Answered step by step

Verified Expert Solution

Question

1 Approved Answer

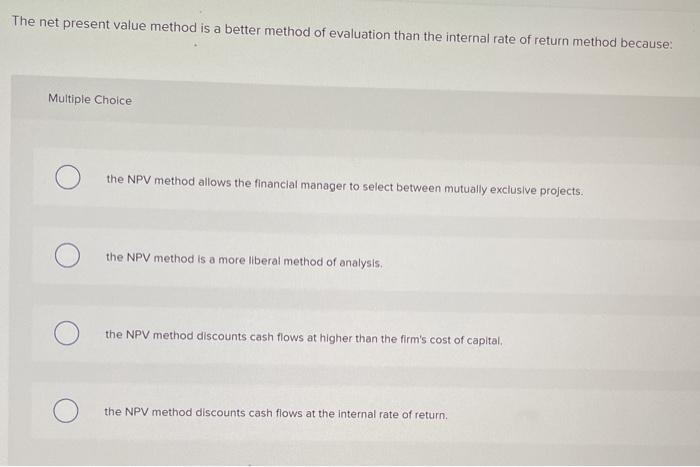

plese help me. thanks The net present value method is a better method of evaluation than the internal rate of return method because: Multiple Choice

plese help me.

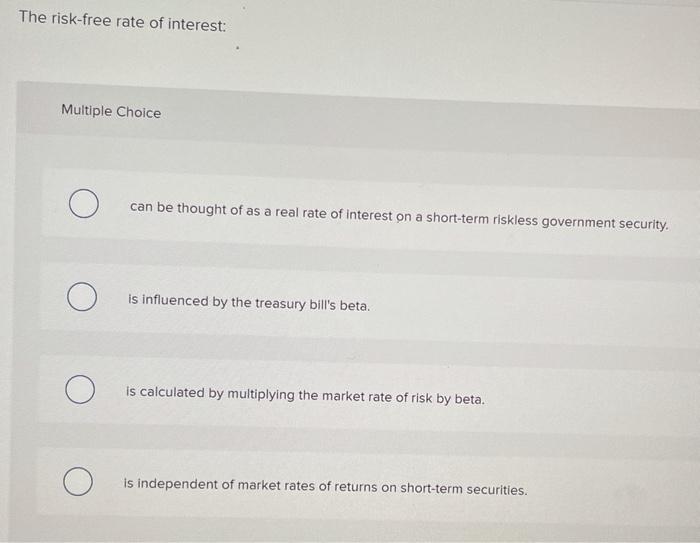

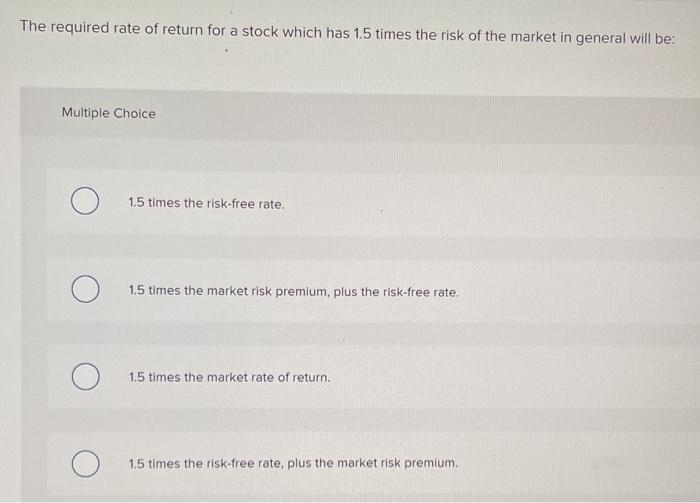

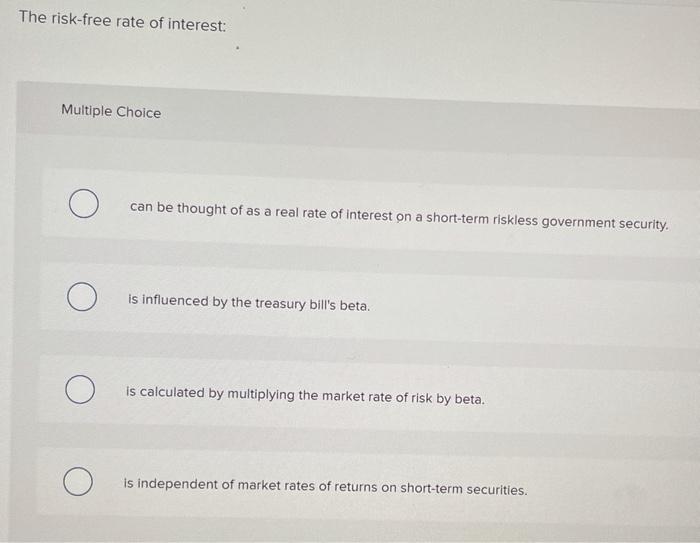

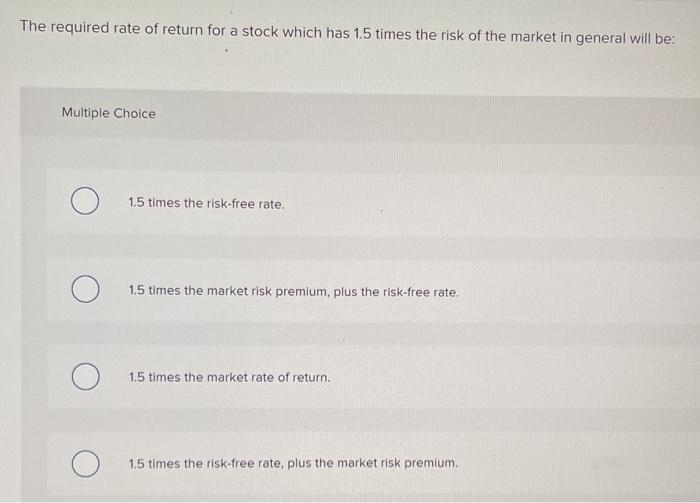

The net present value method is a better method of evaluation than the internal rate of return method because: Multiple Choice the NPV method allows the financial manager to select between mutually exclusive projects. the NPV method is a more liberal method of analysis, the NPV method discounts cash flows at higher than the firm's cost of capital the NPV method discounts cash flows at the Internal rate of return. The risk-free rate of interest: Multiple Choice can be thought of as a real rate of interest on a short-term riskless government security. O is influenced by the treasury bill's beta. O is calculated by multiplying the market rate of risk by beta. is independent of market rates of returns on short-term securities. The required rate of return for a stock which has 1.5 times the risk of the market in general will be: Multiple Choice 1.5 times the risk-free rate. 1.5 times the market risk premium, plus the risk-free rate. 1.5 times the market rate of return. 1.5 times the risk-free rate, plus the market risk premium

thanks

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started