Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pls add explanation for true & false questions A mortgage shopper will pay a interest rate on an adjustable-rate mortgage compared with a conventional fixed

pls add explanation for true & false questions

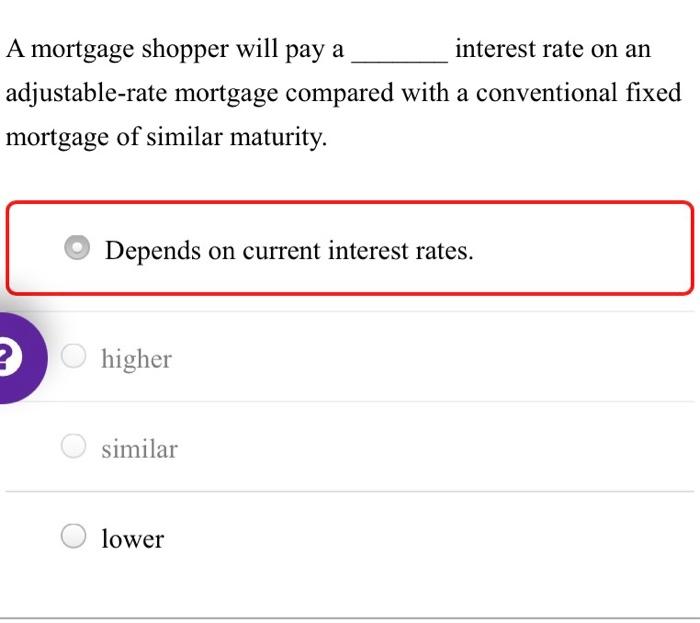

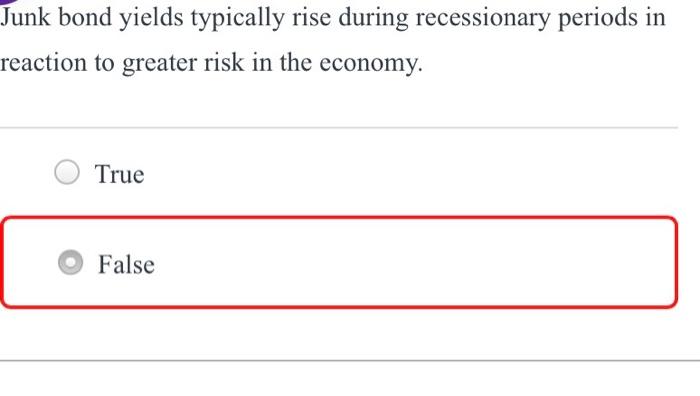

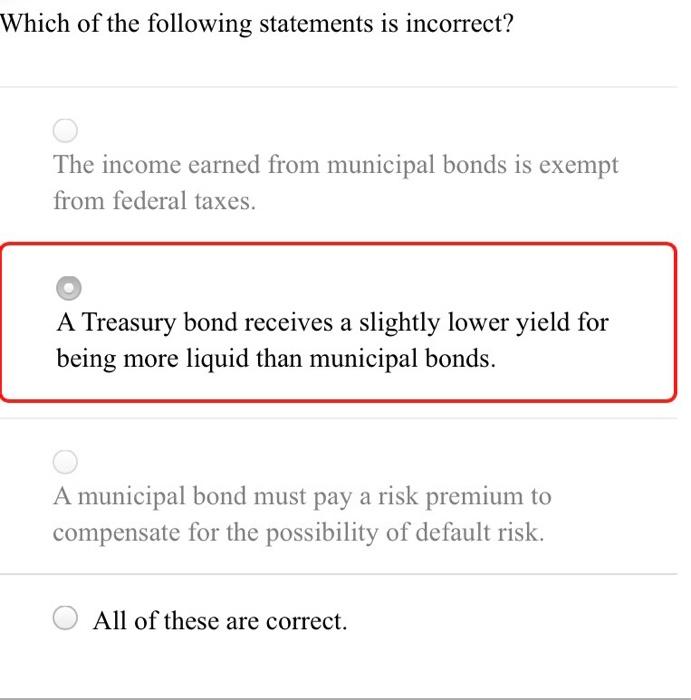

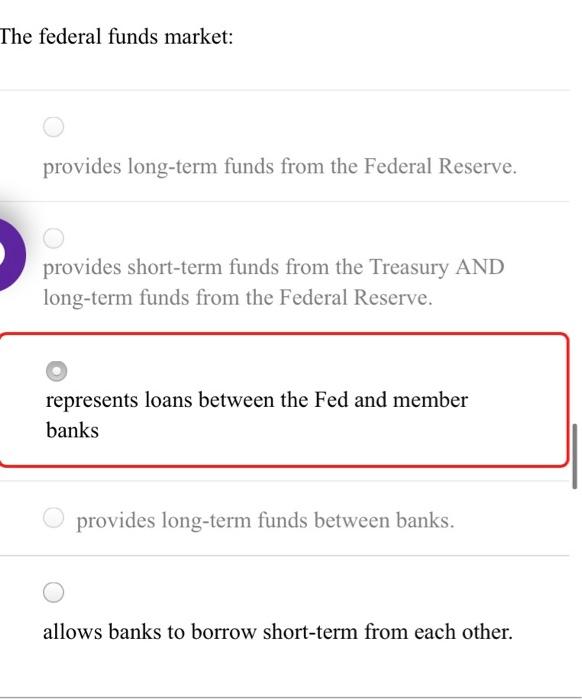

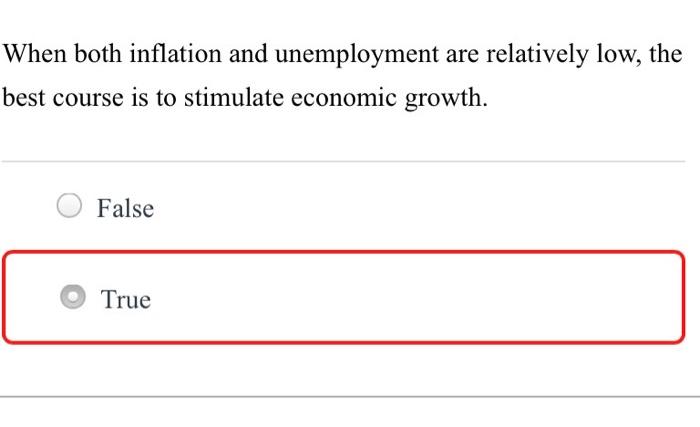

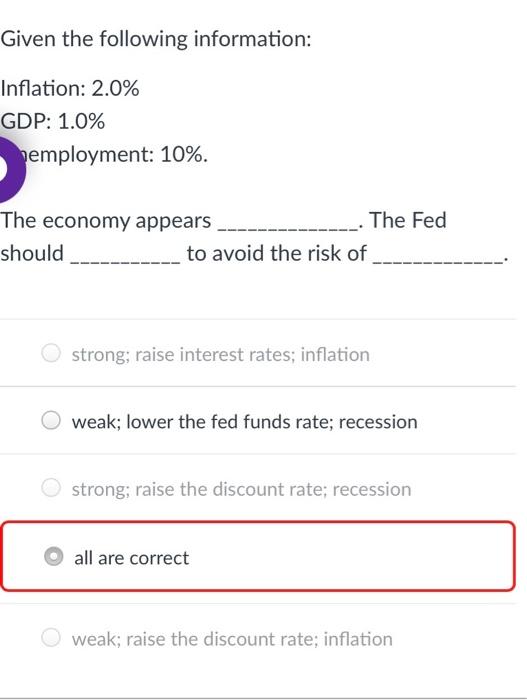

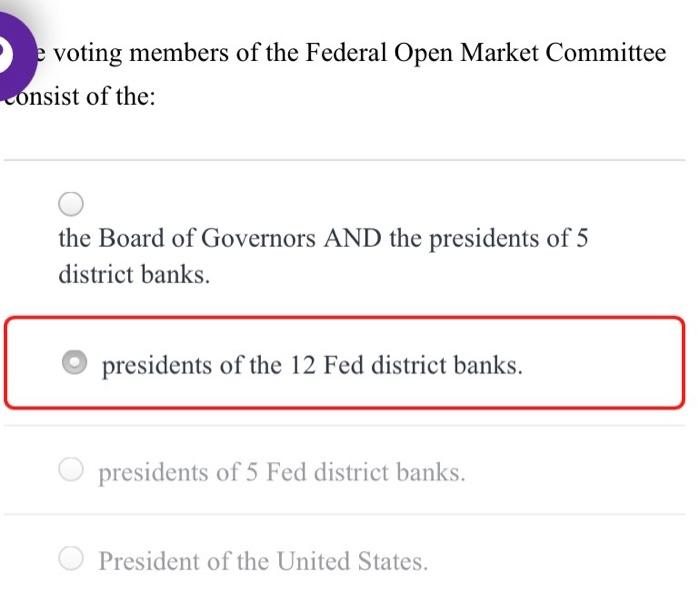

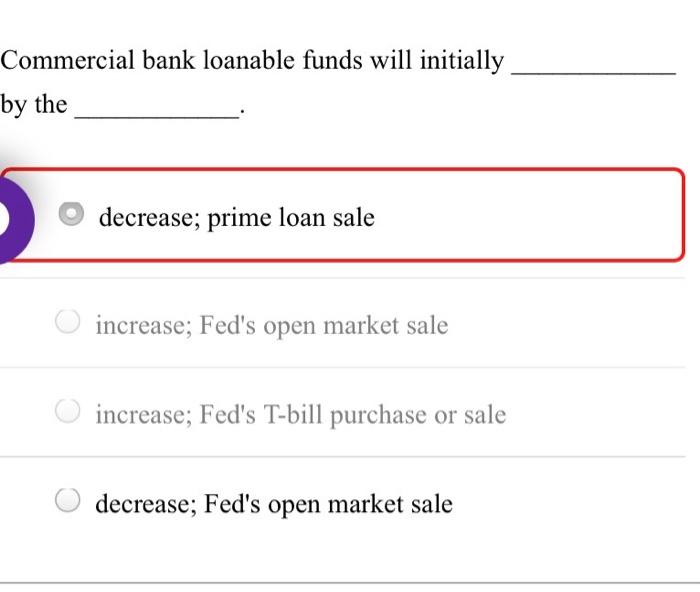

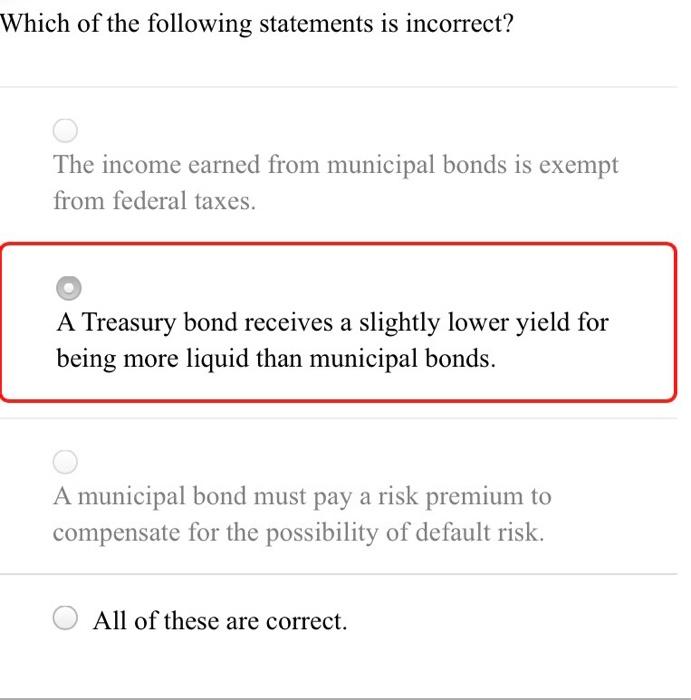

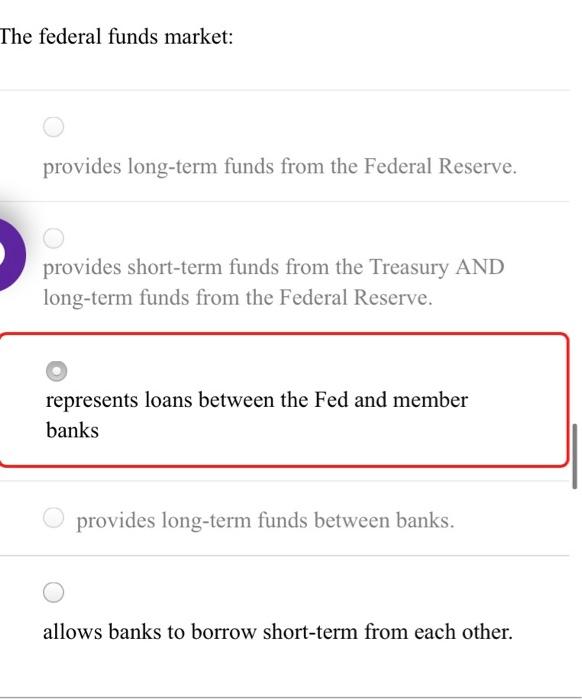

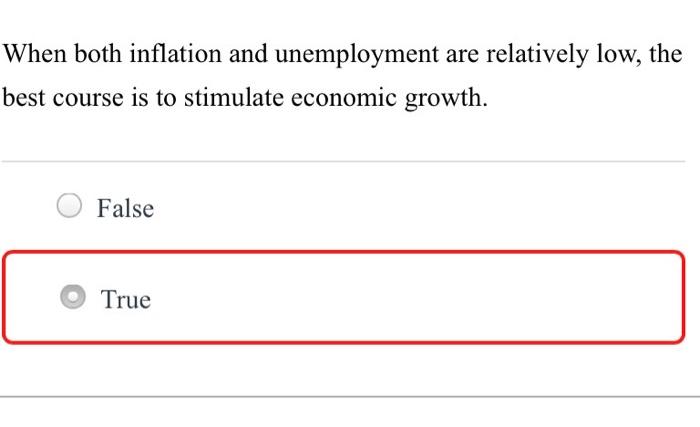

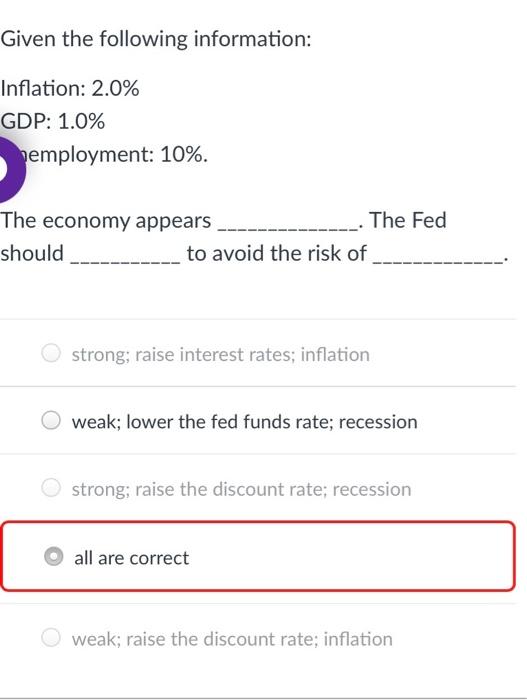

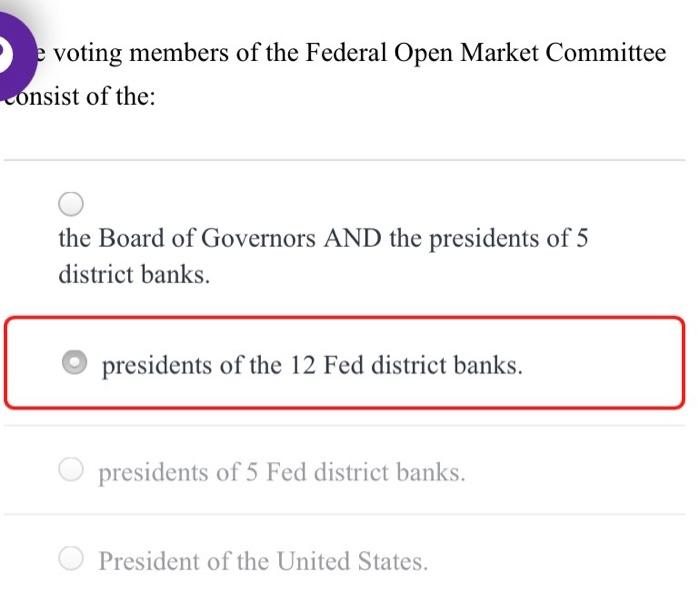

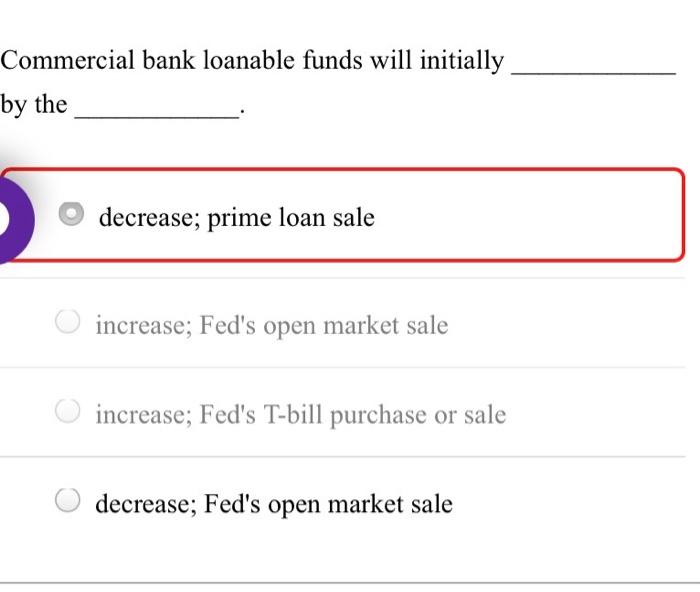

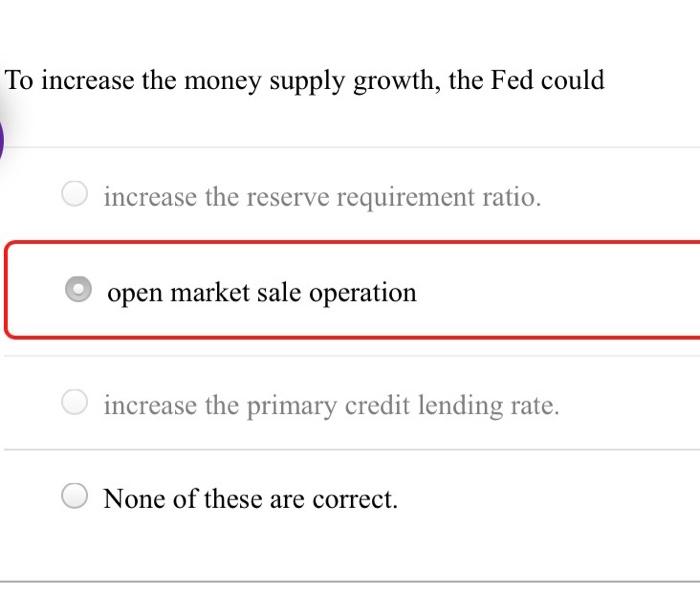

