please you can add additional structure for better summary thankyou

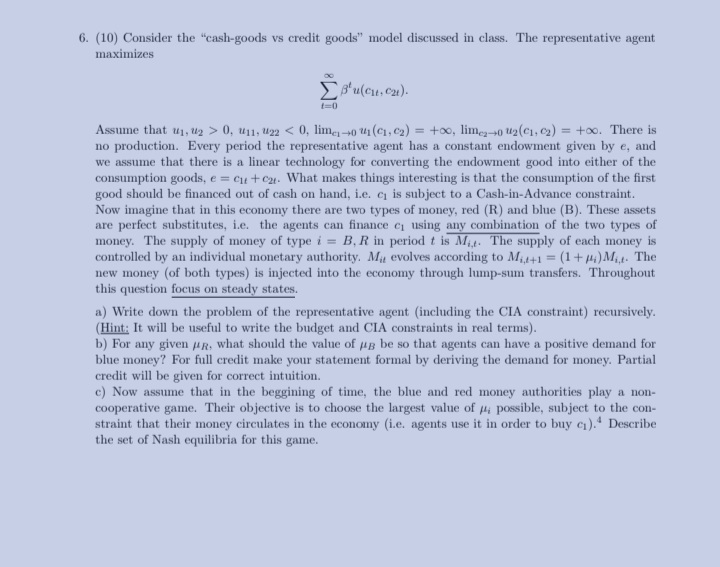

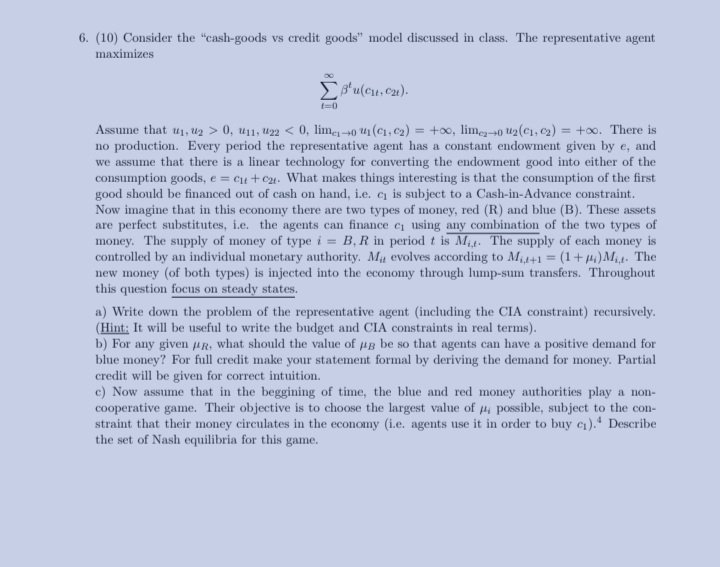

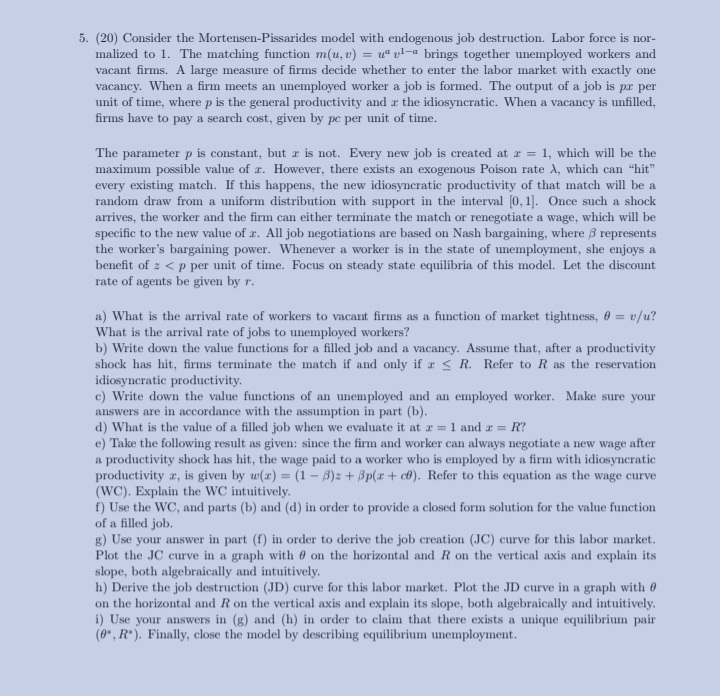

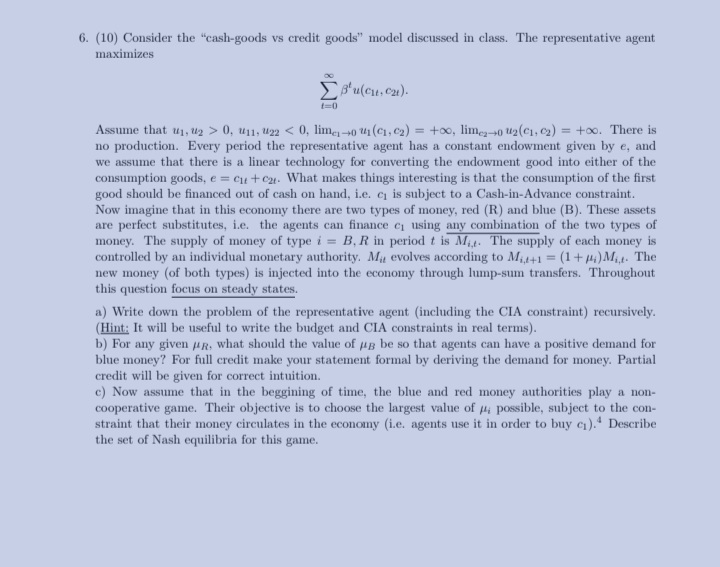

6. (10) Consider the "cash-goods vs credit goods" model discussed in class. The representative agent maximizes 120 Assume that u1, 12 > 0, ull, 122 Bu(c), BE (0, 1). 1=0 Each household has an initial capital stock ro at time 0, and one unit of productive time in each period, that can be devoted to work. Final output is produced using capital and labor services, yi = F(k, n). where F is a CRS production function. This technology is owned by firms whose number will be determined in equilibrium. Output can be consumed (er) or invested (i,). We assume that households own the capital stock (so they make the investment decision) and rent out capital services to the firms. The depreciation rate of the capital stock (2:) is denoted by 6 e [0, 1).! Finally, we assume that households own the firms, i.e. they are claimants to the firms' profits. The functions u and F have the usual nice properties.? a) First consider an Arrow-Debreu world. Describe the households' and firms' problems and carefully define an AD equilibrium. How many firms operate in this equilibrium? b) Write down the problem of the household recursively. Be sure to carefully define the state variables and distinguish between aggregate and individual states. Define a recursive competitive equilibrium (RCE). For the rest of this question focus again on an Arrow-Debreu setting. c) In this economy, why is it a good idea to describe the AD equilibrium capital stock allocation by solving the (easier) Social Planner's Problem? From now on assume that F(k, n) = kin, ", a e (0, 1), and 5 = 1. Also, assume that the households' preferences are characterized by "habit persistence". In particular, households wish to maximize [ s' ( Ing + ylna-1), 720. d) Fully characterize (i.e. find a closed form solution for) the