Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please write out the steps and not solving in excel. i need to see the actual steps to solve the problem. Calculate the NPV of

please write out the steps and not solving in excel. i need to see the actual steps to solve the problem.

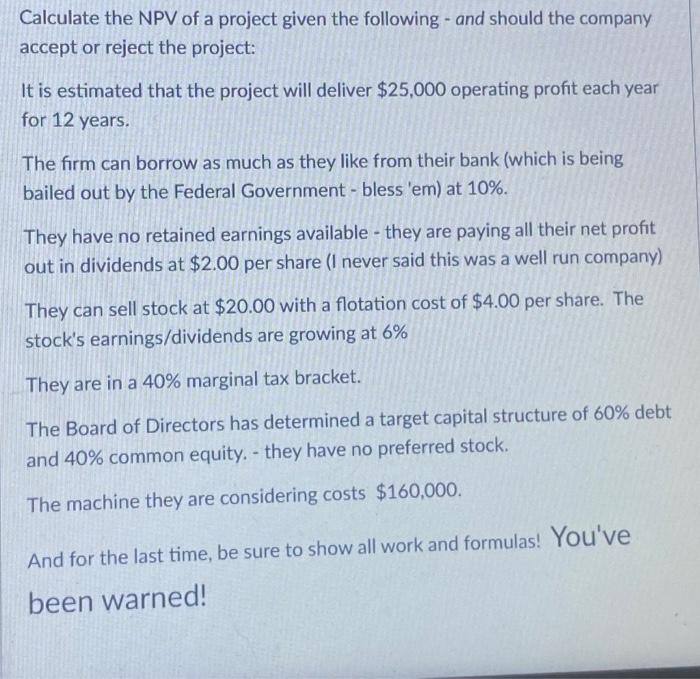

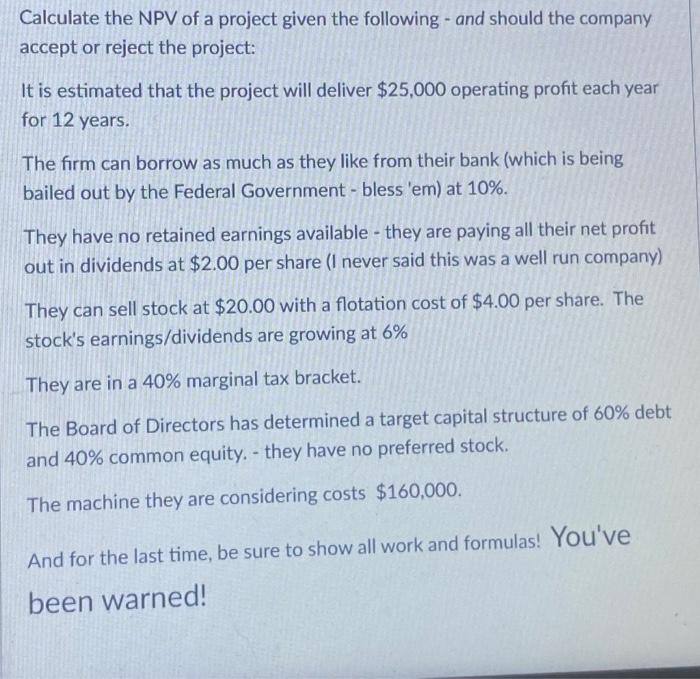

Calculate the NPV of a project given the following - and should the company accept or reject the project: It is estimated that the project will deliver $25,000 operating profit each year for 12 years. The firm can borrow as much as they like from their bank (which is being bailed out by the Federal Government - bless 'em) at 10%. They have no retained earnings available - they are paying all their net profit out in dividends at $2.00 per share (I never said this was a well run company) They can sell stock at $20.00 with a flotation cost of $4.00 per share. The stock's earnings/dividends are growing at 6% They are in a 40% marginal tax bracket. The Board of Directors has determined a target capital structure of 60% debt and 40% common equity. - they have no preferred stock. The machine they are considering costs $160,000. And for the last time, be sure to show all work and formulas! You've been warned

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started