Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pledging receivables: A) Allows firms to raise cash. B) Allows a firm to retain ownership of its receivables. C) Does not transfer risk of bad

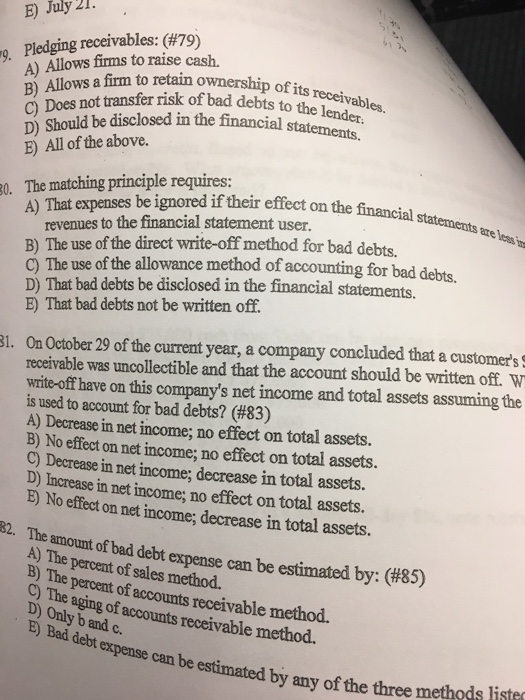

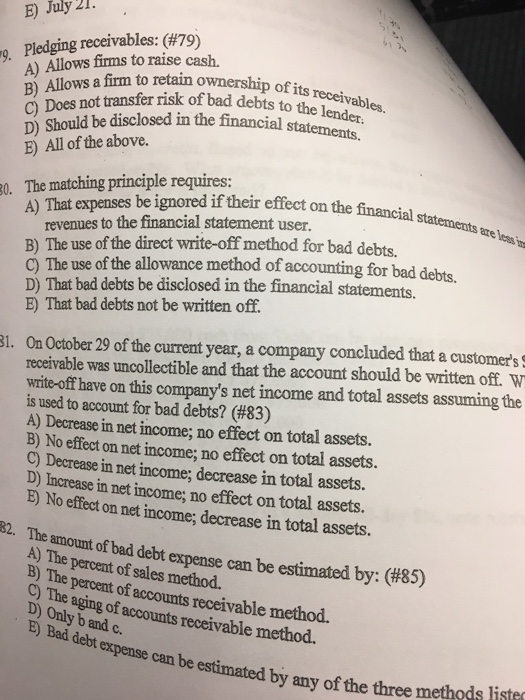

Pledging receivables: A) Allows firms to raise cash. B) Allows a firm to retain ownership of its receivables. C) Does not transfer risk of bad debts to the lender. D) Should be disclosed in the financial statements. E) All of the above. The matching principle requires: A) That expenses be ignored if their effect on the financial statement are less revenues to the financial statement user. B) The use of the direct write-off method for bad debts. C) The use of the allowance method of accounting for bad debts. D) That bad debts be disclosed in the financial statements. E) That bad debts not be written off. On October 29 of the current year, a company concluded that a customer' receivable was uncollectible and that the account should be written off. W write-off have on this company's net income and total assets assuming the is vised to account for bad debts? A) Decrease in net income: no effect on total assets. B) No effect on net income: no effect on total assets. C) Decrease in net income: decrease in total assets. D) Increase in net income: no effect on total assets. E) No effect on net income: decrease in total assets. The amount of bad debt expense can be estimated by: A) The percent of sales method. B) The percent of accounts receivables method. C) The aging of accounts receivables method. D) Only b and c. E) Bad debt expense can be estimated by any of the three methods listed

Pledging receivables: A) Allows firms to raise cash. B) Allows a firm to retain ownership of its receivables. C) Does not transfer risk of bad debts to the lender. D) Should be disclosed in the financial statements. E) All of the above. The matching principle requires: A) That expenses be ignored if their effect on the financial statement are less revenues to the financial statement user. B) The use of the direct write-off method for bad debts. C) The use of the allowance method of accounting for bad debts. D) That bad debts be disclosed in the financial statements. E) That bad debts not be written off. On October 29 of the current year, a company concluded that a customer' receivable was uncollectible and that the account should be written off. W write-off have on this company's net income and total assets assuming the is vised to account for bad debts? A) Decrease in net income: no effect on total assets. B) No effect on net income: no effect on total assets. C) Decrease in net income: decrease in total assets. D) Increase in net income: no effect on total assets. E) No effect on net income: decrease in total assets. The amount of bad debt expense can be estimated by: A) The percent of sales method. B) The percent of accounts receivables method. C) The aging of accounts receivables method. D) Only b and c. E) Bad debt expense can be estimated by any of the three methods listed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started