equilibrium allocation of the capital stock. (Hint: Derive the Euler equation using any method you like. Then guess and verify a "policy rule" of the form ke+1 = gif, where g is an unknown to be determined.) e) What is the capital stock equal to as t -+ co? What is the ADE value of the rental rate of capital as t -+ 00? f) What is the ADE price of the consumption good in t = 1?1. (10) In Mehra and Prescott's analysis of the equity premium, they employed a discrete time asset pricing model in which the exogenous process for consumption growth was assumed to be a two-state Markov process. Denote the two growth rates as Aj 2 and define the transition probabilities as my = Pr ()+1 = ),M = M) where (i, j) = (1,2) . Let & denote the representative agent's subjective discount factor and y denote the agent's relative risk aversion parameter (assumed to be constant). In order for the equilibrium price function to exist, Mehra and Prescott assumed that Said, " 0 and y # 1, and C (t) is per-capita consumption. In addition to households, a government exists which purchases G (t) units of output. This amount is growing at the rate n ta (i.e. the growth rate of government purchases is equal to the sum of the population growth rate and the growth rate of technology). Government purchases are financed via lump-sum taxes on households. Given this environment, do the following (a) Solve the model as a social planner problem. Write down the associated present-value Hamil- tonian and derive the necessary conditions. (b) Define a steady-state equilibrium and derive the phase diagram associated with this economy. (c) Suppose that, in period to the level of government purchases jumps unexpectedly to G' (t) > G (tx) . This has no effect on the growth rate of government purchases. Describe the effect that this has on equilibrium (steady-state and any transition to a new steady-state) and use the phase diagram developed in (b) to support your analysis. (d) Suppose now that, in period tm, the capital depreciation rate falls to o'