please write w same format. thank you!

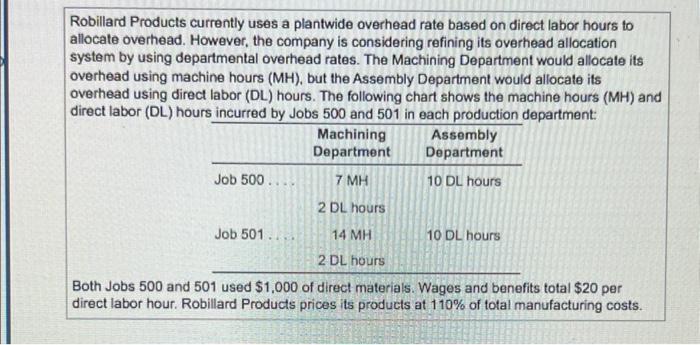

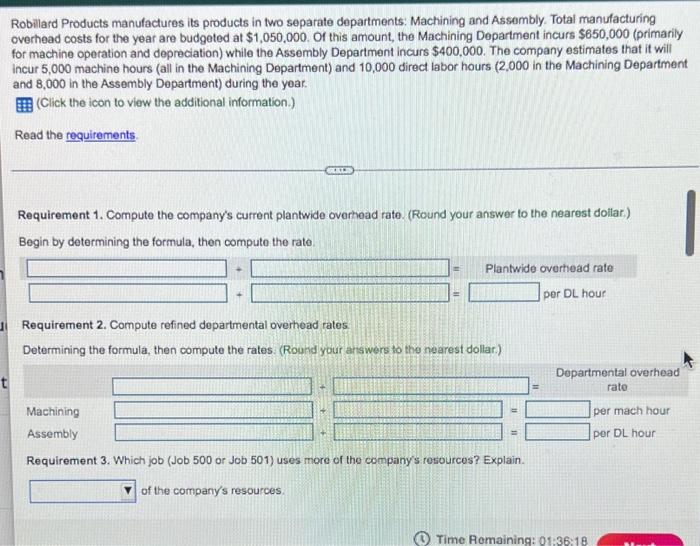

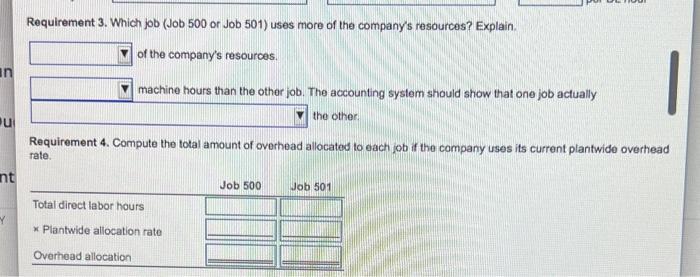

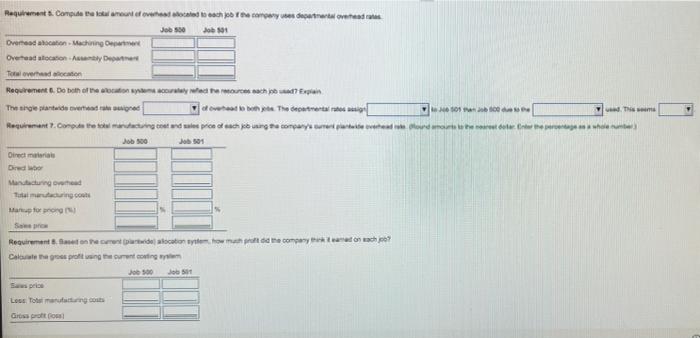

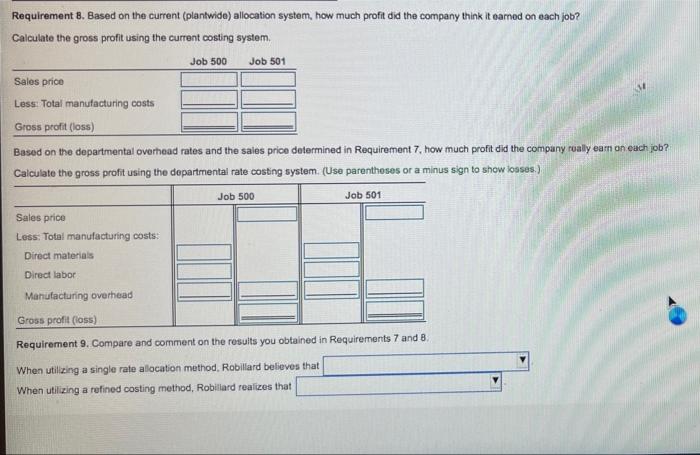

Robillard Products currently uses a plantwide overhead rate based on direct labor hours to allocate overhead. However, the company is considering refining its overhead allocation system by using departmental overhead rates. The Machining Department would allocate its overhead using machine hours (MH), but the Assembly Department would allocate its overhead using direct labor (DL) hours. The following chart shows the machine hours (MH) and direct labor (DL) hours incurred by Jobs 500 and 501 in each production department: Machining Assembly Department Department Job 500 7 MH 10 DL hours 2 DL hours Job 501... 14 MH 10 DL hours 2 DL hours Both Jobs 500 and 501 used $1,000 of direct materials. Wages and benefits total $20 per direct labor hour. Robillard Products prices its products at 110% of total manufacturing costs. Robillard Products manufactures its products in two separate departments: Machining and Assembly. Total manufacturing overhead costs for the year are budgeted at $1,050,000. Of this amount, the Machining Department incurs $650,000 (primarily for machine operation and depreciation) while the Assembly Department incurs $400,000. The company estimates that it will Incur 5,000 machine hours (all in the Machining Department) and 10,000 direct labor hours (2,000 in the Machining Department and 8,000 in the Assembly Department) during the year. (Click the icon to view the additional information.) Read the requirements Requirement 1. Compute the company's current plantwide overhead rate. (Round your answer to the nearest dollar.) Begin by determining the formula, then compute the rate Plantwide overhead rate per DL hour Requirement 2. Compute refined departmental overhead rates Determining the formula, then compute the rates. (Round your answers to the nearest dollar.) Departmental overhead rate