Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please write the detailed formulas and answers, following the hints. ms MN7032- Reassessme X( MN7032-Aug 2018- MN7032-Sample exa D MN7032-Aug 2018- ? e chegg Study

please write the detailed formulas and answers, following the hints.

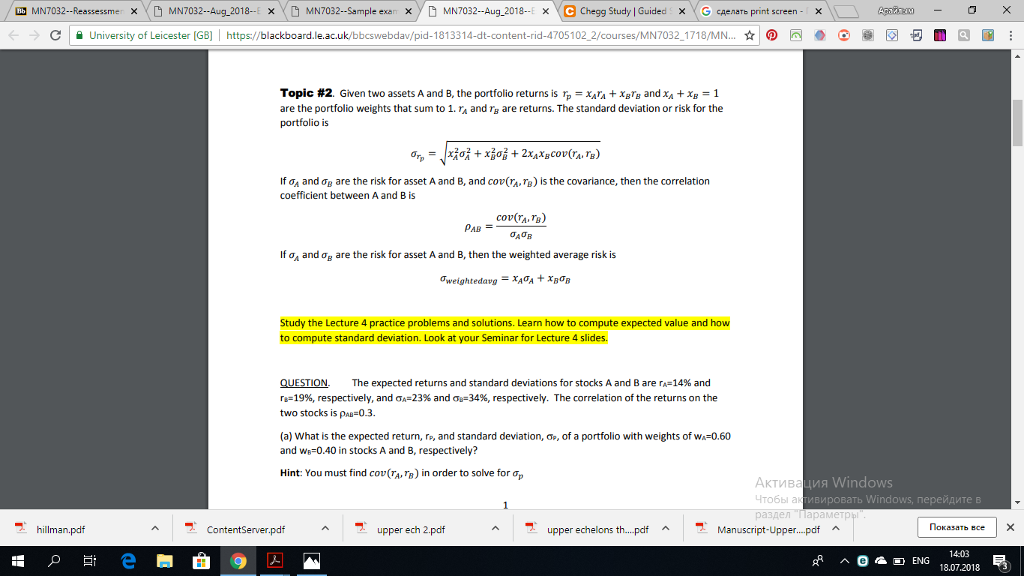

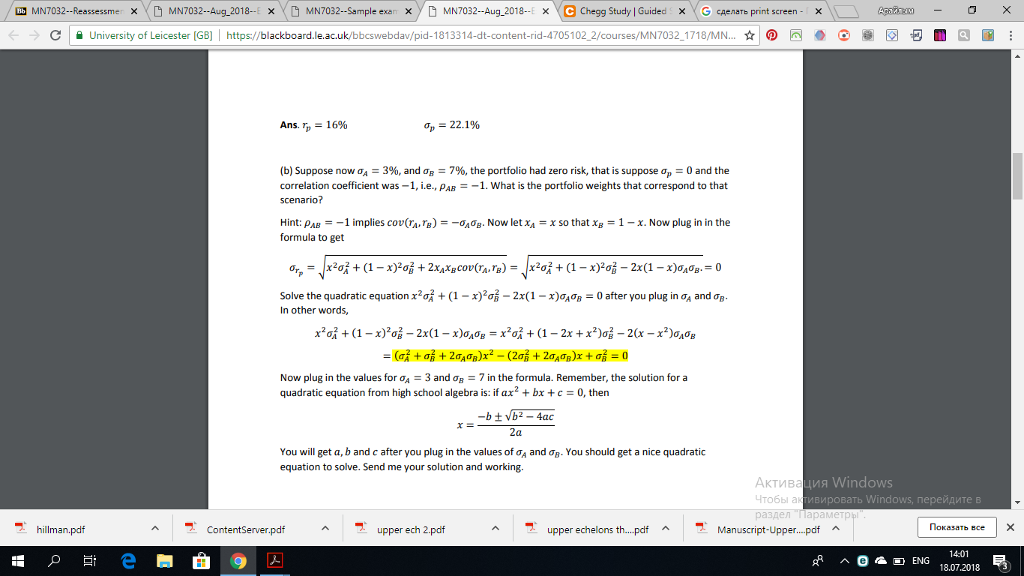

ms MN7032- Reassessme X( MN7032-Aug 2018- MN7032-Sample exa D MN7032-Aug 2018- ? e chegg Study Guidec ?G ??????? print screen- ? x X C University of Leicester GB https://blackboardle.ac.uk/bbcswebdav/pid-181 3314-dt-content-rid-4705102 2/courses/MN7032 1718/MN. ?@ . ? 0 ? 0 Topic #2. Given two assets A and B, the portfolio returns is rp-x/1+ xBTg and Xa + XB-1 are the portfolio weights that sum to 1. r and rg are returns. The standard deviation or risk for the portfolio is if ?? and ?e are the risk for asset A and B, and cor(a,Tg) ?s the covariance, then the correlation coefficient between A and B is ?AOg If and ?e are the risk for asset A and B, then the weighted average risk is Study the Lecture 4 practice problems and solutions. Learn how to compute expected value and how to compute standard deviation. Look at your Seminar for Lecture 4 slides. QUESTION. The expected returns and standard deviations for stocks A and B are rA 14% and rF 1996, respectively, and ?,-23% and ??-34%, respectively. The correlation of the returns on the two stocks is paa-0.3 (a) what is the expected return, r, and standard deviation, ?, of a portfolio with weights of wa-0.60 and WE-0.40 in stocks A and B, respectively? Hint: You must find cou(a, ?) in order to solve for ?p AKTMBa ?????| a ?????? ??? Windows ?? ? ??????? Windows, ????????? ? hillman.pd ContentServerpdf upper ech 2.pdf upper echelons th...pdf Manuscript-Upper...of ???????? ??? | >Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started