Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please write on so I can follow. no pictures and new work please. I keep getting different answers, help! 17.7 a. & b. ems 17.4

please write on so I can follow. no pictures and new work please. I keep getting different answers, help!

17.7 a. & b.

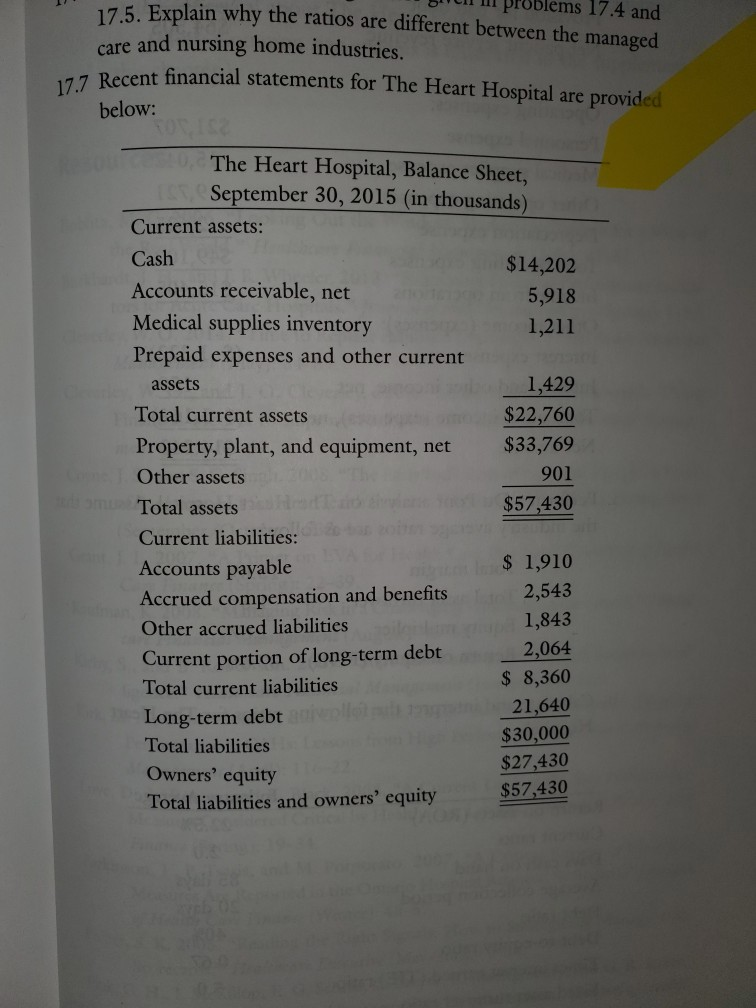

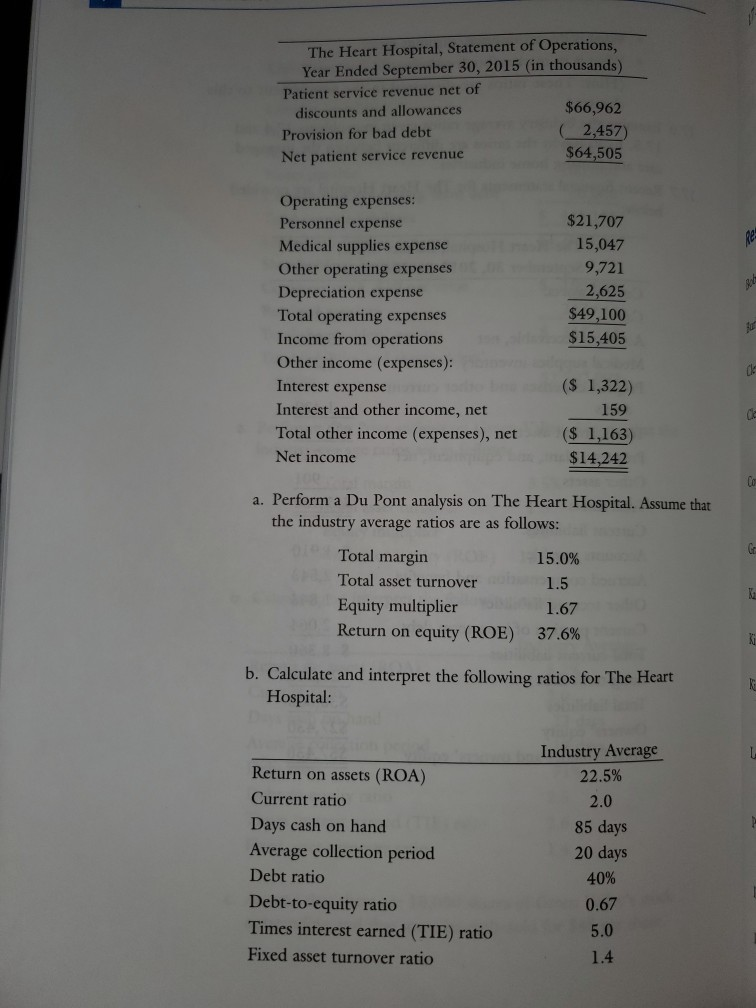

ems 17.4 and 17.5. Explain why the ratios are different between the managed care and nursing home industries. 17.7 Recent financial statements for The Heart Hospital are provided below: 0. The Heart Hospital, Balance Sheet, September 30, 2015 (in thousands) Current assets: Cash $14,202 Accounts receivable, net 5,918 Medical supplies inventory 1,211 Prepaid expenses and other current assets 1,429 Total current assets $22,760 Property, plant, and equipment, net $33,769 Other assets 901 Total assets $57,430 Current liabilities: Accounts payable Accrued compensation and benefits 2,543 Other accrued liabilities 1,843 2,064 Current portion of long-term debt $ 8,360 Total current liabilities 21,640 Long-term debt Total liabilities $30,000 $27,430 Owners' equity Total liabilities and owners' equity $57,430 $ 1,910 The Heart Hospital, Statement of Operations, Year Ended September 30, 2015 (in thousands) Patient service revenue net of discounts and allowances $66,962 Provision for bad debt (2,457) Net patient service revenue $64,505 RE Operating expenses: Personnel expense Medical supplies expense Other operating expenses Depreciation expense Total operating expenses Income from operations Other income (expenses): Interest expenses Interest and other income, net Total other income (expenses), net Net income $21,707 15,047 9,721 2,625 $49,100 $15,405 05 ($ 1,322) 159 ($ 1,163) $14,242 Co GO a. Perform a Du Pont analysis on The Heart Hospital. Assume that the industry average ratios are as follows: Total margin 15.0% Total asset turnover 1.5 Equity multiplier 1.67 Return on equity (ROE) 37.6% X2 ki b. Calculate and interpret the following ratios for The Heart Hospital: KE Return on assets (ROA) Current ratio Days cash on hand Average collection period Debt ratio Debt-to-equity ratio Times interest earned (TIE) ratio Fixed asset turnover ratio Industry Average 22.5% 2.0 85 days 20 days 40% 0.67 5.0 1.4

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started