Answered step by step

Verified Expert Solution

Question

1 Approved Answer

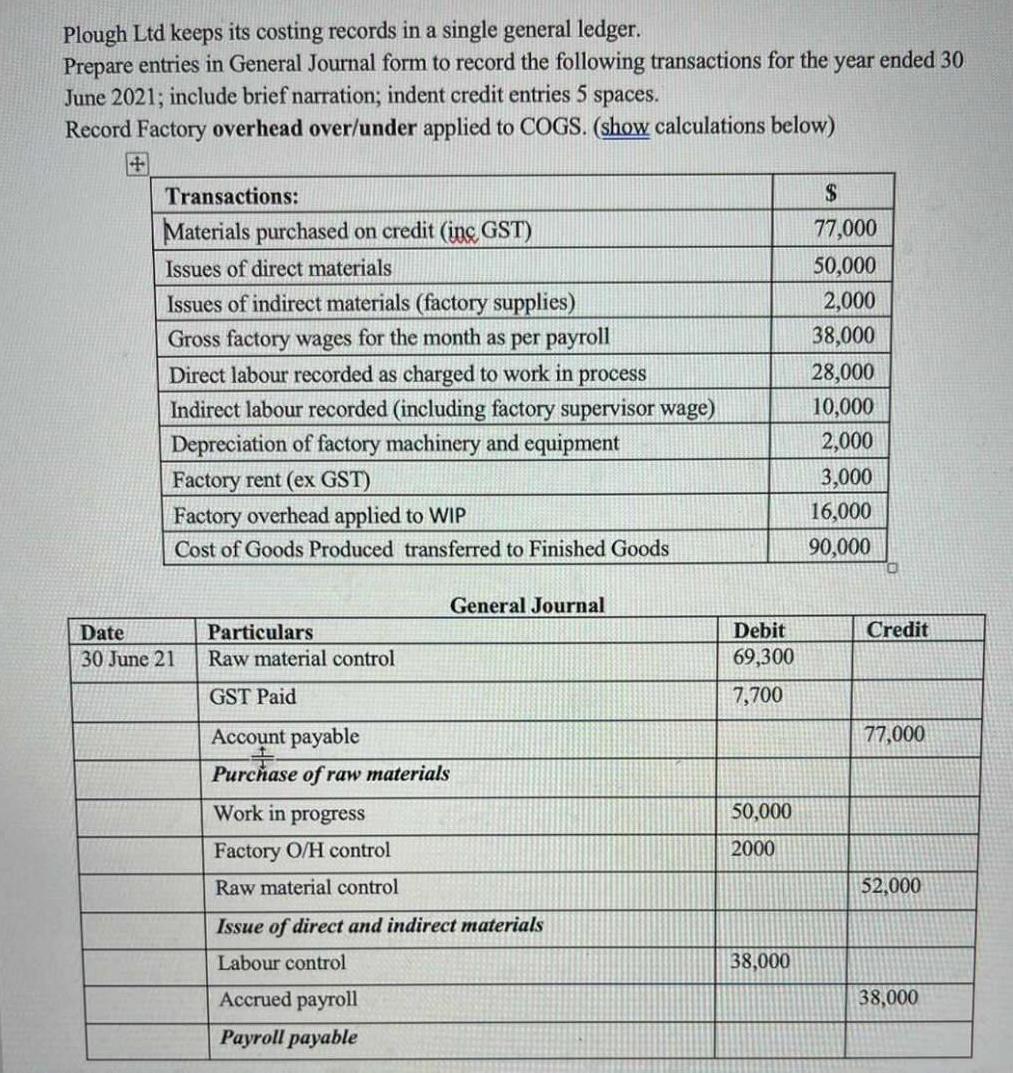

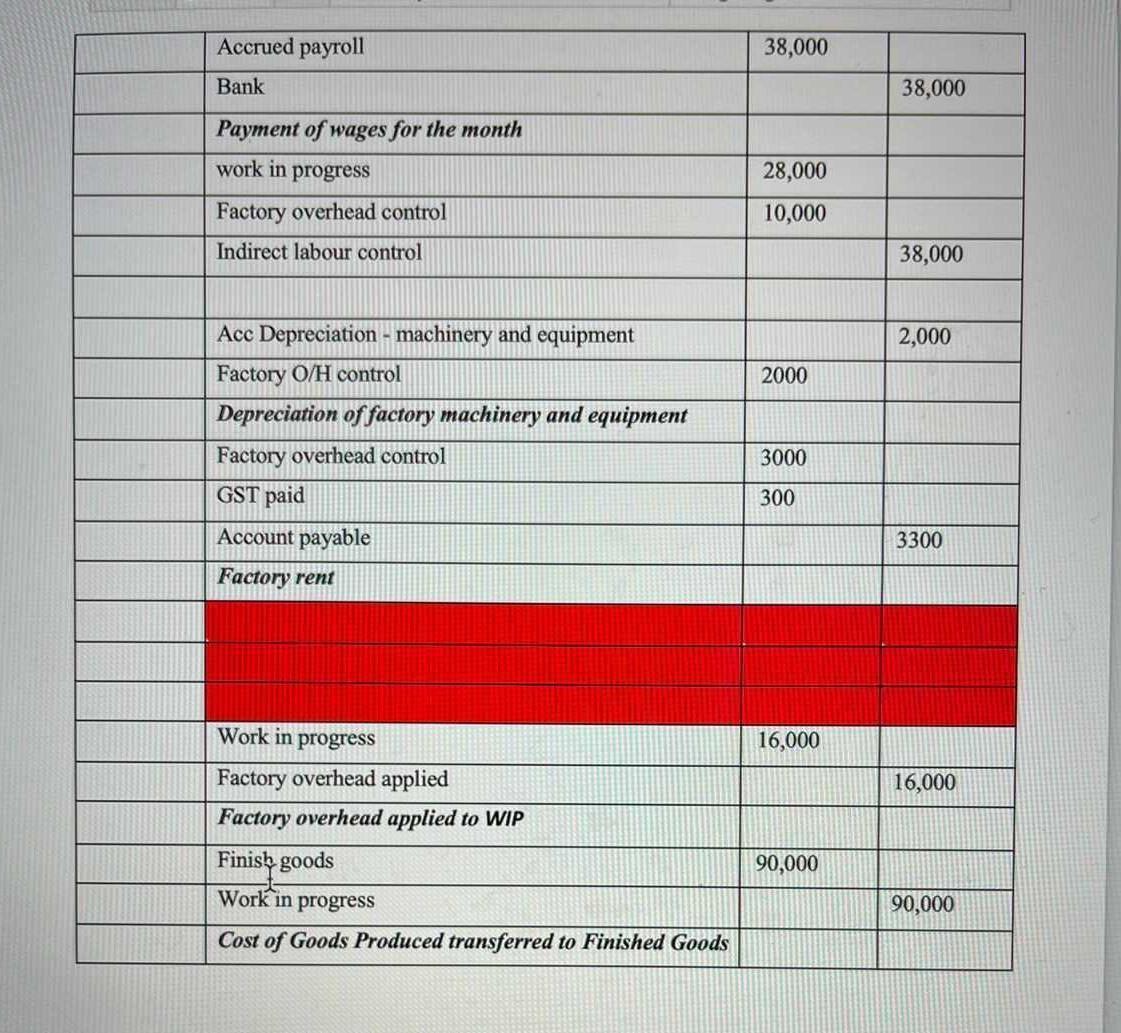

Plough Ltd keeps its costing records in a single general ledger. Prepare entries in General Journal form to record the following transactions for the