A mortgage shopper will pay a interest rate on an adjustable-rate mortgage compared with a conventional fixed mortgage of similar maturity. Depends on current interest rates. higher similar lower Junk bond yields typically rise during recessionary periods in reaction to greater risk in the economy. True False Which of the following statements is incorrect? The income earned from municipal bonds is exempt from federal taxes. A Treasury bond receives a slightly lower yield for being more liquid than municipal bonds. A municipal bond must pay a risk premium to compensate for the possibility of default risk. All of these are correct. The federal funds market: provides long-term funds from the Federal Reserve. provides short-term funds from the Treasury AND long-term funds from the Federal Reserve. represents loans between the Fed and member banks provides long-term funds between banks. allows banks to borrow short-term from each other. When both inflation and unemployment are relatively low, the best course is to stimulate economic growth. False True Given the following information: Inflation: 2.0% GDP: 1.0% employment: 10%. The economy appears The Fed should to avoid the risk of strong; raise interest rates; inflation weak; lower the fed funds rate; recession strong; raise the discount rate; recession all are correct weak; raise the discount rate; inflation voting members of the Federal Open Market Committee onsist of the: the Board of Governors AND the presidents of 5 district banks. presidents of the 12Fed district banks. presidents of 5 Fed district banks. President of the United States. Commercial bank loanable funds will initially by the decrease; prime loan sale increase; Fed's open market sale increase; Fed's T-bill purchase or sale decrease; Fed's open market sale To increase the money supply growth, the Fed could increase the reserve requirement ratio. open market sale operation increase the primary credit lending rate. None of these are correct

