pleaseplease help

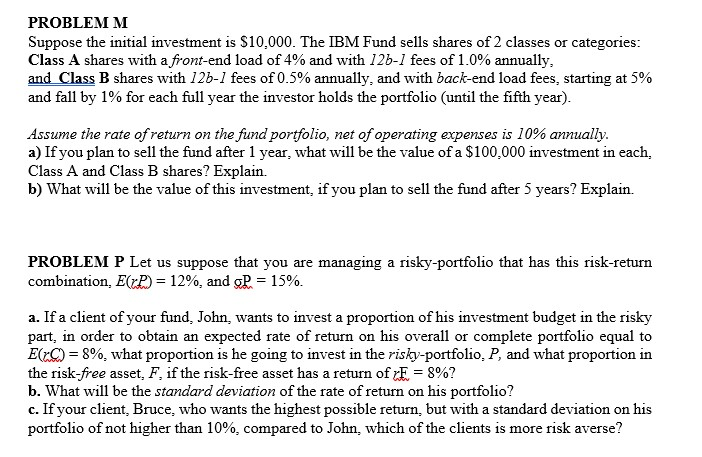

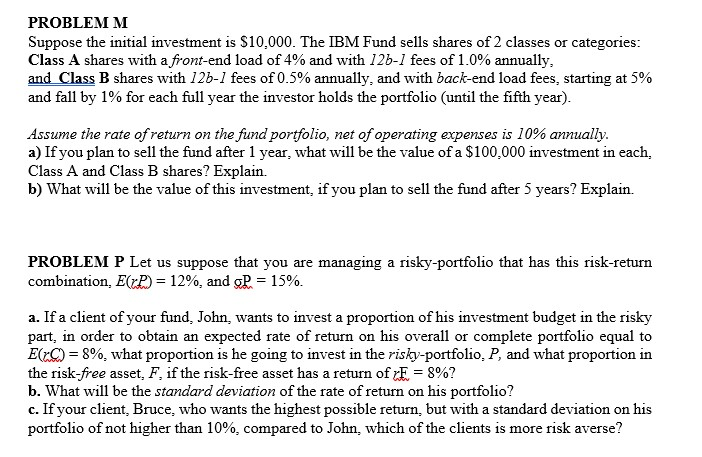

PROBLEM M Suppose the initial investment is $10,000. The IBM Fund sells shares of 2 classes or categories: Class A shares with a front-end load of 4% and with 125-1 fees of 1.0% annually, and Class B shares with 126-1 fees of 0.5% annually, and with back-end load fees, starting at 5% and fall by 1% for each full year the investor holds the portfolio (until the fifth year). Assume the rate of return on the fund portfolio, net of operating expenses is 10% annually. a) If you plan to sell the fund after 1 year, what will be the value of a $100.000 investment in each, Class A and Class B shares? Explain. b) What will be the value of this investment, if you plan to sell the fund after 5 years? Explain. PROBLEM P Let us suppose that you are managing a risky-portfolio that has this risk-return combination. E(XP) = 12%, and P = 15%. a. If a client of your fund, John, wants to invest a proportion of his investment budget in the risky part, in order to obtain an expected rate of return on his overall or complete portfolio equal to E(x) = 8%, what proportion is he going to invest in the risky-portfolio. P, and what proportion in the risk-free asset, F, if the risk-free asset has a return of rE. = 8%? b. What will be the standard deviation of the rate of return on his portfolio? c. If your client, Bruce, who wants the highest possible return, but with a standard deviation on his portfolio of not higher than 10%, compared to John, which of the clients is more risk averse? PROBLEM M Suppose the initial investment is $10,000. The IBM Fund sells shares of 2 classes or categories: Class A shares with a front-end load of 4% and with 125-1 fees of 1.0% annually, and Class B shares with 126-1 fees of 0.5% annually, and with back-end load fees, starting at 5% and fall by 1% for each full year the investor holds the portfolio (until the fifth year). Assume the rate of return on the fund portfolio, net of operating expenses is 10% annually. a) If you plan to sell the fund after 1 year, what will be the value of a $100.000 investment in each, Class A and Class B shares? Explain. b) What will be the value of this investment, if you plan to sell the fund after 5 years? Explain. PROBLEM P Let us suppose that you are managing a risky-portfolio that has this risk-return combination. E(XP) = 12%, and P = 15%. a. If a client of your fund, John, wants to invest a proportion of his investment budget in the risky part, in order to obtain an expected rate of return on his overall or complete portfolio equal to E(x) = 8%, what proportion is he going to invest in the risky-portfolio. P, and what proportion in the risk-free asset, F, if the risk-free asset has a return of rE. = 8%? b. What will be the standard deviation of the rate of return on his portfolio? c. If your client, Bruce, who wants the highest possible return, but with a standard deviation on his portfolio of not higher than 10%, compared to John, which of the clients is more risk averse