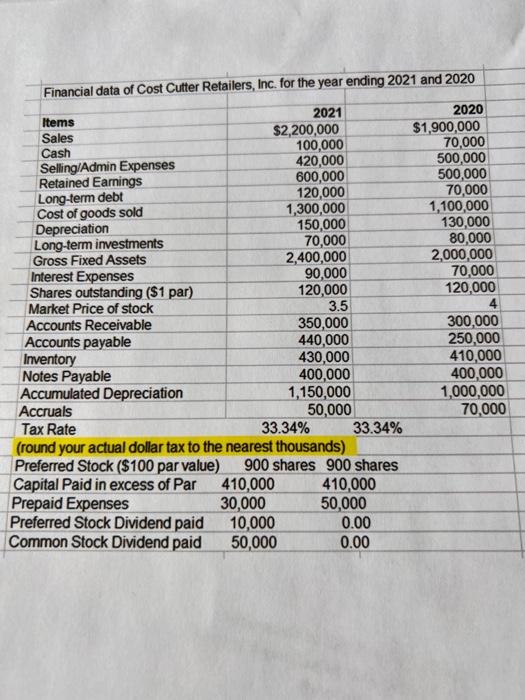

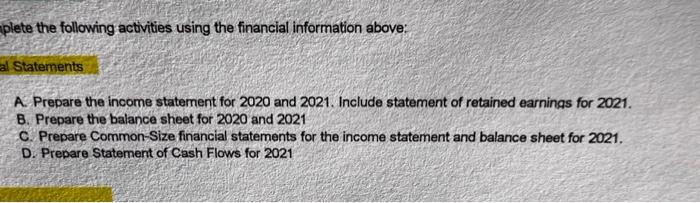

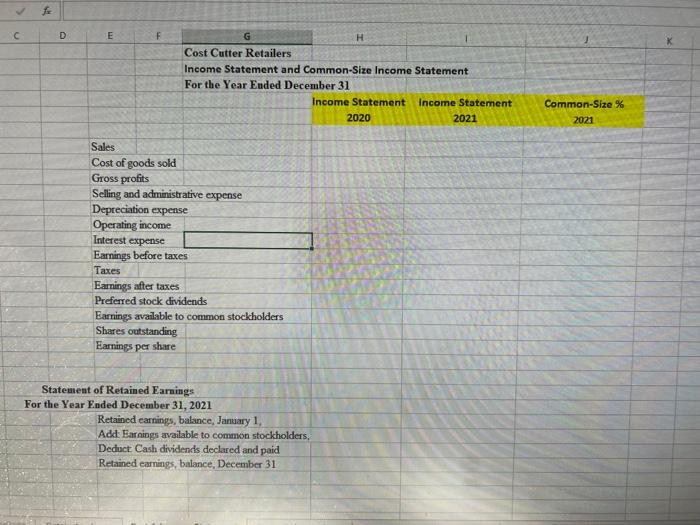

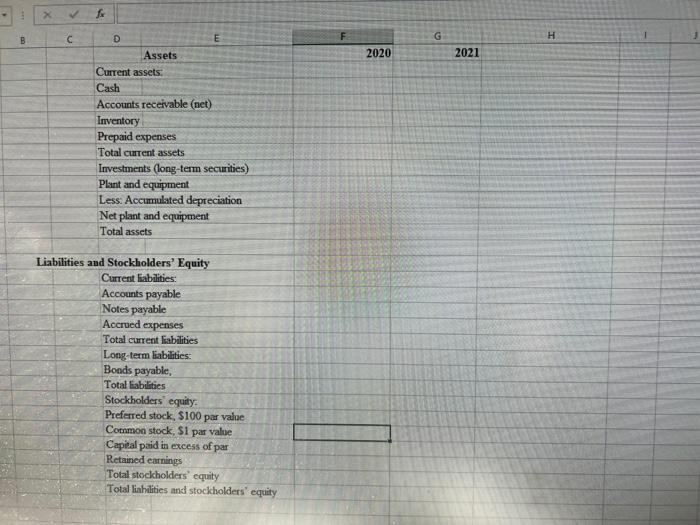

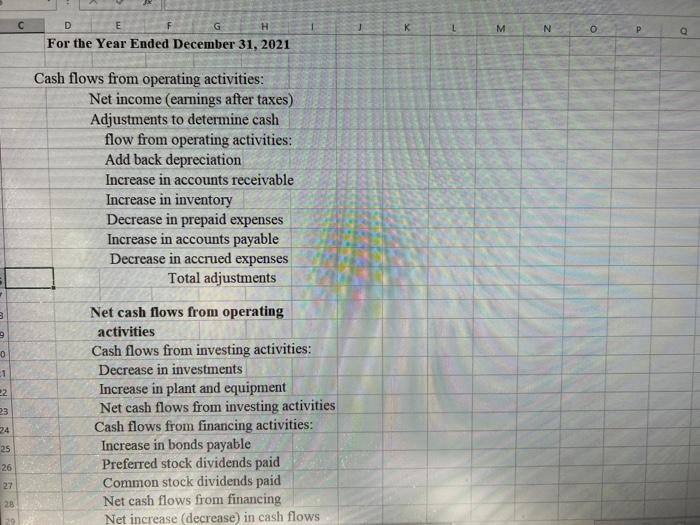

plete the following activities using the financial information above: A. Prepare the income statement for 2020 and 2021. Include statement of retained earnings for 2021 . B. Prepare the balance sheet for 2020 and 2021 C. Prepare Common-Size financial statements for the income statement and balance sheet for 2021. D. Prepare Statement of Cash Flows for 2021 fx \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline c & D & E & f & G & H & 1 & 1 \\ \hline & & & & Cost Cutter Retailers & & & \\ \hline & & & & \multicolumn{4}{|c|}{ Income Statement and Common-Size Income Statement } \\ \hline & & & & \multicolumn{3}{|c|}{ For the Year Ended December 31} & \multirow{3}{*}{\begin{tabular}{c} Common-Size \% \\ 2021 \end{tabular}} \\ \hline & & & & & Income Statement & Income Statement & \\ \hline & & & & & 2020 & 2021 & \\ \hline & & & & & & & \\ \hline & & Sales & & & & & \\ \hline & & Cost of & ods sold & & & & \\ \hline & & Gross pi & & 60 & & & \\ \hline & & Selling a & administr & trative expense & & & \\ \hline & & Depreci & expens & & & & 38 \\ \hline & & Operatin & income & & & & \\ \hline & & Interest & pense & & & & \\ \hline & & Earnings & efore taxe & & & & 3 \\ \hline & & Taxes & & & & & 85 \\ \hline & & Earnings & tter taxes & & & 8 & 5 \\ \hline & & Preferre & stock divi & idends & & & \\ \hline & & Earnings & valable to & o common stockholders & & 6 & 28 \\ \hline & & Shares & standing & & & 4 & \\ \hline & & Earnings: & er share & & & & 4 \\ \hline & & & & - & & +3 & E \\ \hline & & & & 372 & & 8 & 3 \\ \hline & teme & tof Retai & ed Earnin & & & & \\ \hline & e Year & Ended De & ember 31 & 1,2021 & & & \\ \hline & & Retaine & carnings, b & balance, January 1 , & & 8 & \\ \hline & & Add E & ings avsile & lable to common stockholders. & & & \\ \hline & & Deduct & ash divide & lends declared and paid & & & \\ \hline & & Retaine & earnings, b & balance, December 31 & & & \\ \hline & & & & & & & \\ \hline & & & & & 8 & & \\ \hline \end{tabular} Financial data of Cost Cutter Retailers, Inc. for the year ending 2021 and 2020 \begin{tabular}{|c|c|} \hline & \multirow{2}{*}{2020} \\ \hline 2021 & \\ \hline$2,200,000 & $1,900,000 \\ \hline 100,000 & 70,000 \\ \hline 420,000 & 500,000 \\ \hline 600,000 & 500,000 \\ \hline 120,000 & 70,000 \\ \hline 1,300,000 & 1,100,000 \\ \hline 150,000 & 130,000 \\ \hline 70,000 & 80,000 \\ \hline 2,400,000 & 2,000,000 \\ \hline 90,000 & 70,000 \\ \hline 120,000 & 120,000 \\ \hline 3.5 & 4 \\ \hline 350,000 & 300,000 \\ \hline 440,000 & 250,000 \\ \hline 430,000 & 410,000 \\ \hline 400,000 & 400,00 \\ \hline 1,150,000 & 1,000,000 \\ \hline 50,000 & 70,00 \\ \hline 33.34% & 33.34% \\ \hline \multicolumn{2}{|c|}{ (round your actual dollar tax to the nearest thousands) } \\ \hline \multicolumn{2}{|c|}{900 shares 900 shares } \\ \hline \multicolumn{2}{|c|}{410,000} \\ \hline \multicolumn{2}{|c|}{50,000} \\ \hline \multicolumn{2}{|l|}{10,000} \\ \hline \multicolumn{2}{|l|}{50,000} \\ \hline \end{tabular}