A mortgage shopper will pay a interest rate on an adjustable-rate mortgage compared with a conventional fixed mortgage of similar maturity. Depends on current interest rates. higher similar lower Junk bond yields typically rise during recessionary periods in reaction to greater risk in the economy. True False Which of the following statements is incorrect? The income earned from municipal bonds is exempt from federal taxes. A Treasury bond receives a slightly lower yield for being more liquid than municipal bonds. A municipal bond must pay a risk premium to compensate for the possibility of default risk. All of these are correct. The federal funds market: provides long-term funds from the Federal Reserve. provides short-term funds from the Treasury AND long-term funds from the Federal Reserve. represents loans between the Fed and member banks provides long-term funds between banks. allows banks to borrow short-term from each other. When both inflation and unemployment are relatively low, the best course is to stimulate economic growth. False True Given the following information: Inflation: 2.0% GDP: 1.0% employment: 10%. The economy appears The Fed should to avoid the risk of strong; raise interest rates; inflation weak; lower the fed funds rate; recession strong; raise the discount rate; recession all are correct weak; raise the discount rate; inflation voting members of the Federal Open Market Committee onsist of the: the Board of Governors AND the presidents of 5 district banks. presidents of the 12Fed district banks. presidents of 5 Fed district banks. President of the United States. Commercial bank loanable funds will initially by the decrease; prime loan sale increase; Fed's open market sale increase; Fed's T-bill purchase or sale decrease; Fed's open market sale To increase the money supply growth, the Fed could increase the reserve requirement ratio. open market sale operation increase the primary credit lending rate. None of these are correct

pls add explanation for true & false questions

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started