|} \hline & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 & Year End \\ \hline Total Direct Labor Hours for Production & & & & & \\ \hline Variable MH Costs Per Direct Labor Hours & & & & \\ \hline Total Variable MH Costs & & & & \\ \hline Fixed Manufacturing Overhead Costs & & & & \\ \hline Total Manufacturing Overhead Costs & & & & \\ \hline Less: Depreciation & & & & \\ \hline Cash Distribument for MH & & & & \\ \hline Total Manufacturing Overhead Costs & & & & \\ \hline Potal Direct Labor Hours for Production & & & & \\ \hline \end{tabular} Endless Mountain Company Finished Ending Goods Inventory Budget For Year Ending December 31, 2022 \begin{tabular}{|l|l|l|l|} \hline Item & Quantity & Cost & Total \\ \hline product Unit Cost: & & & \\ \hline Direct Materials & & & \\ \hline Direct Labor & & & \\ \hline Manufacturing OH & & & \\ \hline Total Product Cost Per Unit & & & \\ \hline \end{tabular} Budgeted Finished Goods Inventory: \begin{tabular}{|l|l|l|l|} \hline Units From Prior Year's Production & & & \\ \hline Unit Product Cost & & & \\ \hline Cost From Prior Year's Production & & & \\ \hline Units From Current Year's Production & & & \\ \hline Unit Product Cost & & & \\ \hline Cost From Current Year's Production & & & \\ \hline Cost of Ending Finished Goods Inventory & & & \\ \hline \end{tabular} Endless Mountain Company Selling and Administrative Expense Budget For Year Ending December 31, 2022 Endless Mountain Company Cash Budget For Year Ending December 31, 2022 Endless Mountain Company Budgeted Income Statement For Year Ending December 31, 202 \begin{tabular}{|l|l|} \hline sales & \\ \hline cost of goods sold & \\ \hline gross margin & \\ \hline selling and administrative expenses & \\ \hline & \\ \hline & \\ \hline & \\ \hline & \\ \hline net operating income & \\ \hline interest expense & \\ \hline \end{tabular} Endless Mountain Company Budgeted balance Sheet For Year Ending December 31, 2022 Assets: Current assets: \begin{tabular}{|l|l|} \hline Cash & \\ \hline Accounts receivable (net) & \\ \hline Raw materials inventory & \\ \hline Finished goods inventory & \\ \hline Total current assets & \\ \hline Plant and equipment: & \\ \hline Buildings and equipment & \\ \hline Accumulated depreciation & \\ \hline Plant and equipment, net & \\ \hline Total assets & \\ \hline & \\ \hline Liabilities Stockholder's Equity & \\ \hline Current liabilities: & \\ \hline Accounts payable & \\ \hline Stockholders' equity: & \\ \hline Common stock & \\ \hline Retained earnings & \\ \hline Total stockholders' equity & \\ \hline Total liabilities and stockholders' equity & \\ \hline \end{tabular}