Machining per mach hour Assembly per DL hour Requirement 3. Which job (Job 500 or Job 501) uses more of the company's resources? Explain. t of the company's resources Time Romaining: 01:36:18 Requirement 3. Which job (Job 500 or Job 501) uses more of the company's resources? Explain. of the company's resources an machine hours than the other job. The accounting system should show that one job actually the other Requirement 4. Compute the total amount of overhead allocated to each job if the company uses its current plantwide overhead Tate. nt Job 500 Job 501 Total direct labor hours Y * Plantwide allocation rate Overhead allocation Requirements. Compute the talent of owerhes led to the com vue department owned a Job 500 Jo 01 Overhead alocation Machining Overad oction Troverando Requirement. Do both of the reaction may need to march noch niet? Explain The repartido verde of what the de Requirement ? Con the soul matering cont und untee price och ming te compare parte and more on the Job 500 Director Drew Mandung Tomingo Map forong Requirement. But the corrent de location the town of the competent on each? Cable the gros proftwang turning Job 100 Loss Touring costs Crossroom Requirement 8. Based on the current (plantwide) allocation system, how much profit did the company think it earned on each job? Calculate the gross profit using the current costing system Job 500 Job 501 Sales price 1 Less: Total manufacturing costs Gross profit (loss) Based on the departmental overhead rates and the sales price determined in Requirement 7. how much profit did the company rally earn on each job? Calculate the gross profit using the departmental rate costing system (Use parentheses or a minus sign to show losses.) Job 500 Job 501 Sales price Less: Total manufacturing costs: Direct materials Direct labor Manufacturing overhead Gross profit (loss) Requirement 9. Compare and comment on the results you obtained in Requirements 7 and 8. When utilizing a single rate alocation method. Robillard believes that When utilizing a refined costing method, Robiliard realizes that