Plough Ltd keeps its costing records in a single general ledger. Prepare entries in General Journal form to record the following transactions for the year ended 30 June 2021; include brief narration; indent credit entries 5 Record Factory overhead over/under applied to COGS. (show calculations below) spaces. Transactions: 24 Materials purchased on credit (inc GST) 77,000 Issues of direct materials 50,000 Issues of indirect materials (factory supplies) 2,000 38,000 Gross factory wages for the month as per payroll Direct labour recorded as charged to work in process 28,000 Indirect labour recorded (including factory supervisor wage) Depreciation of factory machinery and equipment 10,000 2,000 Factory rent (ex GST) 3,000 Factory overhead applied to WIP 16,000 Cost of Goods Produced transferred to Finished Goods 90,000 General Journal Date Particulars Debit Credit 30 June 21 Raw material control 69,300 GST Paid 7,700 77,000 Account payable Purchase of raw materials Work in progress 50,000 Factory O/H control 2000 Raw material control 52,000 Issue of direct and indirect materials Labour control 38,000 Accrued payroll 38,000 Payroll payable Accrued payroll 38,000 Bank 38,000 Payment of wages for the month work in progress 28,000 Factory overhead control 10,000 Indirect labour control 38,000 Acc Depreciation - machinery and equipment 2,000 Factory O/H control 2000 Depreciation of factory machinery and equipment Factory overhead control 3000 GST paid 300 Account payable 3300 Factory rent Work in progress 16,000 Factory overhead applied 16,000 Factory overhead applied to WIP Finisk goods 90,000 Work in progress 90,000 Cost of Goods Produced transferred to Finished Goods Factory OH Co (Actual) Under-applied O/H Plough Ltd keeps its costing records in a single general ledger. Prepare entries in General Journal form to record the following transactions for the year ended 30 June 2021; include brief narration; indent credit entries 5 Record Factory overhead over/under applied to COGS. (show calculations below) spaces. Transactions: 24 Materials purchased on credit (inc GST) 77,000 Issues of direct materials 50,000 Issues of indirect materials (factory supplies) 2,000 38,000 Gross factory wages for the month as per payroll Direct labour recorded as charged to work in process 28,000 Indirect labour recorded (including factory supervisor wage) Depreciation of factory machinery and equipment 10,000 2,000 Factory rent (ex GST) 3,000 Factory overhead applied to WIP 16,000 Cost of Goods Produced transferred to Finished Goods 90,000 General Journal Date Particulars Debit Credit 30 June 21 Raw material control 69,300 GST Paid 7,700 77,000 Account payable Purchase of raw materials Work in progress 50,000 Factory O/H control 2000 Raw material control 52,000 Issue of direct and indirect materials Labour control 38,000 Accrued payroll 38,000 Payroll payable Accrued payroll 38,000 Bank 38,000 Payment of wages for the month work in progress 28,000 Factory overhead control 10,000 Indirect labour control 38,000 Acc Depreciation - machinery and equipment 2,000 Factory O/H control 2000 Depreciation of factory machinery and equipment Factory overhead control 3000 GST paid 300 Account payable 3300 Factory rent Work in progress 16,000 Factory overhead applied 16,000 Factory overhead applied to WIP Finisk goods 90,000 Work in progress 90,000 Cost of Goods Produced transferred to Finished Goods Factory OH Co (Actual) Under-applied O/H Plough Ltd keeps its costing records in a single general ledger. Prepare entries in General Journal form to record the following transactions for the year ended 30 June 2021; include brief narration; indent credit entries 5 Record Factory overhead over/under applied to COGS. (show calculations below) spaces. Transactions: 24 Materials purchased on credit (inc GST) 77,000 Issues of direct materials 50,000 Issues of indirect materials (factory supplies) 2,000 38,000 Gross factory wages for the month as per payroll Direct labour recorded as charged to work in process 28,000 Indirect labour recorded (including factory supervisor wage) Depreciation of factory machinery and equipment 10,000 2,000 Factory rent (ex GST) 3,000 Factory overhead applied to WIP 16,000 Cost of Goods Produced transferred to Finished Goods 90,000 General Journal Date Particulars Debit Credit 30 June 21 Raw material control 69,300 GST Paid 7,700 77,000 Account payable Purchase of raw materials Work in progress 50,000 Factory O/H control 2000 Raw material control 52,000 Issue of direct and indirect materials Labour control 38,000 Accrued payroll 38,000 Payroll payable Accrued payroll 38,000 Bank 38,000 Payment of wages for the month work in progress 28,000 Factory overhead control 10,000 Indirect labour control 38,000 Acc Depreciation - machinery and equipment 2,000 Factory O/H control 2000 Depreciation of factory machinery and equipment Factory overhead control 3000 GST paid 300 Account payable 3300 Factory rent Work in progress 16,000 Factory overhead applied 16,000 Factory overhead applied to WIP Finisk goods 90,000 Work in progress 90,000 Cost of Goods Produced transferred to Finished Goods Factory OH Co (Actual) Under-applied O/H Plough Ltd keeps its costing records in a single general ledger. Prepare entries in General Journal form to record the following transactions for the year ended 30 June 2021; include brief narration; indent credit entries 5 Record Factory overhead over/under applied to COGS. (show calculations below) spaces. Transactions: 24 Materials purchased on credit (inc GST) 77,000 Issues of direct materials 50,000 Issues of indirect materials (factory supplies) 2,000 38,000 Gross factory wages for the month as per payroll Direct labour recorded as charged to work in process 28,000 Indirect labour recorded (including factory supervisor wage) Depreciation of factory machinery and equipment 10,000 2,000 Factory rent (ex GST) 3,000 Factory overhead applied to WIP 16,000 Cost of Goods Produced transferred to Finished Goods 90,000 General Journal Date Particulars Debit Credit 30 June 21 Raw material control 69,300 GST Paid 7,700 77,000 Account payable Purchase of raw materials Work in progress 50,000 Factory O/H control 2000 Raw material control 52,000 Issue of direct and indirect materials Labour control 38,000 Accrued payroll 38,000 Payroll payable Accrued payroll 38,000 Bank 38,000 Payment of wages for the month work in progress 28,000 Factory overhead control 10,000 Indirect labour control 38,000 Acc Depreciation - machinery and equipment 2,000 Factory O/H control 2000 Depreciation of factory machinery and equipment Factory overhead control 3000 GST paid 300 Account payable 3300 Factory rent Work in progress 16,000 Factory overhead applied 16,000 Factory overhead applied to WIP Finisk goods 90,000 Work in progress 90,000 Cost of Goods Produced transferred to Finished Goods Factory OH Co (Actual) Under-applied O/H

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

Answer 114 Date Account Titles Explanation Debit Credit 115 30Jun21 Raw Material Control 6930...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started